AIStocks.io

Overview of AIStocks.io

What is AIStocks.io?

AIStocks.io is an advanced AI-powered stock research and trading copilot platform designed to transform complex market data into clear, actionable investment insights. By leveraging machine learning algorithms and real-time data analysis, the platform helps investors make informed decisions across various trading horizons—from intraday momentum plays to long-term portfolio strategies.

How Does AIStocks.io Work?

The platform employs a sophisticated model stack ensemble that combines:

- Gradient-boosted trees for analyzing fundamental and tabular data features

- Time-series and transformer models for identifying sequential patterns in market data

- Regime classifiers that dynamically adjust model weights based on market volatility and liquidity conditions

Key Technical Features

- Feature engineering incorporates price/volume structure analysis, volatility metrics, earnings revision patterns, analyst dispersion data, and macroeconomic proxies

- Regime detection identifies market states (risk-on/off, high/low volatility periods) to prevent model overfitting

- Signal translation converts forecasts into practical trading rules with built-in risk management parameters

- Explainability framework provides feature attributions and confidence bands for every prediction

Core Functionality

📈 Multi-Horizon AI Forecasts

The platform generates predictions across multiple timeframes:

- Intraday movements

- 1-5 day trends

- 1-4 week outlooks

- Multi-quarter projections

Each forecast includes confidence intervals and rationale notes, allowing users to understand the reasoning behind predictions.

✅ Automated Buy/Sell Signals

AIStocks.io translates forecasts into actionable trading signals featuring:

- Clear entry and exit points

- Position sizing recommendations

- Fully backtested performance metrics

- Customizable risk parameters

📋 Custom Watchlists & Screening

Users can create personalized watchlists based on:

- Sector preferences (tech, healthcare, energy, financials)

- Investment themes (AI infrastructure, cloud computing, semiconductors)

- Fundamental criteria (dividends, volatility metrics)

- Factor tilts (value, growth, quality, momentum)

🔔 Real-Time Alert System

The platform provides comprehensive alert capabilities for:

- Price level breaches

- Percentage movement thresholds

- Earnings events and announcements

- Sentiment regime shifts

- Custom trading conditions

Alerts are delivered via push notifications, email, and SMS, ensuring users never miss critical market movements.

📰 News & Sentiment Analysis

AIStocks.io incorporates advanced natural language processing to:

- Score news articles and social media sentiment

- Generate sentiment heatmaps across sectors

- Identify "momentum of news" patterns for early inflection detection

- Contextualize market movements with real-time information flow

🧪 Strategy Lab & Backtesting

The Strategy Lab enables users to:

- Design custom trading strategies using built-in libraries

- Apply risk overlays and position sizing rules

- Conduct rigorous backtesting across market regimes

- Validate strategies with walk-forward testing methodologies

🛡 Comprehensive Risk Management

Risk management features include:

- Position sizing assistant based on volatility and account risk parameters

- Multiple stop-loss types (static, ATR-scaled, trailing, time-based)

- Portfolio-level risk monitoring (beta, sector concentration, correlation analysis)

- Scenario testing for market shock events

Market Coverage & Intelligence

Asset Universe

- Current coverage: Major U.S. equities and ETFs

- Expansion plans: Global market coverage in development

Sector Specialization

The platform provides deep coverage across key sectors including:

- Technology: AI infrastructure, cloud computing, semiconductors

- Healthcare & Biotechnology: Pharmaceutical and medical technology companies

- Industrial Automation: Robotics and automation technologies

- Energy: Traditional energy and grid storage companies

- Financial Services: Fintech and brokerage firms

- Consumer Discretionary: E-commerce and retail sectors

AI Economy Focus

AIStocks.io offers specialized lenses for analyzing the AI ecosystem:

- Compute backbone: GPU manufacturers, networking infrastructure

- Cloud platforms: Hyperscalers and enterprise AI solutions

- AI applications: Security, design software, vertical SaaS solutions

- Edge computing: Mobile devices, wearables, automotive AI systems

Practical Applications

For New Investors

- Educational tooltips and guidance

- Simplified interface with safer default settings

- Step-by-step investment process guidance

For Active Traders

- Intraday momentum identification

- Gap and continuation pattern recognition

- Discipline-enhancing exit strategies

For Swing & Position Traders

- Earnings drift prediction models

- Trend-following methodology implementation

- Value-momentum combination strategies

For Research Teams

- Universal screening capabilities

- Standardized playbook sharing

- API integration and export functionality

- Collaborative research environment

Technical Excellence

Evaluation Discipline

AIStocks.io maintains rigorous validation standards:

