Davidovs Venture Collective

Overview of Davidovs Venture Collective

What is Davidovs Venture Collective?

Davidovs Venture Collective (DVC) is a specialized venture capital firm focused exclusively on artificial intelligence startups. Founded by Marina and Nick Davidovs, the firm provides strategic funding and hands-on support to repeat founders in the AI space at both early-stage (pre-seed and seed rounds) and growth-stage (Series A and B rounds).

How Does Davidovs Venture Collective Work?

The firm operates through a unique community-driven model that brings together over 160 limited partners (LPs) including engineers, founders, and AI researchers, along with 240+ portfolio founders. This ecosystem creates unmatched deal flow and provides Silicon Valley access to supported startups.

Investment Structure:

- Pre-seed/Seed Funding: $100,000 - $300,000 investments

- Series A/B Follow-on Funding: $1,000,000 - $3,000,000 investments

The most active LPs can become Deal Advisors or Venture Partners, participating in DVC's investment decisions and sharing in the firm's success.

Core Team and Expertise

Marina Davidova - Managing Partner & Founder

- Former AI startup founder and operator (Humanism.is, Cherry Labs, exited)

- Previous VC/investor experience at Gagarin Capital

- Leads DVC strategy, investment process, internal products, and community

Nick Davidov - Managing Partner & Founder

- Repeat founder and VC in AI space

- Co-founder of Cherry Labs (exited) and Gagarin Capital (exited)

- Former growth executive at MSQRD (30M MAU in 3 months, acquired by Meta)

- Focuses on investments and portfolio management

Additional Key Team Members:

- Mel Guymon (GP) - Brings investment, startup (IMVU), and Big Tech experience (ex-Yahoo, ex-Google)

- Charles Ferguson (GP) - Experienced founder, investor, and Academy Award-winning filmmaker

- Alexey Rybak (Venture Partner) - Product expertise from Meta, Perplexity.ai, and Google

- Tony Shapovalov (Head of Product) - Repeat founder with exit experience

- Elena Malyanova (IR & Community) - Operations and investor relations specialist

- Vlad Baskakov (Head of Engineering) - Lead engineer building AI agents and automated workflows

Who is Davidovs Venture Collective For?

DVC specifically targets:

- Repeat AI founders with proven track records

- Early-stage AI startups requiring pre-seed and seed funding

- Growth-stage AI companies seeking Series A and B follow-on investments

- Investors looking to participate in AI-focused venture opportunities through the LP program

Why Choose Davidovs Venture Collective?

The firm offers several distinct advantages:

- Specialized AI Focus: Deep expertise in artificial intelligence technologies and markets

- Hands-on Support: Active operational assistance beyond just capital investment

- Powerful Network: Access to 160+ LPs and 240+ portfolio founders for networking and business development

- Community-Driven Approach: Collaborative ecosystem that enhances deal flow and support resources

- Experienced Team: Founders with both startup operating experience and investment expertise

Practical Value and Impact

Davidovs Venture Collective provides more than just funding - they offer a comprehensive support system that includes strategic guidance, technical expertise, business development opportunities, and access to a valuable professional network. This holistic approach helps AI startups accelerate their growth and increase their chances of success in the competitive technology landscape.

Best Alternative Tools to "Davidovs Venture Collective"

VentureMate is an AI-powered platform that revolutionizes startup funding by connecting startups with ideal investors. It offers features like investment likelihood scores and tailored investor matching to boost startup success.

VentureMate is an AI-powered platform that connects startups with ideal investors using advanced matching algorithms and investment likelihood scoring to maximize funding success.

IdeasFundX is an AI-driven platform connecting qualified startups with relevant VCs for +$1 million USD funding. Optimize dealflow, secure fundraising, and connect with investors.

Evalyze AI's fundraising agent automates the entire startup fundraising process. It analyzes each startup, matches them with suitable investors, and manages personalized outreach.

IdeasFundX is an AI-driven platform that connects Series A/B startups with relevant VCs for over $1M funding. It streamlines dealflow screening, qualifies deals, and facilitates investor introductions for secure fundraising.

Slidebean's AI pitch deck creator helps startups craft professional pitches to raise over $500M in funding. Access free software for AI-driven slides, collaboration, and analytics, or hire their expert agency for custom designs and financial modeling.

