Greip

Overview of Greip

Greip: AI-Powered Fraud Prevention for Online Businesses

What is Greip?

Greip is an AI-driven fraud prevention solution designed to safeguard online businesses from various types of fraudulent activities. It leverages advanced technologies to provide real-time insights and proactive measures to reduce losses and enhance transaction security.

How does Greip work?

Greip combines multiple advanced technologies to deliver comprehensive fraud protection:

- Payment Fraud Analysis: Detects high-risk, fraudulent payments using BIN checks and AI-driven transaction analysis.

- Card Issuer Verification: Verifies card issuer details, including bank, brand, and country, to enhance transaction security.

- IBAN Verification & Insights: Validates IBANs and provides specific insights into the issuing country and bank for seamless payments.

- Content Moderation: Identifies and filters offensive language to maintain safe and respectful online interactions.

- Proxy & VPN Detection: Detects VPNs and proxies to reduce risks from masked IPs and unauthorized access.

- IP Location Intelligence: Pinpoints user locations with IP-based data for tailored content and fraud prevention.

- Network Intelligence (ASN): Provides ASN details to understand network ownership and routing, enhancing security analysis.

- Country Intelligence: Accesses detailed information on countries for better compliance and fraud detection.

- User Data Scoring & Validation: Verifies and scores emails and phone numbers to detect fake or temporary accounts, enhancing data integrity.

Key Features of Greip:

- Real-time Dashboard: Effortlessly track, monitor, and gain valuable insights in real-time.

- Custom Rules & Blacklists: Tailor-made security with custom rules and blacklists to fit unique business needs.

- Libraries & SDKs: Available for popular programming languages and frameworks for quick and easy integration.

Why is Greip important?

In today's digital landscape, online fraud is a significant threat to businesses. Greip provides a robust solution to mitigate these risks, ensuring financial security and maintaining a safe online environment. By using AI and real-time data analysis, Greip helps businesses stay one step ahead of fraudsters.

Who is Greip for?

Greip is designed for a wide range of online businesses, including:

- E-commerce platforms

- Financial institutions

- Online gaming companies

- Social media platforms

- Any business that processes online payments or relies on user-generated content

How to use Greip?

- Sign up for a free plan: Start with a free plan to explore the features and benefits of Greip.

- Integrate the API: Use the available libraries and SDKs to integrate Greip into your system.

- Customize rules and blacklists: Tailor the security settings to match your specific business requirements.

- Monitor the dashboard: Track and analyze real-time data to identify and prevent fraudulent activities.

Practical Value and User Benefits:

- Reduced Fraud Losses: Minimize financial losses by detecting and preventing fraudulent transactions.

- Enhanced Security: Protect sensitive data and maintain a secure online environment.

- Improved Compliance: Ensure compliance with industry regulations and standards.

- Better User Experience: Filter out fake accounts and offensive content, creating a safer and more enjoyable experience for legitimate users.

Trusted by Businesses Worldwide:

Greip is trusted by innovative businesses worldwide, with clients praising its ease of integration, accuracy, and cost-effectiveness.

- Samar Ali: "Greip.io is a great product that helps keep your website/app secure and safe."

- Ayesha Awan: "The product is fantastic and helps keep my website/app secure and safe."

- Fred Rodriguez: "We’ve seen incredible results since integrating Greip’s fraud prevention services. The real-time alerts and accurate IP geolocation have drastically reduced chargebacks for our business."

Pricing Plans:

Greip offers flexible pricing plans to suit different business needs:

- Free: 10k requests/month

- Standard: $29/month, 170k requests/month

- Premium: $89/month, 400k requests/month

- Pay-as-you-go: Usage-based pricing for large enterprises

Conclusion

Greip stands out as a comprehensive and versatile fraud prevention solution, particularly beneficial for businesses seeking to safeguard their financial interests and enhance online security. By combining AI-driven insights with customizable features and flexible pricing, Greip empowers businesses to proactively combat fraud and maintain a safe, reliable online environment. With the increasing complexity of online threats, investing in a robust solution like Greip is becoming essential for businesses of all sizes.

