PathPilot

Overview of PathPilot

What is PathPilot?

PathPilot is a specialized AI platform designed to help fintech companies, banks, and financial institutions rapidly develop and deploy secure AI agents. Unlike general-purpose AI tools, PathPilot is tailored for the unique challenges of the financial sector, where data privacy, regulatory compliance, and operational security are paramount. It allows engineering teams to launch AI agents up to 10 times faster, without exposing sensitive data or intellectual property to external risks. By handling 80% of the foundational work, PathPilot lets developers focus on customizing the remaining 20% to align with specific business needs, such as automating customer support, fraud detection, or compliance checks.

This platform stands out for its emphasis on internal control: everything runs within your own infrastructure, eliminating vendor lock-in and third-party SaaS dependencies. Whether you're streamlining credit risk assessments or enhancing customer interactions, PathPilot ensures that AI integration feels seamless and trustworthy.

How Does PathPilot Work?

At its core, PathPilot operates as a low-code platform that provides pre-built modules for AI agent creation. Engineering teams start with ready-to-use templates optimized for financial services, then customize them using intuitive tools. The process is straightforward:

- Select a Use Case Template: Choose from specialized agents like Credit Risk AI Agent or Business KYC Assistant.

- Integrate Internal Resources: Connect to your existing APIs, databases, models, and infrastructure—no data leaves your environment.

- Configure and Customize: Use low-code interfaces for quick setup, with full override options for advanced tweaks.

- Deploy and Monitor: Launch agents in your cloud, with full traceability for every decision, audit trails, and compliance reporting.

PathPilot's modular design means agents can plug directly into your systems, leveraging your own large language models or custom logic. This approach avoids black-box AI, making every output inspectable and aligned with financial regulations like GDPR or SOX. For instance, in fraud detection scenarios, the platform can process real-time data streams securely, flagging anomalies without compromising speed.

The platform's security model is built around 'boundary of trust'—deployments happen entirely in your cloud, ensuring no forced hosting or data transfers. This is particularly valuable in fintech, where even minor data exposures can lead to significant risks.

Key Features of PathPilot

PathPilot packs powerful features that cater to the demands of financial engineering teams:

- Secure Internal Deployment: Agents run on your infrastructure, keeping sensitive financial data and IP protected. No external servers or risky integrations.

- Low-Code Customization: Accelerate development with drag-and-drop tools, while allowing code-level overrides for precision control.

- Modular Agent Architecture: Easily integrate with your APIs, models, and tools. Examples include the FinSupport Agent for handling inbound queries or the KYC Assistant for automated identity verification.

- Traceability and Auditability: Every AI decision is logged, inspectable, and compliant-ready, reducing regulatory headaches.

- Scalability for Fintech Workloads: Handles high-volume tasks like support ticketing or risk validation without performance dips.

These features translate to real-world efficiency: teams report building functional agents in days, not months, leading to faster time-to-value.

Use Cases for PathPilot

PathPilot shines in financial services where AI must balance speed, accuracy, and security. Here are some primary applications:

Credit Risk Assessment: The Credit Risk AI Agent automates initial decisioning in consumer lending. It analyzes applications, validates data against internal rules, and provides summaries for human review—speeding up approvals while minimizing errors.

Customer Support Automation: The FinSupport Agent manages high-volume inbound requests. Using your internal tools and APIs, it resolves issues securely, pulls real-time data, and escalates complex cases, improving response times and customer satisfaction (CX).

KYC and Compliance: The Business KYC Assistant streamlines know-your-customer processes. It extracts info from identity documents, flags risks, and generates audit-ready summaries, helping legal teams focus on high-value reviews.

Fraud Detection: Agents monitor transactions in real-time, integrating with your fraud logic to detect patterns and alert teams—essential for maintaining trust in digital banking.

These use cases demonstrate PathPilot's versatility, from front-end customer interactions to back-end risk management, all while ensuring compliance with industry standards.

Why Choose PathPilot for Your Fintech AI Needs?

In a landscape crowded with generic AI solutions, PathPilot differentiates itself by prioritizing security and customization for financial pros. Engineering teams love it because it eliminates the grunt work of building AI from scratch—focusing instead on what makes their operations unique. Cost savings are immediate: reduce development time by 90%, cut reliance on external vendors, and boost operational efficiency.

User testimonials highlight its impact. Michael Cazayoux, CEO of Sharewize, shared: "What impressed me most about working with PathPilot was how easy it was to get our AI Agent up and running while adapting it to our specific constraints. In just days, we had a fully functional agent augmenting our contact team with real-time information, which has been key to improving our SLAs and delivering real value to our customers."

Compared to alternatives, PathPilot avoids common pitfalls like data leakage or inflexible deployments. It's ideal if you're scaling AI without expanding headcount or risking compliance violations.

Who is PathPilot For?

This platform is perfect for:

- Fintech Startups and Scale-Ups: Teams needing quick AI wins to compete in lending, payments, or wealth management.

- Banks and Financial Institutions: Compliance officers and devs building secure agents for regulatory-heavy environments.

- Engineering Leads: Those tired of piecing together disparate AI tools and wanting an integrated, internal solution.

If your team handles sensitive data and demands full control, PathPilot empowers you to innovate confidently.

How to Get Started with PathPilot

Getting up and running is simple: Schedule a demo via the PathPilot website to explore templates and integrations. From there, your team can prototype an agent in hours, deploy in days, and iterate based on real feedback. No steep learning curve—just results.

In summary, PathPilot redefines AI adoption in fintech by making secure, compliant agents accessible and efficient. Whether enhancing CX, automating workflows, or fortifying risk management, it's a game-changer for building internal AI that scales with your business.

