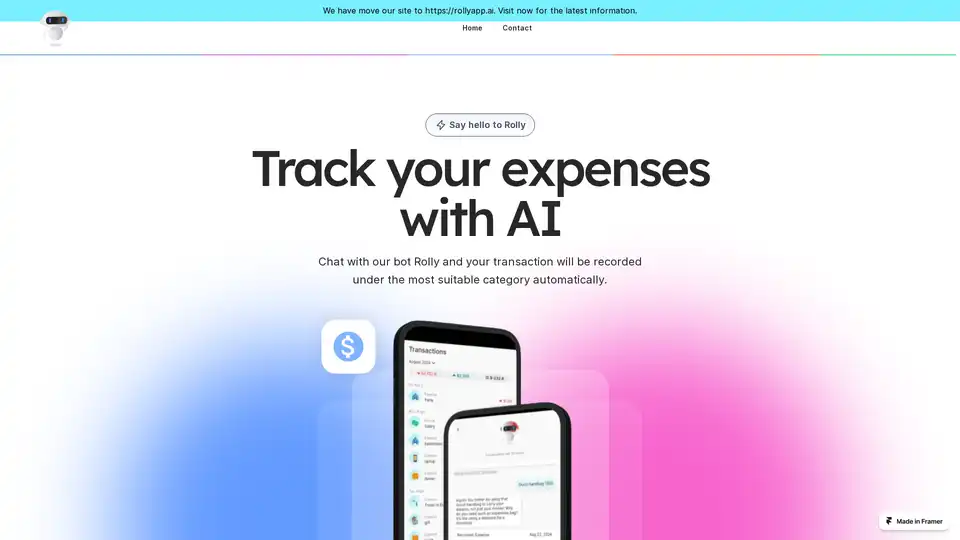

Rolly

Overview of Rolly

What is Rolly?

Rolly is an innovative AI-powered money tracker designed to make financial management effortless and engaging. Unlike traditional budgeting apps that require manual data entry and complex interfaces, Rolly leverages advanced artificial intelligence to handle your transactions through simple, conversational chats. Whether you're logging a casual dinner expense or a major flight purchase, Rolly's intelligent bot understands your inputs in any language and automatically categorizes them with remarkable accuracy. This tool is perfect for anyone looking to gain better control over their finances without the hassle of spreadsheets or cumbersome apps.

At its core, Rolly transforms the often tedious task of expense tracking into a fun, interactive experience. By chatting with the bot, users can record income and expenses on the go, receiving instant feedback and even personalized responses like excitement about an upcoming trip. As highlighted on the official site, Rolly is built for convenience, ensuring that every transaction is captured precisely where it belongs—be it under 'Travel,' 'Dining,' or any other relevant category.

How Does Rolly Work?

Rolly operates on a straightforward yet powerful AI framework trained specifically for financial data processing. The bot, named Rolly, is powered by natural language processing (NLP) capabilities, allowing it to interpret user messages naturally. For instance, if you type "dinner with friends last Friday 30," Rolly parses the details—date, description, amount—and slots it into the appropriate category without needing explicit instructions.

The process is seamless:

- Input via Chat: Users interact through a chat interface on the Rolly website (now accessible at https://rollyapp.ai). No downloads or setups required—just start typing.

- AI Analysis: The system uses machine learning algorithms to analyze the text, extracting key elements like amounts, dates, merchants, and contexts.

- Automatic Categorization: Transactions are sorted into predefined or learned categories, such as Travel for a flight ticket or Food for a meal.

- Confirmation and Insights: Rolly responds with a summary, like "Recorded your expense: Flight ticket under Travel Category," and adds a touch of personality, such as "Looking forward to travel! Let's enjoy some fresh sushi in Japan!"

This multilingual support means users from diverse backgrounds can track finances in their preferred language, making it globally accessible. The AI's training ensures high accuracy, reducing errors common in manual logging, and it adapts over time to user patterns for even better personalization.

Key Features of Rolly

Rolly stands out with a suite of features that prioritize user-friendliness and efficiency:

- Chat-Based Recording: Forget forms and buttons; simply converse with Rolly to log any transaction. This mimics everyday messaging, making it intuitive for all ages.

