Simpla AI

Overview of Simpla AI

Simpla AI: The Future of Tax and Accounting

What is Simpla AI? Simpla AI is an innovative platform that leverages artificial intelligence to revolutionize tax and accounting compliance for businesses of all sizes. It aims to provide faster, more affordable, and more accurate solutions compared to traditional firms.

How does Simpla AI work? Simpla AI offers three primary modules:

- Advise: Provides instant, tailored tax and accounting advice using AI trained by financial experts. It offers rapid human advisory sign-off for verification and access to sources for all answers.

- Process (Beta): An AI-powered computer vision tool for document processing. It automates tasks like scanning invoices, auto-filling data, and validating VAT.

- Analyse (Beta): Unlocks business insights by analyzing financial data. Users can upload P&L, balance sheet, and cash flow statements to get customizable analysis and optimize operations.

Key Features and Benefits

- AI-Powered Advice: Get personalized tax and accounting advice in seconds with the Advise module.

- Human Advisor Sign-Off: Verify queries with human experts for added accuracy.

- Source Transparency: Access sources for all answers provided by the Advise module.

- Workflow Automation: Automate tasks like generating advisory emails and creating journal entries with action prompts.

- Speech-to-Text AI: Use voice commands for easier access to tax and accounting advice.

- Financial Data Analysis: Unlock insightful analytics to optimize your operations with the Analyse module.

- Document Processing: Automate invoice scanning, data entry, and VAT validation with the Process module.

Who Can Benefit from Simpla AI?

- Startups & SMEs: Benefit from time-saving automation, easy compliance, and cost-effective solutions.

- Accounting & Advisory Firms: Access accurate, up-to-date insights, scalable for high-volume workloads, and improved client communication.

- Large Enterprises & Banks: Utilize customized knowledge bases, cross-border compliance features, and tailored, scalable solutions.

How Simpla AI Solves Common Problems

- Overpaying for Tax Advice: Simpla AI offers a more affordable alternative to traditional firms, being 43x cheaper.

- Time-Consuming Compliance: Simpla AI provides a 6x faster compliance solution compared to traditional methods.

- Inaccurate Information: Simpla AI's platform is always backed by up-to-date, reliable regulatory information, updated within 48 hours of any tax and accounting regulatory changes.

Practical Applications

- VAT Compliance: The Process module helps businesses validate VAT effortlessly, particularly useful for UAE small business owners.

- Financial Forecasting: The Analyse module provides tools for insightful financial forecasting, helping businesses make informed decisions.

- Streamlining Operations: Simpla AI automates various financial processes, freeing up time for businesses to focus on core activities.

Pricing

Simpla AI offers a free trial. Contact them for pricing details on Simpla Enterprise and other plans.

What is the best way to streamline my tax and accounting compliance? Simpla AI provides a comprehensive suite of tools to automate, analyze, and advise on all aspects of tax and accounting, empowering businesses to stay compliant and make smart financial decisions. It is a powerful tool designed to transform the way businesses manage their finances and navigate the complexities of tax and accounting regulations.

Best Alternative Tools to "Simpla AI"

Inkwise uses AI to transform your uploaded files into expertly crafted reports and articles. Extract key information seamlessly with smart content extraction, predictive writing, and AI chat.

Black Ore is the first AI tax platform for CPAs, automating 1040 tax preparation to free up billable hours, supercharge efficiency, and ignite growth. It offers effortless client management and AI-powered preparation.

Discover the best AI accounting software for finance professionals. Automate accounting services with AI tools for bookkeeping, tax prep, and financial analysis.