Best Alternative Tools to "Greip"

Oscilar is an AI-powered risk decisioning platform that helps businesses manage fraud, credit, onboarding, and AML compliance risks. It offers agentic AI, comprehensive analytics, and proactive detection capabilities.

PathPilot empowers fintechs, banks, and financial institutions to build secure AI agents in days—cutting costs, improving CX, and ensuring compliance. Launch AI agents 10x faster without compromising data security.

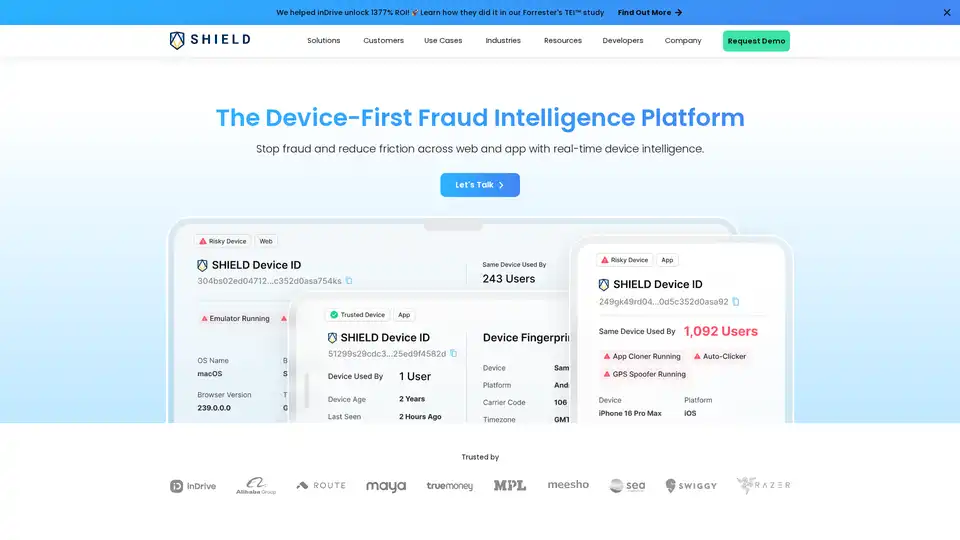

SHIELD is a device-first fraud intelligence platform that helps businesses stop fraud and reduce friction using real-time device intelligence. It offers tamper-proof device IDs and configurable risk controls.

Prembly provides comprehensive identity verification and fraud prevention services with advanced KYC, KYB, AML, and background check solutions for businesses.

FlowX.AI is an AI agentic platform designed for deploying AI agents in banking, insurance, and logistics. Build and deploy enterprise-ready AI solutions in weeks, integrating with legacy systems.

Coworker is an AI agent designed for financial services, automating back-office tasks like QA, disputes, and compliance. It ensures SLAs are met, reduces escalations, and enhances customer experience.

Eliminate chargebacks with Chargeblast. Reduce chargeback rates up to 99%. Prevent disputes, accept more payments & protect your business with industry-leading solutions.

Agent Herbie is an offline AI agent designed for real-time, mission-critical operations in private environments. It leverages LLMs, SLMs, and ML for unmatched flexibility and reliability without data egress.

FraudNet is an AI-powered platform for enterprise fraud detection, risk management, and compliance. It offers real-time fraud intelligence, customizable solutions, and proven outcomes for various industries.

Güeno is an all-in-one platform for fraud prevention and compliance, offering AI-powered risk engine, transaction monitoring, and KYC validation to automate and predict transactional behavior.

Oversight is an AI-powered platform for risk and spend control, providing financial analytics to uncover risk, ensure compliance, and automate audits.

KYC Hub is an AI-powered compliance automation platform designed for AML and fraud prevention. Streamline KYC processes with risk detection, real-time monitoring, and global AML screening.

DataVisor: AI-powered fraud & risk platform for real-time fraud attack response, improving detection & efficiency.

InsightAI: AI-powered fraud detection and risk management for financial institutions. Reduce loss, improve compliance. Best AI tool for Finance professionals.