- Any Language Support: Whether English, Spanish, Japanese, or others, Rolly handles inputs seamlessly, breaking language barriers in financial tracking.

- Automatic Categorization: AI intelligently assigns categories, saving time and minimizing mistakes. For example, a flight to Japan gets tagged under Travel without user intervention.

- Free Access to All Features: Unlike many competitors with paywalls, Rolly offers its full functionality at no cost, democratizing financial tools.

- Personalized Responses: Beyond logging, Rolly engages users with friendly acknowledgments, turning tracking into an enjoyable routine.

These elements combine to 'supercharge' money tracking, as described on the site, making it not just easier but also more fun.

How to Use Rolly

Getting started with Rolly is incredibly simple, aligning with its goal of accessibility:

- Visit the Site: Head to https://rollyapp.ai to access the chat interface.

- Start Chatting: Type your transaction details in natural language, e.g., "Bought groceries for $50 today."

- Review and Confirm: Rolly will categorize and confirm—edit if needed via follow-up messages.

- Track Over Time: Build a history of your finances, with the AI providing ongoing insights into spending patterns.

No accounts or integrations are mentioned as mandatory, though users can explore the full dashboard for visualizations. For best results, be descriptive in chats to leverage the AI's full parsing power. Common queries like "How much did I spend on travel this month?" could potentially be handled in future updates, based on the bot's conversational design.

Why Choose Rolly for Financial Tracking?

In a world overflowing with budgeting apps, Rolly differentiates itself through AI-driven simplicity and zero cost. Traditional tools often overwhelm users with charts and manual inputs, leading to abandonment. Rolly counters this by making tracking feel like a casual conversation, which boosts consistency—key to effective financial habits.

Its practical value shines in real-world scenarios: busy professionals can log expenses during commutes, travelers can capture costs abroad in local languages, and families can manage shared budgets effortlessly. The automatic categorization reduces the cognitive load, allowing users to focus on insights rather than data entry. Plus, the engaging responses foster a positive relationship with money management, potentially encouraging better saving and spending decisions.

From an SEO perspective, if you're searching for 'best AI money tracker' or 'easy expense categorization tool,' Rolly addresses these needs directly. It aligns with informational intents by explaining features clearly and transactional ones by guiding users to the site for immediate use.

Who is Rolly For?

Rolly is ideal for a broad audience seeking hassle-free financial oversight:

- Everyday Users: Individuals tired of complicated apps who want quick, accurate tracking.

- Frequent Travelers: Those dealing with multi-currency or international expenses, benefiting from language support.

- Budget-Conscious Families: Groups needing simple ways to monitor household spending without tech expertise required.

- Small Business Owners: Freelancers or solopreneurs logging irregular income and costs on the fly.

It's particularly valuable for non-tech-savvy users, as the chat format feels familiar, like texting a friend. Even tech enthusiasts will appreciate the underlying AI sophistication without needing to dive into code.

Practical Value and Potential Drawbacks

The true worth of Rolly lies in its ability to build financial awareness effortlessly. Users report (based on the site's enthusiastic tone) that it turns tracking into a habit rather than a chore, leading to better money decisions over time. For example, automatic insights into categories like 'Travel' can highlight overspending early, aiding in adjustments.

While the site emphasizes free access, exploring https://rollyapp.ai might reveal premium options or integrations not detailed here. Potential limitations include dependency on internet for chats and lack of offline mode, but for most, the convenience outweighs this.

In summary, Rolly redefines AI in personal finance by making it conversational and inclusive. Whether you're optimizing your budget or just curious about smart tracking tools, Rolly offers a refreshing, effective solution. Visit https://rollyapp.ai today to experience how AI can simplify your financial life.

