Simplify Money

Overview of Simplify Money

Simplify Money: Your AI-Powered Personal Finance Companion

What is Simplify Money? Simplify Money is an AI-driven personal finance app designed to help users, especially Gen Z, effortlessly manage their finances. It offers a comprehensive suite of tools for tracking net worth, exploring financial products, and enhancing financial literacy through gamified learning.

How does Simplify Money work? Simplify Money leverages AI to provide personalized insights and recommendations based on your financial habits. It offers features like real-time financial health scores, AI-powered assistance via Kuber.AI, and access to Money 101 courses to improve your financial knowledge. The app also rewards users for positive financial actions like signing up, tracking progress, and referring friends.

Key Features:

- Net Worth Tracking: Monitor your assets and liabilities in one place.

- Financial Product Marketplace: Discover curated insurance, investment, and loan options.

- Money 101 Courses: Learn about finance through interactive quizzes, stories, and videos.

- Gamified Learning: Earn rewards and track progress through challenges and milestones.

- AI Advisory with Kuber.AI: Get real-time, unbiased financial advice from an AI assistant.

Smarter Insurance, Investments & Loans

Simplify Money streamlines access to essential financial products:

- Insurance: Compare and purchase tailored health, term, and car insurance plans with transparency and zero commission.

- Digital Gold: Invest in 24K gold with small amounts, starting as low as ₹10.

- Loan Against Mutual Funds: Borrow against your mutual funds with flexible repayment options and minimal paperwork.

Master Your Money, The Fun & Easy Way

Simplify Money transforms financial management into an engaging experience:

- Quizzes, Stories & Bite-Sized Videos: Learn with quizzes, interactive stories, and bite-sized videos.

- AI-Powered Money Management: An AI-powered, intuitive app designed for effortless money management.

- Earn Rewards for Every Move: Sign Up, Track, Refer & Win: Get Rewarded For Every Action - Earn rewards for signing up, tracking your financial health, referring friends, taking on daily challenges, and much more.

How to use Simplify Money:

- Download the App: Available on both the Play Store and App Store.

- Quick Onboarding: Answer a few questions about your finances and demographics.

- Plan Your Financial Goals: Set and track milestones for education, homeownership, or travel.

- Get Real-Time Assistance: Use Kuber.AI for instant answers to financial queries.

- Check Your Financial Health Score: Understand your financial habits and identify areas for improvement.

- Access Money 101: Learn from videos, quizzes, and courses on various financial topics.

User Reviews:

Users praise Simplify Money for its ease of use, AI-powered insights, and gamified approach to financial learning.

- Aditya Jha: "Simplify Money is a great personal finance app that helped me manage my money effortlessly. Its AI gives smart recommendations based on spending habits, which makes budgeting and saving easier."

- Hemant maurya: "I recently started using this financial app, and it has completely transformed the way I manage my money!"

- Abhishek Kumar: "I recently used the app, and the insights it provided about my financial health were impressive."

Why is Simplify Money important?

Simplify Money is important because it addresses the challenges of financial literacy and accessibility, particularly among young adults. By offering AI-driven insights, gamified learning, and a streamlined interface, it empowers users to take control of their finances and achieve their financial goals.

Where can I use Simplify Money?

Simplify Money can be used anywhere with a smartphone and internet connection. It's available on both the Google Play Store and Apple App Store.

Conclusion:

Simplify Money is an innovative AI-powered personal finance app that makes money management fun, easy, and accessible. Whether you're a Gen Z individual looking to build healthy financial habits or someone seeking to optimize your investment strategy, Simplify Money offers the tools and resources you need to succeed. Download the app today and take control of your financial future! With its AI advisory, personalized score, Simplify Money is the best way to plan your goals and investment.

Best Alternative Tools to "Simplify Money"

2K is an AI-powered personal finance app that tracks spending, forecasts budgets, and offers expert coaching to help you make smarter money decisions and maximize savings effortlessly.

Fina Money is an AI-powered financial tracker for personal & business use. Manage your money easily, create custom budgets, and get financial insights.

Tendi is an AI-powered personal financial advisor that helps you understand, plan, and achieve your financial goals with ease. Get personalized financial advice and insights.

