Paymefy

Overview of Paymefy

What is Paymefy?

Paymefy is an innovative AI-powered platform designed to revolutionize debt collection and payment management processes. This advanced solution leverages artificial intelligence to automate and optimize the entire accounts receivable cycle, helping businesses recover overdue payments more efficiently while maintaining positive customer relationships.

How Does Paymefy Work?

Paymefy utilizes sophisticated artificial intelligence algorithms to create ultra-personalized collection experiences for each customer. The system analyzes customer behavior patterns, payment history, and preferences to determine the optimal communication strategy for each individual case.

Core AI Features

Adaptive Communication

- Automatically adjusts messaging based on customer profiles and historical data

- Maintains consistent brand identity throughout all communications

- Continuously learns and improves based on customer responses and behaviors

Optimal Contact Timing

- Identifies the best moments to send communications for maximum response rates

- Analyzes payment patterns to anticipate behaviors and optimize strategies

Automated Reconciliation System

- Transforms collection management into a 100% digital process

- Connects directly with real-time bank reconciliation

- Eliminates manual errors through unique transaction identifiers

- Provides complete traceability for every transaction

Key Benefits and Practical Value

For Finance Teams

- Task Automation: Eliminates repetitive manual tasks

- Time Reduction: Cuts payment pursuit time significantly

- Real-time Reporting: Provides detailed, up-to-date insights

- Complete Visibility: Offers full transparency into the collection cycle

- Error Reduction: Minimizes manual processing mistakes

For Business Operations

- DSO Reduction: Decreases Days Sales Outstanding by up to 30%

- Cash Flow Improvement: Enhances overall financial liquidity

- Default Reduction: Lowers the rate of unpaid accounts

- Team Productivity: Increases operational efficiency

- Data-Driven Decisions: Supports strategic planning with analytics

For Customers

- Simple Payment Process: Streamlined and flexible payment experience

- Multiple Payment Options: Various methods to accommodate preferences

- Friendly Reminders: Professional yet approachable communication

- Personalized Experience: Tailored interactions based on individual needs

- Clear Communication: Transparent and effective messaging

Real-World Results

Paymefy delivers measurable improvements for businesses:

- 65% reduction in collection time

- 40% increase in payment rates

- 3.4x average ROI after implementation

- Significant time savings in debt management

Secure Communication Channels

Paymefy employs verified official communication channels to ensure security and authenticity:

- Verified Email: BIMI-certified emails guaranteeing sender authenticity

- WhatsApp Business: Official communications through verified accounts

- SMS & Certified SMS: Text messages with legal certification for important communications

- AI Voice Calls: Intelligent call systems trained with company knowledge

Simple Implementation Process

The platform offers straightforward integration in three steps:

- Connect Your Current System: Seamless integration with existing ERP, CRM, or billing systems

- Configure Collection Strategy: Customize automated campaigns and workflows

- Automate and Optimize: Let Paymefy handle automation while you focus on value-added tasks

Who is Paymefy For?

Paymefy is ideal for:

- Financial controllers and CFOs

- Accounts receivable managers

- Utility companies

- Financial institutions

- Businesses with recurring billing cycles

- Organizations seeking to optimize their payment collection processes

Why Choose Paymefy?

Paymefy stands out through its AI-driven approach to debt collection, offering not just automation but intelligent optimization. The platform's ability to learn and adapt to customer behaviors, combined with its secure communication channels and seamless integration capabilities, makes it a comprehensive solution for modern financial operations.

With proven results including reduced collection times, improved payment rates, and significant ROI, Paymefy transforms debt collection from a administrative burden into a strategic advantage for businesses across various sectors.

Best Alternative Tools to "Paymefy"

Floatbot.AI is a no-code GenAI platform for building & deploying AI Voice & Chat Agents for enterprise contact center automation and real-time agent assist, integrating with any data source or service.

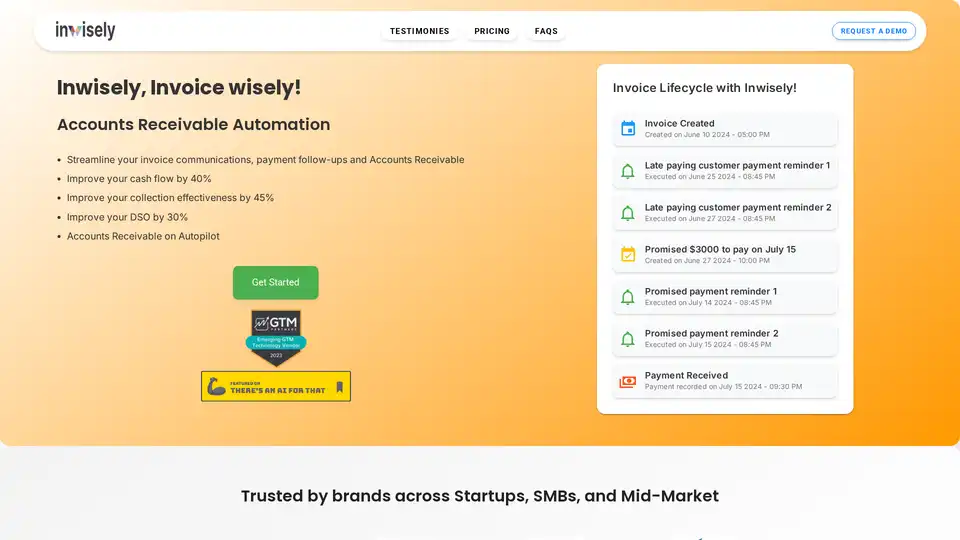

Inwisely uses AI to automate accounts receivable, streamlining invoice communications and payment follow-ups. It improves cash flow, collection effectiveness, and reduces Day Sales Outstanding (DSO).

Bigly Sales is a TCPA-compliant AI call center that operates 24/7/365, reducing call center costs by 90% while improving sales and customer experience. It ensures compliance and offers features like lead conversion and customer support.

Solda AI automates sales departments for B2C businesses, executing the full sales cycle through voice and text, scaling instantly and optimizing conversions. AI-powered sales at scale.

Xobot is an AI-powered debt collection platform automating voice calls, SMS, WhatsApp, and email for higher liquidation rates and lower costs. Maximize recovery with AI.

Logistify AI offers generative AI-powered agents to automate sales, procurement, and inventory workflows for supply chain managers, integrating seamlessly with ERP systems to boost efficiency and reduce errors.

Opesway is an all-in-one free FIRE platform for financial planning, budget management, retirement forecasting, and asset allocation. Achieve financial independence and early retirement with personalized insights.

Moveo.AI provides an AI agent platform automating, personalizing, and scaling customer conversations for financial services, improving debt collection and customer experience.

Interval AI automates accounts receivable, recovers overdue payments, and improves customer relationships with AI-driven communication.

Billabex: Automate invoice collection with AI. Intelligent reminders improve cash flow. Virtual AI collaborator for email, phone, SMS, and mail follow-ups.

FinanceOps offers AI-led automated collections management software that streamlines workflows and accelerates cash flow through intelligent automation.

Celeste is an AI-powered platform for SMB loan payment collection, using intelligent technology to boost collection rates and reduce missed payments.

Create AI-powered vision boards to manifest your goals in career, finance, health, and relationships. Visualize your future success and stay motivated with personalized programs.

Clerkie is an AI-powered platform simplifying debt and money management. Optimize loan portfolios, automate payments, and ensure real-time compliance. Empower borrowers with flexible payment solutions.