Best Alternative Tools to "PathPilot"

Roe AI provides auditable AI agents for automating risk and compliance operations in marketplaces, fintech, and banks. It enables 9x operational gains and is 15% more accurate than human reviewers.

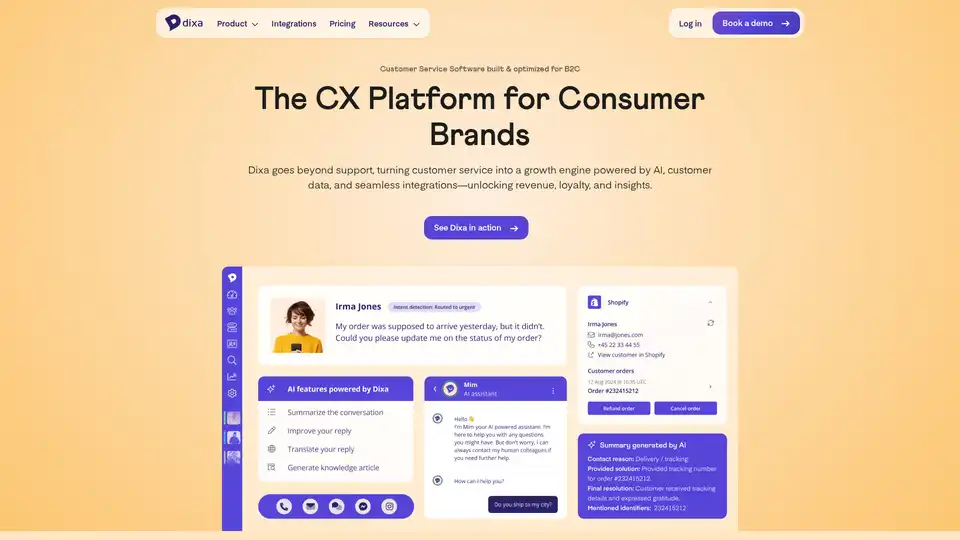

Dixa is an AI-powered customer service platform designed for B2C brands. It provides omnichannel support, AI automation, and customer data integration to boost efficiency, customer loyalty, and revenue growth.

APIDNA leverages autonomous AI agents for seamless and secure API integrations, providing developers with an easy, automated platform experience. Simplify complex integration processes and accelerate development.

CEQUENS is a global CPaaS provider offering AI-powered communication and engagement solutions, including SMS, voice APIs, and omnichannel chat, helping businesses enhance customer interactions and streamline communication workflows.

OmniAI uses AI agents to automate borrower onboarding, handling communication, document collection, and follow-ups. It accelerates loan processing and ensures compliance.

Markprompt offers enterprise-grade AI agents for customer support automation, specializing in developer platforms and fintech. It autonomously resolves tickets, unifies data, and ensures strict compliance.

Blaze is a powerful no-code platform for building secure apps 10x faster. Automate workflows, integrate with APIs, and add AI capabilities. HIPAA and SOC 2 compliant.

Twig AI is an advanced assistant for B2B customer support teams, featuring chatbots that reduce ticket handling and agent-assist tools that compile context-aware responses from data sheets and customer info for faster, efficient service.

Explore AIConsole, the comprehensive AI integration platform built for enterprises. Streamline your business processes, orchestrate AI tools from any vendor, and empower your team to innovate.

Build task-oriented custom agents for your codebase that perform engineering tasks with high precision powered by intelligence and context from your data. Build agents for use cases like system design, debugging, integration testing, onboarding etc.

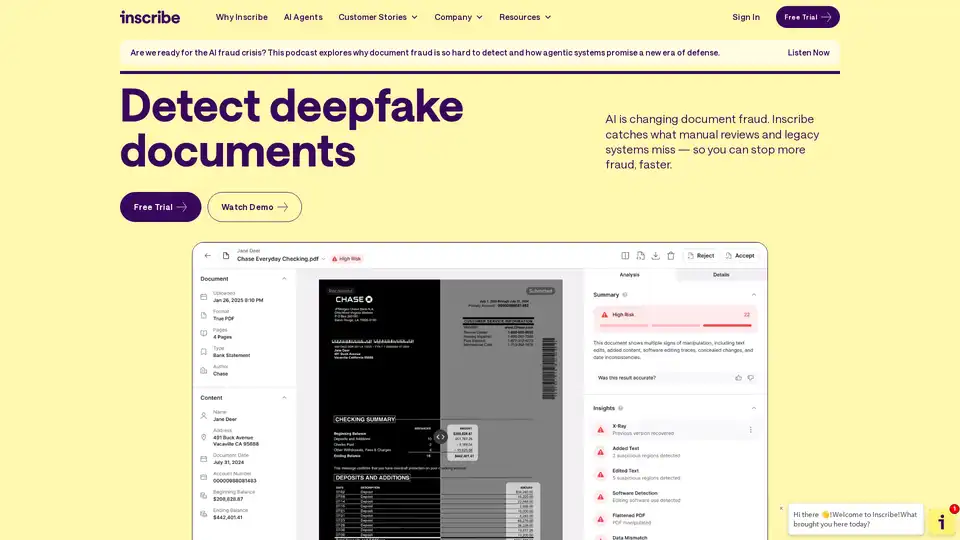

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

ReelSights AI combines human expertise with AI automation to deliver predictable revenue growth and measurable marketing ROI. Unlock your marketing potential today!

Arta is an AI-powered digital wealth platform offering access to private & public markets, financial planning, tax, and estate planning. Invest in elite private investment funds with intelligent tools.

BeetleLabs offers AI-driven solutions for financial compliance, KYC/KYB automation, and enhanced customer support in the BFSI sector. Streamline processes and manage risk with their all-in-one platform.