2K

Overview of 2K

What is 2K?

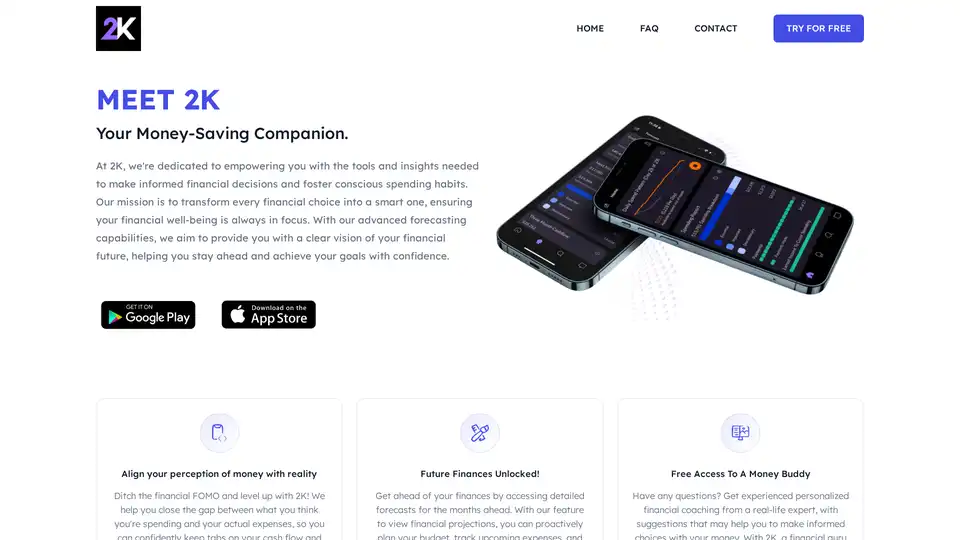

2K is your ultimate money-saving companion, an innovative AI-powered personal finance app designed to empower users with actionable insights into their spending habits and financial future. Launched by Consciously.AI LAB INC., 2K bridges the gap between perceived and actual expenses, helping individuals ditch financial FOMO (fear of missing out) and adopt conscious spending practices. Whether you're juggling credit cards, mortgages, or student loans, this app aggregates all your accounts into one intuitive dashboard, providing a holistic view of your cash flow without the hassle of manual tracking.

At its core, 2K isn't just another budgeting tool—it's a proactive financial ally that uses advanced AI models to deliver personalized forecasts and expert guidance. Imagine having a virtual financial guru at your fingertips, ready to analyze your transactions, highlight trends, and suggest ways to optimize your money management. With features like real-time spending breakdowns and future projections, 2K ensures you're always one step ahead, turning everyday financial decisions into opportunities for growth and stability.

How Does 2K Work?

Getting started with 2K is straightforward and secure. Download the app from your mobile device, register with a simple sign-in, and link your bank accounts, credit cards, and investment portfolios. The app employs robust encryption and doesn't store your passwords, prioritizing user privacy as outlined in its comprehensive Privacy Policy and Terms of Service.

Once connected, 2K's AI engine springs into action:

- Daily Tracking (Today Mode): Monitor this month's spending patterns with detailed breakdowns of payments, income, and categories like travel or living expenses. It structures transactions automatically, categorizing them for easy understanding—no more guessing how your money is being spent.

- Future Insights (Tomorrow Mode): Leverage AI-driven models to generate insights for the next three months. View financial projections, upcoming bills, and expense forecasts to plan proactively and avoid surprises.

- Personalized Coaching: Access free financial literacy support from real experts. Pose questions about your finances, and receive tailored responses within 12-24 hours. This human-AI hybrid approach fills knowledge gaps, offering recommendations on everything from paying down debt to building an emergency fund.

The app highlights bills, tracks new purchases (which post almost immediately), and even structures spending data for deeper analysis. You can link investment accounts, delete connections anytime, and share your progress with friends if desired. Importantly, 2K doesn't charge subscription fees—it's free to use, with no hidden costs for core features.

Core Features of 2K

2K stands out with its blend of automation and personalization, making complex financial data accessible to everyone:

- Expense Aggregation and Categorization: Consolidate all accounts to see balances, interest accruals, and spending details in one place. This eliminates the anxiety of bill surprises by providing real-time updates.

- AI-Powered Forecasting: Unlike basic trackers, 2K uses machine learning to predict future cash flow based on historical data, helping you anticipate shortfalls or surpluses.

