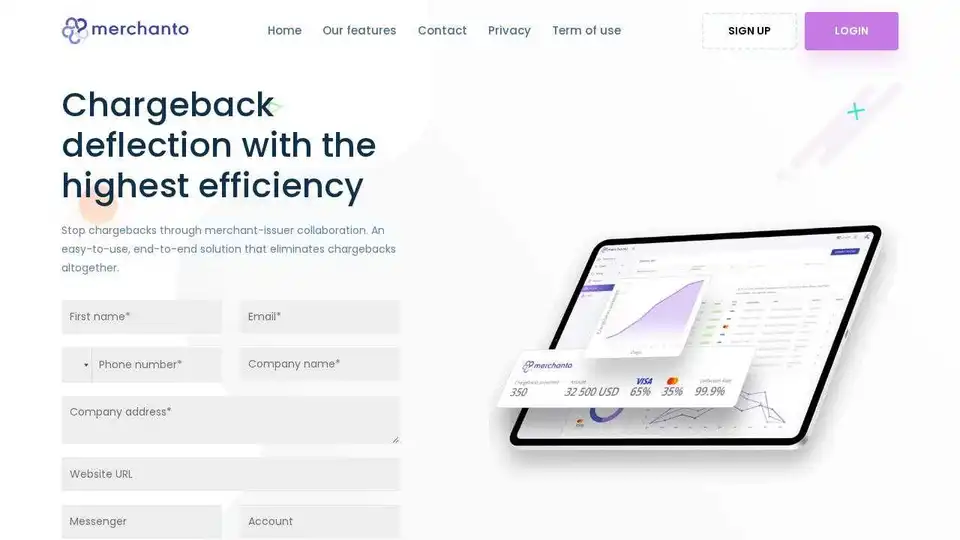

Merchanto

Overview of Merchanto

Merchanto: The AI-Powered Chargeback Prevention Solution

What is Merchanto? Merchanto is an innovative, AI-driven solution designed to help online businesses effectively prevent chargebacks and combat fraud. It works through collaboration between merchants and card issuers, providing an end-to-end platform to resolve disputes before they escalate into chargebacks.

How Does Merchanto Work?

Merchanto integrates directly with VISA and MasterCard via API connections to provide real-time data sharing. This allows merchants and card issuers to collaborate and resolve disputes quickly and efficiently. Using advanced AI and machine learning algorithms, Merchanto analyzes transaction data to identify and prevent fraudulent activities.

Key Features:

- Direct VISA and MasterCard Partnership: Connects to a global network of VISA and MasterCard issuers through a single integration.

- Global Reach: Supports quick resolution services in global markets during the pre-dispute stage, preventing chargebacks.

- Real-time Operation: Enables near-real-time sharing of dispute data and purchase details between financial institutions and merchants.

- Increased Acceptance Rates: Facilitates issuing refunds and rapid resolutions, improving customer experience and card acceptance rates.

- Transparent Statistics: Offers access to key performance indicators (KPIs) and approval rates for data-driven decision-making.

- Advanced AI and Machine Learning Analysis: Utilizes AI-powered digital payments fraud and chargeback prevention.

Why is Merchanto Important?

Chargebacks can be a significant hurdle for e-commerce businesses. Merchanto provides a technology-based strategy to combat these issues by:

- Reducing fraud and preventing chargebacks.

- Improving customer satisfaction through quick resolutions.

- Providing valuable data insights to optimize business operations.

- Increasing acceptance rates for online transactions.

Who is Merchanto for?

Merchanto is designed for online businesses of all sizes, from startups to large enterprises, operating in any country. It’s particularly useful for businesses that:

- Experience a high volume of chargebacks.

- Want to reduce fraud and improve customer satisfaction.

- Seek a simple and efficient chargeback prevention solution.

How to Use Merchanto?

- Integration: Merchanto offers lightning-fast integration for online businesses, often completed within one day.

