AVJO

Overview of AVJO

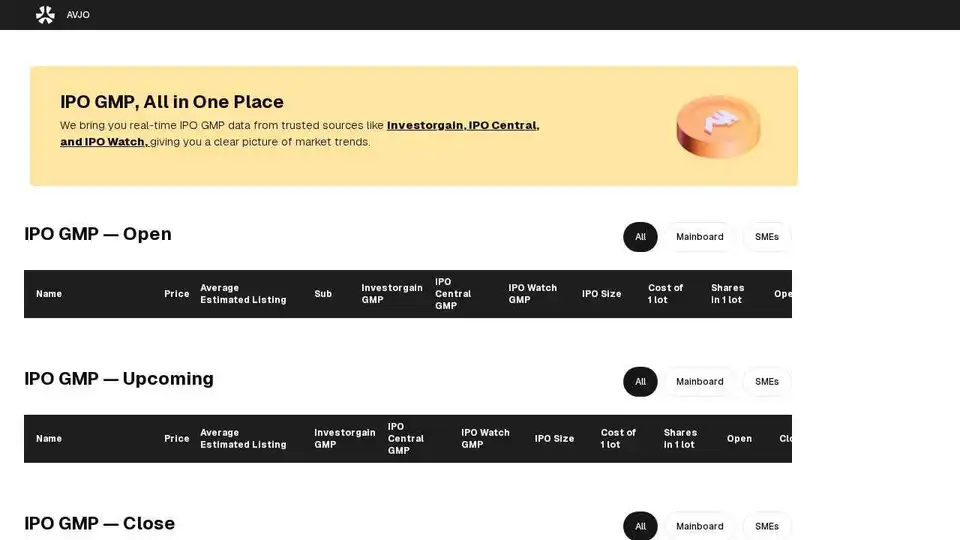

AVJO: Your All-in-One IPO GMP and Market Data Platform

What is AVJO?

AVJO is a comprehensive platform designed to provide real-time data and insights into the Initial Public Offering (IPO) market. It aggregates data from trusted sources to offer a clear picture of market trends, including the Grey Market Premium (GMP). AVJO aims to assist investors in making informed decisions by providing up-to-date information on IPOs.

Key Features and Benefits

- Real-Time IPO GMP Data: AVJO collects and presents real-time GMP data from reputable sources such as Investorgain, IPO Central, and IPO Watch.

- Comprehensive Coverage: The platform covers IPOs from both Mainboard and SME (Small and Medium Enterprise) companies.

- User-Friendly Interface: AVJO organizes data in a clear, accessible format, making it easy for investors to find the information they need.

- Market Trend Analysis: By aggregating data from various sources, AVJO provides insights into market sentiment and potential listing gains.

How does AVJO work?

AVJO works by collecting data from multiple trusted sources to give users a clear picture of market trends for IPOs. It aggregates real-time IPO GMP data from sources such as Investorgain, IPO Central, and IPO Watch.

Using AVJO

- Accessing the Platform: AVJO is accessible online, providing users with real-time data and insights from anywhere.

- Navigating the Interface: The platform is designed for ease of use, with clear categorization of IPOs by type (Mainboard, SME) and status (Open, Upcoming, Closed).

- Interpreting Data: AVJO provides metrics such as price, average estimated listing, and GMP from various sources, enabling users to assess potential investment opportunities.

Key Metrics Provided by AVJO

- Name: The name of the company offering the IPO.

- Price: The IPO price per share.

- Average Estimated Listing: The estimated listing price based on market sentiment.

- GMP (Grey Market Premium): The premium at which shares are traded in the grey market, indicating potential listing gains.

- Subscription: The subscription level, showing how many times the IPO has been oversubscribed.

- IPO Size: The total value of the IPO.

- Cost of 1 Lot: The cost for one lot of shares.

- Shares in 1 Lot: The number of shares included in one lot.

Understanding IPO Basics with AVJO

AVJO also provides educational content to help investors understand the fundamentals of IPOs.

What is an IPO?

An Initial Public Offering (IPO) is the first time a private company sells shares to the public. This allows the company to raise capital for growth or expansion. The Securities and Exchange Board of India (SEBI) regulates IPOs, overseeing aspects such as issue price, price band, lot size, and subscription status.

What is GMP in IPO?

The IPO grey market premium (GMP) is an unofficial indicator of market sentiment towards an upcoming IPO. It represents the difference between the grey market price and the upper end of the IPO's price band.

For example, if an IPO's price band is ₹100-110 and the shares trade in the grey market at ₹130, the GMP is ₹20. Qualified institutional buyers (QIBs) and retail investors often use the IPO grey market premium to gauge potential listing gains.

SME vs. Mainboard IPO

- SME IPO: Small and Medium Enterprise Initial Public Offering. It helps smaller companies raise money from the public by listing shares on the stock exchange.

- Mainboard IPO: Large, privately-owned company sells shares to the public for the first time to raise capital for expansion, new projects, or debt repayment.

How to Apply for an IPO

To apply for an IPO in India, investors can submit bids once the issue opens and before it closes. The process is called IPO bidding, and there are two ways to apply:

- Online IPO application: Apply online through your bank’s net banking or mobile app, or via a stock broker. Use UPI or ASBA to make payments.

- Offline IPO application: Fill out a paper form and submit it to your broker or a bank branch that accepts IPO applications.

Investor Categories in an IPO

In an IPO, there are four main investor categories that participants can apply under. Each category has specific criteria and rules for allotment:

- Retail Individual Investor (RII)

- Non-Institutional Investor (NII)

- Qualified Institutional Buyers (QIBs)

- Anchor Investors

Retail Individual Investor (RII)

An RII is any individual, NRI (Non-Resident Indian), or HUF (Hindu Undivided Family) who applies for shares in an IPO for an amount less than Rs 2 lakhs. This category reserves at least 35% of the total IPO offer.

Non-Institutional Investor (NII)

An NII is an investor who applies for IPO shares worth more than Rs 2 lakhs. This category reserves shares for individuals, NRIs, HUFs, companies, and other entities like corporate bodies, societies, and trusts. The IPO allocates a minimum of 15% of the total shares to NIIs.

Qualified Institutional Buyers (QIBs)

QIBs are large, SEBI-registered institutional investors such as public financial institutions, mutual funds, banks, and foreign portfolio investors. These entities represent smaller retail investors through mutual funds, pension schemes, and insurance products.

Anchor Investors

Anchor Investors are a special class of QIBs who invest a large amount (Rs 10 crores or more) before the IPO opens to the public. They boost investor confidence by participating early and demonstrating interest in the company.

Conclusion

AVJO is a valuable resource for investors seeking real-time data, analysis, and educational content related to IPOs. By providing comprehensive coverage of GMP, market trends, and application processes, AVJO empowers investors to make informed decisions and navigate the IPO market effectively. Whether you are a retail investor or a qualified institutional buyer, AVJO can assist you in staying up-to-date with the latest IPO developments and maximizing your investment potential.

Disclaimer: Investing in IPOs involves risk. Investors should conduct thorough research and consult with financial advisors before making any investment decisions. Grey Market Premium (GMP) is an unofficial indicator and should not be the sole basis for investment decisions.

Tags Related to AVJO