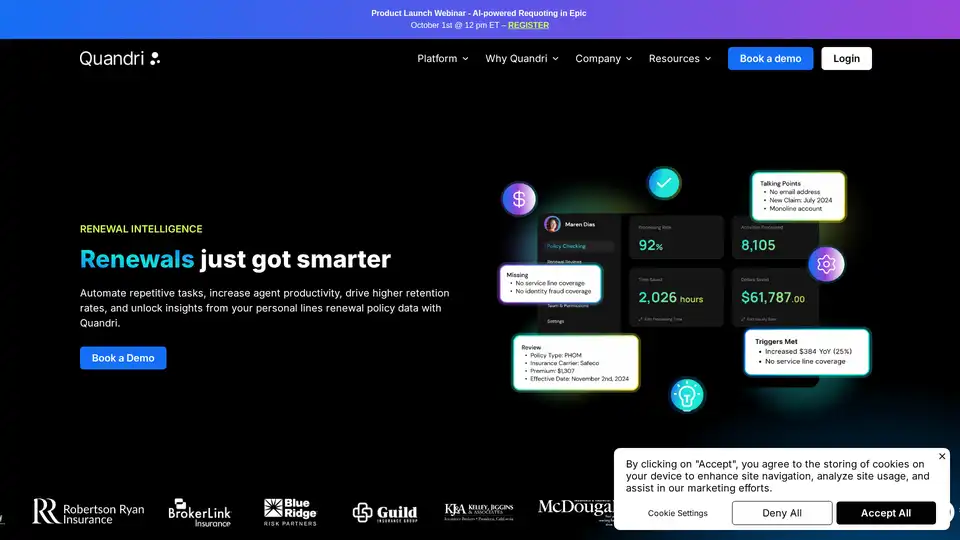

Quandri

Overview of Quandri

Quandri: Revolutionizing Insurance Renewals with AI

What is Quandri? Quandri is an AI-driven Renewal Intelligence Platform designed to transform the way insurance agencies manage policy renewals. It automates repetitive tasks, increases agent productivity, and unlocks valuable insights from personal lines renewal policy data. By leveraging AI, Quandri helps agencies improve client retention, minimize errors and omissions, and identify opportunities for cross-selling and upselling.

How does Quandri work?

Quandri synthesizes three layers of analysis on data drawn from Applied Epic to increase your agents' productivity by intelligently segmenting their policies and providing them with timely and actionable insights. Here's a breakdown:

- AI Agents: These agents retrieve data directly from your agency management system (Applied Epic).

- Intelligence Engine: The retrieved data is extracted via OCR and algorithmically classified into carrier and region-specific coverage and underwriting data.

- Preferences: Based on personalized configurations for each agency, actions are triggered for the AI agents, and easy-to-read insights are presented to brokers directly within the Applied Epic AMS.

Key Features and Benefits

- Policy Checking: Quandri empowers agents to have meaningful conversations with clients by providing them with the right information at the right time in the review cycle.

- Client Retention: Quandri-enabled agencies have seen client retention rates increase by over 1%.

- Automation: Complete in-depth annual reviews 80% faster by automating manual and repetitive tasks with Quandri's AI-enabled bots.

- Sales Opportunities: Quandri identifies cross-sell and upsell opportunities to ensure all clients meet your minimum standard.

- Error Reduction: Quandri's AI agents reduce accuracy errors throughout the review process, mitigating potential E&O risks by flagging coverage gaps and missing discounts.

- Real-time Control: Agencies can set up and reconfigure renewal parameters to meet their changing needs.

- Increased Visibility: Quandri provides visibility into the processing of renewals, including the policy checking rate, any exceptions, and the estimated time and money saved.

- Data and Insights: Quandri collects and analyzes policy data, underwriting information, discounts, and open activities from Applied Epic and IVANS to provide accurate and timely insights.

Why Choose Quandri?

In today's challenging market, insurance agencies face increased costs, talent shortages, and staffing constraints. Quandri addresses these issues by:

- Automating Repetitive Tasks: Freeing up agents to focus on more strategic and client-facing activities.

