Private Equity List

Overview of Private Equity List

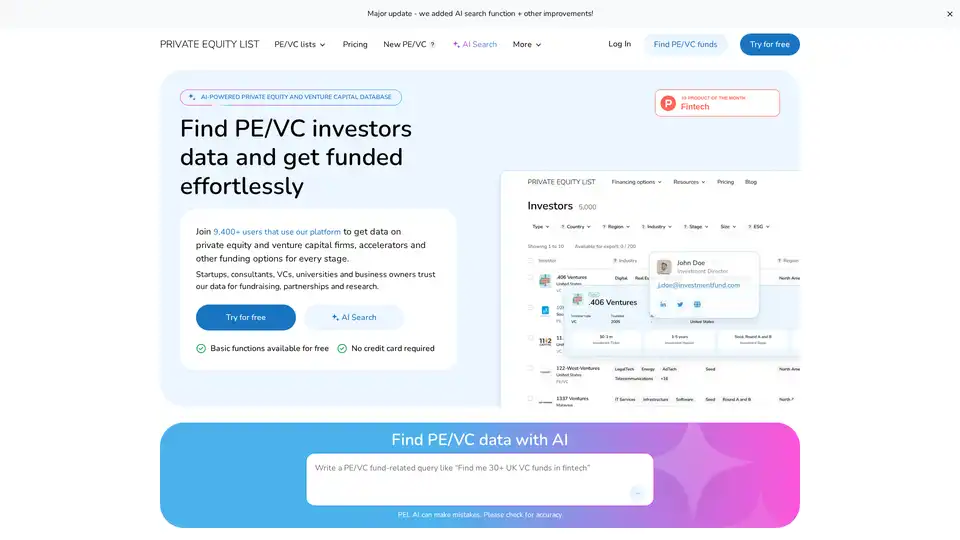

Private Equity List: AI-Powered Database for PE/VC Investors

What is Private Equity List?

Private Equity List is an AI-powered database designed to help startups, consultants, venture capitalists, universities, and business owners find private equity (PE) and venture capital (VC) investors. It offers comprehensive data and tools to streamline fundraising, partnerships, and market research.

Key Features:

- AI-Powered Search: Quickly find potential investors using AI-driven search capabilities.

- Extensive Database: Access a global network of over 6,761 PE/VC investors and 26,076 investment team contacts.

- Advanced Filters: Narrow your search by sector, geography, investment size, and more.

- New PE/VC Funds: Discover recently launched funds actively seeking investments.

- Premade Lists: Explore curated lists of investors for specific industries like Edtech, Gaming, E-commerce, and AI.

How does Private Equity List work?

Private Equity List aggregates data from various sources to provide users with an up-to-date and comprehensive view of the PE/VC landscape. The platform's AI-powered search allows users to quickly identify potential investors based on specific criteria. Filters enable users to refine their search and focus on investors that align with their investment thesis or funding needs.

How to use Private Equity List?

- Search: Use the AI-powered search to find investors based on keywords, industry, or investment stage.

- Filter: Apply filters to narrow down your search based on geography, ticket size, and investment thesis.

- Explore: Review investor profiles to learn about their investment focus, portfolio companies, and contact information.

- Connect: Reach out to potential investors directly through the platform.

Why choose Private Equity List?

- Save Time: Quickly identify potential investors without manually sifting through countless databases.

- Access Comprehensive Data: Get access to a wide range of information, including investor contacts, fund details, and investment preferences.

- Make Informed Decisions: Leverage data-driven insights to make informed decisions about fundraising and partnerships.

Who is Private Equity List for?

- Startups: Raise money faster from pre-seed to Series C investors.

- Consultants & Advisors: Create tailored investor shortlists for clients.

- VC Ecosystem: Find co-investors and strategic partners.

- Universities, Journalists, Researchers: Leverage PE/VC intelligence for research and market analysis.

User Testimonials:

Here's what users are saying about Private Equity List:

- Mark Gladney, Principal, GPI Group: "Vast amount of relevant information on PE/VC combined with friendly UI/UX."

- Stephan Horvath, Founder Ideations: "A consolidated database of VCs and Private Equity companies that has information on not only mainstream investment regions."

- Aladár Tepelea, EMEA & APAC lead, ALLINDEX: "An open PE/VC database is the tool that all startups need."

Pricing:

Private Equity List offers basic functions for free. For full database access, CSV exports, and investment team contacts, users can upgrade to a Pro subscription.

FAQ:

- Why should I use privateequitylist.com? To save time and access comprehensive data on PE/VC investors.

- What makes your database special? Its AI-powered search and extensive coverage of global investors.

- Who are the users of your platform? Startups, consultants, VCs, universities, and researchers.

Conclusion:

Private Equity List is a valuable resource for anyone seeking to navigate the complex world of private equity and venture capital. Its AI-powered search, comprehensive database, and user-friendly interface make it an essential tool for fundraising, partnerships, and market research. By providing access to a global network of investors and data-driven insights, Private Equity List helps users unlock the best funding opportunities.

Best Alternative Tools to "Private Equity List"

Junior is an AI-powered tool designed for consultants, private equity, and hedge funds to extract and structure insights from expert calls. It provides client-ready transcripts, key takeaways, and automated quant sheets.