Origin Financial is an AI-powered platform that consolidates finances for budgeting, investment tracking, and financial planning, offering personalized advice.

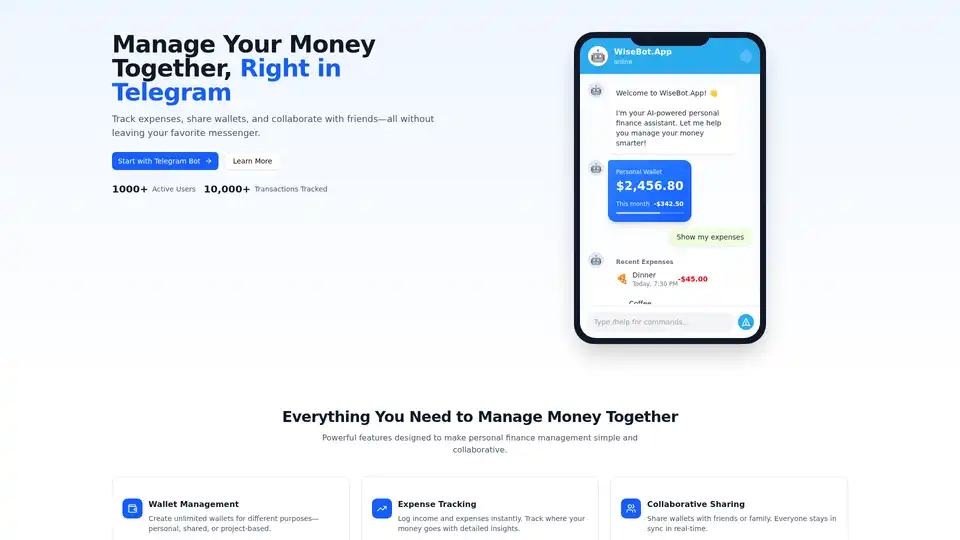

WiseBot.App is an AI-powered personal finance assistant in Telegram. Track expenses, manage wallets, share budgets collaboratively, and get smart AI insights—all securely without extra apps.

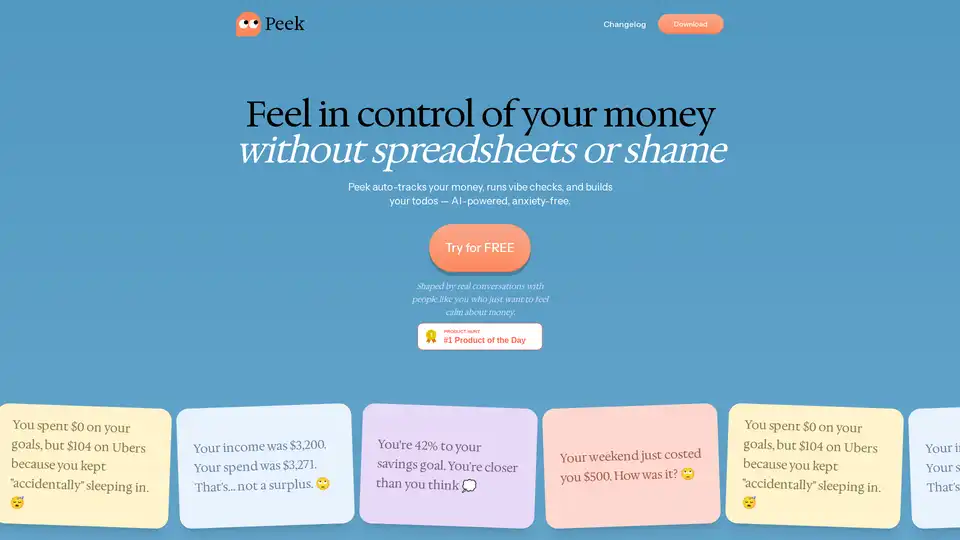

Understand your spending and build better habits with AI. Peek auto-tracks your money, provides vibe checks, and helps set achievable goals for anxiety-free financial wellness.

