Swiftgum

Overview of Swiftgum

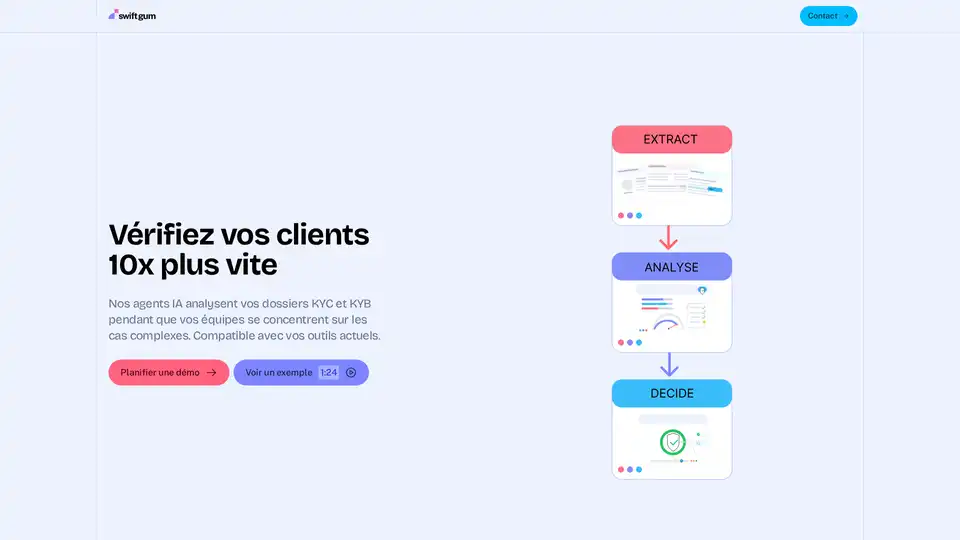

Swiftgum: Automating KYC/KYB Compliance with AI

What is Swiftgum? Swiftgum is an AI-powered solution designed to automate post-IDV (Identity Verification) document analysis for KYC (Know Your Customer) and KYB (Know Your Business) compliance. It leverages specialized AI agents to analyze compliance documents, allowing human teams to focus on complex cases.

How Does Swiftgum Work?

Swiftgum's AI agents are trained on thousands of real-world documents to ensure operational reliability and accuracy. Here's a breakdown of its functionality:

- Automated Analysis: AI agents automatically analyze KYC and KYB documents based on pre-defined rules and internal policies.

- Seamless Integration: Swiftgum integrates with existing IDV solutions and databases, such as ComplyAdvantage, Onfido, Jumio, and others, without requiring a complete system overhaul.

- Comprehensive Documentation: Every decision made by the AI agent is documented for audit purposes, providing a clear and transparent record of the compliance process.

- Human Oversight: All cases require validation by human teams, ensuring that complex or ambiguous cases are escalated to experts.

- Regulatory Compliance: Swiftgum automates threshold monitoring, generates ACPR-ready reports, and offers integrated regulatory archiving.

Key Features and Benefits

- Operational Reliability: Trained on thousands of real documents, ensuring accurate and consistent analysis.

- Auditability: Automatic documentation of each decision for compliance audits.

- Regulatory Compliance: Automates compliance tasks, including threshold monitoring and report generation.

- Compatibility: Integrates with existing verification tools and databases.

- Security: ISO 27001 infrastructure, end-to-end encryption, and GDPR compliance.

Use Cases

- Financial Institutions: Automating KYC/KYB processes to comply with regulations and reduce manual workload.

- Fintech Companies: Streamlining customer onboarding and compliance checks.

- Any Business Requiring Customer Verification: Enhancing efficiency and accuracy in verifying customer identities.

Why Choose Swiftgum?

- Speed: Verify clients 10x faster by automating document analysis.

- Accuracy: AI models trained on real-world data ensure reliable results.

- Integration: Compatible with existing systems, minimizing disruption.

- Compliance: Automates regulatory requirements and provides audit trails.

Pricing

Swiftgum offers transparent pricing at €1000 per AI agent per month. Each agent can process one case in parallel, 24/7. The number of agents can be scaled to meet specific needs, with additional costs for third-party services passed through at cost.

- Single Agent: €1000/month, processing approximately 4,000 KYC or 1,400 KYB cases per month.

- Multiple Agents: €1000/agent/month, scaling linearly with the number of agents.

How to Use Swiftgum?

- Integration: Connect Swiftgum to your existing IDV solutions, customer databases, and compliance tools.

- Configuration: Customize the AI agents with your internal rules and policies.

- Automation: Allow the AI agents to automatically analyze incoming documents.

- Validation: Review and validate the decisions made by the AI agents.

- Compliance: Generate reports and ensure adherence to regulatory requirements.

Who is Swiftgum for?

Swiftgum is ideal for:

- Compliance officers and teams

- Risk management professionals

- Financial institutions

- Fintech companies

- Businesses requiring robust KYC/KYB processes

What are the benefits of using Swiftgum?

- Reduced manual workload

- Improved accuracy and consistency

- Faster client verification

- Enhanced compliance

- Seamless integration with existing systems

In summary, Swiftgum offers a powerful solution for automating KYC/KYB compliance, providing operational reliability, regulatory adherence, and seamless integration with existing systems. By leveraging AI agents, Swiftgum helps businesses verify clients faster and more accurately, while freeing up human teams to focus on complex cases.

Best Alternative Tools to "Swiftgum"

Prembly provides comprehensive identity verification and fraud prevention services with advanced KYC, KYB, AML, and background check solutions for businesses.

BeetleLabs offers AI-driven solutions for financial compliance, KYC/KYB automation, and enhanced customer support in the BFSI sector. Streamline processes and manage risk with their all-in-one platform.

OCR API for data extraction, mobile SDK for document capture, and toolkits to liberate trapped data in your unstructured documents like invoices, bills, purchase orders, checks (cheques) and receipts in real-time.

Greenlite AI automates AML, Sanction, and KYC reviews for financial institutions, reducing costs and improving compliance. Trusted by top banks and platforms.