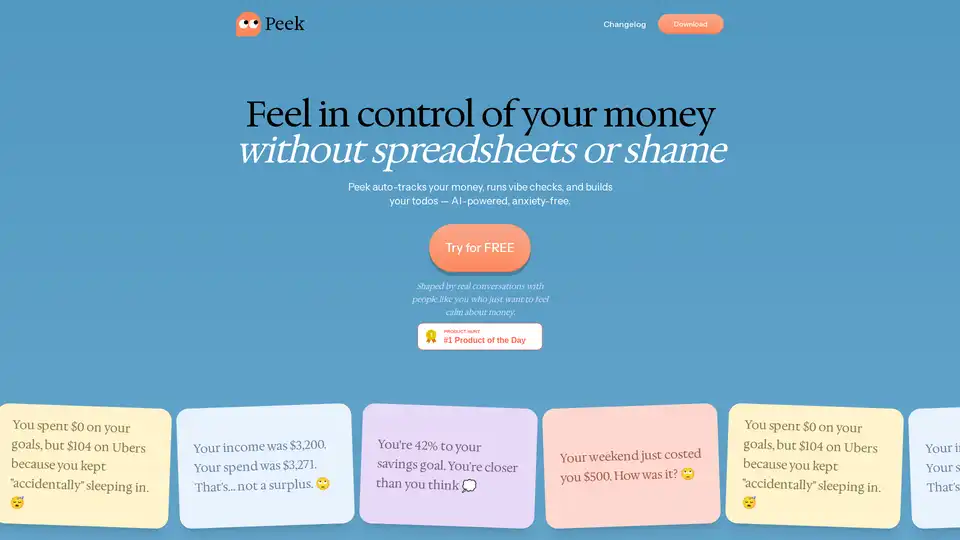

Peek

Overview of Peek

What is Peek?

Peek is an innovative AI-powered personal finance app designed to transform how you manage your money without the usual stress or judgment. Unlike traditional budgeting tools that feel overwhelming or outdated, Peek acts as your empathetic financial wellness coach. It automatically tracks your spending, analyzes patterns with a touch of humor and insight, and helps you build sustainable habits. Whether you're feeling broke despite a decent income or dread opening your banking app, Peek makes financial management feel approachable and even enjoyable. Launched with a focus on emotional well-being, it's perfect for young adults navigating modern life expenses like Ubers, Uber Eats, and weekend splurges.

At its core, Peek leverages artificial intelligence to provide personalized insights that resonate with your lifestyle. No more spreadsheets or guilt-tripping notifications—Peek delivers 'money vibes' that encourage positive change. It's available as a mobile app, easy to download and connect to your bank accounts in seconds, ensuring privacy with no ads or data selling.

How Does Peek Work?

Peek simplifies financial tracking through seamless integration and smart AI analysis. Here's a breakdown of its key mechanics:

Automatic Money Tracking: Once you link your bank accounts (a process that takes mere seconds), Peek pulls in all your transactions without manual input. It categorizes expenses like coffee runs, delivery fees, or subscription creep, highlighting hidden costs such as the $109.44 in Uber Eats delivery fees that might surprise you.

Weekly Money Vibes: Every week, Peek runs a 'vibe check' on your finances. Using AI, it reviews your income versus spending—for instance, noting if your $3,200 income led to a $3,271 outflow—and delivers digestible summaries with relatable commentary. Examples include: 'Your weekend just cost you $500. How was it?' or 'You're 42% to your savings goal. You're closer than you think.' This non-judgmental approach helps you process spending without anxiety.

AI-Powered Goal Setting: Peek turns daunting financial targets into bite-sized, motivating tasks or 'todos.' If you're overspending on Ubers due to sleeping in, it suggests adjustments without shaming. It tracks progress toward goals like saving for a vacation, celebrating small wins to keep you engaged.

Insightful Pattern Recognition: The AI identifies behavioral trends, such as weekday thriftiness versus weekend extravagance or how coffee habits lead to impulse snack buys. It even adds levity: 'Your net worth increased by exactly one houseplant this month. At least it's still alive!' This makes insights memorable and actionable.

Peek's AI is tuned to understand your 'financial situationship'—the emotional side of money management—making it feel like chatting with a supportive friend rather than a stern accountant.

Key Features of Peek

Peek stands out with features tailored for real-life financial challenges:

- Effortless Bank Syncing: Securely connect multiple accounts for a holistic view of your finances.

- Humor-Infused Insights: AI-generated messages that point out issues lightly, like calling out subscription waste or delivery fee traps, helping you cut unnecessary spending (users report saving $215/month).

- Goal-Oriented Todos: Customizable, ADHD-friendly tasks that break down savings or debt goals into manageable steps.

- Privacy-First Design: No data sharing, ads, or invasive tracking—your info stays yours.

- Modern, Intuitive Interface: Sleek UX that feels contemporary, not like outdated bank software, appealing to millennials and Gen Z.

These elements combine to create 'money on autopilot,' where tracking happens in the background while you receive proactive nudges.

Who is Peek For?

Peek is ideal for anyone who wants better financial control without obsession or complexity. It's particularly suited for:

- Young Professionals (Ages 18-30): Like Jamie (23, Designer), who now enjoys weekly check-ins instead of dreading them, feeling organized without stress.

