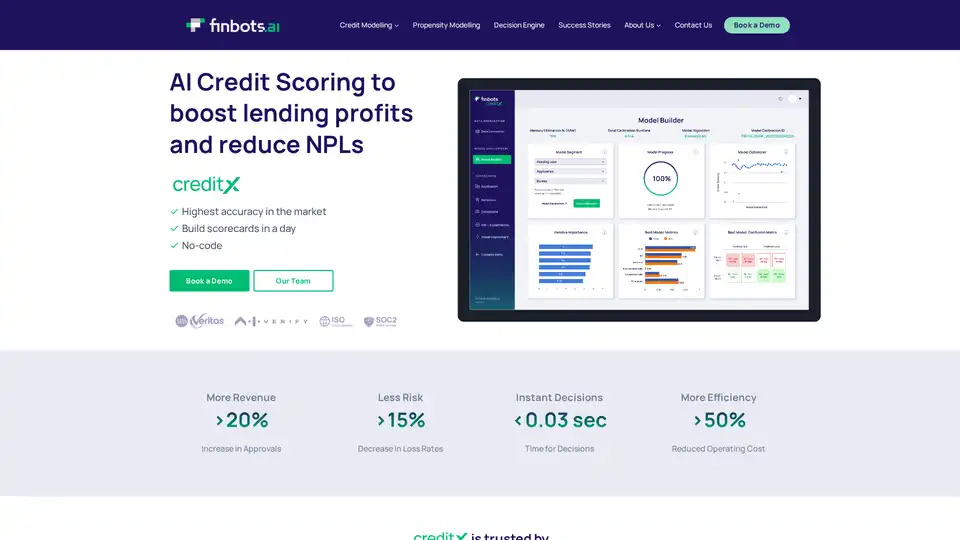

finbots.ai CreditX

Overview of finbots.ai CreditX

finbots.ai CreditX: Your AI-Powered Credit Risk Platform

What is finbots.ai CreditX? It's an AI-driven platform designed to revolutionize credit risk management for lenders. By offering custom scorecards, rapid deployment capabilities, and smarter lending decision tools, CreditX aims to boost profits and reduce non-performing loans (NPLs).

Key Features and Benefits:

- Highest Accuracy: Leverages powerful AI/ML algorithms for precise credit scoring.

- Rapid Deployment: Build and deploy scorecards in as little as a day, significantly faster than traditional methods.

- No-Code Platform: User-friendly interface requiring no coding expertise.

- Increased Approvals: Aims to increase loan approvals by over 20%.

- Reduced Loss Rates: Aims to decrease loss rates by over 15%.

- Instant Decisions: Provides decision-making in under 0.03 seconds.

- Improved Efficiency: Reduces operating costs by over 50%.

- Compliance and Regulation Proof: Meets regulatory requirements for data privacy, hosting, and security.

- Fair, Transparent, and Explainable AI: Validated by regulators using frameworks like MAS Veritas and AI Verify.

How does finbots.ai CreditX work?

CreditX simplifies the process of building and deploying custom credit scorecards using a proprietary AI engine. The platform enables lenders to:

- Connect Data: Integrate internal, external, and alternative data sources.

- Automate Scorecard Building: Automatically build, validate, and deploy custom scorecards.

- Deploy with One-Click: Instantly deploy scorecards for retail, SME, and other lending segments.

Why choose finbots.ai CreditX?

- Faster Time-to-Value: Build scorecards in hours instead of months.

- Affordable Pricing: Accessible for both banks and start-up lenders.

- Regulatory Compliance: Built to meet stringent data privacy and security standards.

Who is finbots.ai CreditX for?

CreditX is ideal for:

- Banks: Streamline credit risk management and improve profitability.

- Fintech Companies: Enhance lending processes with AI-driven insights.

- Start-up Lenders: Access advanced credit scoring capabilities at an affordable price.

- Personal Loan Providers: Place big ticket items within reach.

- SME Lenders: Encouraging financial inclusion for business of all sorts and sizes.

- Credit Card Issuers: Making life’s important milestones affordable

What problems does it solve?

CreditX addresses key challenges in traditional credit risk management:

- Inaccurate Scoring: Improves accuracy with AI/ML algorithms.

- Slow Deployment: Reduces deployment time from months to days.

- High Costs: Lowers operating costs and offers affordable pricing.

- Compliance Issues: Ensures compliance with data privacy regulations.

User Testimonials:

- Julian Kyula, Founder, EDOMx: "Utilizing AI technology for credit scoring aligns perfectly with our mission to provide ethical and inclusive financial services to our customers, empowering us to make more accurate lending decisions."

- Fung Kai Jin, CEO, Sathapana Bank: "finbots.ai’s solution creditX is a transformative solution that will help us strengthen our credit risk management and enhance our operational efficiency and agility."

- Soronzonbold Lkhagvasuren, CEO, M Bank: "finbots.ai provides a robust AI-powered solution that can be easily deployed and it further enables us to reach an audience segment and improve profitability of our lending business."