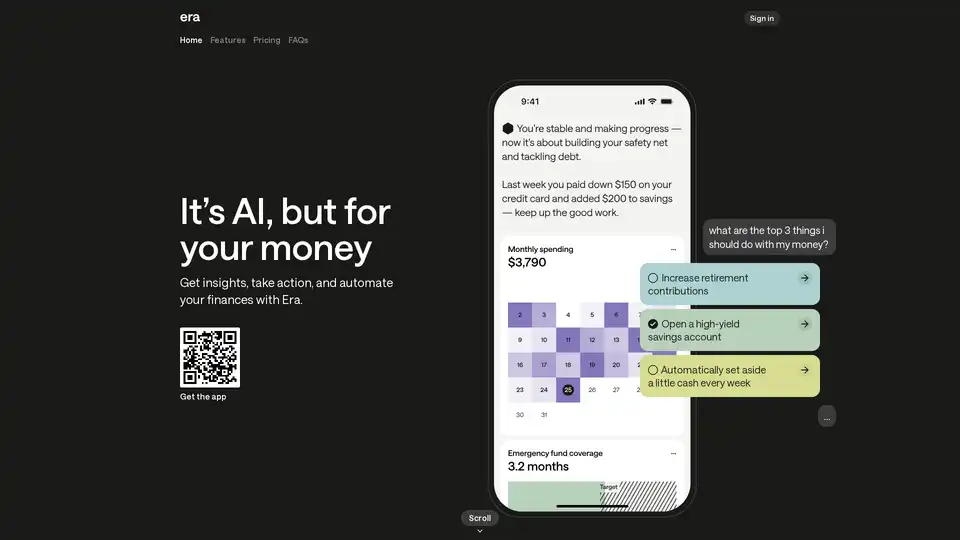

Era is an AI-powered personal finance app providing personalized insights, automated savings, and investment optimization. Connect accounts for up-to-date insights, and let Era guide your financial decisions.

Kniru: AI-powered personal finance app for tracking spending, optimizing investments, and managing loans. Start for free.

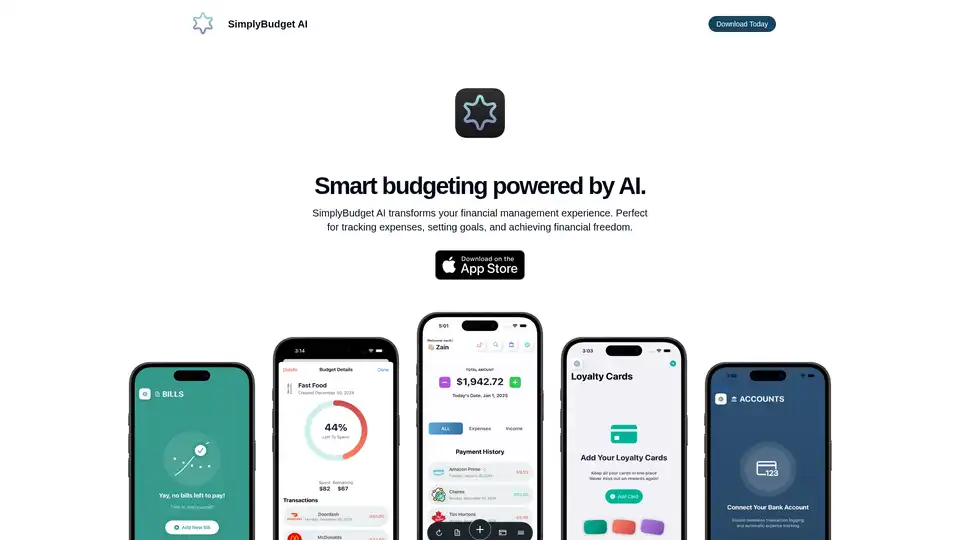

SimplyBudget AI is a smart budgeting app that uses AI to simplify financial management. Track expenses, set goals, and manage loyalty cards effortlessly. Download today to achieve financial freedom!

TalkieMoney is an AI-powered voice expense tracker app that makes financial management fun and easy. Log expenses with voice or text commands and get smart categorisation.

SnaptoBook simplifies personal accounting with AI-powered receipt management. Effortlessly organize tax-related receipts, track expenses, split bills transparently, and auto-generate forms for easy reimbursement.

