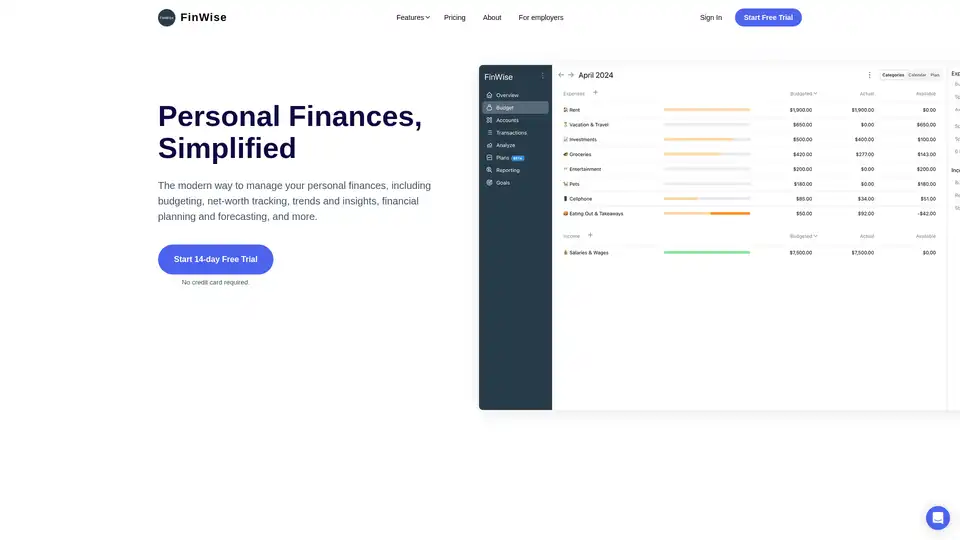

FinWise

Overview of FinWise

FinWise: The Modern Solution for Personal Finance Management

What is FinWise? FinWise is a comprehensive platform designed to simplify personal finance management. It offers a range of tools and features to help users budget effectively, track their net worth, gain insights into their spending habits, and plan for their financial future. FinWise aims to empower individuals to take control of their finances and achieve their financial goals more efficiently.

Key Features and Benefits

- Budgeting: FinWise allows users to create budgets and track their spending against those budgets. This helps users stay on top of their expenses and identify areas where they can save money.

- Net Worth Tracking: The platform securely connects to bank accounts, credit cards, and investment accounts to provide a complete view of a user's financial situation, including assets, liabilities, and net worth growth.

- Financial Planning and Forecasting: FinWise enables users to plan for major life events, such as buying a house or having children, by forecasting their financial future and ensuring they never run out of money.

- Trends and Analysis: Users can gain meaningful insights into their income, spending, savings, and net worth through detailed analysis and trends, helping them reach their financial goals faster.

- Account Aggregation: FinWise securely connects all your favorite accounts in one place, offering a centralized view of your financial life.

How Does FinWise Work?

FinWise operates by securely connecting to your various financial accounts, aggregating data, and providing intuitive tools for analysis and planning. Here's a breakdown:

- Account Connection: Users securely connect their bank accounts, credit cards, and investment accounts to FinWise.

- Data Aggregation: FinWise automatically pulls transaction data from these accounts and categorizes them for easy tracking.

- Budgeting and Tracking: Users can set budgets for different categories and monitor their spending in real-time.

- Financial Planning: Users can create financial plans by inputting their income, expenses, assets, and liabilities to forecast their financial future.

- Insights and Analysis: FinWise provides insights into spending habits, net worth growth, and other key financial metrics.

Why Choose FinWise?

FinWise offers several advantages over traditional methods of personal finance management:

- Comprehensive Tools: The platform provides a wide range of tools and features to help users manage every aspect of their financial life.

- User-Friendly Interface: FinWise is designed to be intuitive and easy to use, even for those who are not familiar with financial management.

- Secure and Private: FinWise takes data privacy seriously and employs robust security measures to protect user data.

- Affordable: FinWise offers a competitive pricing structure, making it accessible to a wide range of users.

Who is FinWise For?

FinWise is ideal for:

- Individuals Seeking Financial Control: Those who want to take control of their finances and gain a better understanding of their financial situation.

- Budget-Conscious Users: People who want to create and stick to a budget, track their spending, and identify areas where they can save money.

- Financial Planners: Individuals who want to plan for their financial future and ensure they are on track to achieve their financial goals.

- Tech-Savvy Users: Those who appreciate a modern, user-friendly interface and the convenience of managing their finances online.

Real User Testimonials

FinWise has garnered positive feedback from its users, with many praising its ease of use and comprehensive features. Here are a few testimonials:

- Paul K. "Excellent interface, super easy to use. By far the best money management and planning app I've used."

- Sean P. "FinWise is much better than any other app. Looking forward to using the collaborative budgeting you're building with my wife."

