Artivatic

Overview of Artivatic

Artivatic: AI-Powered Insurance Platform

Artivatic is an AI-native SaaS solution transforming the insurance and health services landscape. It offers modular building blocks powered by best-in-class APIs, designed to revolutionize how insurance products are designed, priced, and managed. The platform focuses on making insurance more affordable and accessible by leveraging artificial intelligence, machine learning, and data-driven insights.

What is Artivatic?

Artivatic is an AI-driven platform that offers a suite of products and APIs to modernize the insurance industry. It provides tools for underwriting, claims processing, risk assessment, and customer relationship management, all designed to enhance efficiency, reduce costs, and improve customer experience.

How does Artivatic work?

Artivatic employs a range of AI technologies to streamline insurance processes:

- AI-Powered Underwriting: AUSIS uses AI to provide real-time, personalized underwriting for life and health insurance.

- Claims Processing: ALFRED automates health claims processing using AI and data to ensure faster and more accurate settlements.

- Risk Assessment: PRODX helps in rapid product designing with risk insights, utilizing historical data, underwriting risks, and location data to create risk-based products.

- Lead Management: MiO is an integrated AI platform that empowers insurance players with specialized lead management and scoring processes.

Key Features and Benefits

- API-First Approach: With over 400 APIs, Artivatic allows for seamless integration with existing systems and third-party applications.

- Modular Solutions: Offers a range of products like AUSIS, ALFRED, ASPIRE, and PRODX, each designed for specific insurance needs.

- Data-Driven Insights: Leverages AI, ML, and data to provide actionable insights for better decision-making.

- Automation: Automates key processes such as underwriting, claims processing, and lead management, reducing manual effort and improving efficiency.

- Personalization: Enables personalized product offerings and dynamic pricing based on individual risk assessments.

Use Cases

- Life Insurance: Transforms life insurance with embedded APIs and core platforms for new-age insurance products.

- Health Insurance: Simplifies integration with existing environments, offering full-stack on-premise setup for modern health insurance experiences.

- Property Insurance: Provides an end-to-end risk inspection system that connects with multiple systems via APIs.

- SME Insurance: Allows SMEs to self-buy and manage personalized insurance for employees digitally.

Why is Artivatic important?

In the insurance industry, Artivatic addresses several critical challenges:

- Affordability: By automating and streamlining processes, Artivatic helps reduce operational costs, making insurance more affordable.

- Accessibility: The platform’s API-driven approach makes it easier for businesses to integrate insurance products into their existing systems, expanding access to insurance.

- Personalization: AI-driven risk assessment allows for personalized product offerings, ensuring customers get the coverage they need at a fair price.

Customer Success Stories

- SBI Life Insurance: Utilizes Artivatic for intelligent document processing to assist in medical underwriting.

- Aegon (Bandhan) Life Insurance: Found Artivatic's alternative underwriting services satisfactory with prompt and complete service.

- ICICI Prudential Life Insurance: Achieved promising results in decision-making and risk profiling using Artivatic's digital footprints and technology.

Pricing

Artivatic offers customized pricing based on the specific needs and scale of the business. Potential customers can request pricing through the Artivatic website.

Conclusion

Artivatic is an innovative AI-driven platform that is revolutionizing the insurance industry. By leveraging AI, ML, and data-driven insights, Artivatic enables businesses to create more affordable, accessible, and personalized insurance products. Its modular solutions and API-first approach make it a versatile tool for insurers looking to modernize their operations and improve customer experience. For businesses looking to transform their insurance offerings, Artivatic presents a compelling solution. By automating key processes, personalizing product offerings, and providing data-driven insights, Artivatic enables insurers to reduce costs, improve efficiency, and better serve their customers. Artivatic is not just a technology provider, but a growth partner committed to helping its customers succeed in the digital age.

