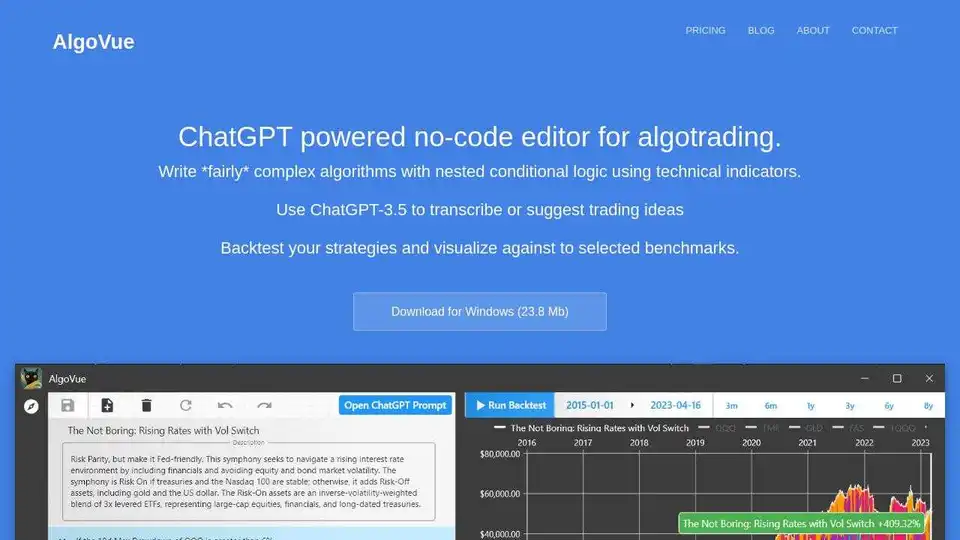

AlgoVue

Overview of AlgoVue

What is AlgoVue?

AlgoVue stands out as an innovative no-code editor designed specifically for algorithmic trading, or algo trading. Powered by ChatGPT-3.5, it democratizes access to sophisticated trading strategies by allowing users to create, test, and refine algorithms without writing a single line of code. Whether you're a seasoned trader looking to automate portfolio management or a beginner exploring quantitative finance, AlgoVue simplifies the process of turning trading ideas into actionable strategies. Built on Flutter for a seamless desktop experience, it's downloadable for Windows and keeps all your data local on your device for enhanced privacy.

At its core, AlgoVue bridges the gap between AI-driven insights and practical trading tools. It integrates OpenAI's ChatGPT to generate and transcribe trading ideas, making it easier to experiment with concepts like pairs trading, buying the dip, or portfolio rebalancing. This tool is particularly valuable in the fast-paced world of financial markets, where timely strategy development can make all the difference.

How Does AlgoVue Work?

AlgoVue operates through a intuitive visual interface that emphasizes drag-and-drop functionality, enabling users to construct complex nested logic without programming knowledge. Here's a breakdown of its workflow:

1. Strategy Building with No-Code Visual Editor

Users start by accessing a drag-and-drop inline editor to define trading rules. You can incorporate technical indicators—such as moving averages, RSI, or MACD—to create if/then control flow logic. For example, set conditions like "If the stock price dips below a certain threshold and the RSI indicates oversold, then buy." The editor supports searching thousands of securities, ETFs, or cryptocurrencies, allowing for diverse asset allocation methods: evenly distributed, by percentage, or even by inverse volatility to optimize risk.

The visual control flow is a standout feature. By hovering over a specific date in the visualization, users get an interactive explanation of how nested if/else logic triggered changes in conditions, providing transparency into strategy decisions.

2. AI-Powered Idea Generation with ChatGPT Integration

One of AlgoVue's key strengths is its seamless integration with a custom fine-tuned version of ChatGPT-3.5-turbo. Simply input a text prompt, and the AI can suggest entire balanced portfolio recommendations or various trading strategies. For instance, describe your risk tolerance and market outlook, and ChatGPT will outline a pairs trading approach or a dip-buying tactic.

