Custerem

Overview of Custerem

Custerem: Your Path to Financial Independence

What is Custerem? Custerem is a Polish platform designed to empower individuals with the knowledge and tools they need to achieve financial independence. It offers a range of resources, including articles, interactive calculators, and courses, covering essential aspects of personal finance.

How does Custerem work? Custerem simplifies financial education by providing a step-by-step approach. Users can register, choose their areas of interest (budgeting, investing, insurance, retirement), and learn at their own pace. The platform emphasizes practical application, encouraging users to implement their knowledge and track their financial progress.

Key Features and Benefits

- Comprehensive Financial Education: Custerem covers various topics, from basic budgeting to advanced investment strategies.

- Practical Tools and Resources: Users can access templates, calculators, and step-by-step guides to help them manage their finances effectively.

- Personalized Learning Paths: The platform allows users to customize their learning experience based on their interests and goals.

- Beginner-Friendly Approach: Custerem explains complex financial concepts in a simple and accessible way.

- Community Support: Users can connect with other learners and share their experiences.

Main Solutions Offered

Budgeting and Saving

Custerem teaches users how to create and stick to a budget that works for them. It provides methods for saving money to reach larger goals, such as buying a home or traveling. The platform offers templates, tools, and step-by-step guides to make budgeting easier. This helps users identify where their money is going and how to control it.

Investments for Beginners

Custerem helps users build a solid foundation of knowledge about investing. It explains what stocks, bonds, and investment funds are. It presents different investment strategies tailored to a user's risk profile, from simple passive investing to more advanced techniques. Custerem addresses myths and fears associated with entering the stock market.

Insurance and Retirement

Custerem emphasizes the importance of insurance and helps users choose the best protection for their families. It explains the complexities of retirement systems so users can plan for their future. The platform offers information on various retirement pillars and ways to save additionally for a comfortable retirement.

How to Use Custerem

- Register: Sign up quickly to gain full access to all educational resources.

- Choose a Path: Select topics of interest, such as budgeting, investments, insurance, or retirement.

- Learn and Act: Use articles, interactive calculators, and quizzes to apply the knowledge and observe financial growth. Custerem provides tools for action, including simulations and real-world changes.

Who is Custerem For?

- Beginners: Those just starting with personal finance can learn basic concepts, create a budget, and start saving.

- Advanced Users: Individuals with existing knowledge can deepen their understanding with market analyses, advanced investment strategies, and tax optimization tips.

Pricing

- Free: Access to blog articles, basic calculators, and a monthly newsletter.

- Premium (49 zł/month): Includes everything in the Free plan plus advanced video courses, access to an expert community, and advanced calculators.

User Testimonials

- Anna K., Wrocław: "Thanks to Custerem, I finally understood how a household budget works. Before, money was slipping through my fingers. Now I have control, I save, and I plan for the future."

- Marek S., Gdynia: "I was always afraid of investing, but the courses on Custerem explained everything from scratch. I built my first portfolio and I see my savings grow. I highly recommend it!"

- Katarzyna W., Kraków: "I didn't think that financial knowledge could be presented so simply and accessibly. Interactive tools and quizzes make learning a pleasure. Big kudos to the team!"

FAQ

What makes Custerem different from other financial portals?

Custerem focuses on a practical approach and provides specific tools for managing finances, rather than just dry theory. The content is created by experienced experts and is regularly updated to reflect the latest market trends. Custerem is independent and does not promote specific financial products, which guarantees objectivity.

Do I need a large capital to start investing with your advice?

Absolutely not! Much of the advice concerns investing with small amounts, even from small, one-time payments. Custerem shows how the principle of compound interest works and how small, regular savings can turn into significant capital over time. Starting with small amounts is a great way to learn without taking big risks.

Does Custerem offer individual consultations?

Currently, Custerem does not provide individual financial consultations. The focus is on providing high-quality, generally available knowledge and tools that allow users to make informed decisions independently. Custerem encourages users to take advantage of courses, articles, and active participation in the community, where they can exchange experiences.

What topics are covered in the blog section?

The blog regularly publishes articles on many topics related to personal finance, including tips on saving for retirement, analysis of current market trends, reviews of books on financial topics, guides to cryptocurrencies, and interviews with experts. Custerem is constantly expanding the range of topics to meet the needs of the community.

What is the best way to start planning your financial future? Join Custerem today and take the first step towards financial independence. With knowledge, tools, and inspiration all in one place, Custerem is your trusted partner on the journey to financial freedom. By understanding personal finance and building better habits, it can help transform your life.

Best Alternative Tools to "Custerem"

Tendi is an AI-powered personal financial advisor that helps you understand, plan, and achieve your financial goals with ease. Get personalized financial advice and insights.

Finance Rants uses AI & financial psychology to redefine personal finance. Discover your financial personality with a quiz & get tailored advice for smarter financial decisions.

