Insightfolio

Overview of Insightfolio

Insightfolio: AI-Powered Investment Portfolio Analysis

What is Insightfolio?

Insightfolio is an AI-driven investment analysis tool designed to provide investors with clear, actionable insights into their portfolio's performance, risk, and diversification. It simplifies complex financial concepts, making it easier for both experienced and novice investors to understand their investments and make informed decisions.

How does Insightfolio work?

Insightfolio analyzes your investment portfolio using advanced algorithms to provide a comprehensive overview. Key features include:

- Risk Level Assessment: Evaluates the overall risk associated with your investments, helping you align your portfolio with your risk tolerance.

- Diversification Analysis: Determines how well your portfolio is diversified across asset classes, sectors, and regions.

- Exposure Analysis: Provides a detailed breakdown of where your investments are allocated.

- Future Projection: Simulates potential future performance based on various market scenarios.

- Cost Evaluation: Identifies hidden costs and fees that can impact your returns.

Why is Insightfolio important?

- Save Costs: Identifies and helps you eliminate unnecessary investment fees.

- Control Risks: Provides a comprehensive understanding of your portfolio's risks.

- Improve Returns: Offers simulations to help you adapt your strategy for maximized returns.

- Holistic View: Provides a clear view of how individual investments impact the overall portfolio.

How to use Insightfolio?

- Sign Up: Create a free account on the Insightfolio website.

- Input Portfolio: Add your investments to Insightfolio. The tool supports a variety of investment types.

- Analyze Report: Recieve detailed report about the performance, risks, diversification.

- Take Action: Make informed adjustments to optimize your investment strategy.

Key Features:

- AI-Powered Insights: Translates complex financial concepts into simple language.

- Time-Saving Analysis: Quickly provides explanations, allowing you to focus on decision-making.

- Increased Confidence: Provides a clear understanding of your portfolio strategy.

Who is Insightfolio for?

Insightfolio is ideal for:

- Individual Investors: Who want a better understanding of their investment portfolio.

- Financial Advisors: Looking for tools to provide better insights to their clients.

- Beginner Investors: Who are just starting to invest and need help understanding the basics.

Pricing:

- Starter Option: Free for your first report.

- Investor Packages: Additional reports available for $4.99 for 3 reports.

Customer Testimonial:

"The visual breakdown instantly showed me where I needed to rebalance." — User of Insightfolio

FAQ

What is Insightfolio and how can it help me? Insightfolio is an investment analysis tool designed to provide you with a comprehensive understanding of your investment portfolio. It offers a detailed examination of your portfolio's performance, risk levels, and diversification across asset classes, sectors, and regions. Insightfolio can help you gain clarity, make informed decisions, and align investments with your goals and values.

Disclaimer:

The information provided by Insightfolio is for informational purposes only and should not be considered as financial or investment advice. Always consult with a qualified financial professional before making investment decisions.

Best Alternative Tools to "Insightfolio"

Gorilla Terminal: AI-powered investment research platform providing rapid insights & analysis for smarter investment decisions. Analyze earnings calls, macro data, & manage risk efficiently.

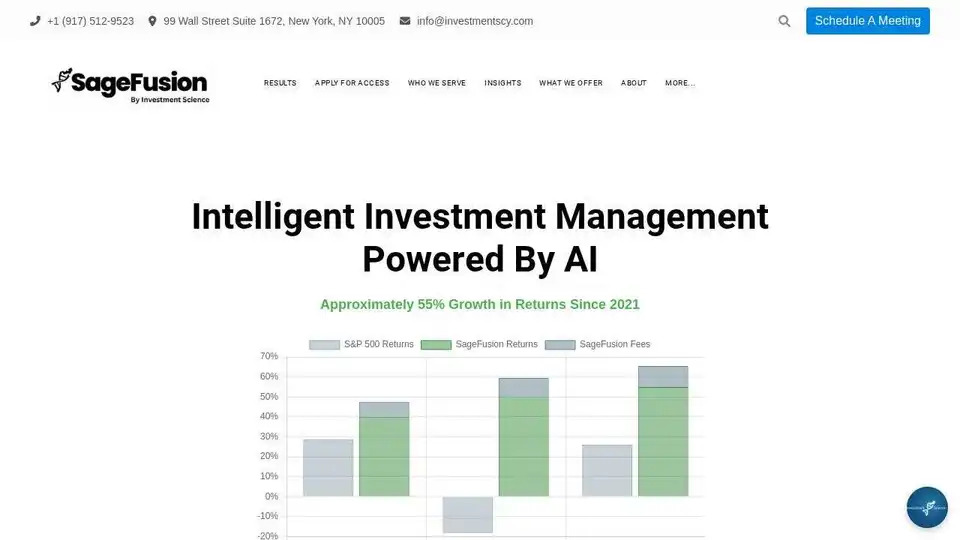

Discover SageFusion, an AI-driven investment platform offering advanced strategies, superior risk management, and personalized wealth management to optimize returns and simplify investing.

FinanceGPT Chat lets you build your own AI co-pilots for personalized financial insights, market analysis, and smarter decision-making.

Briink is an AI-powered platform automating ESG data extraction and analysis. It helps ESG teams turn data into actionable insights for strategic decision-making, risk mitigation, and improved sustainability performance.

Social Sentiment Insights (SSi) is an AI-powered platform providing real-time equity research and trading insights to institutional firms, leveraging social sentiment analysis for maximized gains and minimized risk.

Moning is an AI-powered platform for managing and boosting wealth, offering portfolio tracking, AI analysis, and dividend forecasting to make informed investment decisions.

Powder is an AI agent revolutionizing wealth management by extracting data from documents and meetings, cutting manual tasks by 95%, ensuring compliance, and boosting productivity for financial advisors.

Ultra WM is your AI-powered wealth manager. It provides personalized guidance, integrates with your financial data, and helps you understand market dynamics for confident investment decisions.

MAPLE: AI-powered financial advisor, offering personalized advice for wealth management and investment, analyzes assets and optimizes financial goals.

PortfolioPilot is an AI financial advisor that helps self-directed investors track investments, optimize taxes, and receive personalized financial advice, including estate & retirement planning.

Discover CryptoTradeMate, the best AI crypto trading bot for 2025. Get real-time signals, automated trading, and proven results with AI-driven strategies.

Finroo is a generative AI app for portfolio management, empowering investors to scan assets in crypto, stocks, real estate, and more. It uses advanced neural networks for trend detection, automated trading, and simplified insights to boost returns effortlessly.

Onnix AI serves as a personalized co-pilot for bankers, accelerating slide deck creation, Excel-based data analysis, and instant queries from financial data providers like FactSet and CapIQ to deliver quick, accurate insights.

Avanzai empowers asset managers with AI-driven workflow automation. Our agents leverage your data and tools to streamline report generation, risk alerts, scenario analysis, and insights—accelerating decision-making in today's dynamic financial markets.