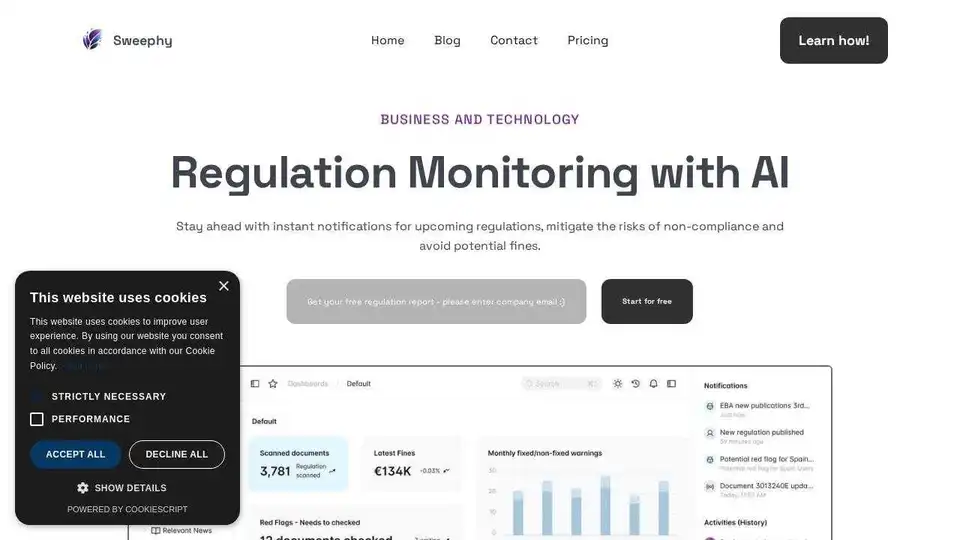

Sweephy

Overview of Sweephy

Sweephy: AI-Powered Regulatory Compliance for Finance

In today's rapidly evolving regulatory landscape, financial institutions face increasing pressure to stay compliant. Non-compliance can lead to hefty fines, reputational damage, and operational disruptions. Sweephy is an AI-driven platform designed to streamline regulatory monitoring, helping businesses in the finance sector proactively manage compliance and mitigate risks.

What is Sweephy?

Sweephy is a regtech solution that leverages Artificial Intelligence to monitor regulatory changes across various sources, including regulatory portals, news outlets, and other publications. It provides users with real-time updates, custom notifications, and comprehensive analysis to ensure they stay ahead of the curve.

Key Features of Sweephy

- Real-time Monitoring: Sweephy continuously scans regulatory data sources, providing instant notifications of any changes or updates.

- Comprehensive Coverage: The platform monitors regulations across Europe, Turkey, and the UK, ensuring broad coverage for businesses operating in these regions.

- Custom Notifications: Users can customize their notification preferences to receive alerts only for the regulations relevant to their specific business needs.

- Regtech LLM Powered Analysis: Sweephy utilizes a Large Language Model (LLM) to analyze regulatory data, providing insights and interpretations to help users understand complex requirements.

- Region-Specific Compliance: The platform offers specialized tools to streamline compliance across multiple regions, simplifying navigation of complex regulatory environments.

- Automated Data Collection: Sweephy automates the process of collecting regulatory data, eliminating the need for manual monitoring and reducing the risk of errors.

- Instant Red Flag Alerts: The system provides instant alerts for critical regulatory changes that could impact a business's operations.

- Sweephy API: Seamlessly integrate regulatory data directly into internal systems via the Sweephy API for streamlined workflows.

How Does Sweephy Work?

Sweephy employs a multi-faceted approach to regulatory monitoring:

- Data Collection: The platform integrates directly with regulatory databases and other data sources to gather the latest compliance requirements.

- AI-Powered Analysis: An LLM analyzes the collected data, identifying key changes and potential impacts.

- Notification & Alerts: Users receive customized notifications and alerts based on their specific needs and preferences.

- Reporting & Insights: Sweephy provides tools for reporting and analyzing regulatory data, helping users gain valuable insights into their compliance posture.

Who is Sweephy For?

Sweephy is designed for a range of businesses in the finance sector, including:

- FinTechs: Monitoring regulations from regulatory portals for 27 EU countries

- Small Banks: Regulation and compliance monitoring and credit risk scoring

- Stock Traders: Financial regulation and trade report analytics for mid-long term decisions

Why Choose Sweephy?

- Save Time and Resources: Automate regulatory monitoring, freeing up valuable time and resources for other critical tasks.

- Reduce Risk of Non-Compliance: Proactively manage compliance and avoid costly fines and penalties.

- Gain Actionable Insights: Transform raw regulatory data into actionable business insights.

- Custom Compliance Solutions: Tailored compliance solutions that seamlessly integrate with business processes.

User Reviews and Testimonials

- Senih Mete Dal, Founder, Finfree: Praises Sweephy's intuitive interface and ease of use, even for those not tech-savvy.

- Roy Padgett, Omega Capital Advisors LLC: Highlights the platform's continuous improvement and timely customer support.

- Frederik, Founder: Emphasizes Sweephy's ability to save time and reduce errors in data handling.