- Matt C. "FinWise is the most beautiful money management tool, and I've tried them all. You guys have my vote!"

Pricing

FinWise offers both monthly and annual subscription options, with the annual plan providing a 17% discount. The pricing is transparent, with no hidden fees. FinWise choose to charges a subscription fee to support the business because they will never sell your data, and they take your data privacy very seriously.

Conclusion

FinWise is a powerful and user-friendly platform that simplifies personal finance management. With its comprehensive tools, intuitive interface, and focus on data privacy, FinWise empowers individuals to take control of their finances and achieve their financial goals more effectively. Whether you are a budget-conscious user or a financial planner, FinWise can help you manage your money better and plan for a secure financial future.

Best Alternative Tools to "FinWise"

MoneyCoach is a personal finance app for managing money, budgeting, and tracking spending across Apple devices. Take control of your finances with smart budgets and goals.

Kniru: AI-powered personal finance app for tracking spending, optimizing investments, and managing loans. Start for free.

Maxint is your AI-powered personal financial analyst. It organizes transactions, crafts budgets, tracks net worth, and helps you reach your financial goals. Available on multiple platforms.

Understand your spending and build better habits with AI. Peek auto-tracks your money, provides vibe checks, and helps set achievable goals for anxiety-free financial wellness.

Simplify Money is an AI-powered personal finance app that helps you plan your goals, invest, and learn finance with ease. Track your net worth and more!

Rocket Money helps manage subscriptions, track spending, create budgets, and save money. Cancel unwanted subscriptions and take control of your finances effortlessly.

Tendi is an AI-powered personal financial advisor that helps you understand, plan, and achieve your financial goals with ease. Get personalized financial advice and insights.

Origin Financial is an AI-powered platform that consolidates finances for budgeting, investment tracking, and financial planning, offering personalized advice.

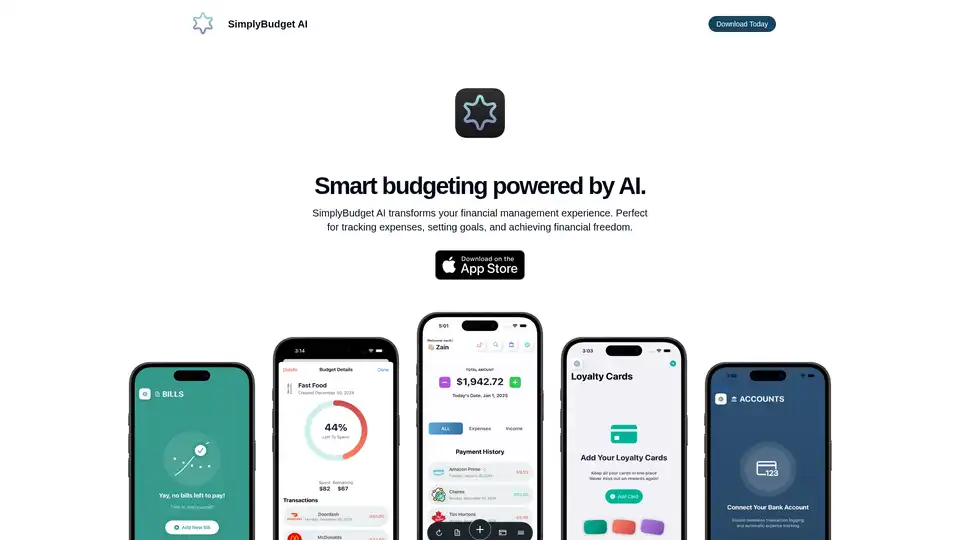

SimplyBudget AI is a smart budgeting app that uses AI to simplify financial management. Track expenses, set goals, and manage loyalty cards effortlessly. Download today to achieve financial freedom!

Track spending & save with Spendtally. Snap receipts, see where money goes, & find savings. Simple, quick, & for everyone – manage your money better today!