- Bill Highlighting and Refund Tracking: Set up activity alerts for categories like travel, ensuring you catch issues like missing refunds (as one user did with American Airlines).

- Financial Coaching Integration: Beyond AI, get human expert advice to build literacy—perfect for those who can't afford traditional advisors.

- Trend Analysis and Recommendations: Receive feedback on interest payments, lifestyle spending, and optimization strategies to reduce debt faster.

These features work seamlessly to align your money perception with reality, fostering habits that lead to relaxation and control over finances.

How to Use 2K Effectively

To maximize 2K's potential:

- Link Accounts Securely: Start by connecting your primary financial institutions. The app supports major banks, cards, and investments without compromising security.

- Review Daily Insights: Check the 'Today' dashboard for spending patterns. Use breakdowns to identify leaks, like excessive credit card rollovers.

- Plan with Forecasts: Dive into 'Tomorrow' views to simulate scenarios—what if you cut dining out? Adjust budgets on the fly.

- Engage Coaching: Ask specific questions, e.g., "How can I save for a trip?" Experts provide actionable steps.

- Monitor and Adjust: Regularly review trends, pay down high-interest debts, and set aside leftovers for goals like vacations or rainy-day funds.

Users can access 2K via mobile app, with no desktop version mentioned, ensuring on-the-go convenience. Before full commitment, explore a demo mode without linking accounts.

Why Choose 2K?

In a world of overwhelming financial apps, 2K differentiates itself through its focus on conscious spending and AI-enhanced foresight. It doesn't just track— it educates and motivates. Key benefits include:

- Cost-Effective: Free access to premium features like coaching, saving you advisor fees.

- User-Friendly for All Levels: From beginners anxious about bills to seasoned users managing multiple debts, its intuitive interface reduces stress.

- Proven Results: Real user stories highlight transformative impacts—paying off cards faster, avoiding refund hassles, and breaking paycheck-to-paycheck cycles.

- Privacy-First Design: No payment processing or money movement; it only reads data for insights.

Compared to competitors, 2K's AI-human combo offers deeper personalization without subscriptions, making it ideal for budget-conscious individuals seeking long-term financial health.

Who is 2K For?

2K is tailored for a wide audience:

- Young Professionals: Like Jason M., who combats bill anxiety by tracking credit card details.

- Debt Managers: Users like Sam Y. benefit from holistic views to prioritize payments.

- Solo Planners: Forest S. and Anna B. appreciate affordable coaching for independent growth.

- Travel Enthusiasts: Robert P.'s story shows how it safeguards against expense oversights.

- Future-Focused Savers: Vik W., Ed W., and Victoria M. use forecasts to build funds without lifestyle sacrifices.

If you're tired of financial surprises, feel isolated in money matters, or want to level up without expert costs, 2K is your go-to tool. It's especially valuable for those with multiple accounts (credit, loans, mortgages) seeking control and confidence.

Real User Experiences and Practical Value

The app's impact shines through testimonials:

- Sam Y.: Gained visibility into interest and balances, leading to fewer cards and a relaxed life.

- Forest S.: Discovered surplus for future planning, easing loneliness in financial management.

- Robert P.: Caught a refund issue early, saving hassle.

- Jason M.: Ended guessing games with detailed spending, reducing anxiety.

- Anna B.: Focused lifestyle spending to save for trips and emergencies.

- Vik W.: Achieved control over extras monthly, no more bill shocks.

- Ed W.: Accelerated debt payoff with feedback, feeling empowered.

- Victoria M.: Broke paycheck cycles by visualizing spending, enabling vacations.

These stories underscore 2K's practical value: It not only tracks but inspires behavioral changes, leading to tangible savings and peace of mind.

Frequently Asked Questions

- How Secure Is 2K? Highly secure with encryption; no password storage or money handling.

- Can I Make Payments Or Move Money? No, 2K is for insights only.

- Does 2K Keep My Password? Never—uses secure token-based access like major banks.

- Can I Play With 2K Before Linking? Yes, try a demo mode.

- Do New Purchases Post Immediately? Yes, near real-time.

- Can 2K Highlight My Bills? Absolutely, with customizable alerts.

- Does 2K Charge A Subscription Fee? No, fully free.

- Can I Link Investments? Yes, for complete portfolio views.

- Delete Accounts Anytime? Yes, easily.

- Structure Transactions? AI auto-categorizes for clarity.