- Rolling out-of-sample testing protocols

- Walk-forward validation methodologies

- Transaction cost and slippage adjustments

- Regime-specific performance metrics (hit rates, payoff ratios, risk-adjusted returns)

Model Integrity

- Continuous model performance monitoring

- Regular algorithm updates and improvements

- Transparency in methodology and assumptions

- Robustness testing across market conditions

Platform Accessibility

- Web-based application accessible on desktop computers

- Mobile-responsive design for tablet and smartphone usage

- Synchronized preferences across all devices

- Continuous alert synchronization ensuring seamless user experience

Compliance & Transparency

AIStocks.io operates with complete transparency regarding its capabilities and limitations:

- Not financial advice: Platform provides analytical tools only

- Educational focus: All outputs are for informational purposes

- Risk disclosure: Clear communication about market risks

- Performance transparency: Historical and backtested results clearly labeled as such

Getting Started

New users can begin with a free trial that provides access to:

- Basic forecasting capabilities

- Limited watchlist functionality

- Essential risk management tools

- Educational resources and tutorials

Premium subscription tiers offer:

- Advanced signal generation

- Full backtesting capabilities

- Priority alert delivery

- Extended historical data access

- Custom strategy development tools

Why Choose AIStocks.io?

Differentiating Factors

- Explainable AI: No black-box predictions—every forecast includes rationale

- Regime awareness: Models adapt to changing market conditions

- Discipline enforcement: Built-in risk management prevents emotional trading

- Human oversight: Final trade decisions remain with the user

- Comprehensive coverage: Multiple asset classes and timeframes

Practical Benefits

- Time savings: Compresses hours of research into minutes of analysis

- Confidence building: Data-driven insights reduce emotional decision-making

- Risk control: Comprehensive tools prevent catastrophic losses

- Performance improvement: Backtested strategies with proven historical efficacy

- Educational value: Learning platform for developing investment skills

Who Is AIStocks.io For?

The platform serves diverse investor profiles:

- Individual investors seeking data-driven decision support

- Active traders requiring real-time market intelligence

- Portfolio managers needing comprehensive risk analysis tools

- Research analysts looking for automated screening capabilities

- Financial advisors wanting to enhance client service offerings

Final Considerations

AIStocks.io represents the convergence of artificial intelligence and investment management, providing sophisticated tools previously available only to institutional investors. By democratizing access to advanced analytics and risk management capabilities, the platform empowers users to make more informed, disciplined investment decisions across various market conditions and time horizons.

Note: All investing involves risk of loss. Past performance does not guarantee future results. AIStocks.io provides analytical tools only, not investment advice.

Best Alternative Tools to "AIStocks.io"

PinkLion is a platform that empowers retail investors with tools for portfolio tracking, AI-powered optimization, smart forecasting, and automatic broker integrations, providing insights for smarter financial decisions.

SoStocked is an Amazon inventory management software trusted by 1000+ sellers to save time, accurately forecast, and avoid stockouts. Say goodbye to spreadsheets!

Transform business data into strategic decisions with Electe. AI-powered analytics, automated reports, and real-time insights for SMEs aiming for growth.

Machine learning powered demand forecasting for manufacturers, wholesalers and retailers. Forecast demand with more customization and automation.