Best Alternative Tools to "Rolly"

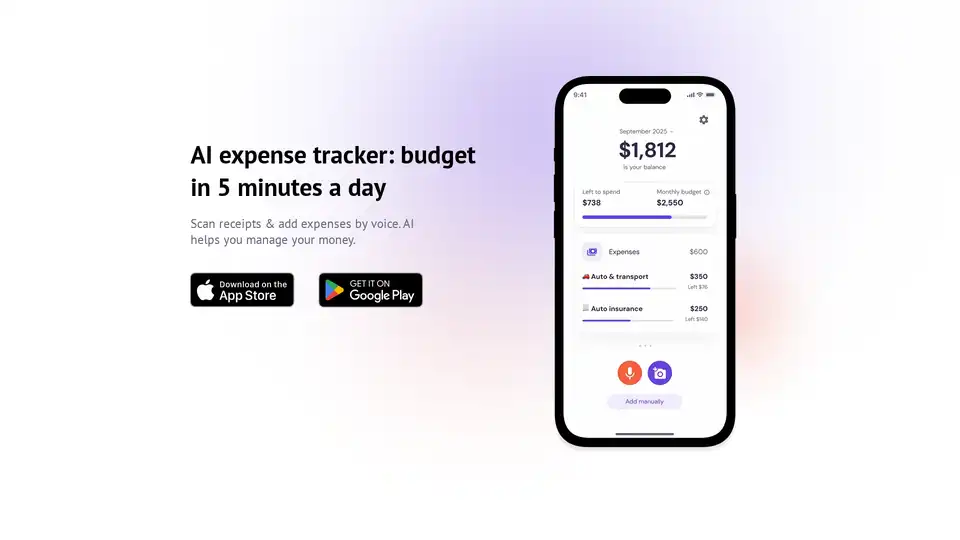

Vossa is an AI expense tracker app that simplifies budgeting with receipt scanning, voice input, and manual entry. Manage your money easily and stay on track with smart auto-categorization and clear stats.

FlyFin is an AI-powered tax service that helps freelancers and self-employed individuals maximize tax deductions and file federal & state tax returns with expert CPAs, saving time and money.

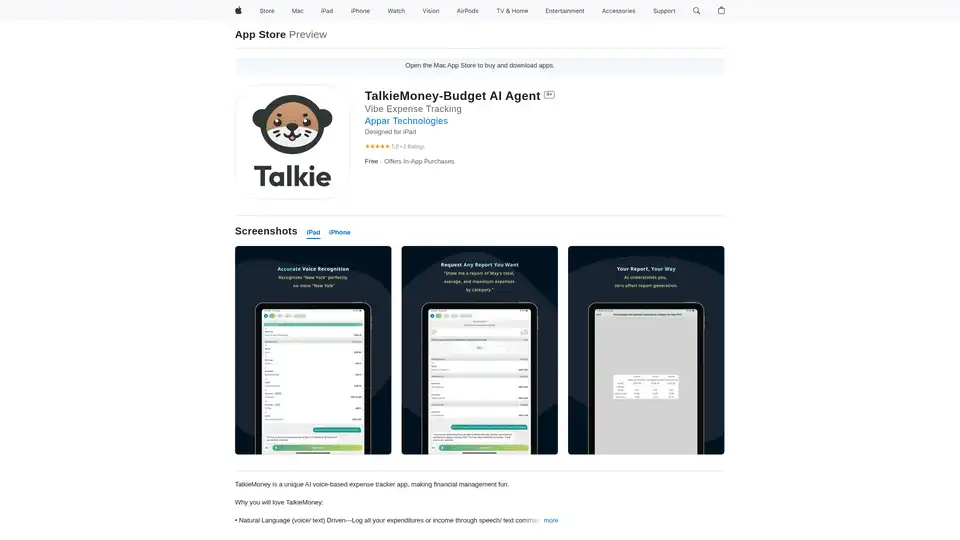

TalkieMoney is an AI-powered voice expense tracker app that makes financial management fun and easy. Log expenses with voice or text commands and get smart categorisation.

Automate bookkeeping with Paula, an AI accountant powered by Bookeeping.ai. Create reports, send invoices, and manage finances effortlessly via chat.