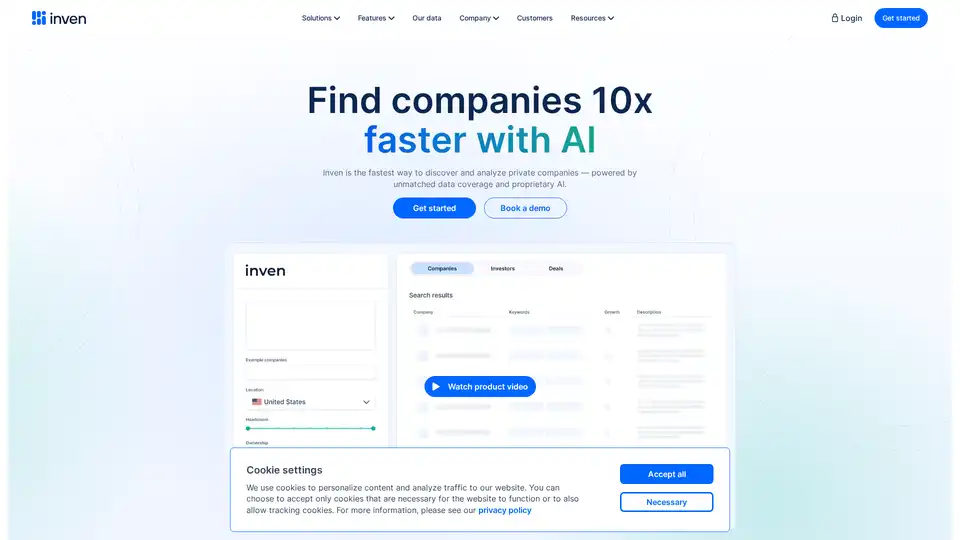

Inven is an AI-powered platform that accelerates the discovery and analysis of private companies for M&A, investment, and market research. It uses AI to sift through millions of sources, providing refined lists of relevant companies.

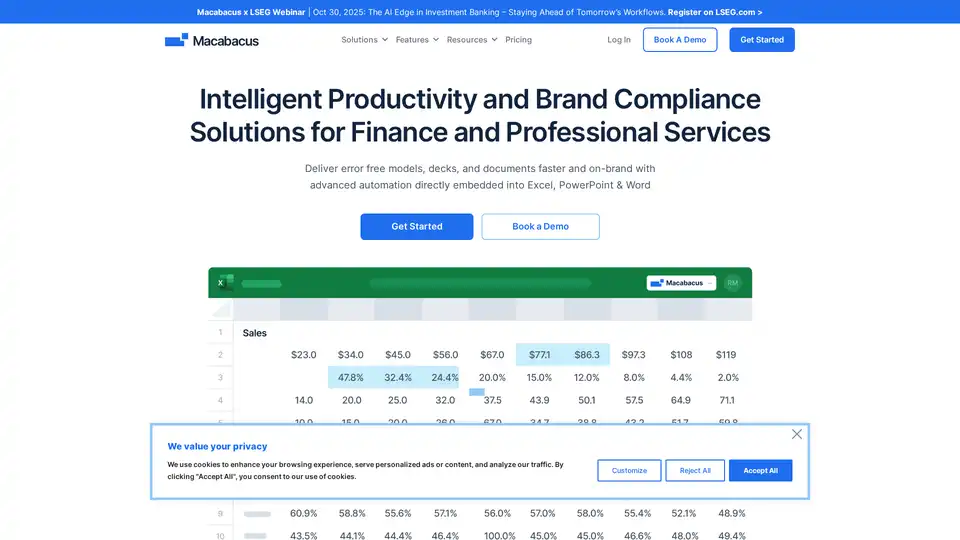

Macabacus is the #1 productivity suite for finance, designed for flawless execution in Excel, PowerPoint & Word. Automate financial modeling, presentation proofing, and ensure brand compliance.

Discover M&A targets 10x faster with Inven, an AI-powered platform for deal sourcing. Analyze millions of companies with unmatched data coverage and proprietary AI.

Blueflame AI is an agentic AI platform designed for private equity, investment banking, and M&A professionals. It automates sourcing, diligence, research, and deal execution to save time and enhance decision-making.

Bloks is an AI-driven 360° relationship intelligence platform that captures calls, emails, docs, and web data to build a searchable knowledge base, enhancing client relationships and workflows for professionals in finance, consulting, and more.

Arta is an AI-powered digital wealth platform offering access to private & public markets, financial planning, tax, and estate planning. Invest in elite private investment funds with intelligent tools.

Enhance research, sourcing, and competitor analysis with Eilla AI, designed for VC, PE investors and M&A professionals. Boost efficiency and discover more deals.

Raizer is an AI-powered platform connecting startups with relevant investors. Discover top investors, pitch effectively, and secure funding to scale your startup. Access 140K+ VCs & startups, get AI insights & close deals faster.

Hushl offers human-centric AI solutions, resources, and tools for various industries, empowering individuals and businesses with AI.

Vega is a finance focused AI Agent with first-class integrations with Excel, Snowflake, and Python.

PolygrAI Interviewer is an AI-first platform that automates, analyzes, and authenticates interviews using AI to detect deception and provide insights into candidate behavior.

Visible.vc provides tools for startup fundraising, stakeholder communication, and investor reporting. Trusted by over 5,600 founders and VCs.

Quantera.ai is an AI-powered platform for equity professionals, analysts, and asset managers. Automate workflows, unlock insights, and drive faster decisions with verified data and AI agents.