Salient

Overview of Salient

Salient: AI Agents for Modern Loan Servicing

What is Salient?

Salient is an AI-powered loan servicing platform designed specifically for the consumer finance industry. It streamlines loan onboarding, collections, and compliance, providing a modern operating system for lenders.

Key Features:

- AI Agents: Interact with consumers via voice, text, email, and web chat for payments, extensions, and more.

- Compliance: Ensure interactions comply with regulations like FDCPA, FCRA, UDAAP, and CFPB.

- Workflow Automation: Streamline operations and improve efficiency.

Benefits:

- Reduced Handle Times: Cut handle time by up to 70%.

- Maximized Connections: Outreach at the optimal time for each customer.

- Real-Time Compliance: Detect violations as they occur.

- Enterprise-Ready: Secure and scalable for large organizations (SOC 2 and PCI L1 compliant).

- Seamless Integration: Works with existing systems like OFSLL and Shaw Systems.

How to use Salient?

Integrate Salient with your existing contact center, payment processor, and LMS systems. Salient supports integrations with popular platforms like Stripe, ACI, PayNearMe, OFSLL, Shaw Systems, and Nortridge.

Why is Salient important?

Salient's AI agents are purpose-built for financial services, with compliance at their core. They are trained on CFPB, FCRA, TILA, and UDAP regulations before handling any customer interactions.

Salient FAQs

- What makes Salient different? Salient prioritizes compliance from the ground up.

- What languages are supported? English, Spanish, Portuguese, and Vietnamese.

- Are compliance guidelines updated? Yes, monthly updates are incorporated.

- How secure is my data? Each lender gets a private cloud, plus SOC 2 and PCI L1 compliance.

- Can I integrate Salient? Yes, with payment processors, LMS, and contact centers.

Customer Success

Salient is trusted by leading lenders, processing millions of consumer interactions and billions of dollars.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "Salient"

Alltius is an AI platform for financial services, automating customer queries, reducing support costs, and boosting sales. It provides AI agents and workflows for insurance, banking and finance.

Floatbot.AI is a no-code GenAI platform for building & deploying AI Voice & Chat Agents for enterprise contact center automation and real-time agent assist, integrating with any data source or service.

Stunning is an AI-powered website builder that helps you create result-driving websites with better SEO, faster builds, and happy clients. Build websites by chatting with AI.

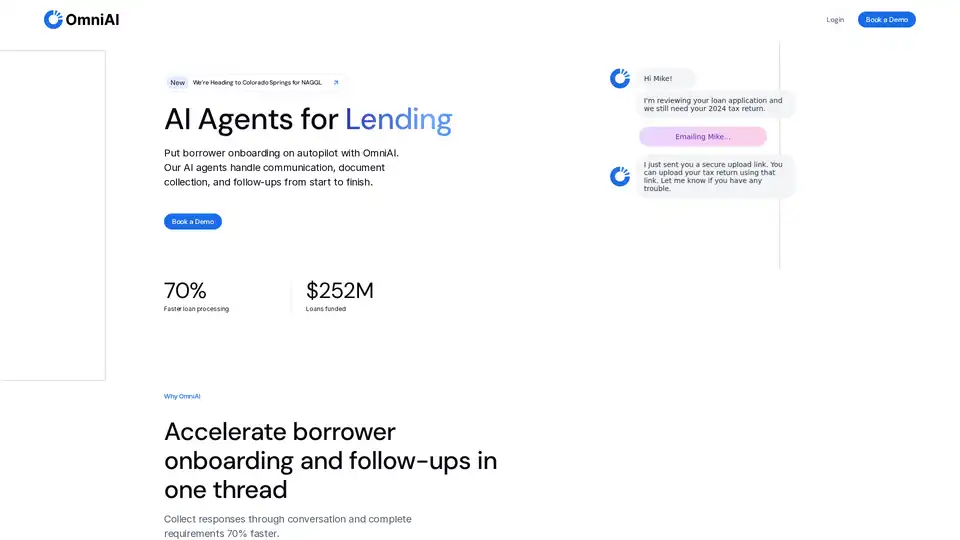

OmniAI uses AI agents to automate borrower onboarding, handling communication, document collection, and follow-ups. It accelerates loan processing and ensures compliance.