Best Alternative Tools to "Artivatic"

StackAI is a no-code platform to build and deploy AI Agents for Enterprise AI. Automate workflows, analyze data, and enhance decision-making effortlessly. SOC2, HIPAA, and GDPR compliant.

FurtherAI is an AI platform for insurance professionals that automates underwriting, claims, and compliance, boosting efficiency and accuracy.

Docugami is an agentic document AI platform that transforms unstructured business documents into actionable knowledge graphs for enterprise automation.

Monitaur is an AI governance platform that helps organizations manage AI risks, ensure compliance, and accelerate AI initiatives, particularly in regulated industries like insurance.

FlowX.AI is an AI agentic platform designed for deploying AI agents in banking, insurance, and logistics. Build and deploy enterprise-ready AI solutions in weeks, integrating with legacy systems.

FPT.AI provides AI solutions transforming businesses into AI-first organizations, offering virtual assistants, digital workforce solutions, and operational excellence tools.

Indico Data's Agentic Decisioning Platform automates insurance intake, triage, and decisioning across underwriting and claims with explainable AI. Built for insurance, built for trust.

Basepilot provides custom AI workers to automate insurance back-office operations including claims processing, policy management, and document automation for insurers, MGAs, and brokers.

Alltius is an AI platform for financial services, automating customer queries, reducing support costs, and boosting sales. It provides AI agents and workflows for insurance, banking and finance.

Attestiv is an AI-powered platform that validates digital content, detecting deepfakes, fraud, and cyber threats. It helps businesses in insurance, finance, media, and HR build trust and improve security.

Base64 Document Intelligence Platform automates document processing with Agentic AI and over 2,800 prebuilt models.

DocExtractor automates data extraction from various document types using AI. It supports multiple formats and offers features like bulk processing, customizable extraction, and secure data handling. Ideal for businesses seeking to streamline document workflows.

Photo Journey AI transforms your travel and landscape photos into captivating stories using AI, streamlining trip planning, shooting, writing, and selling prints for photographers seeking to elevate their art.

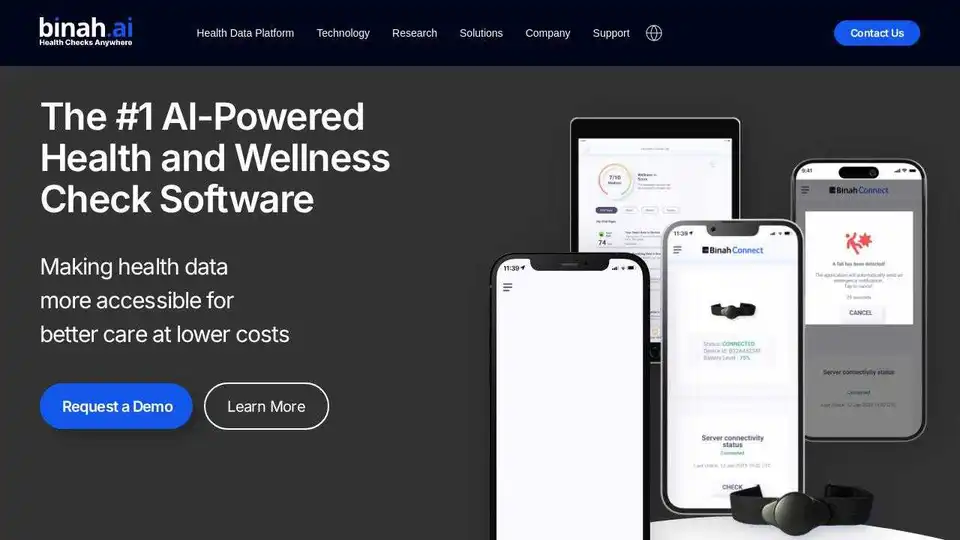

Binah.ai is an AI-powered health data platform providing video-based vital signs monitoring through a smartphone or tablet camera. Measure blood pressure, heart rate, and more in seconds.