Pocket Adviser

Overview of Pocket Adviser

Pocket Adviser: Personalized Financial Guidance for Achieving Your Goals

What is Pocket Adviser? Pocket Adviser is a platform designed to provide personalized financial advice and planning to help individuals achieve their financial goals. Unlike generic financial tools, Pocket Adviser tailors its advice to your unique financial situation, goals, and risk tolerance.

How does Pocket Adviser work?

- Goal Definition: You start by defining your financial goals, whether it's buying a home, planning a holiday, saving for a new car, a wedding, education, or retirement.

- Financial Assessment: Pocket Adviser gathers information about your current financial situation, including income, expenses, assets, and liabilities.

- Custom Financial Plan: Based on your goals and financial assessment, Pocket Adviser generates a custom financial plan outlining the steps you need to take. This includes how much to save and which investments to make.

- Ongoing Advice and Support: Pocket Adviser provides ongoing advice and support, adapting the plan to changes in your life and market conditions.

Key Features and Benefits

- Personalized Guidance: Tailored to your unique financial situation, goals, and risk tolerance. No more one-size-fits-all solutions.

- Goal-Oriented Approach: Helps you stay on course to achieve your financial goals by tracking your progress.

- Transparent, Rules-Based Model: The advice is generated by a transparent, rules-based financial model, ensuring trust and reliability. No AI hallucinations.

- 24/7 Support: Always available to help you navigate uncertainty and make informed decisions.

- Comprehensive Approach: Brings together all aspects of your financial journey, eliminating guesswork.

- Educational Resources: Provides a blog with articles on stock market basics and financial planning topics.

Why is Pocket Adviser important?

Pocket Adviser addresses the financial advice gap, where rising cost of living and falling advisor numbers create a need for accessible and affordable financial guidance. By automating the advice process, Pocket Adviser makes it easier for individuals to stop stressing and start achieving their goals.

How to use Pocket Adviser?

- Join the Waitlist: Sign up on the Pocket Adviser website to join the waitlist.

- Define Your Goals: Tell Pocket Adviser about your financial goals.

- Provide Financial Information: Share details about your current financial situation.

- Receive a Custom Plan: Get a personalized financial plan with clear steps to achieve your goals.

- Track Your Progress: Monitor your progress and receive ongoing advice and support.

Existing Solutions vs. Pocket Adviser

| Feature | Existing Solutions | Pocket Adviser |

|---|---|---|

| Personalization | One Size Fits All | Tailored to your unique situation |

| Focus | Limited Focus | Goal-Oriented Approach |

| Support | Lack of Support | 24/7 Support |

What users are saying?

- "I was struggling to save for a home deposit, but Pocket Adviser helped me create a plan and stay on track." - Sarah, 28

- "I never understood investing before, but Pocket Adviser made it easy to understand and get started." - John, 35

Get Started Today

Ready to take control of your financial future? Join the waitlist for Pocket Adviser and start achieving your financial goals today!

Best Alternative Tools to "Pocket Adviser"

AI4Fire helps you reach Financial Independence, Retire Early (FIRE) effortlessly. It provides AI-driven insights into spending habits, financial enlightenment, and acts as a coach to stay focused on your FIRE objectives.

WeFIRE is an AI-powered personal finance copilot that provides personalized services to help you achieve financial freedom. Track your progress, budget, and learn about FIRE.

Tendi is an AI-powered personal financial advisor that helps you understand, plan, and achieve your financial goals with ease. Get personalized financial advice and insights.

Custerem is a comprehensive financial education platform. Learn how to budget, invest, and manage your money effectively to achieve financial independence.

FinanceGPT Chat lets you build your own AI co-pilots for personalized financial insights, market analysis, and smarter decision-making.

Origin Financial is an AI-powered platform that consolidates finances for budgeting, investment tracking, and financial planning, offering personalized advice.

Simplify Money is an AI-powered personal finance app that helps you plan your goals, invest, and learn finance with ease. Track your net worth and more!

MAPLE: AI-powered financial advisor, offering personalized advice for wealth management and investment, analyzes assets and optimizes financial goals.