- Providing Data-Driven Insights: Enabling agencies to make informed decisions and optimize their renewal processes.

- Improving Client Experience: Ensuring clients receive timely and personalized service.

Who is Quandri for?

Quandri is designed for insurance agencies that:

- Use Applied Epic or IVANS agency management systems.

- Seek to improve client retention rates.

- Want to reduce manual workload and increase agent productivity.

- Need to identify cross-selling and upselling opportunities.

- Aim to minimize errors and omissions in the renewal process.

Customer Success Stories

- Blue Ridge Risk Partners: Reduced requoting time by 94%.

- KJ&A: Turned client losses into loyalty with AI-powered renewal intelligence, increasing client outreach by 5X and client response time by 10X.

- McFarlan Rowlands: Achieved a 350% return on investment in Quandri, processing over 18,000 policy reviews in 6 months and redeploying 5.5 full-time positions to drive more value.

How to Use Quandri?

Quandri integrates with Applied Epic and IVANS. To leverage the platform, agencies need to:

- Integrate Quandri: Connect Quandri to their existing agency management system.

- Configure Parameters: Set up renewal parameters based on their specific agency needs.

- Monitor Performance: Track renewal processing, identify exceptions, and analyze data insights.

The Power of a Platform

Quandri’s proven renewal technology is designed to help insurance agencies seamlessly and cost-efficiently scale operations to improve their overall profitability. Quandri is one of the best insurance products and enables team to leverage their talents effectively, channeling their expertise towards driving greater value for their business.

Conclusion

Quandri is revolutionizing the insurance renewal process with its AI-driven Renewal Intelligence Platform. By automating repetitive tasks, providing data-driven insights, and improving the client experience, Quandri empowers insurance agencies to thrive in today's competitive market. With proven results and a commitment to innovation, Quandri is the future of insurance renewals.

Best Alternative Tools to "Quandri"

FlowX.AI is an AI agentic platform designed for deploying AI agents in banking, insurance, and logistics. Build and deploy enterprise-ready AI solutions in weeks, integrating with legacy systems.

Matik is an AI-powered platform that automates the creation of personalized presentations, documents, and reports from your data, saving time and improving renewal rates.

Meon Onboarding Platform offers digital KYC, eSign, and face verification solutions to automate workflows, enhance compliance, and accelerate business growth. Trusted by top companies for paperless onboarding.

Pyq uses AI to automate insurance agency operations, streamlining quoting, policy comparison, and commission extraction. It helps agencies save time, reduce costs, and grow without needing additional staff.

Health Harbor automates interactions with health insurance companies using AI, handling benefits verification, prior authorizations, and claim follow-ups, saving healthcare staff time and resources.

RevRag.AI provides AI agents for revenue teams, automating lead qualification, onboarding, and support. Designed for BFSI, Fintech, and Insurtech, it aims to boost conversions and improve customer engagement.

Basepilot provides custom AI workers to automate insurance back-office operations including claims processing, policy management, and document automation for insurers, MGAs, and brokers.

Content Goblin is an AI-powered tool that generates listicles, images, recipes, and Pinterest pins in seconds. Ideal for content creators seeking fast, high-quality outputs to boost website traffic and streamline workflows.

We turn product & CRM signals into revenue-saving actions. Start with a Sprint (2 live workflows), then operate with Managed CS Workflows or an embedded pod.

Turn ordinary photos into professional masterpieces with BestPhoto. Create stunning headshots, dating profiles, and social media content using AI photo enhancement tools for instant, high-quality results.

Bright Eye is a versatile AI app for iOS that lets you build custom chatbot characters for entertainment or productivity, like movie bots or homework helpers, powered by advanced AI models for content creation and more.

Automate PDF form filling with Instafill.ai. Quickly and accurately fill out PDF forms and documents using AI, saving time and reducing errors. Try the online AI form filler today!

Automate calendar event creation with Text-2-ICS. Effortlessly convert text, images, PDFs, and CSVs into calendar events. Supports recurring events and bulk scheduling.

Indico Data's Agentic Decisioning Platform automates insurance intake, triage, and decisioning across underwriting and claims with explainable AI. Built for insurance, built for trust.