- Ti Eng Hui, CEO, Baiduri Bank: "finbots.ai’s solution, creditX, is a game-changer in credit modelling that supports our Bank’s digital transformation journey."

How to use finbots.ai CreditX?

- Book a Demo: Request a demo to see how CreditX can transform your lending business.

- Connect Your Data: Integrate your data sources with the CreditX platform.

- Build Scorecards: Use the AI-powered platform to automatically build and validate custom scorecards.

- Deploy and Monitor: Deploy scorecards and continuously monitor performance to optimize lending decisions.

Conclusion

finbots.ai CreditX offers a comprehensive AI-powered solution for modern credit risk management. Its accuracy, rapid deployment capabilities, and affordability make it an invaluable tool for lenders seeking to improve profitability, reduce risk, and enhance operational efficiency. It is a complete solution that addresses scoring, deployment, compliance and costs, enabling lenders to approve and lend more, profitably.

Best Alternative Tools to "finbots.ai CreditX"

GiniMachine is a no-code AI decision-making platform that empowers businesses with predictive models in minutes. It reduces risks, improves credit portfolios, reveals data insights, and predicts churn without needing ML engineers.

Scope Ai is an AI platform that provides intelligence for property, owner, investor, and lender. It offers nationwide coverage, predictive scoring, and flexible delivery to drive business growth.

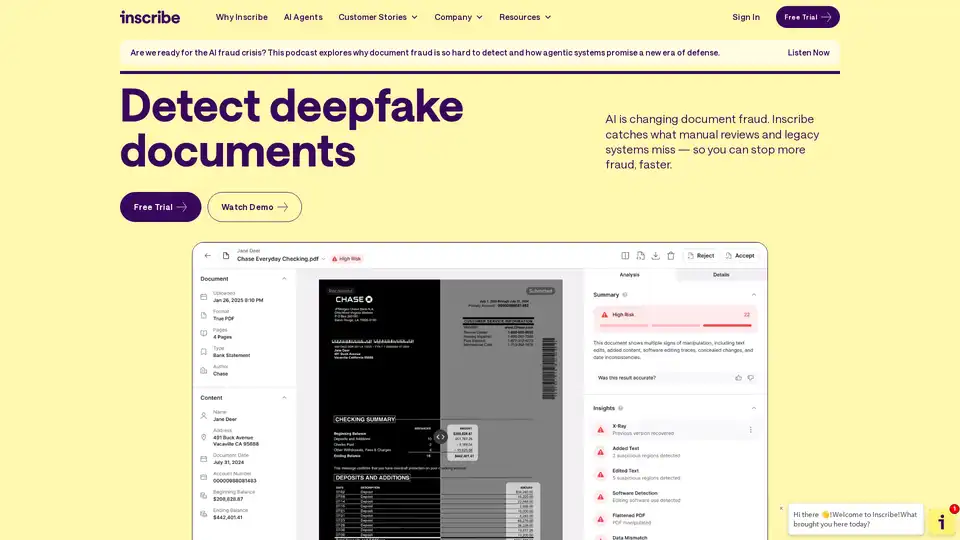

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

RiskInMind offers AI-powered risk management for financial institutions, automating compliance, enhancing loan decisions, and generating insights. It uses AI agents like Ava to provide expert assistance.

Outpost is the AI-powered CRM copilot designed for client-driven businesses, automating lead prioritization, email workflows, and deal closures to help teams close more deals faster without manual effort.

SilkChart revolutionizes sales call analysis by measuring playbook execution, surfacing coaching opportunities for managers, and delivering actionable feedback to reps for better client conversations and higher close rates.

Land your dream job faster with CoverDoc.ai's AI tools for personalized cover letters, interview prep, and salary negotiation. No expertise needed—start free today!

SOAPME.AI is an AI-powered SaaS app that automatically generates accurate, HIPAA-compliant SOAP notes from clinician-patient audio conversations. It helps healthcare professionals save time on documentation, allowing them to focus more on patient care, with features like voice editing and EHR integration.

Discover AIContentfy, the all-in-one AI SEO content platform that generates high-quality, ready-to-publish articles in minutes. Scale your SEO efforts with keyword research, content optimization, and seamless CMS integration for effortless content creation.

Get free AI sports betting picks updated daily for NFL, NBA, MLB, NHL, and more. See how AI models like Remi outperform human handicappers with real-time predictions.

CV Ranker AI uses AI to rank CVs and find the best candidates instantly, saving hours in hiring time.

Sweephy is an AI-powered regulatory monitoring platform that delivers instant notifications for upcoming regulations, helping businesses in finance mitigate risks and avoid fines.

Oscilar is an AI-powered risk decisioning platform that helps businesses manage fraud, credit, onboarding, and AML compliance risks. It offers agentic AI, comprehensive analytics, and proactive detection capabilities.

DealGate is an AI-powered B2B lead generation software that helps businesses 3x qualified leads in 60 days. Automate outreach, access validated B2B data, and close deals faster.