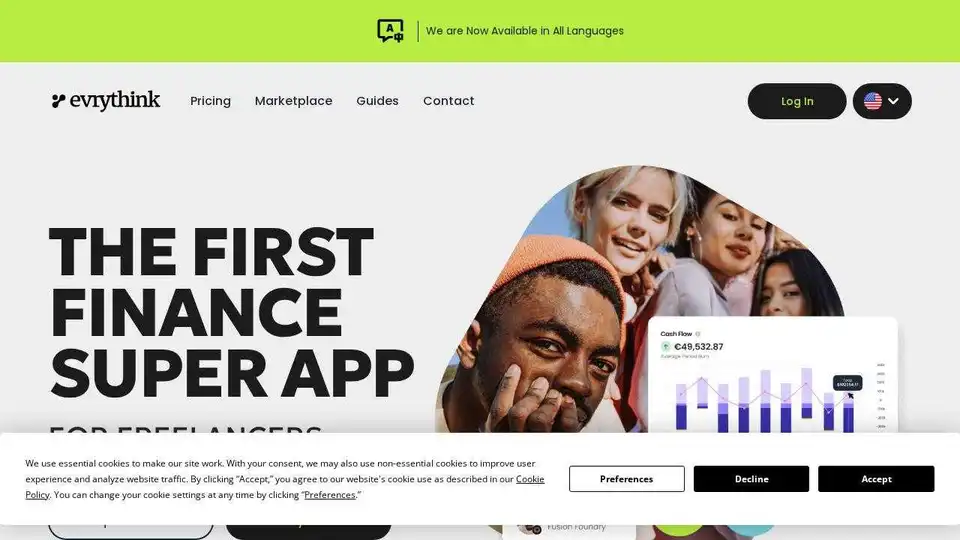

EvryThink

Overview of EvryThink

EvryThink: The First Finance Super App for Freelancers, Startups & SMEs

What is EvryThink?

EvryThink is an all-in-one finance super app designed to simplify financial management for freelancers, startups, and SMEs. It offers a user-friendly platform with a range of features, including expense tracking, budgeting, revenue planning, fundraising support, and financial dashboards. EvryThink empowers businesses to manage their finances effectively without needing extensive financial expertise.

Key Features and Benefits

- Simple Interface: EvryThink is designed for everyone, not just finance professionals. Its intuitive interface makes it easy to manage finances, regardless of your financial knowledge.

- Expense Tracking: Keep track of all your expenses in one place with just a few clicks.

- Financial Dashboards: Access key financial metrics like burn rate and runway in one centralized dashboard.

- Talent Planning: Plan and understand your team's costs to avoid surprises.

- Revenue Planning: Simplify your revenue forecasting process.

- Fundraising Support: Track funding rounds and manage your funding needs effectively.

How does EvryThink work?

EvryThink consolidates various financial applications into a single, powerful platform. It helps users manage their finances almost on autopilot by providing the necessary tools to make proactive decisions. The platform offers real-time insights and scales with your business, ensuring you're always prepared for the next stage of growth.

Use Cases

- Startups: EvryThink helps startups manage their finances from the ground up, providing the tools to track expenses, plan revenue, and manage funding rounds.

- Freelancers: Freelancers can use EvryThink to manage their income, expenses, and invoicing in one simple platform.

- Nonprofits: EvryThink offers a free plan for nonprofits, educational institutions, and B Corporations, helping them manage donations, grants, and budgets effectively.

- B Corporations: Certified B Corps can leverage EvryThink to streamline their finances while focusing on driving positive change.

- Educational Organizations: EvryThink supports educational organizations by simplifying budget management and financial planning.

Why is EvryThink important?

Poor financial management is a major reason why startups fail. EvryThink addresses this issue by providing an easy-to-use platform that simplifies finances, even for those with limited financial knowledge. By using EvryThink, businesses can avoid costly mistakes and make informed decisions, leading to better financial health and increased chances of success.

Who is EvryThink for?

EvryThink is ideal for:

- Founders

- Entrepreneurs

- Freelancers

- Nonprofit Organizations

- B Corporations

- Educational Institutions

- Small and Medium-sized Enterprises (SMEs)

What problems does EvryThink solve?

- Complicated Spreadsheets: EvryThink eliminates the need for complex spreadsheets by providing an intuitive platform for financial management.

- Lack of Financial Expertise: The platform is designed to be user-friendly, even for those without financial backgrounds.

- Poor Financial Management: EvryThink provides the tools and insights needed to manage finances effectively and avoid costly mistakes.

- Time-Consuming Financial Tasks: The platform automates many financial tasks, saving users time and effort.

Customer Testimonials

The webpage does not include user testimonials.

Pricing Plans

EvryThink offers a free plan for founders, entrepreneurs, and freelancers. More advanced features are available in premium plans as your business grows. They also provide free access for nonprofits, educational institutions, and B Corporations.

Frequently Asked Questions About EvryThink

Why should I care about finance, I already have an accountant?

