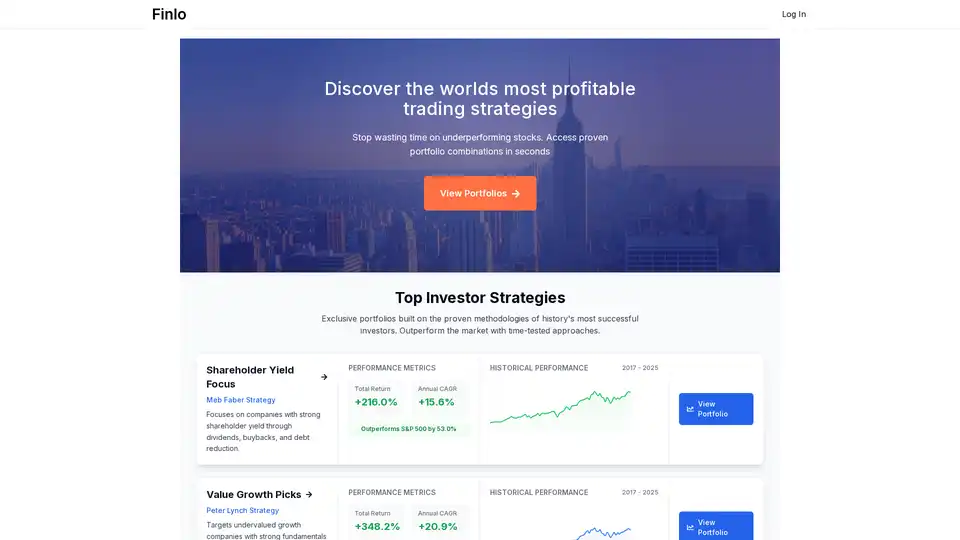

Finlo

Overview of Finlo

What is Finlo?

Finlo is an innovative AI-driven platform designed to simplify stock investing by allowing users to access and replicate proven investment strategies from history's most successful investors. Whether you're a novice looking to build wealth or an experienced trader seeking to enhance your portfolio, Finlo leverages artificial intelligence to curate high-performing stock portfolios. These portfolios are built on methodologies from legendary figures like Warren Buffett, Peter Lynch, Ray Dalio, and others, helping users outperform the market without the need for constant monitoring.

The core appeal of Finlo lies in its ability to distill complex investment wisdom into actionable, easy-to-follow portfolios. By using an AI engine, Finlo analyzes vast amounts of market data to select stocks that align with time-tested principles, such as focusing on undervalued growth companies or building diversified assets for all economic conditions. This approach not only saves time but also reduces the emotional biases that often plague individual investors.

How Does Finlo Work?

Finlo operates on a straightforward, user-friendly model that democratizes access to elite investment strategies. Here's a breakdown of the process:

Select a Strategy: Users browse through a variety of pre-built portfolios on the Finlo website. Each strategy is inspired by renowned investors and includes detailed performance metrics, such as total return, annual CAGR (Compound Annual Growth Rate), and comparison to the S&P 500. For example, the Peter Thiel-inspired Disruptive Growth Stocks portfolio boasts a staggering +602.5% total return since 2017, with a 27.9% annual CAGR, far exceeding the market benchmark.

Unlock and Implement Stocks: Once a strategy is chosen, Finlo provides the list of recommended stocks—typically around 10 holdings. Users then add these to their own brokerage account. The platform doesn't hold funds; instead, it empowers you to execute trades independently, giving you full control over your investments.

Monthly Updates and Tracking: Portfolios are refreshed monthly, with notifications sent via email or the site before the market opens on the first trading day. This low-maintenance update cycle means you only need a few minutes each month to adjust holdings, making it ideal for busy professionals.

At the heart of Finlo's functionality is its AI Engine, which hand-picks stocks based on sophisticated algorithms. For instance, the Finlo Performance Portfolio, curated directly by this AI, has delivered a +702.3% total return and 34.6% annual CAGR over the same period. The system considers factors like historical performance, trading frequency, and risk tolerance to match strategies to user goals.

