Oversight

Overview of Oversight

Oversight: AI-Powered Risk and Spend Control Platform

What is Oversight?

Oversight is an AI-powered platform designed to help organizations control spend, mitigate risk, and ensure compliance across various financial processes. It leverages advanced financial analytics to uncover risks, ensure compliance, and automate audits for smarter, more efficient financial governance.

How does Oversight work?

Oversight uses a comprehensive approach to monitoring spend, simplifying audits with an AI-powered platform that detects risk and modernizes control processes across all spend channels. It provides:

- Continuous Monitoring: Identifies and prioritizes high-risk transactions, fake receipts, and wasteful spend.

- Automation: Automates the invoice-to-statement matching process, ensuring accurate payment, credit, and balance records.

- Insights: Delivers powerful automation and insights to maximize finance team effectiveness.

Key Features and Benefits

- Travel & Expense Monitoring: Provides full visibility on every employee purchase, taking control of T&E spend with continuous monitoring.

- Procure-to-Pay Monitoring: Fortifies the P2P process against leakage, detecting unusual spending patterns and data entry inconsistencies.

- Purchase Card Monitoring: Gaining real-time visibility into every Purchase Card transaction. Cross-check transactional data across T&E and P2P activity to uncover risks, enhance compliance, and ensure wiser spend, organization-wide.

- Vendor Statement Reconciliation: Automates the entire invoice-to-statement matching process, ensuring accurate payment, credit and balance records across all vendors.

Use Cases

- Fraud Detection: Identify and prevent fraudulent transactions within travel and expense, procure-to-pay, and purchase card programs.

- Compliance: Ensure adherence to company policies and regulatory requirements.

- Efficiency: Automate manual processes, freeing up finance teams to focus on more strategic initiatives.

- Cost Savings: Reduce wasteful spending and prevent cash leakage.

Southwest Airlines Case Study

Southwest Airlines uses Oversight to root out risk in their Travel & Expense (T&E) and Purchase Card (P-Card) programs, identifying over $9.1M in issues.

...we have been able to mitigate risk, see behavioral changes within the company to align with company policy, find duplicates, and get those corrected before they're fully processed.

Jennifer Gruich Sr. Supervisor, Corporate Card Services Southwest Airlines

How to get started with Oversight

The first step is to book a demo. By booking a demo you can explore how Oversight can help your company increase efficiency and create better outcomes.

Why is Oversight important?

In today's complex financial landscape, organizations face increasing pressure to control costs, mitigate risks, and ensure compliance. Oversight provides a powerful AI-driven solution that enables finance teams to proactively identify and address potential issues before they escalate, leading to significant cost savings and improved financial governance.

Oversight helps identify and eliminate waste, fraud, and errors from T&E, P2P, and card programs by providing real-time visibility and powerful insights into spending patterns. The AI algorithms analyze transactional data to detect anomalies, inconsistencies, and suspicious activities, allowing organizations to take corrective action promptly.

What is the best way to use Oversight?

The best way to use Oversight is to integrate it across all spend channels, including travel and expense, procure-to-pay, and purchase cards. By monitoring all financial activity in a single platform, organizations can gain a holistic view of their spending and identify potential risks and inefficiencies across the enterprise.

Best Alternative Tools to "Oversight"

KYC Hub is an AI-powered compliance automation platform designed for AML and fraud prevention. Streamline KYC processes with risk detection, real-time monitoring, and global AML screening.

Emly Labs offers a comprehensive no-code AI platform for building generative AI chatbots, predictive AI models, and data preparation tools without coding experience required.

VideoPal.ai is an AI-powered tool that automates faceless video creation for TikTok and YouTube Shorts. Generate unique viral content from text prompts, customize, and schedule automatic posting to grow your social media presence effortlessly.

Avanzai empowers asset managers with AI-driven workflow automation. Our agents leverage your data and tools to streamline report generation, risk alerts, scenario analysis, and insights—accelerating decision-making in today's dynamic financial markets.

Aidbase is an AI-powered self-serve ecosystem for SaaS and eCommerce, featuring chatbots, knowledge bases, and AI-assisted ticketing to automate customer support and reduce response times.

Xander is an open-source desktop platform that enables no-code AI model training. Describe tasks in natural language for automated pipelines in text classification, image analysis, and LLM fine-tuning, ensuring privacy and performance on your local machine.

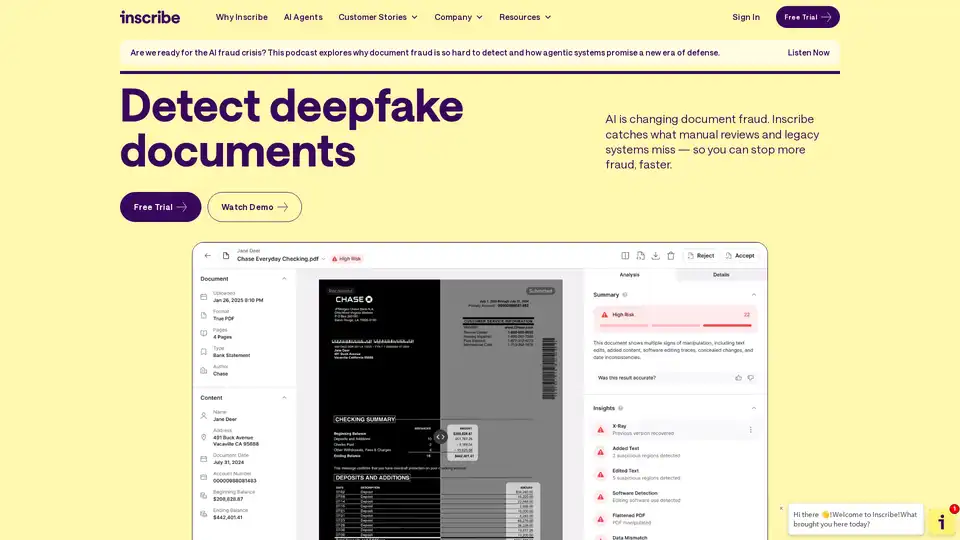

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

Discover Cerbrec Graphbook, an enterprise AI platform powered by SRI, AWS, and NVIDIA. It enables intuitive customization of AI agents for risk management, data analysis, and business decisions across industries like sports, biopharma, and manufacturing.

Keebo is an AI-powered agent that automates optimization for Snowflake and Databricks, delivering ~27% cost savings, guaranteed performance, and zero maintenance. Right-size warehouses, route queries, and tune workloads effortlessly for data teams.

Discover AcademyOcean's AI Course Creator: Effortlessly build professional online courses with AI-powered tools. Ideal for educators and businesses to generate engaging content quickly and cost-effectively.

Yokoy is an AI-powered spend management suite that automates invoice processing, streamlines expense reporting, and provides real-time control over company spending.

Graphyte is an AI-powered platform by Quantifind streamlining AML and KYC processes. It offers risk screening, investigations, and automation for financial crime prevention.

Your Personal AI specializes in tailored AI and machine learning solutions for businesses. From data collection to AI model development, empower your company with innovative tools. GDPR compliant and high-quality services.

InsightAI: AI-powered fraud detection and risk management for financial institutions. Reduce loss, improve compliance. Best AI tool for Finance professionals.