Inscribe AI Agents

Overview of Inscribe AI Agents

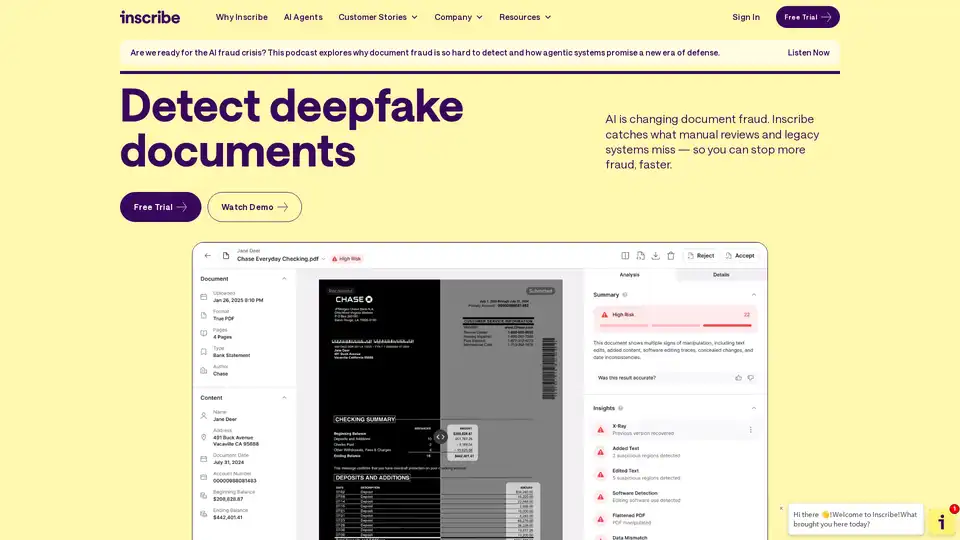

What is Inscribe AI Agents?

Inscribe AI Agents represent a cutting-edge solution in the fight against document fraud, particularly in the financial sector. Developed by Inscribe, a company with roots dating back to 2017, these AI-powered tools are designed to detect advanced forms of fraud, including AI-generated deepfakes and template-based forgeries. As financial crimes evolve with technology, Inscribe's agents provide real-time detection during critical processes like onboarding and underwriting, helping banks, lenders, and fintech companies safeguard their operations. By combining artificial intelligence with forensic analysis, Inscribe goes beyond traditional manual reviews, uncovering inconsistencies in layout, typography, metadata, and signatures that often evade human eyes or legacy systems.

The rise of AI fraud has been dramatic, with document fraud increasing by 208% due to fraudsters leveraging generative AI tools. Inscribe AI Agents address this crisis head-on, offering a proactive defense that catches forged documents, synthetic identities, and suspicious applications the moment they surface. Whether you're dealing with loan applications or customer verifications, these agents ensure compliance and security without slowing down your workflow.

How Do Inscribe AI Agents Work?

At their core, Inscribe AI Agents operate through a sophisticated blend of machine learning models trained on millions of real-world applications. Backed by data scientists and fraud experts with over 40 years of combined experience, the system employs domain-specific knowledge to perform deep forensic analysis. Here's a breakdown of the key mechanisms:

Document Analysis and Validation: The agents scrutinize financial documents with forensic precision, checking elements like formatting, structure, metadata, and contextual clues. Unlike static rule-based systems, they adapt to emerging tactics, identifying subtle anomalies in seconds.

Cross-Referencing and Pattern Synthesis: Fraud doesn't occur in silos. Inscribe's agents connect dots across multiple documents, validating claims against public records and detecting patterns in applicant data. This holistic approach reveals hidden risks, such as synthetic identities or coordinated fraud rings.

Explainable AI Outputs: Every detection comes with plain-language explanations, empowering your team to understand and act on findings confidently. No black-box decisions here—transparency is built in to build trust.

The training process is rigorous: fed data from ongoing fraud investigations, the AI evolves continuously, ensuring it stays ahead of fraudsters' innovations. Integration is seamless via APIs or web interfaces, allowing quick deployment into existing systems like CRM or underwriting platforms.

Key Features and Core Functions

Inscribe AI Agents stand out for their comprehensive toolkit tailored to financial risk management:

Real-Time Fraud Detection: Stop threats instantly during application reviews, reducing false positives and manual interventions.

Deepfake and AI-Generated Forgery Identification: Specialized in spotting AI-crafted fakes that mimic legitimate documents perfectly.

Risk Scoring and Insights: Beyond detection, agents provide contextual risk assessments, highlighting potential issues like identity mismatches or inconsistent financial histories.

Automation of Repetitive Tasks: Automate data chasing and system switching, freeing analysts for high-value work and cutting processing times by up to 30 minutes per application.

These features are powered by a robust backend that processes vast datasets securely, adhering to industry standards for data privacy.

Main Use Cases and Practical Applications

Inscribe AI Agents are versatile for various scenarios in financial services:

Onboarding and KYC Processes: Verify customer identities swiftly, flagging fraudulent submissions before they enter your ecosystem.

Loan Underwriting and Credit Analysis: Assess document authenticity to minimize lending risks, preventing losses from synthetic fraud.