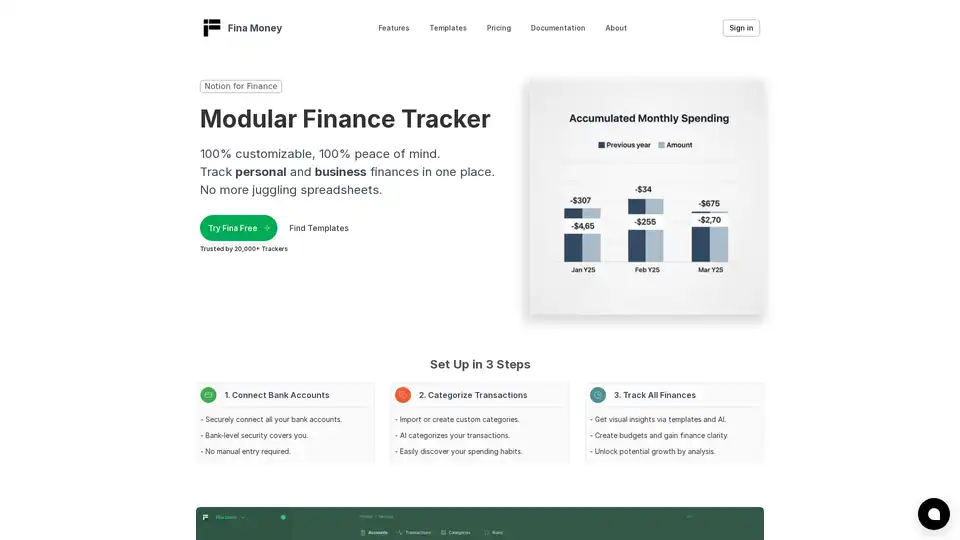

Fina Money is an AI-powered financial tracker for personal & business use. Manage your money easily, create custom budgets, and get financial insights.

SparkReceipt is an AI-powered receipt scanner and expense tracker for individuals and small businesses. Automate accounting, organize receipts, and create expense reports effortlessly.

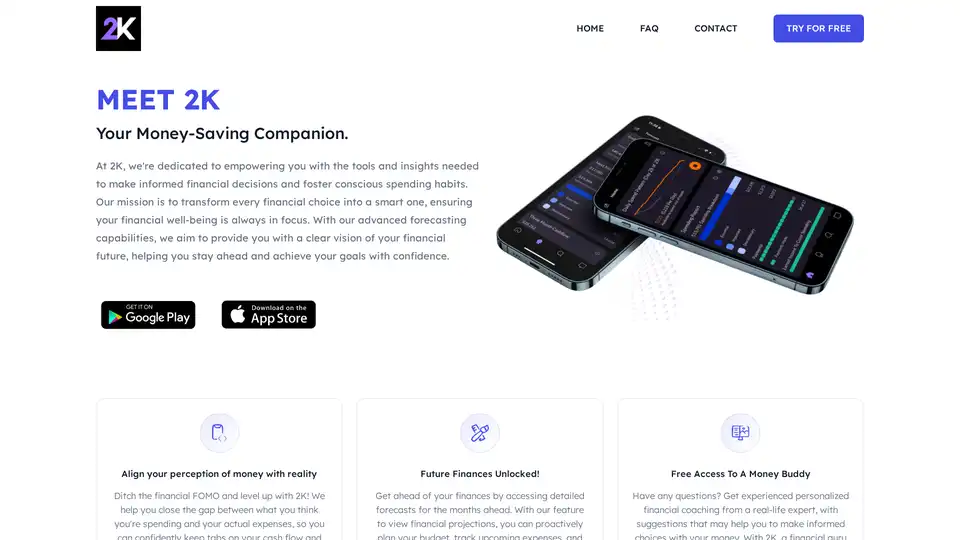

2K is an AI-powered personal finance app that tracks spending, forecasts budgets, and offers expert coaching to help you make smarter money decisions and maximize savings effortlessly.

