DueDeal

Overview of DueDeal

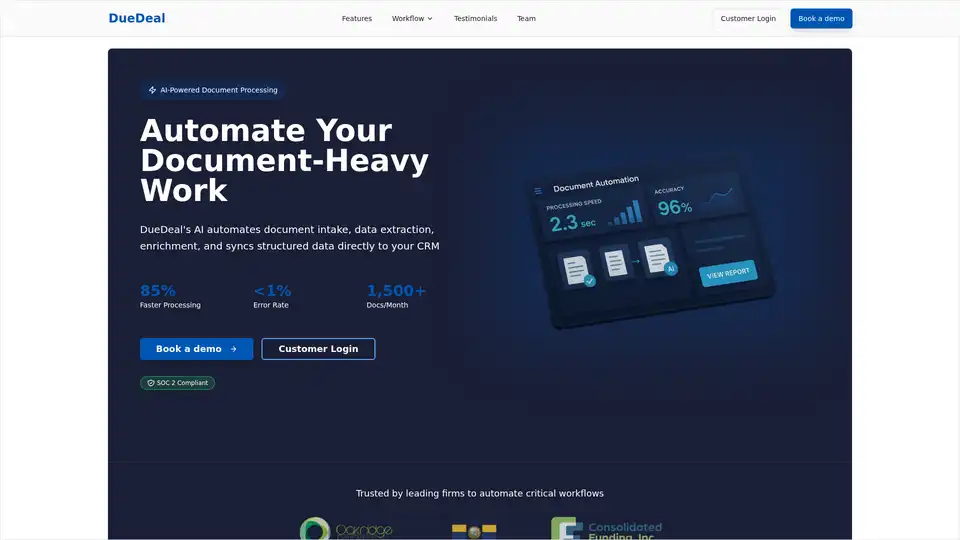

DueDeal: AI-Powered Document Processing for Modern Lending

What is DueDeal?

DueDeal is an AI-powered document processing platform designed to automate document-heavy workflows in the lending and financial industries. It transforms how financial documents are handled by providing structured data to power and auto-fill your CRM systems. This leads to faster processing times, reduced error rates, and improved operational efficiency.

How does DueDeal work?

DueDeal uses artificial intelligence to automate various steps in document processing:

- Document Upload: Documents can be uploaded via a portal or email.

- Classification: AI identifies the document type automatically.

- Data Extraction: Key data points are extracted with a high accuracy rate of 99.2%.

- Validation: Automated checks and feedback ensure data accuracy.

- CRM Auto-Fill: Seamless integration allows data to be synced directly to your CRM.

Key Features of DueDeal

- Document Parsing & Grouping: Intelligently parses financial statements and documents, automatically grouping related items and identifying key stakeholders.

- Automated Checklist Management: Automatically checks documents off compliance lists with immediate feedback on missing requirements.

- Financial Data Extraction: Extracts key financial data points with contextual relationships to power AI lender matching tools.

- Seamless Integration: Connects with Salesforce, email systems, and other tools through API or user interface.

Why Choose DueDeal?

- Faster Processing: Accelerate credit memo creation by up to 85%.

- Reduced Errors: Achieve less than 1% error rate in document processing.

- Cost Savings: Customized workflow automation can significantly reduce operational costs.

- Scalability: Automate microloans and guarantees, tripling processing capacity.

Who is DueDeal for?

DueDeal is ideal for:

- M&A Loan Brokerages looking to expedite credit memo creation.

- US Brokers aiming to reduce operational costs.

- Financial institutions needing to automate microloan operations.

Testimonials

"We used to spend roughly 1 week to create a credit memo, but now using DueDeal, we're able to create one in less than 3 hours. This dramatic time reduction has transformed our operational efficiency and allowed us to serve more clients."

P.R., Head of Credit, M&A Loan Brokerage

"We used to rely on Salesforce to track our operations, but were tired of paying so much for features we didn't need. The DueDeal team helped us create a custom version of the tool with less unnecessary features, saving us money while improving our workflow."

K.S., Founder, US Broker

"We were using outdated tools that weren't letting us scale our microloan operations effectively. Using DueDeal, we found the right partner to automate all our microloans and guarantees, allowing us to focus on growing our internal operations."

S.L., CEO, FDC California

Proven Results

- M&A Loan Brokerage: 85% Faster Credit Memo Creation.

- US Broker: 60% Cost Savings through customized workflow automation.

- FDC California: 3x Increase in Loan Volume due to automated processes.

How to use DueDeal?

- Book a Demo: Contact the DueDeal team to schedule a demo and discuss your specific needs.

- Start a Free Trial: Begin a free trial to experience the benefits of DueDeal firsthand (no credit card required).

- Integrate with your CRM: Seamlessly connect DueDeal with your existing Salesforce or other CRM systems.

