Powder

Overview of Powder

What is Powder?

Powder is an innovative AI agent designed specifically for the financial services industry, particularly wealth management firms. It transforms unorganized information from documents and meetings into high-quality, actionable data. By leveraging advanced AI capabilities, Powder enables users to rapidly extract key insights, build proposals, and integrate external assets without the hassle of manual processing. This tool is particularly valuable for registered investment advisors (RIAs) and financial professionals who deal with complex document analysis on a daily basis.

In essence, Powder acts as a smart assistant that handles tedious data entry and extraction tasks, allowing teams to focus on what truly matters: delivering exceptional client service and strategic advice. Whether you're parsing investment statements, reviewing portfolio recommendations, or aggregating data for client proposals, Powder streamlines the entire workflow with precision and speed.

How Does Powder Work?

At its core, Powder operates through a simple, intuitive process. Users can simply drop files—such as PDFs, statements, or meeting notes—into the platform. The AI then uses sophisticated natural language processing and machine learning algorithms to identify, extract, and structure relevant data. This includes pulling out financial metrics, asset allocations, transaction histories, and compliance-related details from unstructured sources.

For more advanced integrations, Powder offers a robust API that allows seamless embedding into existing systems like CRM platforms or Excel workflows. Once integrated, the API automates data processing in real-time, enabling instant analysis and report generation. The system is AI-enabled and AI-reviewed, ensuring outputs exceed human accuracy levels while minimizing errors.

Security is baked into every step: data is encrypted in transit and at rest, and user information is never used for model training. Powder also includes built-in compliance features to meet SEC and FINRA standards, making it a reliable choice for regulated environments.

Key Steps to Get Started with Powder

- Upload Documents: Drop in files via the web interface or API.

- AI Extraction: The agent automatically identifies and extracts pertinent data points.

- Review and Export: Human oversight for critical tasks, then export to formats like Excel or proposals.

- Integrate and Scale: Use the API for automated workflows in your firm's tech stack.

This workflow not only reduces processing time but also scales effortlessly as your firm grows, without the need to hire additional headcount.

Key Features and Benefits of Powder

Powder stands out in the crowded AI landscape for its industry-specific focus on finance. Here's a breakdown of its core features and the tangible benefits they provide:

Core Features

- Rapid Data Extraction: Handles multiple document types, including statements, reports, and emails, extracting data in minutes rather than hours.

- API Integration: Easy-to-use API for custom applications, allowing firms like Chicago Partners to process proposals at unprecedented speeds.

- Compliance Tools: Built-in checks for regulatory adherence, reducing risk in financial operations.

- Actionable Insights: Not just extraction—Powder aggregates data to support decision-making, such as portfolio weighting or client analysis.

- Enterprise Security: SOC2 Type 1 certified (Type 2 pending), with full encryption and zero data training on user inputs.

Major Benefits

- 95% Time Savings: Validated by customers, Powder slashes data entry and extraction time, freeing analysts for client-facing activities.

- Cost Efficiency: Eliminates manual labor costs, optimizing resource utilization without expanding teams.

- Enhanced Accuracy: AI-driven processes deliver better-than-human precision, minimizing errors in high-stakes financial data.

- Boosted Productivity: Analysts can shift from 'calculator' roles to proactive engagement, like personalized investment strategies.

- Improved Client Satisfaction: Faster turnaround times and higher-quality outputs lead to superior service, as seen in testimonials from firms serving ultra-high-net-worth clients.

- Scalability and Growth: Supports firm expansion through automation, helping businesses like SCS Financial maintain white-glove service at scale.

By turning raw, disorganized information into structured insights, Powder directly addresses pain points in wealth management, such as lengthy manual parsing that can take 30 minutes to 5 hours per document.

Use Cases for Powder in Wealth Management

Powder excels in scenarios where financial professionals need to handle voluminous, unstructured data quickly and accurately. Common applications include:

- Prospect Analysis: Rapidly review client statements to generate tailored proposals, as Chicago Partners did to accelerate their growth by 25%.