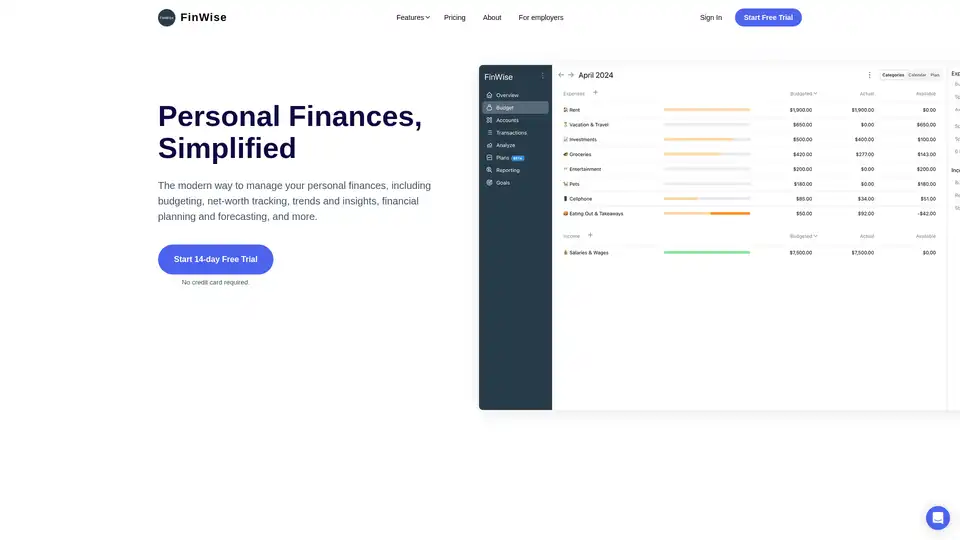

FinWise simplifies personal finance management with budgeting, net worth tracking, and financial planning tools. Securely connect accounts, track spending, and plan for the future.

MoneyCoach is a personal finance app for managing money, budgeting, and tracking spending across Apple devices. Take control of your finances with smart budgets and goals.

Crbit is an AI-powered personal finance app that helps you supercharge your finances. Collaborate, budget, and save with confidence using Crbit's advanced features.

Simplify Money is an AI-powered personal finance app that helps you plan your goals, invest, and learn finance with ease. Track your net worth and more!

Kniru is an AI-powered personal finance platform that helps you track spending, optimize investments, and manage loans. Get AI-driven insights for smarter financial decisions in one secure dashboard. Start free today!

WeFIRE is an AI-powered personal finance copilot that provides personalized services to help you achieve financial freedom. Track your progress, budget, and learn about FIRE.

WiseBot.App is an AI-powered personal finance assistant in Telegram. Track expenses, manage wallets, share budgets collaboratively, and get smart AI insights—all securely without extra apps.

2K is an AI-powered personal finance app that tracks spending, forecasts budgets, and offers expert coaching to help you make smarter money decisions and maximize savings effortlessly.

Track finances & expenses in 10 minutes/month with finance_stuff. AI insights, statistics & visualizations for smarter financial management.

SimplyBudget AI is a smart budgeting app that uses AI to simplify financial management. Track expenses, set goals, and manage loyalty cards effortlessly. Download today to achieve financial freedom!

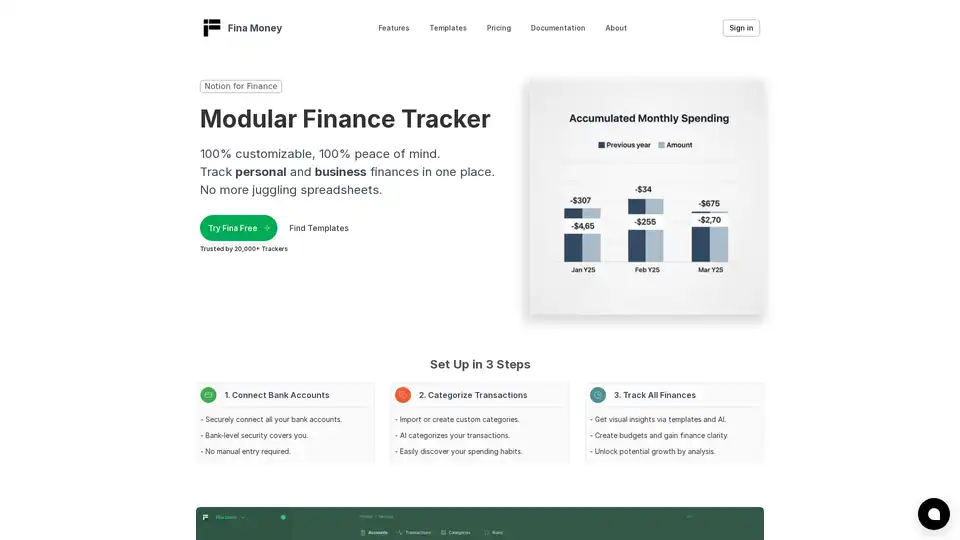

Fina Money is an AI-powered financial tracker for personal & business use. Manage your money easily, create custom budgets, and get financial insights.

intelliAssets simplifies asset management with AI-powered tools for tracking investments, cryptocurrency, and personal finances. Make smarter decisions and achieve better outcomes.