What Problems Does Sweephy Solve?

- Complexity of Regulatory Landscape: Simplifies navigation of complex regulatory environments.

- Manual Monitoring: Automates the process of monitoring regulatory changes, reducing manual effort and risk of errors.

- Lack of Real-Time Updates: Provides instant notifications of regulatory changes, ensuring users are always up-to-date.

- Difficulty in Understanding Regulations: Offers AI-powered analysis and insights to help users understand complex regulatory requirements.

Conclusion

Sweephy offers a comprehensive AI-powered regulatory monitoring solution for businesses in the finance industry. By automating data collection, providing real-time updates, and offering in-depth analysis, Sweephy empowers organizations to stay compliant, mitigate risks, and gain a competitive edge in today's dynamic regulatory environment. With positive user reviews and tailored compliance solutions, Sweephy emerges as a reliable and valuable tool for businesses striving for regulatory excellence. Its ability to provide custom compliance solutions allows businesses to not only meet minimum standards but to excel in their compliance efforts, integrating seamlessly with existing business processes. For fintechs, banks, stock traders, and other financial institutions, Sweephy offers a path to streamlined compliance and operational efficiency.

Best Alternative Tools to "Sweephy"

KYC Hub is an AI-powered compliance automation platform designed for AML and fraud prevention. Streamline KYC processes with risk detection, real-time monitoring, and global AML screening.

BeetleLabs offers AI-driven solutions for financial compliance, KYC/KYB automation, and enhanced customer support in the BFSI sector. Streamline processes and manage risk with their all-in-one platform.

AnChain.AI provides AI-powered AML compliance and crypto investigation solutions for governments, banks, and fintechs, detecting fraud faster and ensuring regulatory compliance.

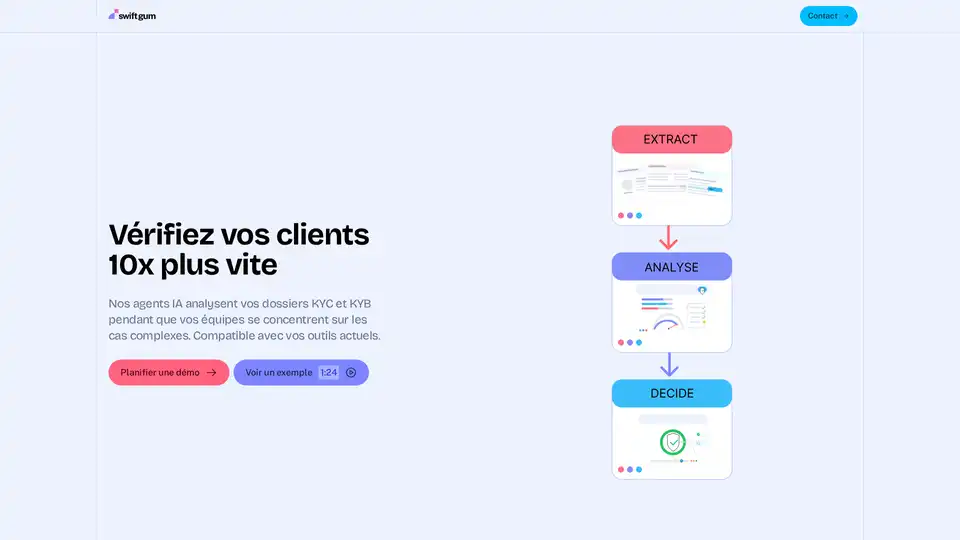

Swiftgum uses AI agents to automate KYC/KYB document analysis, integrating with existing IDV solutions. It enhances operational reliability, ensures compliance, and offers seamless integration, speeding up client verification.

Simplify cybersecurity compliance with CyberUpgrade's automated workflows, audits, and risk management. Expert CISOs tailor solutions to your needs, saving time & costs.

Greenlite AI automates AML, Sanction, and KYC reviews for financial institutions, reducing costs and improving compliance. Trusted by top banks and platforms.

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

Prembly provides comprehensive identity verification and fraud prevention services with advanced KYC, KYB, AML, and background check solutions for businesses.

Coworker is an AI agent designed for financial services, automating back-office tasks like QA, disputes, and compliance. It ensures SLAs are met, reduces escalations, and enhances customer experience.

FraudNet is an AI-powered platform for enterprise fraud detection, risk management, and compliance. It offers real-time fraud intelligence, customizable solutions, and proven outcomes for various industries.

Sprinto is a security compliance automation platform for fast-growing tech companies that want to move fast and win big. It leverages AI to simplify audits, automate evidence collection, and ensure continuous compliance across 40+ frameworks like SOC 2, GDPR, and HIPAA.

Swif.ai is an AI-powered device security platform offering comprehensive Shadow IT coverage, compliance automation, and multi-OS management for complete IT control and governance.

PathPilot empowers fintechs, banks, and financial institutions to build secure AI agents in days—cutting costs, improving CX, and ensuring compliance. Launch AI agents 10x faster without compromising data security.

ViCA is an AI-powered virtual compliance assistant providing real-time regulatory updates and expert support. It simplifies compliance, saves time, and helps organizations stay efficient and confident.