- Portfolio Review and Recommendations: Extract asset details from multiple sources to present optimized portfolios, saving hours of Excel manipulation.

- Meeting Summarization: Analyze meeting notes to pull actionable financial insights, enhancing post-meeting follow-ups.

- Compliance and Reporting: Ensure all extractions align with SEC/FINRA rules, reducing audit risks.

- Backend Automation: Integrate with front- and back-office tasks, like data aggregation for investment analysis at GC Wealth.

For RIAs in San Francisco or Menlo Park, Powder eliminates the 'mind-numbing' drain of manual tasks, allowing focus on business development and client relationships. It's ideal for firms aiming to future-proof operations in a competitive landscape.

Real-World Testimonials and Success Stories

Don't just take our word for it—Powder's impact is evident in feedback from industry leaders:

"Powder has not only allowed us to be more efficient in reviewing and presenting portfolio recommendations to prospects and clients, but as they have added new ways to pull information from different document types, we have been able to enhance other areas of the client experience as well." – Zane Keller, CFP, First Foundation

"Our business model at SCS is predicated on providing white-glove service to the ultra-high-net-worth and family office community. Powder has been instrumental in helping us deliver on this commitment by enabling our people to work more efficiently and focus on delivering comprehensive and insightful investment analysis." – Marcelo Vedovatto, CFA, SCS Financial

"Powder’s decision to expose their API has been a game-changer... On the Chicago Partners side, we can process and create proposals for prospects at a rate we wouldn't have thought possible a year and a half ago." – Mitchell Bratina, CFA, Chicago Partners

"Instead of inputting numbers into Excel... Powder creates that for us for multiple statements in minutes. This allows us to spend more time on clients' needs." – Ben Tuscai, Sunpointe Investments

"Powder drives several front and back-end tasks... Their instantaneous review capabilities significantly enhance the speed and accuracy of our advice." – Joe Matthews, GC Wealth

Anonymous RIAs report dramatic improvements: turnaround times have 'dramatically increased,' and tasks that once took 4-5 hours are now super-efficient, reducing fatigue and boosting focus on growth.

These stories highlight Powder's role in real transformations, from efficiency gains to enhanced client experiences, underscoring its value in practical, high-pressure environments.

Why Choose Powder Over Other AI Tools?

In a market flooded with general-purpose AI solutions, Powder differentiates itself through deep domain expertise in finance. Unlike broad tools that require heavy customization, Powder is pre-tuned for wealth management challenges, offering out-of-the-box accuracy for document types like statements and reports. Its API is praised for simplicity, allowing quick integration without extensive coding.

Moreover, Powder prioritizes trust: with no user data used for training and robust security certifications, it's built for institutions handling sensitive financial information. Compared to manual processes or less specialized AI, Powder delivers measurable ROI—95% time savings, error reduction, and scalable growth—making it a strategic investment for forward-thinking firms.

Who is Powder For?

Powder is tailored for financial professionals and firms, including:

- Wealth Managers and RIAs: Those juggling client documents and needing fast, accurate analysis.

- Financial Advisors: Seeking to automate routine tasks and elevate client interactions.

- Compliance Officers: Requiring tools that embed regulatory standards.

- Growing Firms: Like Chicago Partners, aiming to scale operations without proportional headcount increases.

If your team spends hours on data parsing instead of strategic advising, Powder is the ideal solution to reclaim that time and drive success.

Getting Started and Best Practices

Ready to experience the Powder difference? Book a demo to see it in action. Start small by testing with a few client files, then scale via API for full automation. Best practices include combining AI outputs with human review for complex cases and leveraging testimonials to align with your firm's goals.

In summary, Powder isn't just a tool—it's a partner in modernizing wealth management. By automating the mundane, it empowers professionals to deliver unparalleled value, ensuring your firm stays competitive in an AI-driven future.

Best Alternative Tools to "Powder"

TextMine transforms documents into structured, reviewable data, offering explainable AI models and enterprise-grade security. Automate evidence collection, trace sources, and reduce document review time by 85%.

