Value Sense

Overview of Value Sense

What is Value Sense?

Value Sense is an advanced AI-powered stock analysis platform designed specifically for value investors seeking to identify undervalued stocks in the market. The platform combines sophisticated artificial intelligence algorithms with traditional value investing principles to provide investors with hedge fund-quality analytics in an accessible format.

How Does Value Sense Work?

The platform utilizes multiple valuation methodologies and AI-driven analysis to assess stock opportunities. Value Sense employs intrinsic value calculation tools including Discounted Cash Flow (DCF) analysis, Reverse DCF calculations, Peter Lynch fair value assessment, and Earnings Power Value computations. These tools work together to provide comprehensive valuation insights that help investors make informed decisions.

Core Features and Functionality

🔍 AI Stock Screener

Value Sense features a powerful stock screening tool that allows users to filter stocks based on various fundamental criteria including:

- Low P/E ratios combined with high ROIC (Return on Invested Capital)

- Heavy moat stocks with sustainable competitive advantages

- Undervalued small-cap opportunities

- Essential value investing metrics

📊 Intrinsic Value Tools Suite

The platform offers over 10 specialized valuation tools:

- Intrinsic Value Calculator: Determines the true worth of stocks

- Reverse DCF: Works backward from current prices to implied growth rates

- Peter Lynch Fair Value: Applies the legendary investor's methodology

- Earnings Power Value: Assesses sustainable earning capacity

📈 Advanced Analytics Dashboard

Value Sense provides comprehensive dashboards featuring:

- Quality ratings for stocks

- Fundamental data analysis

- Stock charting capabilities

- Advanced stock heatmaps

- KPI data tracking

- Overview templates for quick analysis

🤖 AI-Powered Earnings Analysis

The platform uses artificial intelligence to analyze earnings reports and identify patterns that might be missed by traditional analysis methods.

Target Audience and Use Cases

Value Sense is designed for:

- Individual investors seeking to apply professional-grade analysis techniques

- Value investing enthusiasts looking for systematic approaches to finding undervalued stocks

- Financial analysts who want to supplement their existing tools with AI-powered insights

- Investment clubs and groups needing collaborative analysis platforms

Practical Value and Benefits

🎯 Beat the Market Performance

The platform aims to help investors identify opportunities that have the potential to outperform market averages through careful valuation analysis and quality assessment.

⏰ Time Efficiency

By automating complex valuation calculations and providing pre-built screening presets, Value Sense saves investors significant research time while maintaining analytical rigor.

📋 Comprehensive Data Access

Users gain access to extensive fundamental data including revenue growth metrics, free cash flow analysis, market capitalization data, and quality ratings across thousands of stocks.

🌐 Community Insights

The platform features public spaces where investors can share analyses, dashboards, and investment ideas, creating a collaborative environment for value investing discussions.

Subscription and Accessibility

Value Sense operates as a web-based platform with both free and premium subscription tiers. The service is accessible through modern web browsers without requiring specialized software installation.

Why Choose Value Sense?

Investors choose Value Sense because it democratizes access to sophisticated valuation tools that were previously only available to institutional investors. The combination of AI-powered analysis with traditional value investing principles creates a unique offering in the financial technology space.

The platform's focus on intrinsic value calculation and quality assessment aligns perfectly with value investing philosophies, making it particularly valuable for investors who follow strategies similar to those used by Warren Buffett, Benjamin Graham, and other renowned value investors.

Getting Started with Value Sense

New users can start with a free account that provides access to basic features, while premium subscriptions unlock advanced tools, detailed analytics, and exclusive stock ideas. The platform offers intuitive navigation and educational resources to help investors make the most of its powerful features.

Best Alternative Tools to "Value Sense"

InvestingPro, powered by Investing.com, offers AI-driven stock analysis, real-time market data, and tools to uncover strategic investment opportunities. Stay informed with news, charts, and expert analysis.

Prospero.ai simplifies complex market patterns into actionable insights with our free AI investing app. Unlock winning trades and uncover high-potential stock picks with advanced AI analysis.

Kavout is an AI investing platform for stocks and crypto. Discover tools like AI Stock Picker, InvestGPT, and Kai Score for high-potential opportunities. Make smarter investment decisions effortlessly.

Moning is an AI-powered platform for managing and boosting wealth, offering portfolio tracking, AI analysis, and dividend forecasting to make informed investment decisions.

Find the best stocks to invest in, analyze and compare fundamentals, and start investing confidently. Access US stocks, ETFs, crypto, bonds, earnings, CPI, GDP, FED interest rates, and more with AI-driven insights.

Manus AI is the world's first general-purpose AI agent launching in 2025, turning thoughts into actions with SOTA GAIA benchmark performance. It automates complex tasks like travel planning, data analysis, and content creation for efficient productivity.

Wave automates research, writing, and analysis, saving you 40+ hours weekly. Access expert skills for work, learning, or home tasks for just $15/month. Common requests include writing, data analysis, and website building.