Conclusion

DueDeal offers a robust, AI-driven solution for document processing in the lending and financial sectors. By automating key tasks, it enables organizations to process documents faster, reduce errors, save costs, and scale operations efficiently. If you're looking to transform your document processing workflows, DueDeal is a powerful tool to consider.

Best Alternative Tools to "DueDeal"

Automate data entry from PDFs to Windows desktop apps with Mediar Agent. AI-powered, no APIs needed. Reduce errors, ensure compliance, and free up your team.

Documente is an AI-powered intelligent document processing software that automates data extraction, analysis, and insights generation from various document formats. It features natural language Q&A, custom chatbot creation, and supports multiple industries.

Intics ADI processes 100% of your documents, regardless of format. First Agentic Document Intelligence product with No-Touch capabilities.

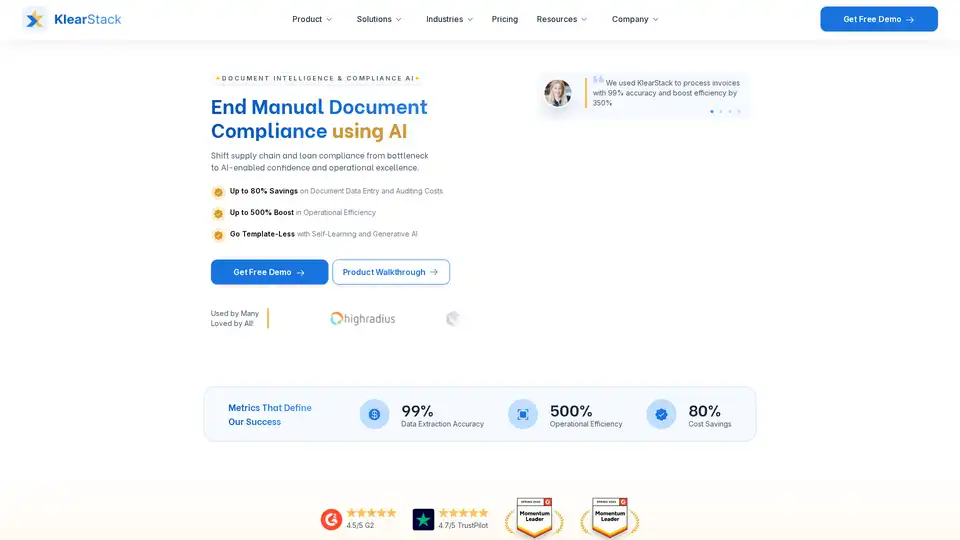

KlearStack is an AI-powered document processing platform for BFSI and logistics, offering up to 80% cost savings and 500% operational efficiency through automated data extraction and compliance.

Automate processes with Beam AI, a leading platform for agentic automation. Build & deploy AI agents in minutes, seamlessly integrate into your workflows & reduce operational costs.

Explore SuperFile's free online PDF and image tools, including converters, editors, and compressors. Simplify digital tasks with this all-in-one platform.