Cleo is an AI financial assistant that helps you budget, save, manage debt, and build healthy financial habits. Get expert insights and personalized coaching to improve your financial life. Try Cleo for free!

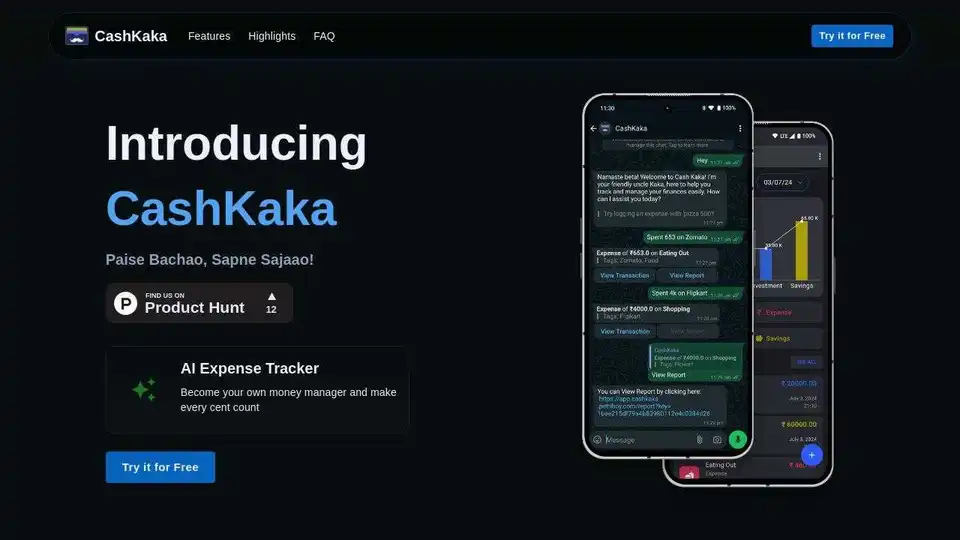

CashKaka: AI Expense Tracker uses WhatsApp to seamlessly track transactions, savings, investments, and expenses. Generate detailed reports effortlessly.

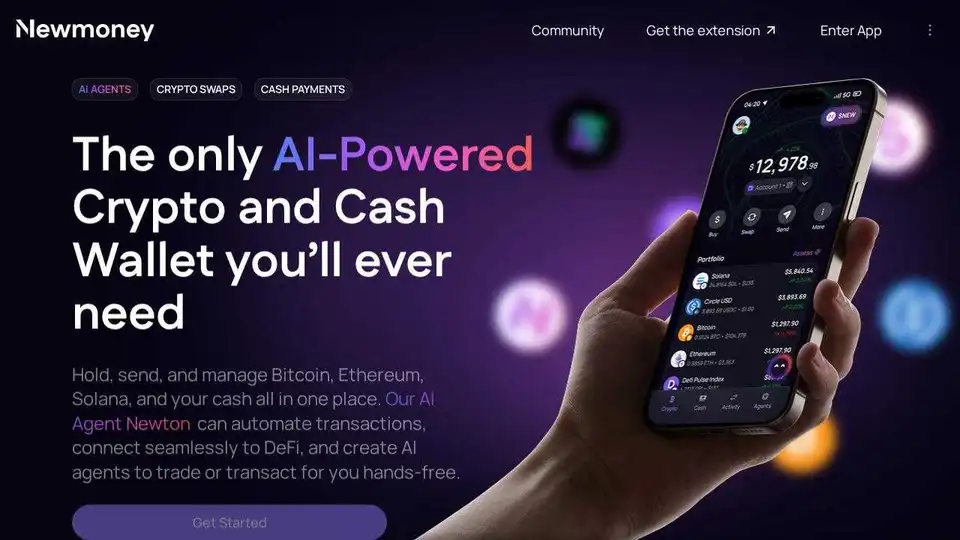

Newmoney.AI is an AI-powered crypto wallet to buy, trade, and bridge crypto across SUI, Solana, Ethereum, and Bitcoin. Get real-time AI insights, swap tokens, and send crypto via WhatsApp, Telegram, and Discord.