Private Equity List is an AI-powered database to find PE/VC investors. Used by startups, consultants, and VCs for fundraising, partnerships, and research. Offers intuitive search and investor contacts.

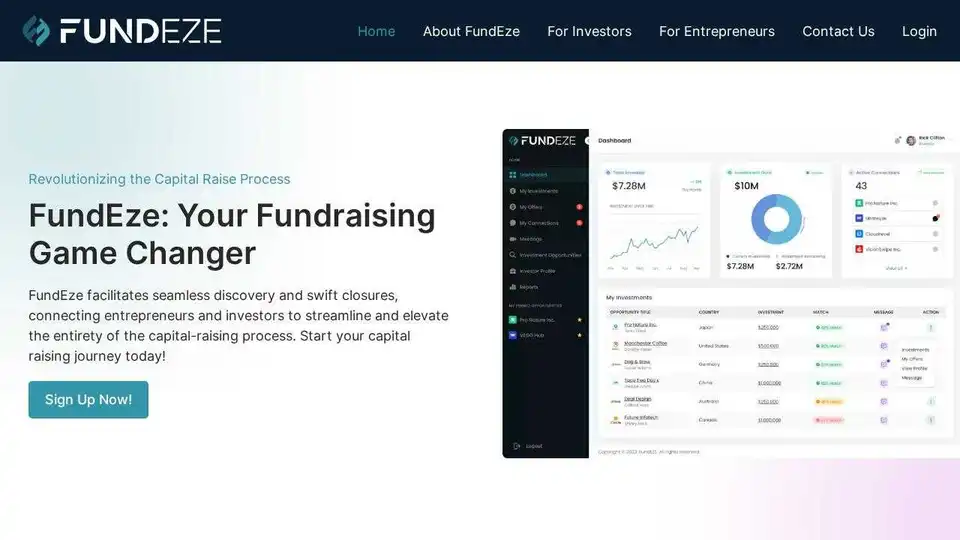

FundEze is an intelligent investment platform that uses AI to connect entrepreneurs and investors, streamlining the capital-raising process for startups.

Raizer is an AI-powered platform connecting startups with relevant investors. Discover top investors, pitch effectively, and secure funding to scale your startup. Access 140K+ VCs & startups, get AI insights & close deals faster.

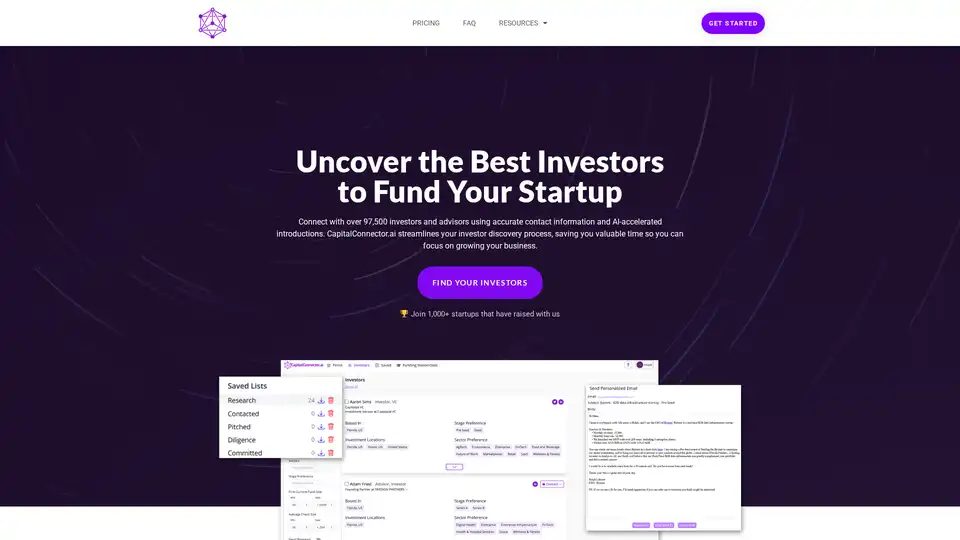

CapitalConnector.ai helps startups connect with over 97,500 investors and advisors using AI-accelerated introductions and accurate contact information, streamlining the investor discovery process.