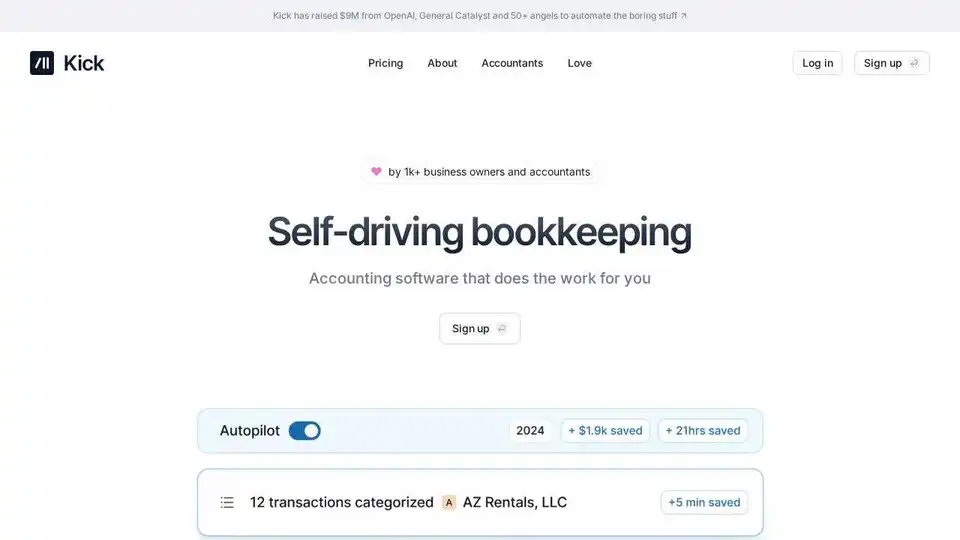

Kick automates bookkeeping for entrepreneurs, offering expense tracking, financial insights, and tax-ready financials. Free to use and designed to save time and money.

SnaptoBook simplifies personal accounting with AI-powered receipt management. Effortlessly organize tax-related receipts, track expenses, split bills transparently, and auto-generate forms for easy reimbursement.

UnitedTax.AI combines AI with tax professionals for fast, accurate, and affordable tax preparation. Ideal for businesses, freelancers, and tech employees with equity compensation.

Transform your financial habits with ExpenseSorted. Smart expense tracking, AI-powered categorization, and insights to improve your financial health. Calculate your financial freedom using Google Sheets.

Track spending & save with Spendtally. Snap receipts, see where money goes, & find savings. Simple, quick, & for everyone – manage your money better today!

Kick automates bookkeeping for entrepreneurs and accountants, offering features like auto-categorization, expense tracking, and revenue insights. Free to use or pays for itself.

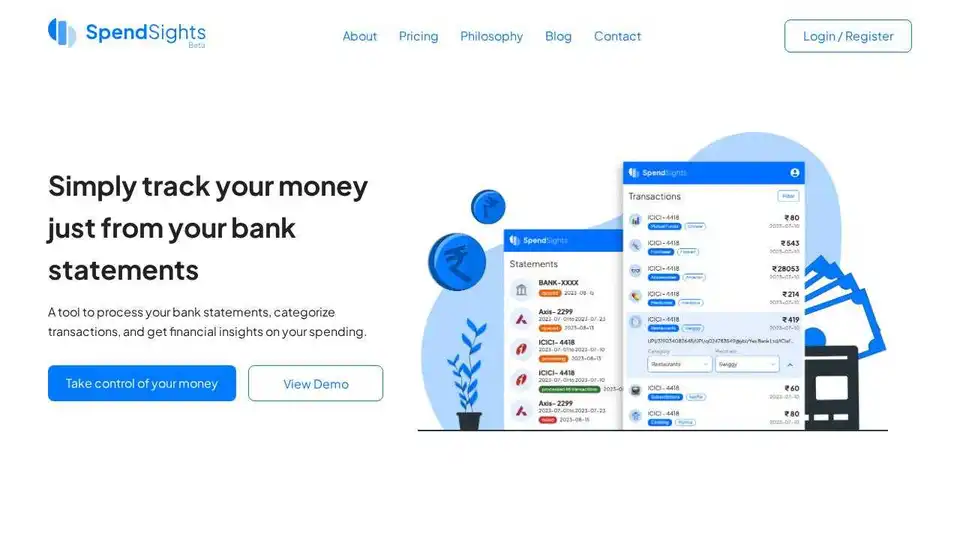

SpendSights analyzes your spendings in autopilot mode. Track money simply from bank statements with automatic categorization and AI learning.