Key Features and Portfolios

Finlo stands out with its diverse range of exclusive portfolios, each tailored to different investment philosophies. Here are some highlights:

Shareholder Yield Focus (Meb Faber Strategy): Emphasizes companies returning value to shareholders via dividends, buybacks, and debt reduction. Performance: +216.0% total return, +15.6% CAGR, outperforming S&P 500 by 53.0%.

Value Growth Picks (Peter Lynch Strategy): Targets undervalued companies with solid fundamentals and growth potential. Performance: +348.2% total return, +20.9% CAGR, outperforming by 185.2%.

All-Weather Strategy (Ray Dalio Strategy): A balanced, risk-diversified approach across asset classes for stability in any economy. Performance: +226.0% total return, +16.1% CAGR, outperforming by 63.0%.

Institutional Model Fund (David Swensen Strategy): Draws from Yale's endowment model, focusing on alternatives for high returns. Performance: +273.4% total return, +18.1% CAGR, outperforming by 110.4%.

Defensive Value Picks (Warren Buffett Strategy): Seeks companies with economic moats, consistent earnings, and quality management. Performance: +247.8% total return, +17.0% CAGR, outperforming by 84.8%.

Disruptive Growth Stocks (Peter Thiel Strategy): Invests in innovative sectors like AI, robotics, and genomics. Performance: +602.5% total return, +27.9% CAGR, outperforming by 439.5%.

Additionally, Finlo offers proprietary strategies like the Insider's Edge Portfolio, which aggregates high-conviction analyst picks for a +285.1% total return, and the High-Growth Innovators with +729.2% returns. Even more conservative options, such as Dividend Aristocrats for stable income, are available, though they may lag in growth (e.g., +74.0% total return).

These portfolios are backed by simulated historical performance from 2017 to 2025, providing transparency into how they've fared against benchmarks. The AI ensures selections are data-driven, incorporating metrics like dividend yields, growth potential, and competitive advantages.

Who is Finlo For?

Finlo is primarily designed for long-term investors who aim to compound wealth steadily without dedicating excessive time to research. It's perfect for:

Beginner Investors: Those intimidated by stock picking but eager to follow proven paths from Buffett or Lynch.

Busy Professionals: With monthly updates requiring minimal effort, it's suited for anyone balancing work and finances.

Passive Income Seekers: Strategies like the Dividend Income Machine offer 8%+ yields for consistent cash flow.

Growth-Oriented Traders: High-performers like Disruptive Growth appeal to those chasing exponential returns in tech-driven sectors.

It's not ideal for day traders or those seeking active fund management, as Finlo focuses on buy-and-hold replication. Importantly, it emphasizes that all investments carry risks, and past performance isn't a guarantee—users should consult professionals for personalized advice.

Practical Value and Benefits

The real value of Finlo lies in its ability to outperform the market through AI-enhanced, expert-inspired strategies. By eliminating the guesswork, it helps users avoid common pitfalls like chasing hot stocks or overtrading. For example, the platform's focus on monthly rebalancing promotes discipline, potentially leading to better long-term results than unmanaged portfolios.

Users report significant time savings— no more hours poring over financial reports—while benefiting from historical edges like the 539.3% outperformance in the AI-curated portfolio. In a volatile market, Finlo's diversified options, such as the All-Weather Strategy, provide resilience, balancing growth with stability.

From an SEO perspective, if you're searching for 'AI stock portfolio tools' or 'how to copy Warren Buffett's strategy,' Finlo delivers actionable insights. It aligns with informational intents by explaining methodologies and transactional ones by guiding users to start investing.

How to Get Started with Finlo

Getting up and running is simple:

Visit the Finlo website and create an account (log in option available).

Explore portfolios under 'View Portfolios' or 'See All Investment Strategies.'

Choose one that matches your risk profile and goals.

Use your preferred broker to buy the stocks.

Opt-in for monthly emails to stay updated.

Finlo stresses education too—its FAQ section addresses concerns like update frequency and money management, reinforcing trust.