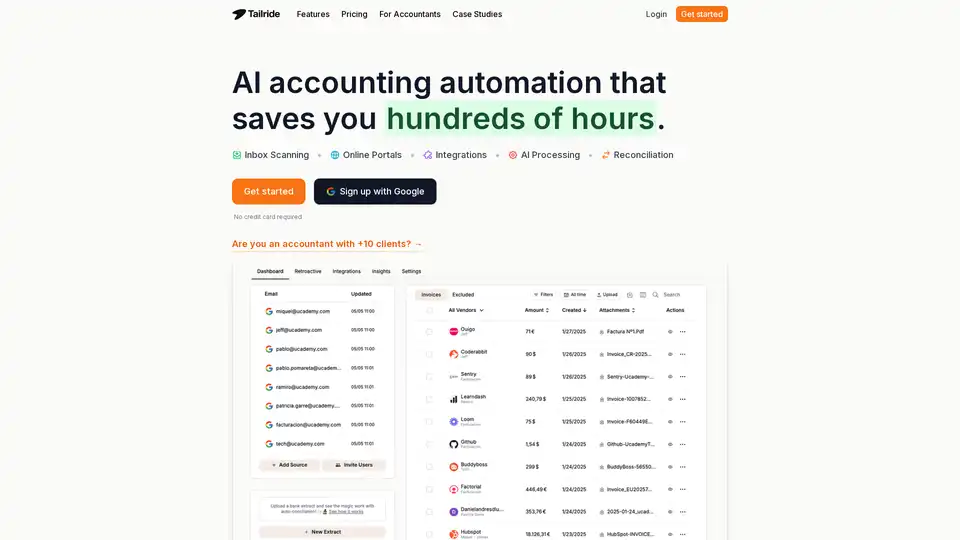

Tailride automates invoice and receipt processing using AI, extracting data from emails and web portals. It integrates with accounting software and offers features like inbox scanning, online portal extraction, and reconciliation.

EliteInvoice is an AI-powered invoicing tool that creates professional invoices in just 30 seconds. Save time with automation, customize designs, and track payments effortlessly for your business.

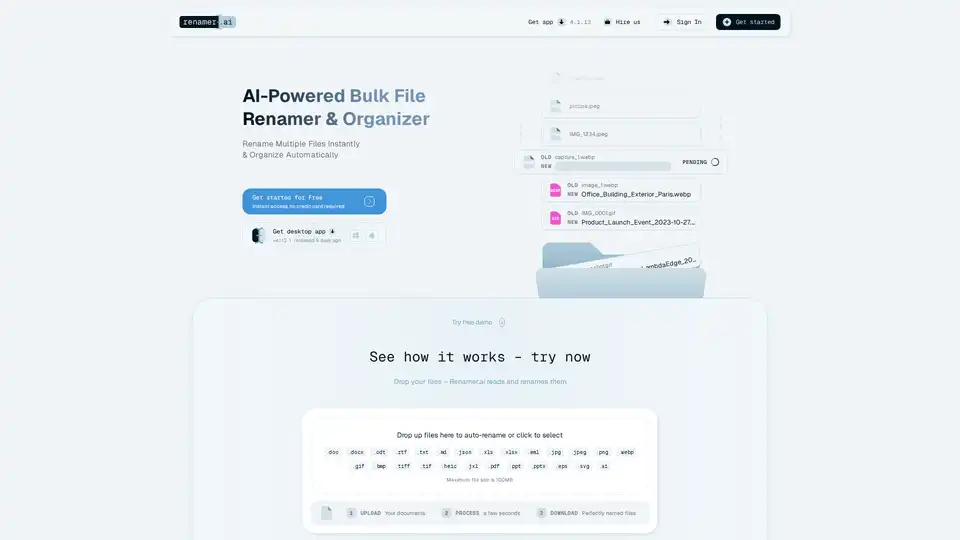

Renamer.ai is an AI-powered tool that automatically renames files based on their content, using OCR and intelligent analysis. It supports multiple file types and languages, offering both a desktop app and a web interface.

An advanced AI-powered bank statement converter that helps you convert your PDF bank statements to a readable CSV or Excel format on your phone. Features include fast and accurate conversion, and a user-friendly interface.

KAOFFEE uses AI to automate accounting tasks, providing cost savings, increased productivity, and enhanced security for businesses. Discover how AI can revolutionize your financial processes.

Transform receipt management with Receipt OCR API. Fast, precise data extraction for streamlined workflows & enhanced efficiency. Extract totals, taxes, dates & more.

WellyBox is an AI-powered solution that automatically collects and organizes receipts and invoices from email and other sources, streamlining financial document operations for businesses.

Quanta automates bookkeeping and provides real-time financial clarity for software companies. Get real-time insights into costs, revenue, and key metrics for informed decision-making.

ClientReports.ai leverages AI to automate client reporting, generating insightful reports in minutes. Streamline data analysis, customization, and secure collaboration.

Smart Clerk transforms bank statements into bookkeeper-ready reports using AI, eliminating manual data entry. Automatically categorize transactions, streamline vendor management, and generate financial reports instantly.

Uplinq AI automates bookkeeping and tax for small businesses, providing real-time financial insights, tax compliance, and strategic tax planning. It integrates with existing tools and offers human oversight for optimal outcomes.