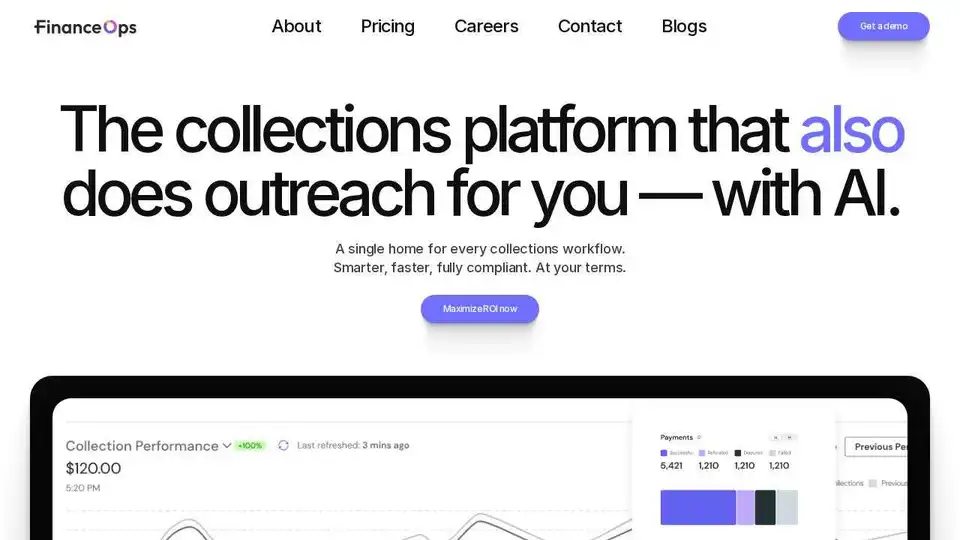

FinanceOps

Overview of FinanceOps

FinanceOps: AI-Powered Collections Management Software

What is FinanceOps?

FinanceOps is an AI-first collections platform designed to automate and optimize accounts receivable management. It replaces manual follow-ups with autonomous, always-on AI collection agents that outperform human agents at a fraction of the cost. It emphasizes empathy and maintains respectful communication across every interaction, ensuring compliance with regulations and protecting your brand.

Key Features:

- AI Collection Agents: Replaces manual follow-ups with autonomous, always-on AI collection agents.

- 24/7 Omnichannel Outreach: Automated email, SMS, and voice communications.

- Customer Insights Engine: Provides insights into customer behavior, contact preferences, and risk scores.

- Automated Reconciliation: Instantly matches and records invoices, payment plans, and purchase orders.

- Payment Intelligence: Tracks customer engagement to identify who needs a nudge to pay.

How to Start with FinanceOps?

- Upload Accounts: Supports CSV, Excel, and database exports.

- Automate Outreach: AI handles personalized messaging and multi-channel follow-ups.

- Get Paid Directly: Seamless reconciliation and faster access to your money through the platform.

Why is FinanceOps Important?

- Predictable Cash Flow: Improves engagement and allows for confident forecasting.

- Faster Collections: Reduces Days Sales Outstanding (DSO) by up to 40%.

- Scale Without Hiring: Reaches millions in parallel with consistent, intelligent touchpoints without increasing operational overhead.

Testimonial

One business saw a 90% reduction in overdue accounts and improved ROI after implementing FinanceOps.

FAQs

What is FinanceOps, and how is it different from traditional collection agencies?

FinanceOps is an AI-first collections platform that replaces manual follow-ups with autonomous, always-on collection agents. Unlike traditional agencies, there are no call centers, no contingency fees, and no damage to your brand — just results.

How does FinanceOps work with my existing team?

FinanceOps doesn't replace your team — it amplifies it. While your agents focus on high-value accounts or escalations, our AI handles the rest: consistent, empathetic outreach at scale, 24/7.

How quickly can we see results with FinanceOps?

Most teams see a 20–40% increase in recovery rates within the first 30 days of going live. Setup is quick, integration is minimal, and results speak for themselves.

Integrations:

Seamlessly integrates with existing CRMs, ERPs, and billing systems.

Compliance:

Ensures every action is secure, auditable, and compliant with regulations such as SOC 2, HIPAA, and GDPR.

AI Customer Service Chatbot AI Voice Customer Service AI Finance and Risk Analysis AI Data Analysis and BI AI Recruitment and Talent Matching

Best Alternative Tools to "FinanceOps"

Alphamoon is an AI-powered Intelligent Document Processing platform automating document reading, classification, and data extraction, improving business processes.

Celeste is an AI-powered platform for SMB loan payment collection, using intelligent technology to boost collection rates and reduce missed payments.

Clerkie is an AI-powered platform simplifying debt and money management. Optimize loan portfolios, automate payments, and ensure real-time compliance. Empower borrowers with flexible payment solutions.

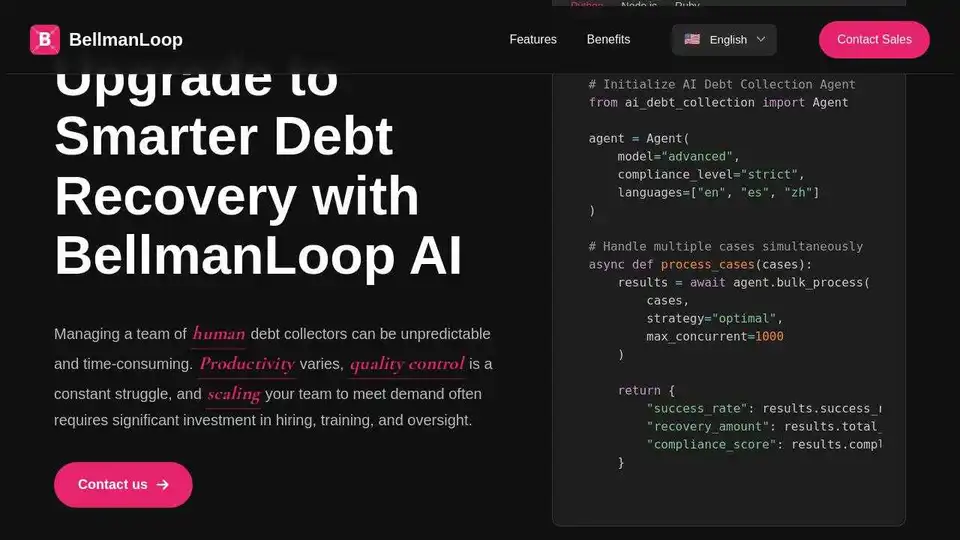

BellmanLoop offers AI-powered debt collection solutions, providing smart, scalable, and cost-effective debt recovery. Automate your processes and improve recovery rates with AI.