Potential Drawbacks and Considerations

While impressive, Finlo's results are based on simulated trading, which doesn't account for real-world fees, slippage, or taxes. Actual returns may vary. The platform includes disclaimers to manage expectations, reminding users of investment risks, including principal loss. It's not financial advice, so pairing it with a licensed advisor is recommended.

In summary, Finlo empowers everyday investors with AI-fueled access to elite strategies, making sophisticated investing approachable. Whether aiming for steady dividends or disruptive growth, it offers a pathway to potentially superior returns. Ready to elevate your portfolio? Explore Finlo today and start investing like the pros.

Best Alternative Tools to "Finlo"

Graydient AI is a platform offering unlimited AI image, video, and text generation with diverse AI models. Features include an AI portfolio, stock images, comic book creation, and more.

Flyhomes offers innovative solutions like Buy Before You Sell, Cash Offer, and Instant Equity to help homebuyers move into their dream homes without the stress of selling first. Partner with Flyhomes to empower your clients!

Outseek Copilot leverages AI for financial research and analysis, providing real-time stock quotes, market analysis, and portfolio management. Save time and make better investment decisions.

Findnlink is an AI-powered virtual space that transforms ideas into reality by generating logos, project descriptions, tasks, and connecting you with collaborators. Ideal for innovators seeking efficient project launch and team building.

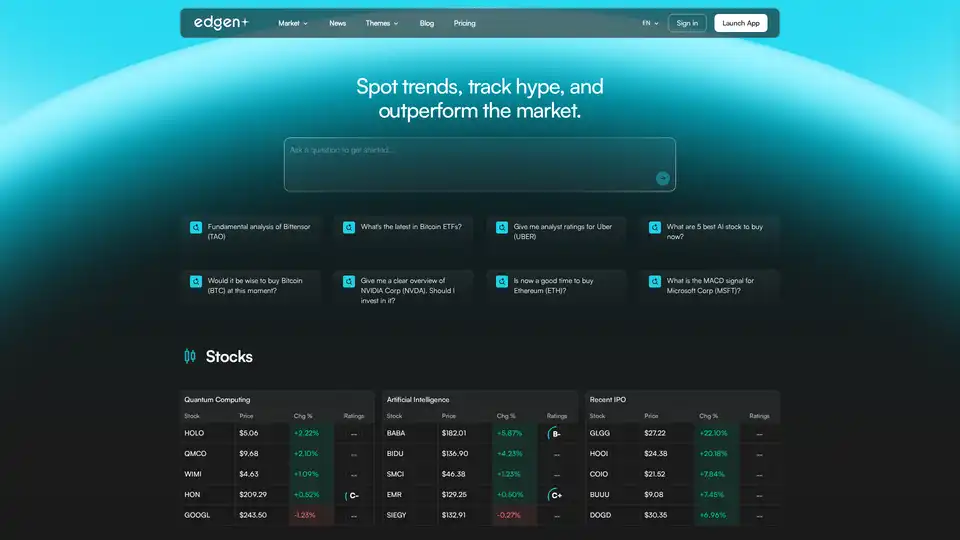

Edgen provides AI-powered tools for crypto and stock investors, offering real-time trading alerts, market signals, analytics, and portfolio analysis to spot trends and make informed decisions efficiently.