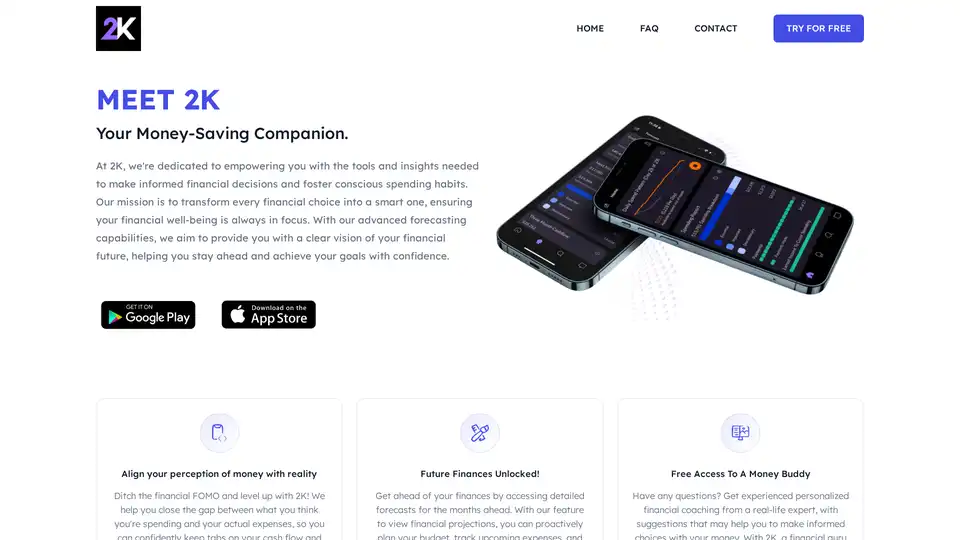

2K is an AI-powered personal finance app that tracks spending, forecasts budgets, and offers expert coaching to help you make smarter money decisions and maximize savings effortlessly.

Opesway is an all-in-one free FIRE platform for financial planning, budget management, retirement forecasting, and asset allocation. Achieve financial independence and early retirement with personalized insights.

PitchYourIdea.ai is an AI-powered platform that enables entrepreneurs to create professional pitch decks in just 3 minutes using voice pitches. It provides instant AI feedback, validates ideas, and prepares users for fundraising with customizable options and expert avatars.

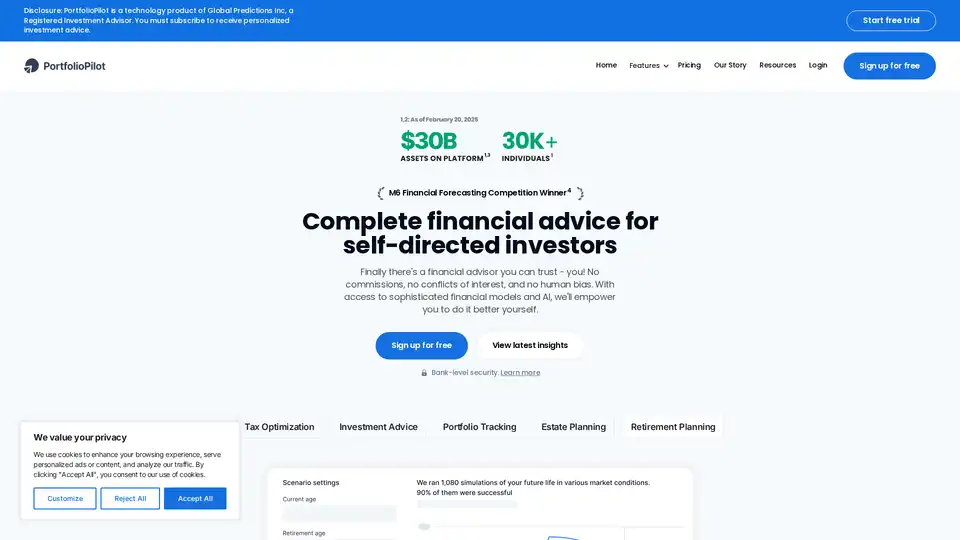

PortfolioPilot is an AI financial advisor helping you track investments, optimize taxes, and get AI-powered financial guidance. Start free and built for long-term investors.

Moning is an AI-powered platform for managing and boosting wealth, offering portfolio tracking, AI analysis, and dividend forecasting to make informed investment decisions.

PortfolioPilot is an AI financial advisor that helps self-directed investors track investments, optimize taxes, and receive personalized financial advice, including estate & retirement planning.