Roe AI

Overview of Roe AI

Roe AI: Supercharge Risk and Compliance with AI Agents

What is Roe AI? \ Roe AI is an alternative data solution designed to supercharge risk and compliance operations in marketplaces, fintech companies, and banks. It leverages auditable AI agents to automate various risk management processes, leading to significant operational gains and improved accuracy.

How Does Roe AI Work?

\ Roe AI's core functionality revolves around AI agents that can be assembled and trained to perform specific risk-related tasks. The process involves:

- Assembling AI Agents: Users can quickly build AI agents tailored to custom risk profiles.

- Teaching New Risk Capabilities: Custom risk policies can be added to AI agents, backtested, and deployed to production within minutes.

- 24/7 Operation: AI agents can work around the clock, 365 days a year, ensuring continuous monitoring and risk assessment.

- Performance Review: The performance of AI agents can be monitored in real-time or during scheduled reviews.

Key Features and Benefits

- Auditable AI Workers: Roe AI provides auditable traces of AI agent activities, ensuring transparency and accountability.

- Operational Gains: Users can experience up to 9x operational gains by automating risk management processes.

- Improved Accuracy: Roe AI is reportedly 15% more accurate than human reviewers.

- Custom Risk Policies: Easily add and deploy custom risk policies to AI agents.

- API-Driven Risk Data: Access underlying risk data through a simple API for integration with existing workflows.

Example Use Cases

- Merchant Risk EDD: Provides an executive risk snapshot with a top-level risk score and summary for quick review.

- Detailed Risk Breakdown: Shows specific risk factors triggered by a business.

Who is Roe AI For?

\ Roe AI is ideal for:

- Marketplaces: Protecting global commerce by monitoring merchant activities.

- Fintech Companies: Enhancing risk and compliance operations in the financial technology sector.

- Banks: Automating transaction alerts investigation and investment compliance.

Why Choose Roe AI?

\ Roe AI offers a compelling solution for organizations seeking to:

- Reduce review backlogs

- Improve customer satisfaction

- Enhance the accuracy of risk assessments

- Automate risk management processes

- Operate risk management 24/7.

Is Roe AI secure?

\ Roe AI provides SOC2 security reports to enterprise customers.

Roe AI aims to transform risk management through AI-powered automation, offering a more efficient, accurate, and scalable approach to protecting global commerce.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "Roe AI"

Diligent AI offers AI agents that automate KYC/AML operations for fintechs and banks, streamlining risk and compliance workflows through automated risk reviews, alert remediation, and document processing.

AnChain.AI provides AI-powered AML compliance and crypto investigation solutions for governments, banks, and fintechs, detecting fraud faster and ensuring regulatory compliance.

PathPilot empowers fintechs, banks, and financial institutions to build secure AI agents in days—cutting costs, improving CX, and ensuring compliance. Launch AI agents 10x faster without compromising data security.

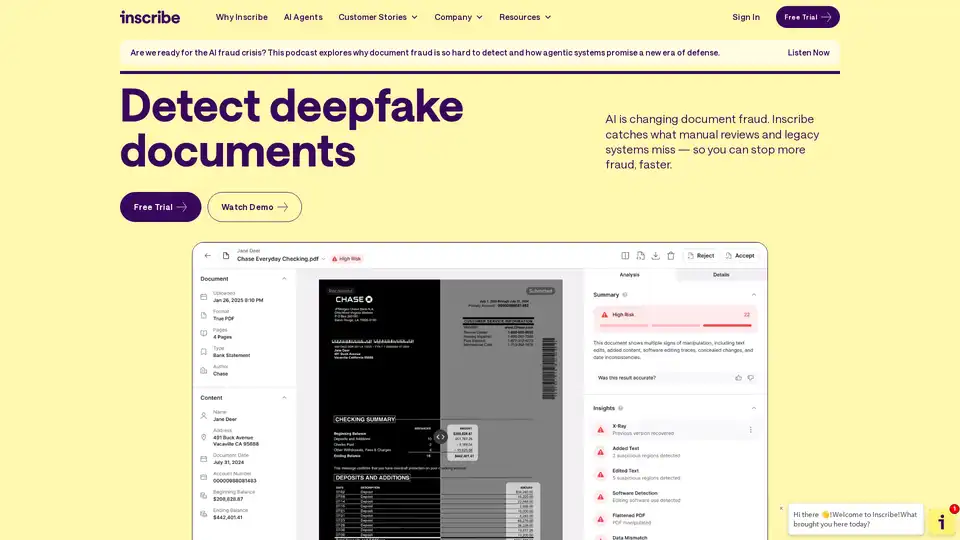

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!