EvryThink helps you manage your finances in real-time, giving you the tools to make proactive decisions and avoid costly mistakes. Your accountant often looks at the past, not the future.

Is it really free to use EvryThink?

Yes! Founders, entrepreneurs, and freelancers can start for free. The platform grows with you, offering advanced features only when you need them.

How is EvryThink different from other tools or ERPs?

EvryThink is an all-in-one solution made specifically for businesses at an early stage and grows with you.

I know zero about finance, can I use it?

Totally. EvryThink is designed to be intuitive and easy to use, even if you’re not a finance expert.

How does EvryThink support me as I grow?

EvryThink scales with you, offering real-time insights and tools to manage your resources in one place, so you’re always prepared for the next stage of your journey.

Conclusion

EvryThink is a comprehensive finance super app that simplifies financial management for freelancers, startups, and SMEs. With its user-friendly interface, expense tracking capabilities, financial dashboards, and fundraising support, EvryThink empowers businesses to take control of their finances and make informed decisions. Whether you're a startup founder, freelancer, or nonprofit organization, EvryThink provides the tools and resources you need to succeed. Start free today and experience the power of EvryThink.

Best Alternative Tools to "EvryThink"

Nume is the AI CFO for founders, delivering instant financial insights on cash flow, profitability, and forecasts. Connect your data securely and automate essential finance tasks to drive smarter decisions for startups.

Transform your financial habits with ExpenseSorted. Smart expense tracking, AI-powered categorization, and insights to improve your financial health. Calculate your financial freedom using Google Sheets.

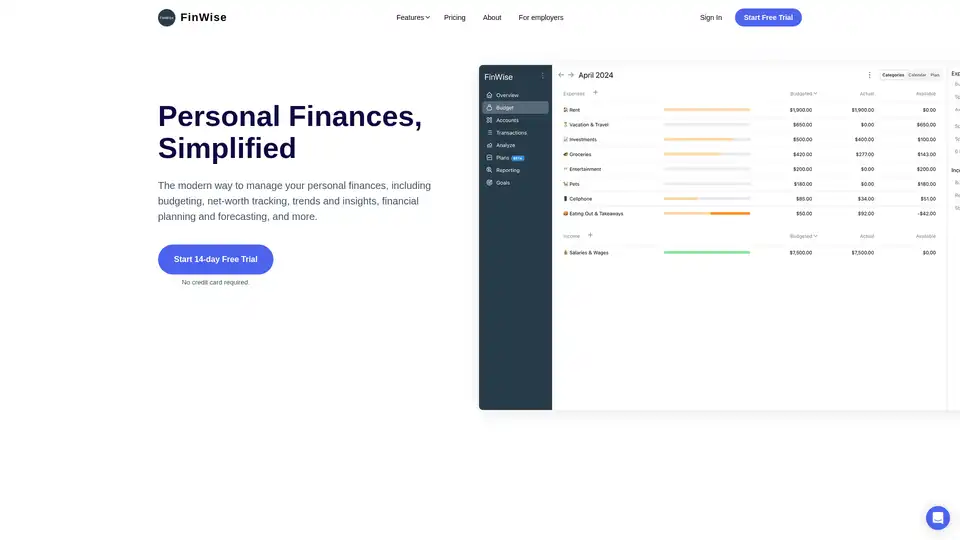

FinWise simplifies personal finance management with budgeting, net worth tracking, and financial planning tools. Securely connect accounts, track spending, and plan for the future.

2K is an AI-powered personal finance app that tracks spending, forecasts budgets, and offers expert coaching to help you make smarter money decisions and maximize savings effortlessly.

WiseBot.App is an AI-powered personal finance assistant in Telegram. Track expenses, manage wallets, share budgets collaboratively, and get smart AI insights—all securely without extra apps.

Rocket Money helps manage subscriptions, track spending, create budgets, and save money. Cancel unwanted subscriptions and take control of your finances effortlessly.

ONtezo is an all-in-one AI-powered business solution unifying teams, streamlining collaboration, and managing projects. Automate tasks, manage CRM, and track finances in one place.

Track finances & expenses in 10 minutes/month with finance_stuff. AI insights, statistics & visualizations for smarter financial management.

Fina Money is an AI-powered financial tracker for personal & business use. Manage your money easily, create custom budgets, and get financial insights.

Crbit is an AI-powered personal finance app that helps you supercharge your finances. Collaborate, budget, and save with confidence using Crbit's advanced features.

Master your financial future with NeonFin, a smart suite of financial calculators. Track expenses, analyze spending, and make informed financial decisions. Start budgeting today!

MoneyCoach is a personal finance app for managing money, budgeting, and tracking spending across Apple devices. Take control of your finances with smart budgets and goals.

Glean.ai transforms accounts payable with AI-powered automation and spend intelligence. Simplify vendor management, reduce overspending, and empower finance teams to drive savings.

Tendi is an AI-powered personal financial advisor that helps you understand, plan, and achieve your financial goals with ease. Get personalized financial advice and insights.