Jack

Overview of Jack

What is Jack?

Jack is an AI-powered bookkeeping agent designed to automate accounting tasks for businesses and accounting practices. It's capable of extracting line-item accounting entries, assigning them to the correct General Ledger (GL) and tax codes, and performing bank reconciliation functions. Unlike traditional Optical Character Recognition (OCR) technology, Jack uses AI to learn from each transaction, improving its contextual understanding of accounting treatments. This leads to more accurate extraction, faster processing, and reduced manual review.

Key Features:

- Automated Bookkeeping: Automates repetitive daily tasks, such as invoice extraction and reconciliation.

- AI-Powered Learning: Learns from each transaction to improve accuracy over time.

- Compliance Checks: Checks for identity, authority, budget, policy, laws, and regulations in real-time for every transaction, including VAT and GL code compliance.

- Faster Processing: Processes 10 invoices every 3 minutes.

- Multiple Submission Methods: Supports invoice submission via WhatsApp, Email Fetch, and Slack.

How does Jack work?

Jack works through a web-based platform, where users can submit invoices and review the extracted data. The AI extracts the necessary information, such as line items and GL codes, and presents it for validation. Once validated, the data can be synced with the user's accounting platform.

Here's a step-by-step breakdown:

- Invoice Submission: Send invoices via WhatsApp, Slack, or email, or allow Jack to monitor your email inbox.

- Automated Extraction: Jack automatically extracts the data, ready for review.

- Review and Validation: Review Jack's extraction and validate the information.

- Sync to Accounting Platform: Sync the expense data and send the invoice directly to your accounting platform.

Why choose Jack?

Jack offers several advantages over traditional bookkeeping methods and outsourcing solutions:

- Cost-Effective: Jack is 10x faster and 4x cheaper than in-house bookkeeping and outsourced solutions.

- Scalable: Allows you to grow your practice without increasing headcount.

- Real-Time Insights: Provides real-time insights to impact client decision-making.

- Improved Accuracy: Reduces errors and improves the accuracy of accounting data.

- Compliance: Ensures compliance with relevant regulations and policies.

Who is Jack for?

Jack supports various types of businesses with differing needs, including:

- Accounting Practices: Jack acts as your firm's individual client bookkeeper, automating time-consuming tasks and improving compliance.

- SME Businesses: Jack streamlines bookkeeping processes, freeing up time for more strategic activities.

- Startups: Jack provides cost-effective bookkeeping solutions to help startups manage their finances.

Practical Value and Use Cases:

- Automated Invoice Processing: Jack can automate the processing of invoices, saving time and reducing errors.

- Bank Reconciliation: Jack can automate the bank reconciliation process, ensuring that your accounts are accurate and up-to-date.

- Compliance Monitoring: Jack can monitor transactions for compliance with relevant regulations and policies.

User Testimonials:

- Marie Speakman, Partner and Accountant: "A eureka moment meeting Jack AI! No more just talking about AI, let’s put it to some good use for bookkeepers and accountants. Jack, built with the help of accountants for bookkeepers."

- Beatrix Schuster, IB books & credits, Kent: "Jack has improved our service quality significantly. Submitting documents through various platforms is now seamless. Jack’s line item extraction and analysis provide valuable insights, such as identifying unusual expenses quickly. This saves time and helps us offer precise advice. Jack is essential for any modern bookkeeping practice."

FAQ:

- How much does Jack cost? Jack costs £21.60 per hour, billed in 30-second increments. There are no minimum monthly time requirements or long-term contracts.

- Is Jack an alternative to outsourcing bookkeeping? Yes, Jack works 10x faster and costs 3-4x less than outsourcing.

- What happens to my staff - does Jack replace them? No, Jack handles 90% of the extraction, including line items, VAT, and account codes. Your team will validate Jack's work until trust is established.

By implementing Jack, accounting practices and businesses can streamline their bookkeeping processes, reduce costs, and improve accuracy. This allows them to focus on more strategic activities and provide better service to their clients.

For more information, visit the Jenesys website and book a demo to see how Jack can revolutionize your bookkeeping processes.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "Jack"

Zeni is an AI-powered bookkeeping platform offering automated accounting, real-time financial insights, and expert financial support. It provides services like AI CFO and Accountant agents, bill payments, and expense reimbursements.

KAOFFEE uses AI to automate accounting tasks, providing cost savings, increased productivity, and enhanced security for businesses. Discover how AI can revolutionize your financial processes.

Zedblock AI builds and manages end-to-end AI automation workflows for law firms, accounting practices, consultancies, and professional services. Streamline operations, reduce costs, and accelerate growth with custom AI solutions.

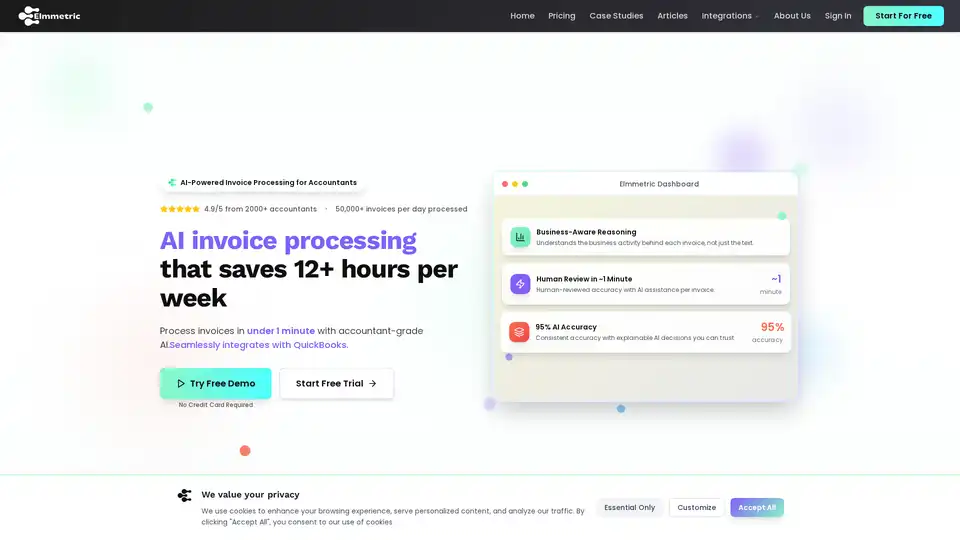

Elmmetric is an AI-powered invoice processing platform for accountants, saving 12+ hours per week. It offers business-aware reasoning, integrates with QuickBooks, and boasts 95% AI accuracy with human review.