This transcription feature turns vague ideas into structured algorithms. As highlighted in their Medium post, the integration was crafted to handle nuanced trading concepts, ensuring suggestions are practical and aligned with real-world market dynamics. All processing happens locally, so your strategies never leave your computer—addressing privacy concerns in an era of data breaches.

3. Backtesting and Performance Visualization

Once your strategy is built, AlgoVue leverages industry-standard tools like Backtrader.py for backtesting and Alpaca Markets as a data source. This setup delivers fast, reliable simulations of how your algorithm would perform against historical data.

Visualization tools let you compare your strategy's allocations and performance against selected benchmarks, such as the S&P 500 or Bitcoin. Charts and graphs make it easy to spot strengths, like consistent returns during market volatility, or weaknesses, such as drawdowns in bull markets. The speed is impressive; backtests run efficiently without cloud dependency, making it ideal for iterative testing.

4. Export and Implementation Options

After refinement, export your algorithm as Backtrader.py Python code or TradingView Pine Script. This flexibility allows integration with other platforms for live trading, extending AlgoVue's utility beyond ideation.

Key Features of AlgoVue

- No-Code Interface: Drag-and-drop for nested conditional logic, supporting complex strategies like portfolio rebalancing or momentum trading.

- ChatGPT Assistance: AI-driven suggestions for ideas, from simple buys to advanced multi-asset portfolios.

- Local Backtesting: Powered by Backtrader.py, with Alpaca data integration for accurate historical simulations.

- Privacy-Focused: All data and strategies remain on your device—no cloud uploads.

- Cross-Asset Support: Handles stocks, ETFs, crypto, and more, with customizable allocation rules.

- Visual Debugging: Interactive hover tools to understand logic flow over time.

These features combine to make AlgoVue not just a tool, but a comprehensive platform for algo trading experimentation.

Who is AlgoVue For?

AlgoVue targets a broad audience in the trading and investment space:

- Retail Traders and Investors: Those new to algo trading who want to automate without learning Python or Pine Script.

- Quantitative Enthusiasts: Hobbyists or professionals experimenting with AI-enhanced strategies.

- Portfolio Managers: Seeking efficient ways to rebalance assets or test risk-adjusted allocations.

- FinTech Learners: Students or self-taught individuals exploring AI in finance.

It's especially suited for users who value privacy and speed, as the desktop app avoids the latency and security risks of web-based tools.

Practical Value and Use Cases

The real-world value of AlgoVue lies in its ability to accelerate strategy development. Imagine identifying a market anomaly, like undervalued pairs in the crypto space—AlgoVue lets you prototype a trading bot in minutes, backtest it against years of data, and visualize outcomes to build confidence before going live.

Use cases include:

- Pairs Trading: AI suggests correlated assets, and you build logic to exploit divergences.

- Dip Buying: Set automated buys during pullbacks, optimized by technical indicators.

- Portfolio Optimization: Rebalance based on volatility, ensuring diversified exposure.

- Educational Simulations: Test hypothetical scenarios to learn about market behaviors.

Users rave about its intuitiveness; one testimonial notes, "OMG this tool is so amazing!" from a fictional CEO, underscoring its ease for non-coders. With dozens of expert-created strategies to browse, beginners can jumpstart their journey.

In terms of SEO for algo trading tools, AlgoVue excels by incorporating long-tail keywords like "no-code backtesting for crypto trading" or LSI terms such as "algorithmic strategy visualization." This positions it well for searches on AI-assisted quantitative finance.

Why Choose AlgoVue Over Traditional Tools?

Compared to coding-heavy platforms like QuantConnect or plain Pine Script editors, AlgoVue lowers the barrier with AI assistance and visual editing. It's faster for ideation, more private than cloud services, and exports to standard formats for scalability. For those wary of AI hype, its fine-tuned ChatGPT ensures relevant, finance-focused outputs, not generic responses.

Pricing details are available on their site, with options to sign up and access docs or status updates. Social channels like Facebook, Twitter, and YouTube offer community insights and tutorials.

How to Get Started with AlgoVue

- Download the 23.8 MB Windows installer from the official site.

- Launch the app and explore pre-built strategies or start from scratch.

- Use ChatGPT prompts to generate ideas, then drag elements into the visual editor.