Kudra is an AI-powered document extraction tool that automates the process of extracting critical data from various document types, including PDFs, emails, and more, transforming unstructured data into structured, searchable insights.

Document Extract is an AI-powered tool that extracts structured JSON data from documents, PDFs, and images using OCR. It offers easy API & SDK integration for developers and pay-as-you-go pricing.

DocExtractor automates data extraction from various document types using AI. It supports multiple formats and offers features like bulk processing, customizable extraction, and secure data handling. Ideal for businesses seeking to streamline document workflows.

Box AI is an intelligent content management platform that leverages AI to automate workflows, enhance collaboration, and secure sensitive data. Unlock content value with AI-driven insights and automation.

Sensible is an API-first document processing platform designed for developers to streamline data extraction. It offers tools for effortless automation, seamless integration, and unwavering security, suitable for businesses of all sizes.

Lido is the leading AI-powered tool for fast and accurate data extraction from PDFs, invoices, and documents to Excel. Eliminate manual entry with 99.9% accuracy, supporting scanned files and various formats—no training required.

OCR API for data extraction, mobile SDK for document capture, and toolkits to liberate trapped data in your unstructured documents like invoices, bills, purchase orders, checks (cheques) and receipts in real-time.

Only H2O.ai provides an end-to-end GenAI platform where you own every part of the stack. Built for airgapped, on-premises or cloud VPC deployments.

Nanonets provides AI-powered intelligent document processing and automated data extraction workflows for document-heavy business processes. Automate invoice processing, accounts payable, and more.

Extract data from documents with AI using Extracta.ai. Automate document data extraction using an AI image data extractor. Start your free trial today!

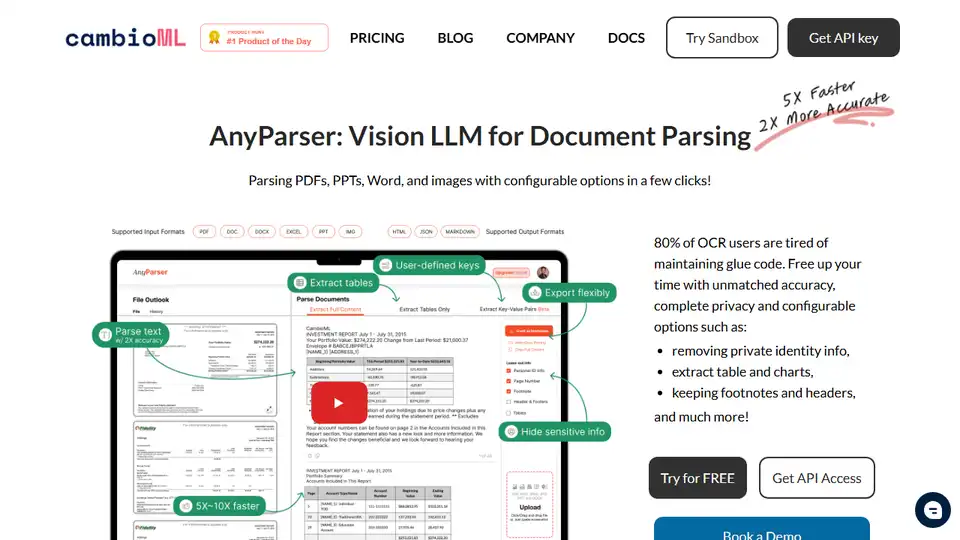

AnyParser: Vision LLM for Document Parsing. Accurately extracts text, tables, charts, and layout from PDFs, PPTs, images. Prioritizes privacy and enterprise integration.

Immersive Translate is an AI-powered translation tool for websites, PDFs, and videos. It supports bilingual reading, context-aware translation, and integrates with multiple AI translation engines.

DocsLoop is an AI-powered document extraction tool that automates data processing from PDFs to Excel with 99% accuracy, saving users hours weekly through drag-and-drop simplicity.