- Share With Friends? Yes, via invites.

- Access Platforms? Primarily mobile app.

Final Thoughts on Unlocking Your Financial Future

2K revolutionizes personal finance by combining AI precision with human wisdom, making smart spending accessible to all. Whether forecasting budgets or seeking coaching, it equips you to maximize savings and make confident decisions. Download today and transform your financial journey—start with linking accounts and watch your money work smarter for you. For more, visit the app or contact support via the FAQ and Contact pages.

Best Alternative Tools to "2K"

Compass AI is an AI-powered financial intelligence tool for SMBs, providing real-time cash flow insights, forecasting, and personalized financial strategies to help businesses make confident decisions.

Zeni is an AI-powered bookkeeping platform offering automated accounting, real-time financial insights, and expert financial support. It provides services like AI CFO and Accountant agents, bill payments, and expense reimbursements.

Sturppy is a financial modeling and forecasting software designed for startups. It offers templates for early-stage founders and AI-powered CFO tools for established businesses, helping you plan and analyze your finances effectively.

Octopus AI is an AI financial platform designed for startups, offering tools to automate financial forecasting, analyze revenue trends, and identify budget variances, helping to make informed decisions.

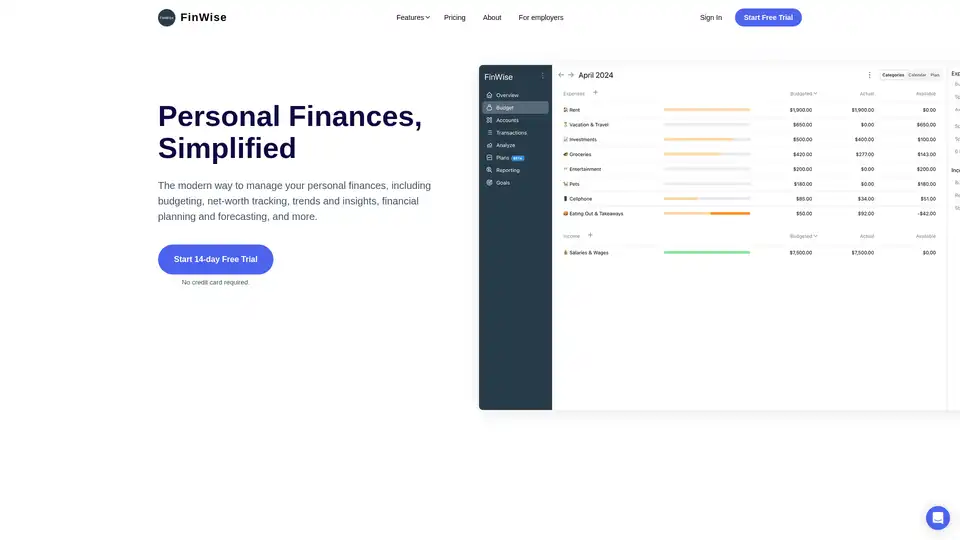

FinWise simplifies personal finance management with budgeting, net worth tracking, and financial planning tools. Securely connect accounts, track spending, and plan for the future.

BringTable uses GPT-4 AI to scan, organize, and analyze bills by extracting data into structured tables for effortless financial management.

An advanced AI-powered bank statement converter that helps you convert your PDF bank statements to a readable CSV or Excel format on your phone. Features include fast and accurate conversion, and a user-friendly interface.

Nume is the AI CFO for founders, delivering instant financial insights on cash flow, profitability, and forecasts. Connect your data securely and automate essential finance tasks to drive smarter decisions for startups.

Venturekit uses AI to generate business plans, financial forecasts, market research, and pitch decks. Trusted by 750k small businesses to plan, start, and grow.

Venturekit uses AI to generate business plans, financial forecasts, and pitch decks. Trusted by 750k+ businesses. Start, plan, and grow your business with AI-powered tools.

Fortune App offers AI-driven accounting software for better business decisions. Analyze finances across bank accounts easily in US & Canada. Get financial insights and automated bookkeeping.

ML Clever: AI Data Analytics Platform for instant dashboards, AutoML, and predictive insights without code. Alternative to complex BI & Data Science platforms.

EvryThink is a free AI-powered finance super app designed for freelancers, startups, and SMEs. It simplifies planning, accounting, invoicing, and more without requiring financial expertise.

Aisera's AI agent platform transforms work experiences, boosts productivity, and reduces operational costs.