Leeway

Overview of Leeway

Leeway: AI-Powered Stock Analysis for Smarter Investments

What is Leeway?

Leeway is an AI-driven stock analysis platform designed to empower investors with comprehensive insights and data-driven recommendations. By combining fundamental analysis, market timing, and an understanding of market regimes, Leeway aims to help users make better, more informed investment decisions. Developed by experts and validated through years of successful returns, Leeway offers a unique approach to stock analysis, leveraging artificial intelligence to uncover hidden opportunities and mitigate risks.

Key Features of Leeway

Leeway provides a range of features to streamline the investment process, including:

- AI-Powered Fundamental Analysis: Leeway utilizes AI algorithms to analyze over 25,000 stocks worldwide, providing in-depth fundamental analysis that goes beyond traditional methods.

- Digital Analyst: Leeway acts as a digital analyst, offering clear, objective insights into a company's business quality, market fit, and cyclical timing.

- Three-Dimensional Analysis: Leeway's scoring system combines three critical dimensions—Business Rating, Market-Fit Rating, and Cycle Rating—to provide a holistic view of a stock's potential.

- Systematic Investment Process: Leeway guides users through a structured five-step investment process, from initial screening to peer comparison.

- Generative AI and LLM Analysis: Leeway incorporates generative AI and Large Language Models (LLMs) to provide understandable and objective analysis, making complex financial data accessible to a wider audience.

How Leeway Works

Leeway's analysis is based on a sophisticated combination of AI and traditional methods:

- Business Rating: Assesses the quality of a company's business model, competitive position, and management effectiveness using LLM analysis.

- Market-Fit Rating: Evaluates a company's profitability, financial health, and value proposition through machine learning analysis of balance sheet patterns.

- Cycle Rating: Determines the optimal timing within the valuation cycle using classical analysis to identify favorable entry and exit points.

These three ratings are then aggregated into a single Leeway Score, providing a quick and easy way to assess a stock's overall potential.

Why Choose Leeway?

- Comprehensive Analysis: Leeway offers a holistic view of stocks by combining business, market, and cycle analysis.

- Data-Driven Decisions: Leeway leverages AI and machine learning to provide objective, data-driven insights.

- Time-Saving: Leeway streamlines the investment process, saving investors time and effort.

- Expert Insights: Leeway is developed by experts with years of experience in the financial industry.

- Systematic Approach: Leeway's structured investment process helps investors stay disciplined and avoid emotional decision-making.

Who is Leeway for?

Leeway is ideal for:

- Individual Investors: Those looking for an edge in the stock market.

- Professional Investors: Portfolio managers and financial analysts seeking to enhance their research capabilities.

- Financial Institutions: Firms looking to integrate AI into their investment processes.

User Testimonial

According to Anko Beldsnijder, Portfolio Manager & Geschäftsführer Avant-garde Capital, Ex-Deutschlandfondsmanager des Jahres with 30+ years of experience:

"Leeway is like a team of Buy-Side analysts in your own house. It reflects my thinking and decision-making processes and helps to avoid systematic errors. The hidden insights that regularly come to light are particularly impressive, while at the same time ensuring a quick and direct overview."

How to use Leeway?

- Rank & Screen: Systematically narrow down 25,000+ stocks with quantitative reasoning.

- Business-Rating: LLM-Analysis for checking the business model.

- Market-Fit-Rating: Machine Learning for patterns in the balance sheet.

- Cycle-Rating: Classical analysis for timing in the valuation cycle.

- Peer-Vergleich: Compare with peers.

Conclusion

Leeway offers a powerful AI-driven solution for stock analysis, combining fundamental analysis, market timing, and market regime understanding to provide investors with comprehensive insights. Its systematic approach, data-driven insights, and expert development make it a valuable tool for both individual and professional investors looking to improve their investment decisions and achieve better returns.

Best Alternative Tools to "Leeway"

Sirius Investors is an AI-powered investment platform providing real-time market intelligence and advanced portfolio analytics based on verified financial data and SEC filings. Get professional-level stock analysis and market trends for smarter investing.

