Stocknear

Overview of Stocknear

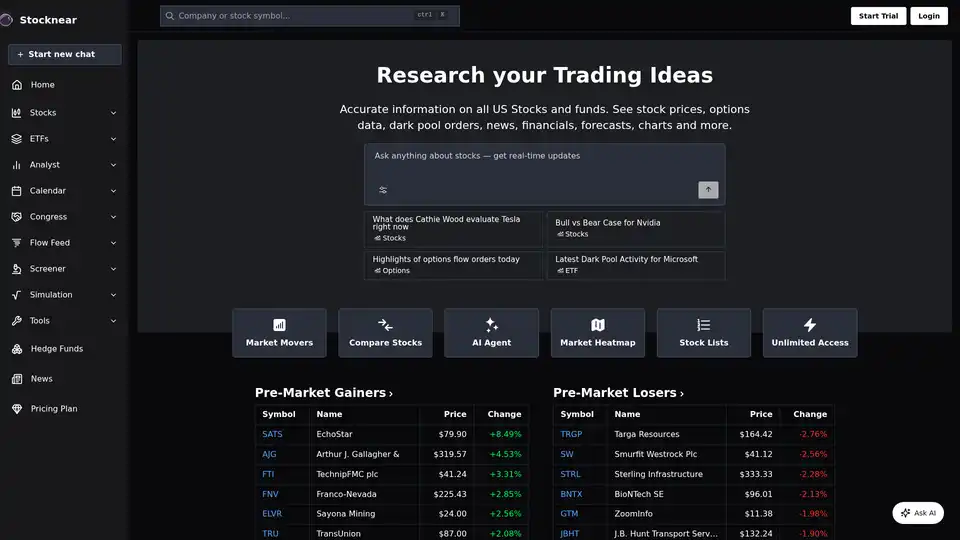

What is Stocknear?

Stocknear is an all-in-one stock analysis platform designed to empower traders and investors with accurate, real-time information on US stocks and funds. It combines advanced stock analysis tools with AI-powered forecasting, options flow tracking, and comprehensive financial data to help users research trading ideas effectively. Whether you're tracking market movers like TSLA, NVDA, or AAPL, or diving into ETFs and analyst insights, Stocknear provides a centralized hub for everything from stock prices and charts to dark pool orders and earnings forecasts.

This platform stands out by integrating AI capabilities, allowing users to ask anything about stocks and receive instant, updated responses. It's particularly valuable for those seeking to stay ahead in fast-paced markets, offering features like market heatmaps, stock comparisons, and AI agents for deeper analysis.

How Does Stocknear Work?

At its core, Stocknear aggregates data from various sources to deliver a seamless experience. Users start by logging in or starting a trial, then access sections like Stocks, ETFs, Analyst reports, and more. The platform's AI-driven engine powers features such as:

- Real-Time Data Feeds: Instant updates on stock prices, options data, dark pool activity, and news.

- AI Forecasting: Predictive insights based on historical data, trends, and machine learning models to forecast potential stock movements.

- Options Flow and Unusual Orders: Tracks large trades and unusual options activity, highlighting symbols like SLV calls or MSTR calls with premium details.

- Interactive Tools: Includes screeners, simulations, and heatmaps to visualize market dynamics.

For example, users can query specific insights like "What does Cathie Wood evaluate Tesla right now?" or explore bull vs. bear cases for Nvidia. The system processes these queries using AI to pull relevant data, generate reports, and even simulate trading scenarios.

The workflow is intuitive: Search for a stock, view its profile with financials and charts, then use AI chats for custom analysis. It's built on reliable data disclaimers, ensuring users understand the informational nature of the content.

Key Features of Stocknear

Stocknear packs a punch with its feature set, tailored for both novice and experienced traders:

- Stock and ETF Coverage: Detailed profiles for all US stocks, including prices, changes, financials, forecasts, and charts.