- Run backtests, tweak based on visualizations, and export for live use.

By focusing on user-friendly AI integration, AlgoVue empowers more people to harness algo trading's potential, fostering informed decision-making in volatile markets.

Best Alternative Tools to "AlgoVue"

Colone is an intuitive childcare app that simplifies logging baby activities and offers AI-powered expert advice on sleep and parenting, helping new parents create more positive moments with their children.

Power up your study materials with AI flashcards, summaries, and quizzes; pull insights and find answers faster with documents chat. Learn something new with personalized AI courses and approved study materials from the web.

CryptoMatic Bot is an AI-driven tool for automated crypto trading, using machine learning to execute strategies like scalping and webhook alerts, integrated with exchanges like Binance to help users profit without constant monitoring.

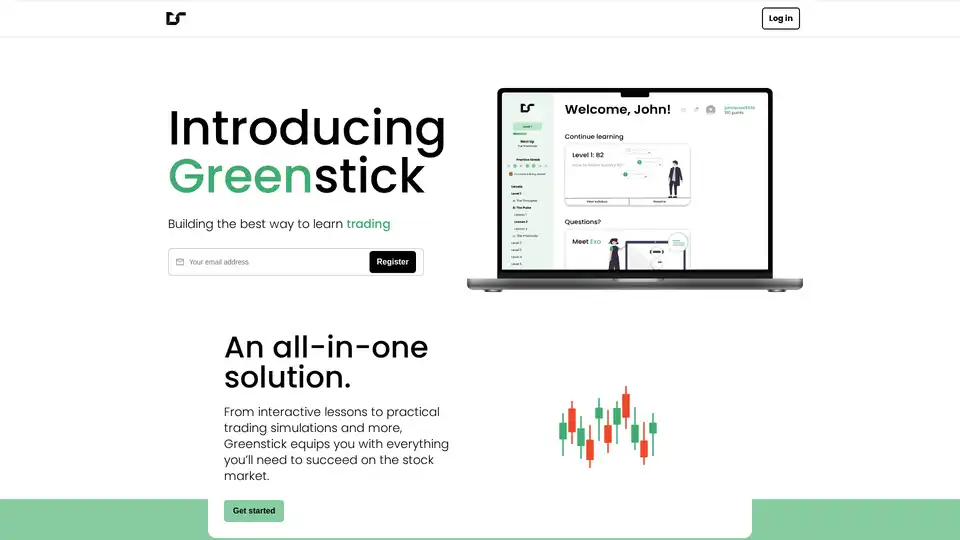

Learn stock market trading with Greenstick, an AI-powered platform offering interactive lessons, trading simulations, and personalized feedback. Master trading with AI-driven strategies and expert insights.

Design your dream T-shirt with AI. Describe what's in your mind, we'll create unique designs for you to literally wear your imagination. You prompt it, we ship it!

Archaide TradeLab: Automate your trading with AI-powered, no-code trading bots. Quickly launch, test, and refine strategies with comprehensive reporting and a supportive Discord community.

Transform your boring resume into a certified banger with Resume Rizzler's AI resume rizzification technology. Upload your resume and get a more engaging version.

Momentum Radar offers technical analysis tools, social sentiment tracking, and trading strategies for financial markets, helping investors make informed decisions.

GHOST is an AI-powered "ghostwriting" service that uses real ghosts to write content for you. Simply select an author and let GHOST do the work.

Track trending stocks online with Uptrends.ai. Get real-time AI-powered alerts for price, sentiment, and mentions to stay ahead of market-moving events. Monitor 5000+ US stocks. Join free!

Algo is a data-visualization studio specializing in AI-driven video automation, turning data into videos at scale for marketing and editorial projects.

TradingWizard AI offers AI-powered technical chart analysis for crypto, stocks, and forex, providing real-time insights to improve trading decisions.

Can't decide what to watch? Use the Random Movie Generator! Powered by AI, it helps you find the perfect movie match by offering random suggestions based on your preferences.

Trade Vector AI: Financial trading platform in Slovakia, offering tools and support for successful crypto trading, market analysis and investment portfolio management.