Prembly

Overview of Prembly

What is Prembly?

Prembly is a comprehensive identity verification and fraud prevention platform that provides businesses with advanced tools for Know Your Customer (KYC), Know Your Business (KYB), Anti-Money Laundering (AML), Counter Financing of Terrorism (CFT), and comprehensive background checks. Built on a robust data infrastructure, Prembly aims to make the internet a safer place by enabling effortless compliance and security measures.

How Does Prembly Work?

Prembly operates through a sophisticated data infrastructure that integrates multiple verification methods and compliance protocols. The platform uses advanced automation and AI-driven processes to deliver faster turnaround times and improved accuracy in identity verification and due diligence processes.

Core Products and Services

For Businesses:

- IdentityForms: Streamlined digital identity collection and verification

- IdentityRadar: Real-time fraud detection and prevention system

- IdentityPass: Secure authentication and access management

- BackgroundChecks: Comprehensive employment and personal background verification

- Compliance Tracker: Ongoing monitoring and compliance management

For Individuals (Coming Soon):

- NISES: Personal identity management solution

- Evento: Event verification and access control system

Key Features and Capabilities

Advanced Identity Verification

Prembly offers multi-layered identity verification processes that combine document verification, biometric analysis, and database cross-referencing to ensure accurate identity confirmation.

Fraud Prevention Systems

The platform employs sophisticated fraud detection algorithms that analyze patterns, behaviors, and anomalies to prevent fraudulent activities in real-time.

Compliance Automation

Automated compliance workflows help businesses meet regulatory requirements for KYC, KYB, AML, and CFT without manual intervention, reducing operational costs and improving efficiency.

Background Check Services

Comprehensive background verification services including employment history, criminal records, credit history, and professional qualifications verification.

Who is Prembly For?

Prembly serves a wide range of businesses and organizations including:

- Financial institutions and banks

- Fintech companies and payment processors

- E-commerce platforms

- Healthcare organizations

- Government agencies

- Educational institutions

- Any business requiring identity verification and compliance solutions

Practical Value and Benefits

Enhanced Security

Prembly's advanced verification systems significantly reduce the risk of identity fraud and unauthorized access, protecting both businesses and their customers.

Regulatory Compliance

The platform ensures businesses remain compliant with evolving regulatory requirements across different jurisdictions, minimizing legal risks and penalties.

Operational Efficiency

Automated processes and streamlined workflows reduce manual verification efforts, saving time and resources while improving accuracy.

Improved Customer Experience

Fast and seamless verification processes enhance customer onboarding experiences, reducing abandonment rates and improving conversion.

Why Choose Prembly?

Prembly stands out through its:

- Advanced Data Infrastructure: Robust foundation supporting accurate and reliable verification

- Global Compliance Coverage: Support for multiple regulatory frameworks worldwide

- Real-time Processing: Instant verification and decision-making capabilities

- Scalable Solutions: Suitable for businesses of all sizes from startups to enterprises

- Continuous Innovation: Regular updates and improvements to address emerging threats

Getting Started with Prembly

Businesses can integrate Prembly's services through comprehensive API documentation available on their platform. The company offers personalized sales consultations to help organizations implement the most suitable verification and compliance solutions for their specific needs.

With headquarters in Washington DC, USA, Prembly serves a global client base and continues to expand its services to address the growing need for secure digital identity verification and fraud prevention solutions.

Best Alternative Tools to "Prembly"

ComplyCube is a SaaS & API platform for digital Identity Verification, AML compliance, and KYC. Verify customer identities in seconds. Start a free trial today!

Shufti provides AI-powered identity verification solutions for KYC/AML compliance, fraud prevention, and customer onboarding across various industries. Enhance security and streamline compliance globally.

Veriff is an AI-powered identity verification platform that helps businesses prevent fraud, comply with regulations, and build trust with customers through fast and secure identity checks.

Facia.ai offers AI-powered deepfake and liveness detection solutions, enhancing identity verification and authentication for businesses and governments. Protect against misinformation and identity fraud with industry-leading accuracy.

AI or Not is the leading AI detection platform that accurately identifies AI-generated content across text, images, music, and video with 98.9% accuracy, helping businesses and individuals verify digital authenticity.

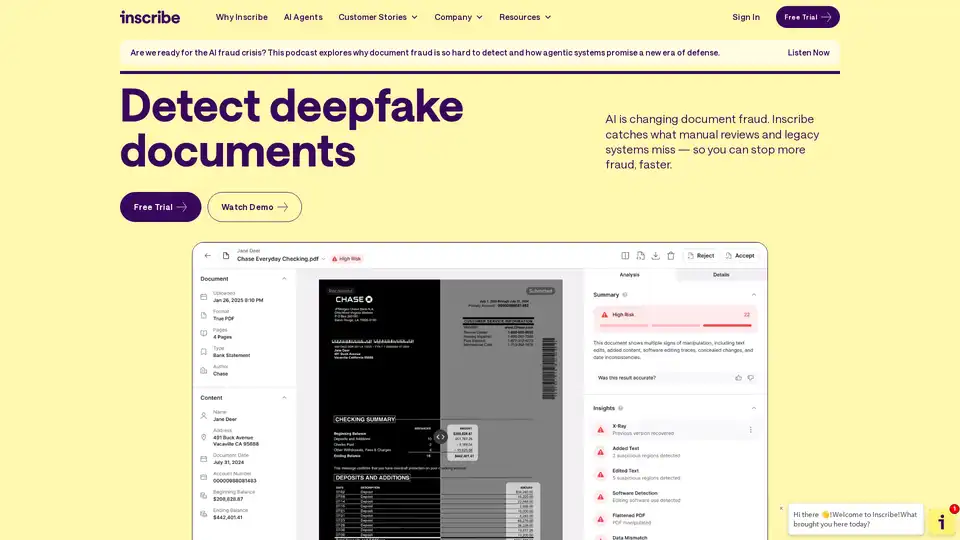

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

SHIELD is a device-first fraud intelligence platform that helps businesses stop fraud and reduce friction using real-time device intelligence. It offers tamper-proof device IDs and configurable risk controls.

OCR API for data extraction, mobile SDK for document capture, and toolkits to liberate trapped data in your unstructured documents like invoices, bills, purchase orders, checks (cheques) and receipts in real-time.

IDScan.net is an AI-powered identity verification platform offering ID fraud prevention, age verification, and access management solutions for enhanced security and compliance.

PreCheck.ai offers AI-driven facial recognition and identity verification services, enabling users to monitor online images, protect personal privacy, and prevent fraud with 99% accuracy.

ShareID authenticates users with a simple smile, ensuring identity verification without storing personal or biometric data. Secure and reliable authentication solution.

My Voice AI's NanoVoiceTM uses tinyML for real-time speaker verification on low-power devices. It offers anti-spoofing, emotion detection, and secure voice authentication solutions.

DuckDuckGoose AI offers AI-powered deepfake detection solutions, including Phocus, Waver, and DeepDetector, providing real-time protection against identity fraud and media manipulation across various media types.

Copyseeker is an AI-powered reverse image search tool that helps you find the source of images, detect duplicates, and protect your content. It offers a Chrome extension, mobile app, and API integration.