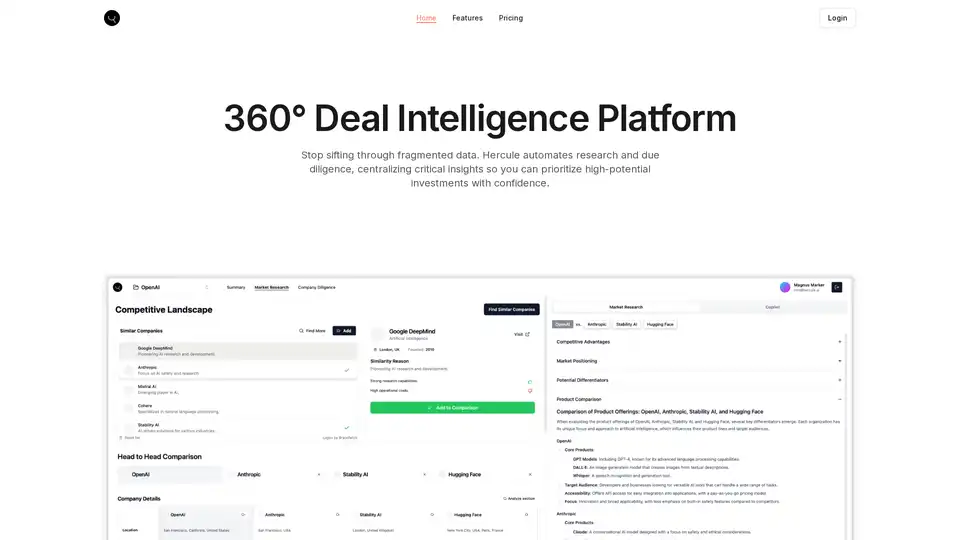

Hercule AI is a 360° deal intelligence platform that automates research and due diligence for venture capitalists. It centralizes critical insights, enabling faster and smarter investment decisions.

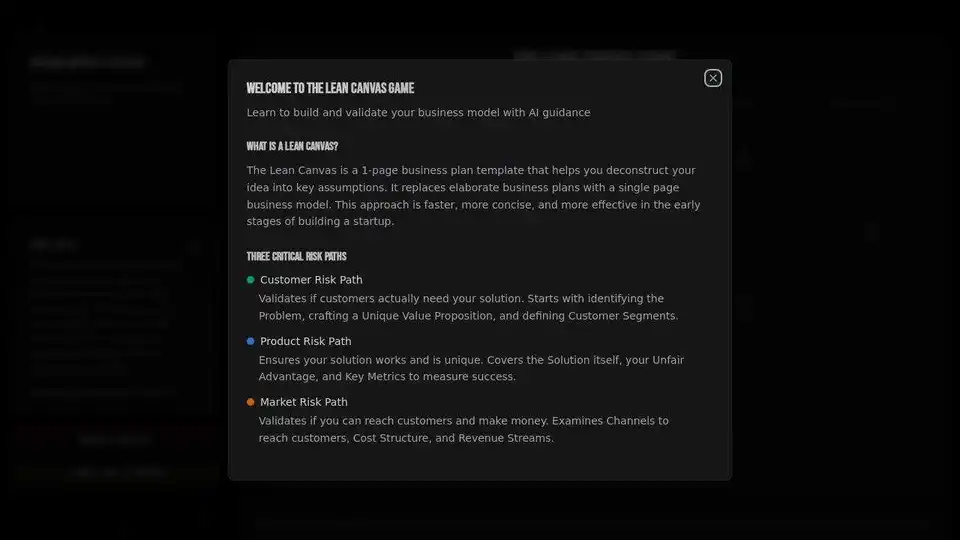

Lean Canvas Game is an interactive Lean Canvas builder with AI venture capitalist feedback. Create and validate your business model step by step with real-time guidance.

Platvix is an AI-powered fundraising ecosystem that provides VC-grade deck analysis, claim verification, and investor pipeline building for startups and investors.

Exitfund helps startups raise venture capital using AI. Apply now to join our portfolio community and get mentorship.