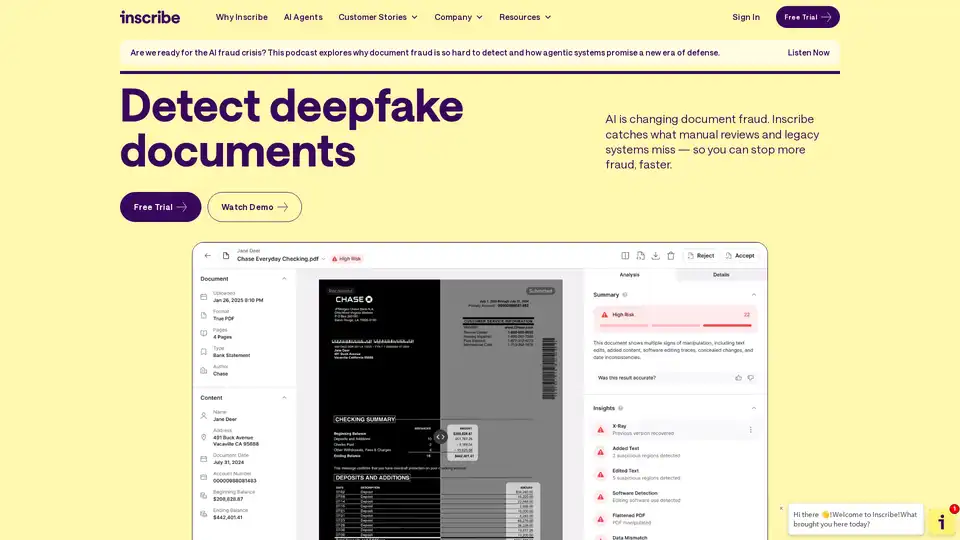

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

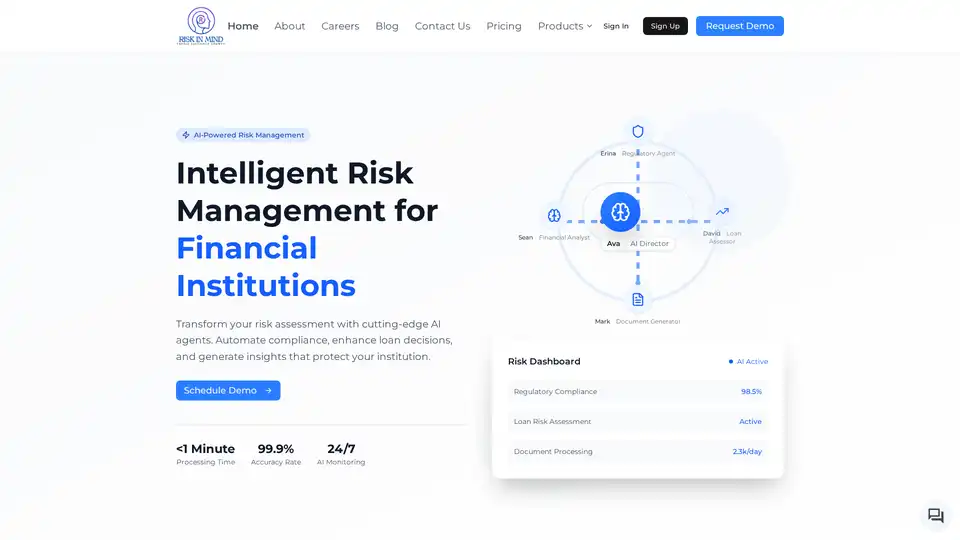

RiskInMind offers AI-powered risk management for financial institutions, automating compliance, enhancing loan decisions, and generating insights. It uses AI agents like Ava to provide expert assistance.

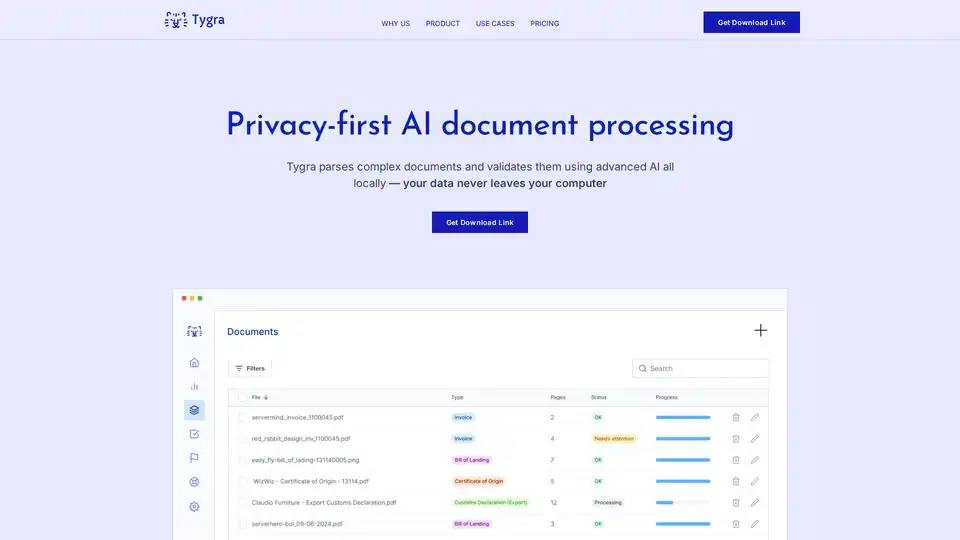

Tygra is a privacy-first AI document processing tool that parses and validates complex documents locally, ensuring data never leaves your computer. It offers high accuracy and reliable data extraction for various industries.

Transform your mortgage business with OptiGenius.ai's AI automation. 3x faster lead response, 60% less document chasing, and 300% more referrals. Get started with a 14-day implementation.

IDScan.net is an AI-powered identity verification platform offering ID fraud prevention, age verification, and access management solutions for enhanced security and compliance.

RevRag.AI provides AI agents for revenue teams, automating lead qualification, onboarding, and support. Designed for BFSI, Fintech, and Insurtech, it aims to boost conversions and improve customer engagement.

LivePlan is business planning software designed for startups and growing businesses. It offers AI assistance, automatic financials, cash flow forecasting, and integrations to help users plan, fund, and grow their business.

Clerkie is an AI-powered platform simplifying debt and money management. Optimize loan portfolios, automate payments, and ensure real-time compliance. Empower borrowers with flexible payment solutions.