- Market Movers and News: Real-time lists of pre-market gainers and losers (e.g., SATS up 8.49% at $79.90), alongside breaking news like BTBT's convertible notes offering or INLF's sales increase.

- Analyst Insights: Aggregated ratings and price targets, such as Rosenblatt's Buy on Western Digital with a $125 target, citing AI-driven storage demand.

- Unusual Activity Tracking: Monitors options orders, dark pools, and flow feeds for anomalies.

- AI-Powered Tools: Chat-based queries, AI agents for research, and forecasting models that analyze patterns in options flow and earnings.

- Additional Resources: Calendar for upcoming earnings (e.g., Nike's Q4 estimates), Congress trading data, hedge fund positions, and a learning center.

These features work together to provide a holistic view, reducing the need to juggle multiple apps or sites.

How to Use Stocknear?

Getting started is straightforward:

- Sign Up and Login: Visit the site, start a free trial, or log in to access unlimited features.

- Navigate Sections: Use the menu for Stocks, ETFs, Screener, or Tools. Toggle between light and dark themes for comfort.

- Query with AI: Start a new chat to ask questions like "Highlights of options flow orders today" or "Latest Dark Pool Activity for Microsoft."

- Analyze Data: Use screeners for custom filters, compare stocks side-by-side, or view market heatmaps for quick insights.

- Track and Simulate: Monitor pre-market movers, simulate trades, or review analyst reports for informed decisions.

Pricing plans offer tiered access, from basic free tools to premium unlimited features. Support is available via FAQ, contact, or the learning center.

Why Choose Stocknear?

In a crowded market of financial tools, Stocknear differentiates itself through its AI integration and comprehensive coverage. Traditional platforms often require manual data compilation, but Stocknear's AI forecasting anticipates trends, such as potential gross margins >40% for stocks like WDC amid cloud/AI demand. Users benefit from real-time updates that catch subtle shifts, like unusual puts on MLTX or calls on HPE.

Its practical value lies in saving time and enhancing accuracy—traders report spotting opportunities faster, like the 46.48% upside in WDC forecasts. Backed by features like options flow tracking, it helps mitigate risks in volatile markets, where dark pool activity can signal big moves.

Compared to competitors, Stocknear's all-in-one approach eliminates silos, making it ideal for multi-asset research. Plus, with data on thousands of symbols and AI-driven personalization, it adapts to your trading style.

Who is Stocknear For?

This platform suits a range of users:

- Day Traders and Active Investors: Needing real-time options flow and market movers for quick decisions.

- Long-Term Investors: Analyzing fundamentals, earnings calendars, and AI forecasts for portfolio building.

- Financial Analysts: Leveraging hedge fund data, Congress trades, and analyst ratings for reports.

- Beginners: With an intuitive interface, learning center, and AI chats to demystify complex data.

It's especially useful for those focused on US markets, tech stocks (TSLA, NVDA), or energy sectors amid news like OPEC+ output changes.

Practical Value and Use Cases

Stocknear's real-world impact shines in scenarios like pre-earnings analysis—users can review Nike's estimated $11B revenue dip or RPM's growth projections to position trades. For options enthusiasts, tracking $21.32M in SLV calls reveals institutional interest.

In volatile sessions, its news feed on events like Firefly Aerospace's testing mishap or BioNTech's offerings keeps users informed. AI simulations allow testing strategies without risk, while heatmaps visualize trends across sectors.

Ultimately, Stocknear boosts decision-making confidence, potentially improving returns by highlighting undervalued assets like Genasys' Army contract or Sunrise New Energy's patent win. For SEO-savvy users researching 'best AI stock analysis tools,' it delivers actionable, data-rich content that aligns with informational and transactional intents.

By focusing on AI-enhanced insights, Stocknear not only tracks the market but anticipates it, making it a go-to for modern traders navigating AI-fueled financial landscapes.

Tags Related to Stocknear