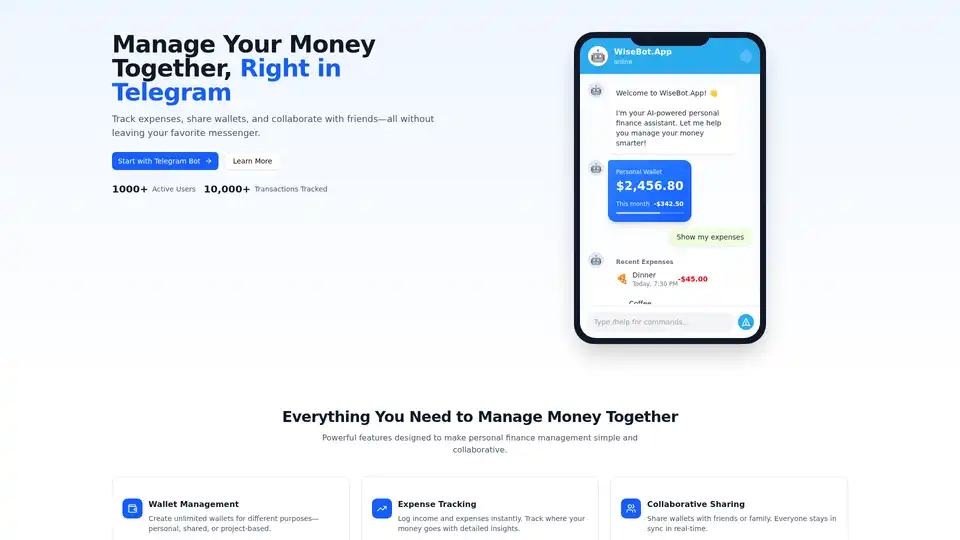

WiseBot.App is an AI-powered personal finance assistant in Telegram. Track expenses, manage wallets, share budgets collaboratively, and get smart AI insights—all securely without extra apps.

Crbit is an AI-powered personal finance app that helps you supercharge your finances. Collaborate, budget, and save with confidence using Crbit's advanced features.

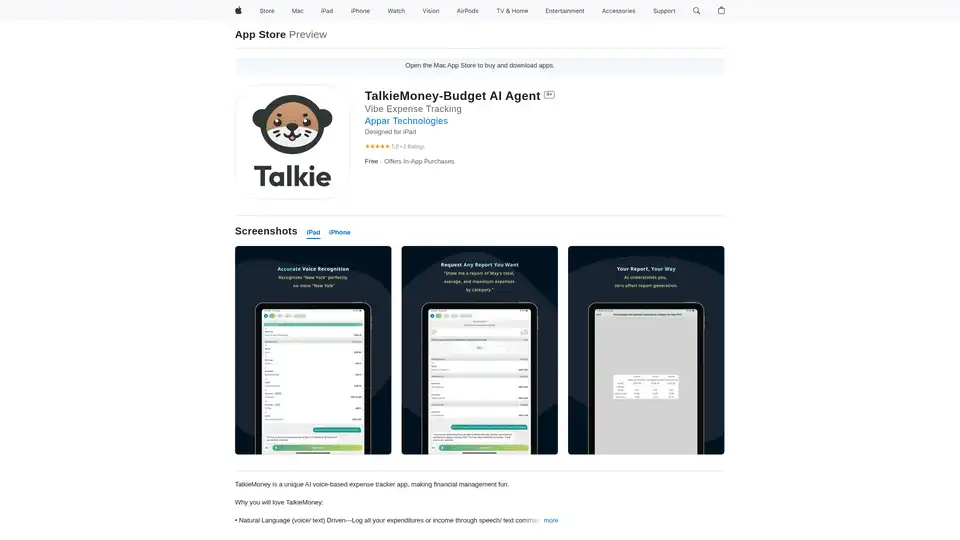

TalkieMoney is an AI-powered voice expense tracker app that makes financial management fun and easy. Log expenses with voice or text commands and get smart categorisation.

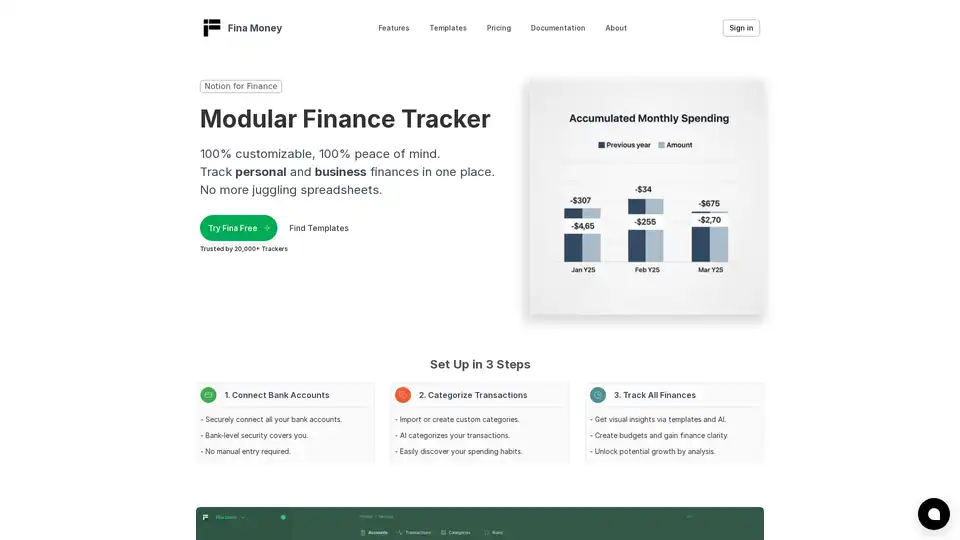

Fina Money is an AI-powered financial tracker for personal & business use. Manage your money easily, create custom budgets, and get financial insights.