- Busy Individuals with ADHD or Anxiety: As Aisha (25, Teacher) shares, it works with your brain, not against it, motivating vacation savings through tiny goals.

- Subscription Spenders and Impulse Buyers: Tyler (24, Developer) discovered joy-sparking expenses versus drains, boosting savings effortlessly.

- Weekend Warriors: If your weekdays are frugal but weekends rack up costs, Peek calls it out gently to balance your habits.

- Anyone Overwhelmed by Traditional Apps: Morgan (26, Marketing Specialist) appreciates the no-judgment, modern vibe over clunky tools.

If you make okay money but feel broke, hate bank apps, or want money smarts without obsession, Peek is your ally. It's not for corporate finance pros seeking advanced analytics but for everyday users building emotional resilience around money.

Why Choose Peek?

In a sea of finance apps that induce guilt or require accounting knowledge, Peek differentiates by prioritizing mental health. Real users rave about its impact:

- Stress Reduction: 'I actually look forward to my weekly money check-ins,' says Jamie.

- Practical Savings: Tyler saved $215/month by ditching unused subscriptions.

- Motivation Boost: Aisha finally saved for a vacation thanks to motivating goal features.

- User-Friendly Design: Morgan loves the fresh UX that suits modern brains, not 'boomers.'

Backed by conversations with real people, Peek addresses common pain points like accidental overspending or goal fatigue. Its AI ensures insights are personalized, not generic, fostering long-term habit change. Plus, it's free to try, with immaculate vibes that make finance fun.

How to Use Peek

Getting started is straightforward:

- Download the App: Available for iOS and Android—search for Peek in your app store.

- Connect Accounts: Securely link banks via the app's simple setup.

- Set Your Goals: Input savings targets or habits to track; Peek suggests todos.

- Review Weekly Vibes: Open the app for AI summaries and act on recommendations.

- Track Progress: Monitor todos and adjust as needed for ongoing improvement.

For best results, engage with the vibe checks regularly. If you're dealing with impulse buys, use the insights to reflect—e.g., question if that Uber Eats splurge aligns with your goals.

Practical Value and Real-World Impact

Peek's value lies in its ability to make finance accessible and empathetic. By automating tracking and using AI for behavioral nudges, it helps users achieve surpluses, hit savings milestones, and curb wasteful spending. Consider Tyler's story: uncovering subscription drags led to tangible monthly savings. Or Aisha's: turning abstract goals into winnable tasks built confidence.

In terms of SEO relevance, if you're searching for 'AI personal finance coach' or 'stress-free budgeting app,' Peek delivers on promises of ease and effectiveness. It supports informational queries by explaining money patterns and transactional ones by guiding actionable steps. With growing awareness of financial mental health, tools like Peek align with trends in AI-driven wellness, potentially saving users hundreds annually while reducing anxiety.

While it doesn't delve into investments or taxes, its focus on daily habits lays a strong foundation. For those curious about AI in finance, Peek exemplifies how machine learning can parse transaction data for personalized advice, without needing deep technical knowledge.

Ultimately, Peek isn't just an app—it's a companion for calmer money management. Try it free today and discover why users say their vibes (and net worth) have never been better.

Best Alternative Tools to "Peek"

Transform limiting beliefs into success with Neomind, AI-powered personalized self-hypnosis sessions designed for personal growth, career, relationships, and more. Start your journey today!

Role Model AI offers tools to create custom AI voice assistants and explore a directory of AI tools. Build AI applications with our platform.

Discover Zenora, the free AI therapy app that empowers mental health with 24/7 AI counseling, mood tracking, and personalized insights for emotional wellness and inner strength.

RewiredMind is an AI-powered app offering personalized stress management techniques like journaling, affirmations, and CBT to help reduce anxiety and promote mental wellness. Start with a free trial for tailored action plans.

TherapyWithAI provides free and personalized AI online therapy, offering affordable and accessible mental health support 24/7. Experience personalized therapy redefined for the digital age.

Spokk is a customer feedback software for service businesses. Get Google reviews, collect feedback, & automate requests via SMS and email. Boost your online reputation effortlessly.

Pulz.io is an AI-driven platform providing real-time, personalized answers and recommendations to enhance user engagement and conversion rates across various industries. Use AI agent and AI-Driven Forms to transform your business.

Tarotia is an online tarot reading application enriched with artificial intelligence, providing accurate and personalized readings anytime, anywhere for spiritual guidance.

RetireMint is a comprehensive retirement planning platform designed for Canadians, offering expert assessments, planning tools, and guidance to ensure a confident and well-prepared retirement.

Jellypod is an AI podcast studio that allows you to create engaging audio content with customizable AI hosts, voice clones, editable scripts, and built-in distribution. Start free!

GPTS Store is a platform to explore and exchange the finest OpenAI GPTs apps. Discover productivity, education, business, and more GPTs.

Experience secure AI conversations with Sanctum, powered by open-source models encrypted locally on your device. Run full-featured LLMs in seconds with complete privacy.

Explore Secret Energy, a conscious ecosystem featuring Sibyl AI, the world's first AI spiritual guide. Discover metaphysical insights, connect with seekers, and enhance your holistic well-being.

NawaCares is an AI-powered mood companion app offering 24/7 support, journaling, and personalized insights for mental wellness. Calm anxiety and elevate your personal growth!