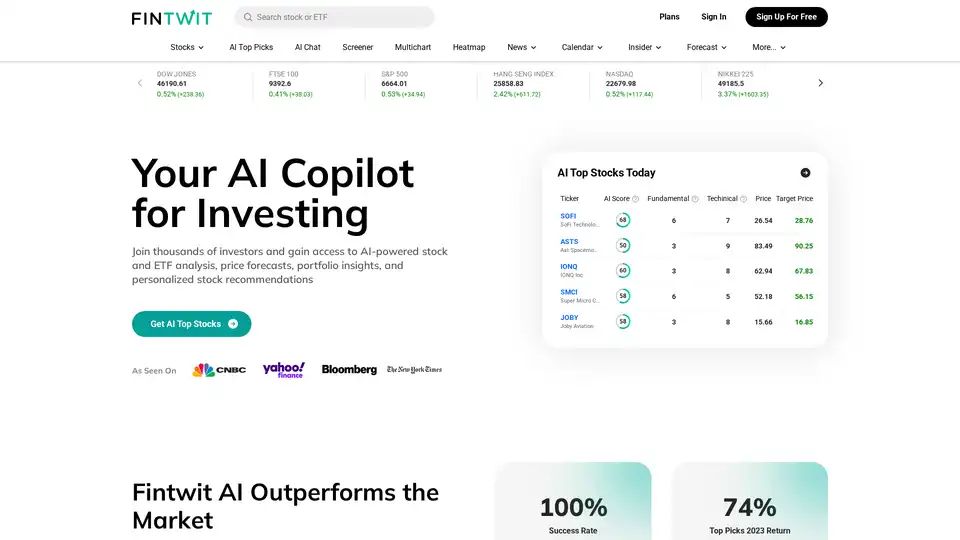

Fintwit is an AI-powered stock analysis platform offering AI stock picks, real-time quotes, screeners, and market news to help investors make informed decisions and grow their portfolios.

Kavout is an AI investing platform for stocks and crypto. Discover tools like AI Stock Picker, InvestGPT, and Kai Score for high-potential opportunities. Make smarter investment decisions effortlessly.

InvestingPro, powered by Investing.com, offers AI-driven stock analysis, real-time market data, and tools to uncover strategic investment opportunities. Stay informed with news, charts, and expert analysis.

Value Sense is an AI-powered stock analysis platform that helps investors discover undervalued stocks using intrinsic valuation tools, earnings reports, and value investing strategies to outperform the market.

Discover TrendEdge, the AI-powered stock prediction tool that leverages alternative data—social media, web traffic, and more—for real-time market insights and investment research. Try it free!

ML Alpha is an AI-powered platform providing data, AI tools, and a community for smarter stock market investing. Access AI insights, backtest strategies, and connect with expert investors.

Find the best stocks to invest in, analyze and compare fundamentals, and start investing confidently. Access US stocks, ETFs, crypto, bonds, earnings, CPI, GDP, FED interest rates, and more with AI-driven insights.

Find the best stocks and trading strategies with our market-leading AI stock trading, AI options trading tools, and the best stock screeners available. Expedite stock and options investment research with advanced news monitoring and alerts. Find the best stock trades for bull markets and bear markets.

Welltrade.ai uses AI to analyze financial data and provide clear investment recommendations. It offers Buy, Sell, or Hold signals for stocks and ETFs based on technical indicators and financial fundamentals.

QUINETICS offers state-of-the-art AI stock predictions using fundamental, technical, sentiment, and economic indicators. Register for free and analyze forecasts today!

VolatilityX provides AI-driven market intelligence, offering unbiased, data-driven analysis on stocks, crypto, commodities, and bonds. Get real-time insights and actionable forecasts to optimize your investment strategies.

AIStocks.io is an AI-powered stock research platform providing real-time forecasts, automated trading signals, and comprehensive risk management tools for confident investment decisions.

AlphaResearch helps investors extract information from unstructured texts, filings, and transcripts with AI-powered search.