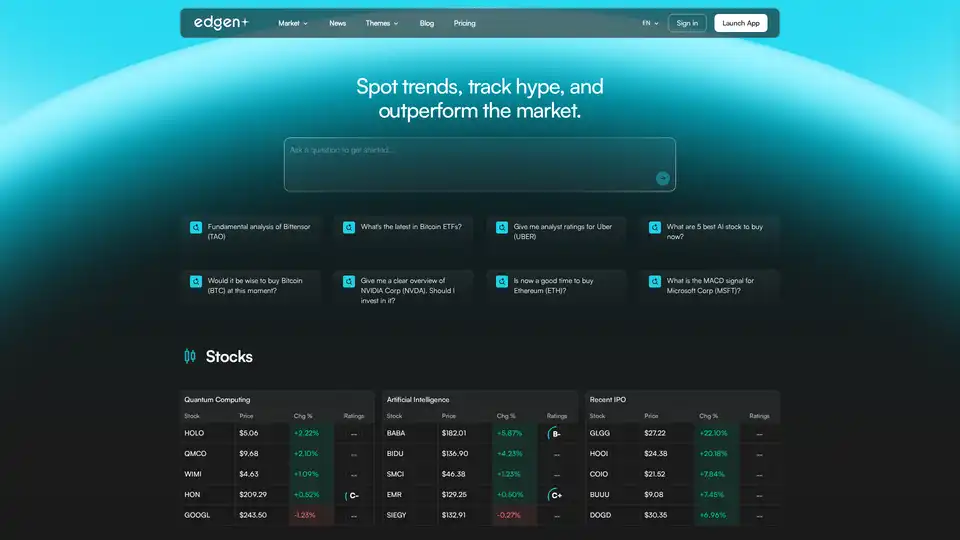

Edgen provides AI-powered tools for crypto and stock investors, offering real-time trading alerts, market signals, analytics, and portfolio analysis to spot trends and make informed decisions efficiently.

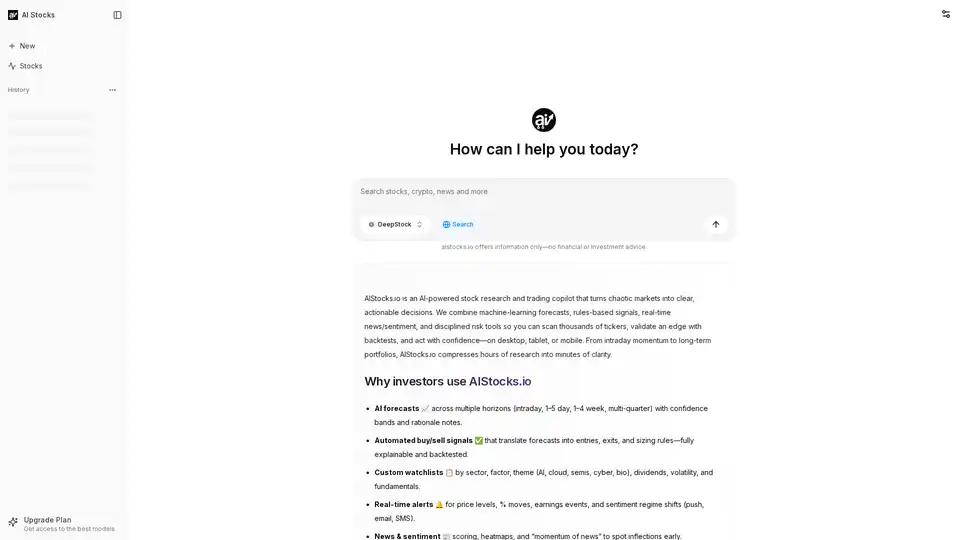

AIStocks.io is an AI-powered stock research platform providing real-time forecasts, automated trading signals, and comprehensive risk management tools for confident investment decisions.

Find the best stocks and trading strategies with our market-leading AI stock trading, AI options trading tools, and the best stock screeners available. Expedite stock and options investment research with advanced news monitoring and alerts. Find the best stock trades for bull markets and bear markets.

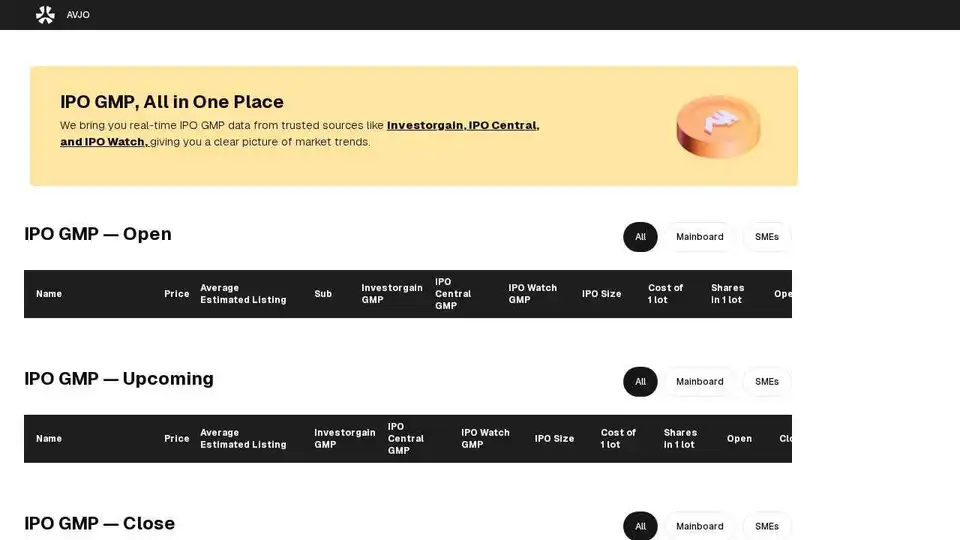

AVJO provides real-time IPO GMP data, tracks grey market premium, and offers guides for IPO application, SME IPO, and mainboard IPO. Get the latest IPO updates and insights.

CatalogIQ by MagnetLABS is an AI-powered platform for building, scoring, and enriching product catalogs. It automates data optimization for manufacturers, retailers, and marketplaces, boosting ecommerce conversions and compliance.

MarketVibes helps you spot long-term market trends in stocks and crypto with simple visual cues powered by AI. Get free weekly newsletter & alerts!

ML Alpha is an AI-powered platform providing data, AI tools, and a community for smarter stock market investing. Access AI insights, backtest strategies, and connect with expert investors.