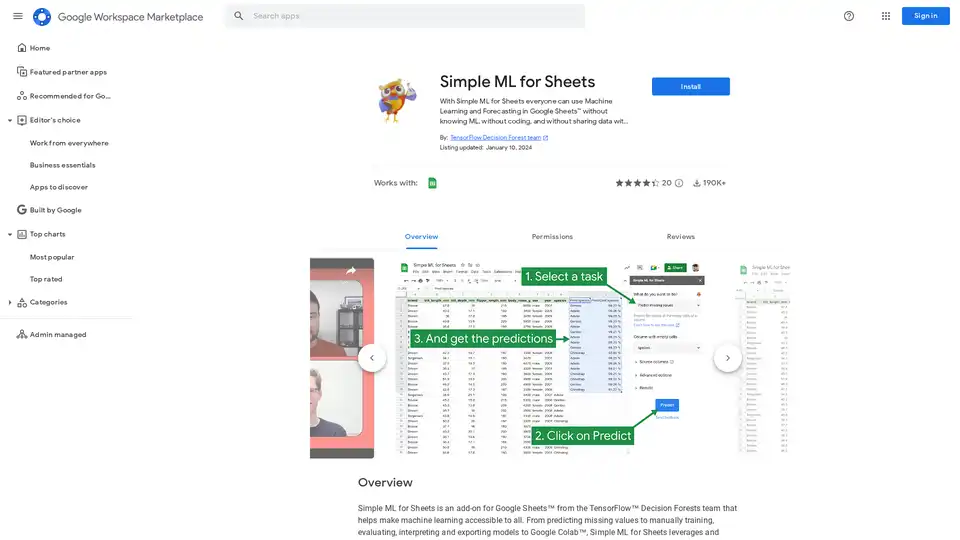

With Simple ML for Sheets everyone can use Machine Learning and Forecasting in Google Sheets™ without knowing ML, without coding, and without sharing data with third parties.

ASK BOSCO® is an AI-powered platform that integrates marketing and ecommerce data for seamless reporting, accurate forecasting with 96% precision, budget planning, and competitor benchmarking to optimize decisions for agencies and retailers.

TickerTrends is an AI-powered platform that transforms consumer interest data into actionable KPI predictions, helping investors forecast company performance with precision using alternative data sources.

Moning is an AI-powered platform for managing and boosting wealth, offering portfolio tracking, AI analysis, and dividend forecasting to make informed investment decisions.

ChartChat AI offers AI-powered trading analysis, real-time predictions, and automated insights for modern traders. Analyze charts, generate trade ideas, and get expert-level insights instantly.

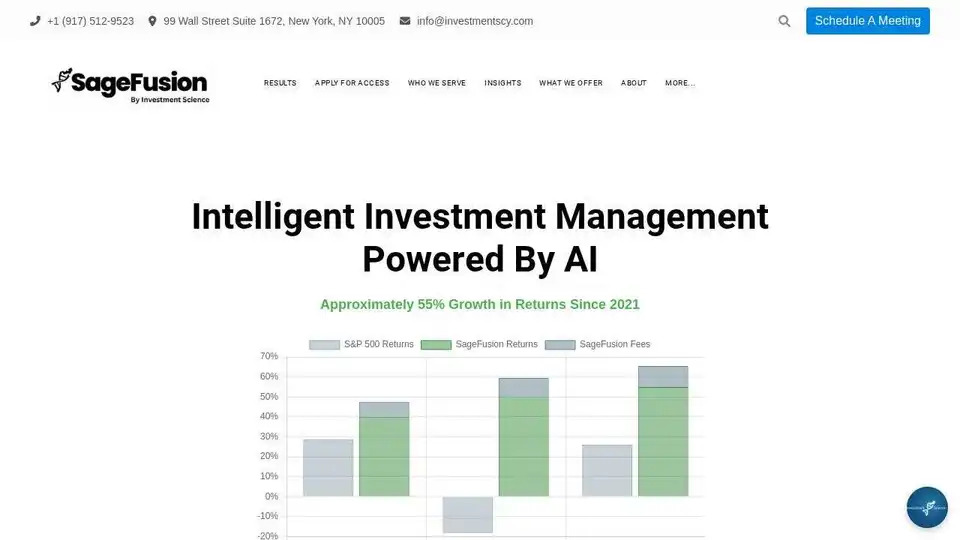

Discover SageFusion, an AI-driven investment platform offering advanced strategies, superior risk management, and personalized wealth management to optimize returns and simplify investing.

Optimize your Shopify store's inventory with Assisty.ai. Track stock levels, reduce overstock, and prevent stockouts with precise forecasting and automated replenishment solutions.

AITradingPredictor uses AI to forecast market trends, analyze stocks, and provide data-driven investment insights for traders and investors.

AInvest: AI-powered stock analysis, real-time market news & predictive tools for smarter trades. Start free!

Inventory365 is an AI-powered inventory management platform for ecommerce, offering real-time tracking, order automation, and multichannel integration. Optimize your inventory & boost sales.