- Dashboard Access: User-friendly dashboard to monitor KPIs and approval rates.

- Real-Time Monitoring: Merchanto operates in real-time, enabling instant sharing of data and rapid resolution of disputes.

- 24/7 Support: Dedicated manager support to quickly resolve any questions.

Benefits of Using Merchanto

- Up to 100% Chargeback Deflection: Achieve significant chargeback prevention through merchant-issuer collaboration.

- In-House Solutions: Platform based on unique in-house developments and direct API connections with VISA and MasterCard.

- Increased Acceptance Rates: By facilitating refunds and quick resolutions instead of chargebacks, you improve customer experience and card issuers open acceptance rates.

Pricing

While not explicitly stated in the provided text, it's best to contact Merchanto directly for pricing details and to schedule a demo. This allows businesses to understand how the platform can best fit their needs.

Contact Information:

- Address: Matīsa iela, 61 - 31, Rīga, Latvia, LV-1009

- Email: sales@merchanto.org

- Phone: +371 64 415 245

Conclusion

Merchanto is a powerful, AI-driven chargeback prevention solution that provides e-commerce businesses with the tools to combat fraud, improve customer satisfaction, and grow their online business. By connecting merchants with card issuers and providing real-time data analysis, Merchanto simplifies chargeback management and helps businesses overcome the hurdles of online payments. If your business is looking for an efficient and technologically advanced solution to stop chargebacks, Merchanto is an excellent choice.

Best Alternative Tools to "Merchanto"

Chargeflow is an AI-powered chargeback management platform that automates chargeback prevention and recovery for eCommerce merchants, guaranteeing a 4x ROI with seamless integrations and industry-leading win rates.

hCaptcha Enterprise: Enterprise-grade AI security platform that stops bots and human abuse with a privacy focus. Accurate bot detection and fraud prevention for various online threats.

Protect your business with Greip, an AI-powered fraud prevention solution offering real-time insights, payment fraud analysis, and user data validation. Start with a free plan today!

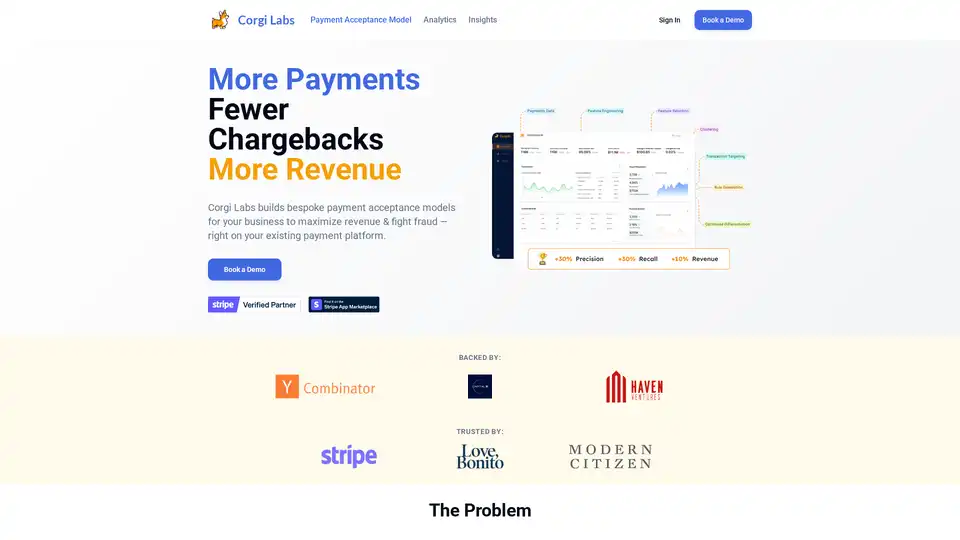

Corgi Labs offers an AI-powered payment acceptance model to optimize payments and prevent fraud, increasing approvals and revenue with customized logic on your existing payment platform.