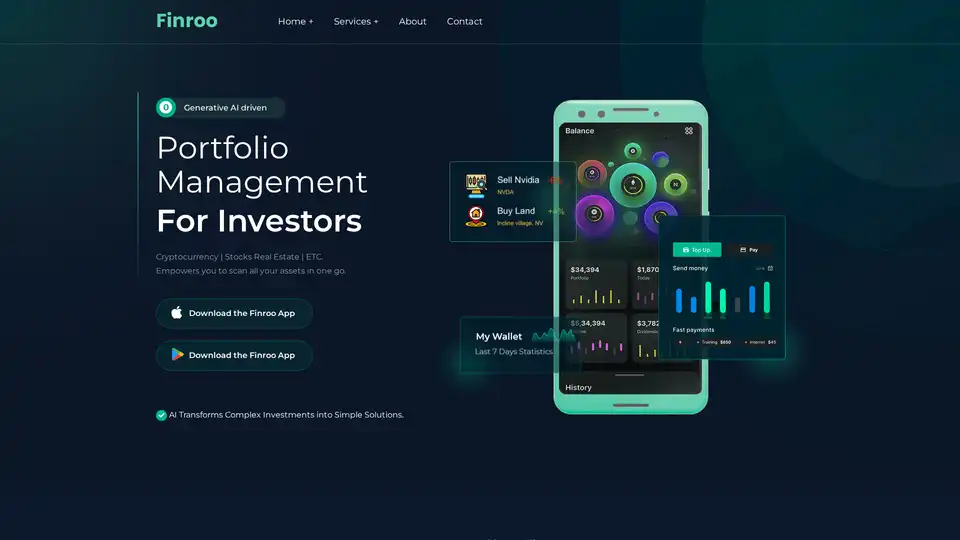

Finroo is a generative AI app for portfolio management, empowering investors to scan assets in crypto, stocks, real estate, and more. It uses advanced neural networks for trend detection, automated trading, and simplified insights to boost returns effortlessly.

Buzzy is an AI-powered no-code platform that transforms ideas into high-quality Figma designs and full-stack web or mobile apps in minutes. Start from scratch or integrate with Figma without coding for rapid app development.

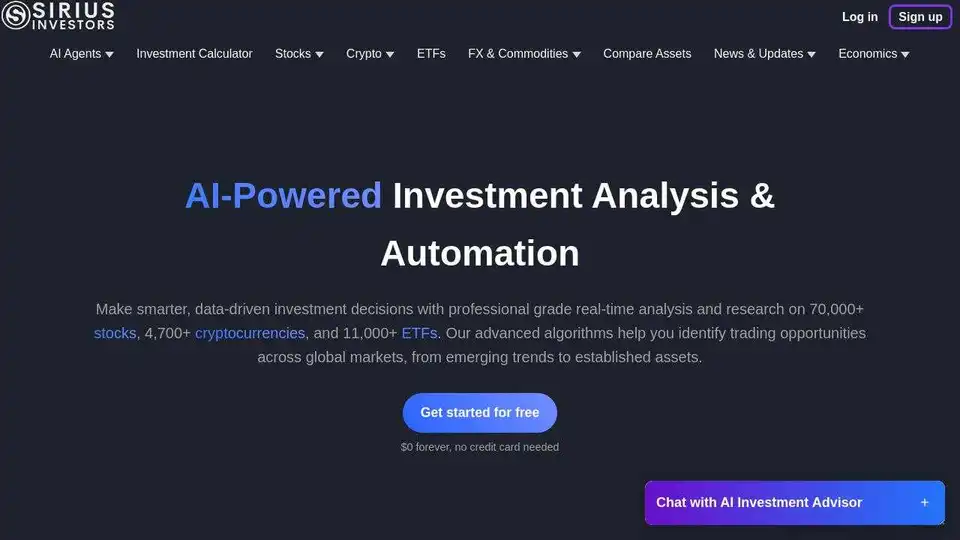

Sirius Investors is an AI-powered investment platform providing real-time market intelligence and advanced portfolio analytics based on verified financial data and SEC filings. Get professional-level stock analysis and market trends for smarter investing.

StockPe is a virtual stock market trading app and learning platform. Learn finance & investing for free, compete with friends, and earn by playing stocks & crypto tournaments.

Get AI-driven stock market analysis with Stockaivisor. Access real-time insights, predictions, and trends to make smarter investment decisions today!

Explore and compare AI models like ChatGPT, Claude, and Gemini with AnyModel. Access 50+ models with a single subscription for superior AI results.

Discover AI agents & avatars for everyday use with StoryLyft AI. Analyze stock portfolios, chat with AI characters, and store memories.

Tykr is a platform that empowers people to become great investors, providing data and knowledge for confident investing.

Leeway AI: AI-powered stock analysis for informed investment decisions. Portfolio monitoring and diversification tools for growth and value.