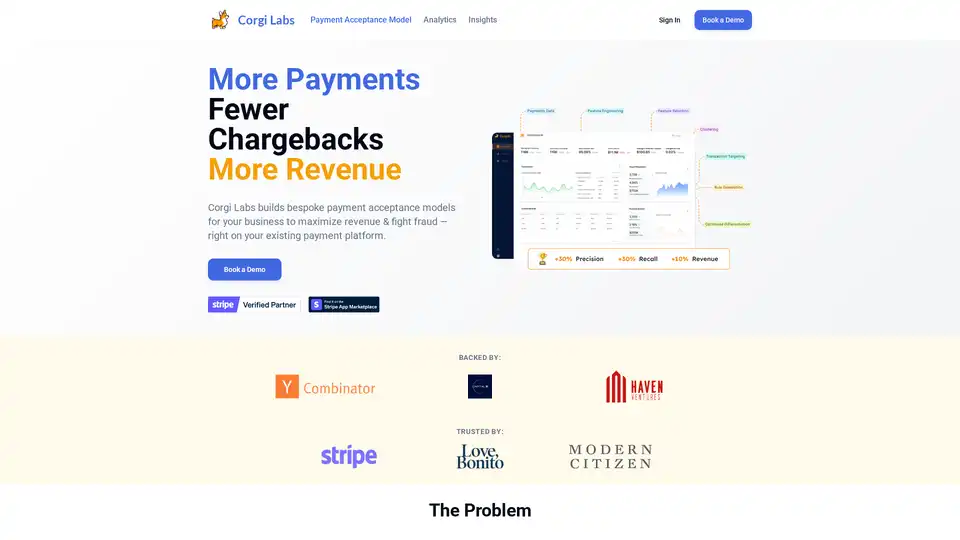

Corgi Labs

Overview of Corgi Labs

Corgi Labs: AI-Powered Payment Acceptance Model for Payment Optimization

What is Corgi Labs?

Corgi Labs provides an AI-powered payment acceptance model designed to optimize payment processes and prevent fraud. It builds bespoke payment acceptance models for businesses, maximizing revenue and combating fraud directly on existing payment platforms like Shopify or Stripe. This is achieved through algorithmic machine learning, making customized payment acceptance accessible and affordable.

How does Corgi Labs work?

Corgi Labs works by analyzing a business's historical payment data to build a custom payment acceptance model. Here’s a breakdown of the process:

- Data Access: A secure plugin is installed to allow Corgi Labs to access transaction data from platforms like Stripe or Shopify.

- Model Building: Corgi Labs builds a customized model, quantifying the expected improvements.

- Solution Activation: Upon confirmation, the Corgi Model is activated within the existing payment provider.

- Results: Businesses benefit from higher revenue due to fewer false declines and lower costs from reduced chargebacks.

This process integrates seamlessly, requiring minimal effort from the business’s team.

Key Features and Benefits

- Reduce Chargebacks: By identifying and preventing fraudulent transactions, Corgi Labs helps businesses significantly reduce chargebacks, with reported reductions ranging from 70-95%.

- Increase Payment Acceptance Rate: Corgi Labs improves the payment acceptance rate by 3-12%, ensuring legitimate transactions are approved, thus boosting revenue.

- Immediate Revenue Impact: Businesses can see measurable improvements to their bottom line within two weeks of implementation.

- Transparent and Clear Insights: Real-time analytics and reporting provide businesses with a clear understanding of how the system is improving their payments.

- Expert Support: Dedicated payment optimization experts are available to help businesses maximize results and ROI.

Why Choose Corgi Labs?

- Customized Logic: Unlike generic payment acceptance models, Corgi Labs builds models tailored to a business’s unique customer base, products, geographies, and risks.

- Affordable Solution: Corgi Labs makes custom payment acceptance models accessible to businesses that may not have the budget for in-house data scientists and fraud modeling.

- Seamless Integration: Corgi Labs integrates with existing payment platforms like Shopify and Stripe, minimizing disruption to business operations.

Who is Corgi Labs for?

Corgi Labs is ideal for:

- E-commerce businesses: Looking to reduce fraud and increase revenue by optimizing their payment acceptance process.

- Businesses using Shopify or Stripe: Seamlessly integrate Corgi Labs into their existing payment platform.

- Small to Medium Enterprises (SMEs): Seeking affordable and effective fraud prevention solutions.

Customer Success Stories

- A Global Payments Provider reported a 24% reduction in disputes and a 15% improvement in accepted payments after implementing Corgi Labs, projecting a potential recovery of $2.4 million in revenue annually.

- An E-Retailer expressed gratitude for Corgi Labs' insights into their payment stats, noting that the increased authorization rate would be a significant boost to their business.

Pricing

Corgi Labs pricing is structured as:

- 0.2% of transaction volume approved by the Corgi Labs model, with discounts for high volume.

- 5% of incremental revenue improvement measured against holdback transactions to maintain accuracy and transparency.

What problems does Corgi Labs solve?

Corgi Labs addresses several critical issues for businesses, including:

- False Declines: Reducing the number of legitimate transactions that are incorrectly declined, thus preventing loss of revenue and customer dissatisfaction.

- Chargebacks: Minimizing the occurrence of chargebacks, which can be costly and time-consuming for businesses to resolve.

- Payment Fraud: Protecting businesses from fraudulent transactions, ensuring secure and reliable payment processing.

Best way to optimize payment acceptance?

The best way to optimize payment acceptance is by leveraging customized payment acceptance models that adapt to a business's specific needs and risks. Corgi Labs provides this customization through its AI-powered platform, helping businesses achieve higher revenue and lower costs.

By reducing chargebacks, increasing payment acceptance rates, and providing transparent insights, Corgi Labs ensures businesses can maximize their payment processing efficiency. With expert support and seamless integration, Corgi Labs stands out as a crucial partner for businesses aiming to enhance their payment systems.

AI Marketing Copy Generation SEO Keyword Optimization AI E-commerce Copy AI Ad Optimization AI Email Marketing Social Media Content Optimization

Best Alternative Tools to "Corgi Labs"

Mobile Credits is an AI-powered decentralized payment processor enabling secure and fast global money transfers 24/7. Accept instant payments from any mobile device in Web3 ecosystems.

Hunchbank: AI-powered Stripe analytics to unlock more revenue from existing customers. Automate email marketing, prevent churn, detect fraud with AI agents.

Shopify is an all-in-one commerce platform that helps businesses of all sizes start, grow, and manage their online and offline sales. It offers tools for website building, marketing, payment processing, and more.

Yokoy is an AI-powered spend management suite that automates invoice processing, streamlines expense reporting, and provides real-time control over company spending.