Ongoing Monitoring: For established clients, continuous checks against new documents ensure sustained security.

Real-world examples from customer stories illustrate their impact:

- A credit union prevented $6.5 million in potential fraud losses by integrating Inscribe early in their pipeline.

- Fintech firm Paylocity reduced application processing by 30 minutes, boosting efficiency without compromising accuracy.

- Lender Ramp saved $3 million in just eight months, demonstrating scalability for high-volume operations.

In each case, the agents not only detected fraud but also streamlined workflows, turning a cost center into a strategic advantage.

Why Choose Inscribe AI Agents?

In an era where manual reviews are overwhelmed by volume and complexity, Inscribe offers unmatched reliability. Traditional tools miss AI-driven frauds, but Inscribe's agentic systems—autonomous AI that reasons and acts—promise a new defense era. Benefits include:

Faster Fraud Prevention: Catch more threats with less effort, reducing losses and compliance headaches.

Cost Savings: By automating busywork, teams handle more cases efficiently, with proven ROI from prevented fraud.

Scalability for Growth: Handles millions of applications annually, ideal for expanding fintechs or banks.

Expert-Backed Assurance: Continuous improvements from in-house specialists ensure the AI remains cutting-edge.

Compared to competitors, Inscribe's explainability and forensic depth provide deeper insights, making it a go-to for risk-averse institutions.

Who is Inscribe AI Agents For?

This tool is tailored for professionals in finance and fintech who grapple with document-heavy workflows:

Risk and Compliance Officers: Seeking automated, accurate fraud detection to meet regulatory demands.

Underwriting Teams: Needing speed and precision in high-stakes decisions.

Fintech Startups and Banks: From small lenders to large institutions, anyone processing applications at scale.

If you're tired of fraud slipping through cracks or endless manual checks, Inscribe empowers you to focus on growth, not guesswork.

How to Get Started with Inscribe AI Agents

Getting up and running is straightforward:

- Sign up for a free trial via the Inscribe website to test on your documents.

- Watch a demo to see the agents in action.

- Integrate via API into your systems for seamless use.

- Leverage resources like the Good Question Podcast or 2025 Document Fraud Report for deeper insights.

Resources such as the Machine Mind Blog and Inside Inscribe Newsletter keep users informed on trends. For support, contact their team or explore the Trust Center.

The Bigger Picture: Tackling the AI Fraud Crisis

As highlighted in discussions like the podcast on Sam Altman's Federal Reserve comments, document fraud's complexity demands innovative solutions. Inscribe AI Agents lead this charge, blending human expertise with AI autonomy. By preventing millions in losses and enhancing decision-making, they deliver tangible value—fewer bottlenecks, smarter risks, and a secure future for financial services.

In summary, for anyone serious about financial risk management and deepfake document detection, Inscribe AI Agents are an essential tool. Start your free trial today and experience the difference in fraud prevention.

Best Alternative Tools to "Inscribe AI Agents"

FlowX.AI is an AI agentic platform designed for deploying AI agents in banking, insurance, and logistics. Build and deploy enterprise-ready AI solutions in weeks, integrating with legacy systems.

Agent Herbie is an offline AI agent designed for real-time, mission-critical operations in private environments. It leverages LLMs, SLMs, and ML for unmatched flexibility and reliability without data egress.

ThirdAI is a GenAI platform that runs on CPUs, offering enterprise-grade AI solutions with enhanced security, scalability, and performance. It simplifies AI application development, reducing the need for specialized hardware and skills.

Basepilot provides custom AI workers to automate insurance back-office operations including claims processing, policy management, and document automation for insurers, MGAs, and brokers.

PathPilot empowers fintechs, banks, and financial institutions to build secure AI agents in days—cutting costs, improving CX, and ensuring compliance. Launch AI agents 10x faster without compromising data security.

Only H2O.ai provides an end-to-end GenAI platform where you own every part of the stack. Built for airgapped, on-premises or cloud VPC deployments.

Recognito offers AI-powered face recognition and ID verification solutions. Secure, fast technology to prevent fraud and build trust. NIST FRVT Top 1.

QuickStart is a SaaS boilerplate providing production-ready features for auth, payments, OpenAI chat, and more. Build your SaaS app faster with Next.js and SolidStart.

Boltic is an enterprise-grade data platform that simplifies data management and automation. Automate workflows, build AI agents, and connect with your favorite tools. Try Boltic for free.

FPT.AI provides AI solutions transforming businesses into AI-first organizations, offering virtual assistants, digital workforce solutions, and operational excellence tools.

StackAI is a no-code platform to build and deploy AI Agents for Enterprise AI. Automate workflows, analyze data, and enhance decision-making effortlessly. SOC2, HIPAA, and GDPR compliant.

nventr.ai is an AI-driven automation platform unifying models, agents, and systems into dynamic workflows. It features intelligent document processing, AI workflow builder, and scalable solutions for modern enterprises.

Datrics HCP streamlines healthcare insurance claims with AI, improving accuracy and reducing processing time, while eliminating costly errors.

InsightAI: AI-powered fraud detection and risk management for financial institutions. Reduce loss, improve compliance. Best AI tool for Finance professionals.