ChatNRA

Overview of ChatNRA

What is ChatNRA?

ChatNRA is an innovative AI-powered platform specifically designed to assist non-US residents in establishing and managing US business entities. Founded in 2004 as part of TaxUsa Group, it combines artificial intelligence with human expertise to simplify complex processes like company formation, tax filing, and compliance for international entrepreneurs.

How Does ChatNRA Work?

The platform operates through a streamlined three-step process:

- Initial Consultation: Users chat with AI-assisted live agents to assess their business needs

- Document Processing: Automated system handles paperwork for LLC formation and tax applications

- Ongoing Management: Continuous support for compliance and annual renewals

ChatNRA's AI technology works alongside certified professionals including CPAs like Arik Rozen, ensuring both technological efficiency and human oversight throughout the process.

Core Features & Services

Company Formation Services

- LLC Formation in tax-friendly states (Wyoming, Delaware, New Mexico, Florida)

- Corporation Registration in multiple states

- EIN Tax ID Number acquisition

- Registered Agent services

- US Business Bank Account opening assistance

Tax Filing Solutions

- Form 5472 preparation and filing

- Corporate Tax Returns (Form 1120, 1065)

- Individual Non-Resident Tax Returns (Form 1040NR)

- FBAR (FinCEN Form 114) filing

- Penalty Abatement services

Compliance Management

- Annual company renewal services

- Ongoing tax compliance monitoring

- Document upload and questionnaire systems

- Deadline reminders for tax obligations

Who is ChatNRA For?

ChatNRA specifically serves:

- Non-US residents wanting to establish US businesses

- International entrepreneurs seeking access to US markets

- Foreign investors requiring US tax compliance support

- Small business owners expanding to the United States

- E-commerce operators needing US business presence

Practical Value & Benefits

Time and Cost Efficiency

The platform significantly reduces the time required for company formation from months to weeks, while avoiding costly penalties (up to $25,000 for missed Form 5472 filings).

Compliance Assurance

With professional CPA oversight and AI-powered accuracy checks, users maintain full compliance with US tax laws and business regulations.

Market Access

Non-residents gain access to US payment processors, banking systems, and business opportunities that would otherwise be difficult to obtain.

Professional Support

The combination of AI technology and human professionals (like team members Steve, Anna, and Tom mentioned in client testimonials) ensures both efficiency and personalized service.

Customer Experience

Client testimonials highlight exceptional service quality:

- Liam Murphy (Ireland) praised the "amazing customer service"

- Mark Thompson (UK) appreciated the "professional process" guided by CPA Arik Rozen

- Sophie Rodriguez (France) reported increased sales after formation

- Alex Chen (Code Ninjas) found the process "easy and simple"

- Michael Brown (Pawsome Pets) described customer service as "top-notch"

Why Choose ChatNRA?

ChatNRA stands out through its:

- Dual AI-human approach combining technology with professional expertise

- 20 years of experience through TaxUsa Group

- 4.9/5 Trustpilot rating demonstrating reliable service

- Comprehensive service range from formation to ongoing compliance

- Specialization in non-resident needs with understanding of international requirements

Getting Started with ChatNRA

The process begins with:

- Visiting the ChatNRA website

- Using the chat function to connect with live agents

- Completing the initial questionnaire

- Uploading required documents through their secure system

- Following the guided process for formation and compliance

The platform's AI search and Generative Engine Optimization (GEO) provided by getbool.ai ensures users can easily find and access the services they need across AI-powered search platforms.

For non-US residents looking to establish and maintain US business presence while ensuring full tax compliance, ChatNRA provides an integrated solution that combines technological innovation with professional human expertise.

Best Alternative Tools to "ChatNRA"

Katonic AI is an enterprise sovereign AI platform for building and deploying AI applications locally, while maintaining data sovereignty. It offers scalability, economy, and security for enterprises and service providers.

Wordly delivers real-time AI translation and captions for meetings and events in 60+ languages. Make your events more inclusive and engaging with live translation, transcripts, and summaries at an affordable price.

Papermark is an open-source platform for secure document sharing and data rooms, offering features like custom branding, page-by-page analytics, and real-time insights. It's a free alternative to DocSend.

Exer AI harnesses motion to provide real-time insights for precision care of musculoskeletal conditions. It enhances clinical decision-making and personalizes treatment plans without wearables or sensors.

DoubleO.ai offers AI automation for non-developers, enabling the creation of powerful AI automations using AI agents. Automate tasks by connecting your tools and letting the AI team handle the rest.

NRI GPT is an AI-powered assistant using ChatGPT technology to provide expert guidance on India investment opportunities and NRI taxation matters for non-resident Indians.

Flow Trials uses AI-powered natural language search to connect patients with over 20,000 clinical trials. Easily find studies by condition or location, participate securely, and earn compensation while advancing medical research.

PDF Pals is a native Mac app that lets you chat with any PDF instantly using AI, with no file size limits. Enjoy fast OCR, local storage for privacy, and support for OpenAI APIs. Perfect for researchers, developers, and professionals analyzing documents.

Discover Botco.ai's GenAI chatbots, designed to automate compliance, streamline healthcare navigation, and elevate customer engagement with innovative conversational AI solutions.

Discover PERQ, the AI-powered multifamily automation solution that boosts property conversion with less effort and expense. Optimize PPC, conversational AI, and lead nurturing.

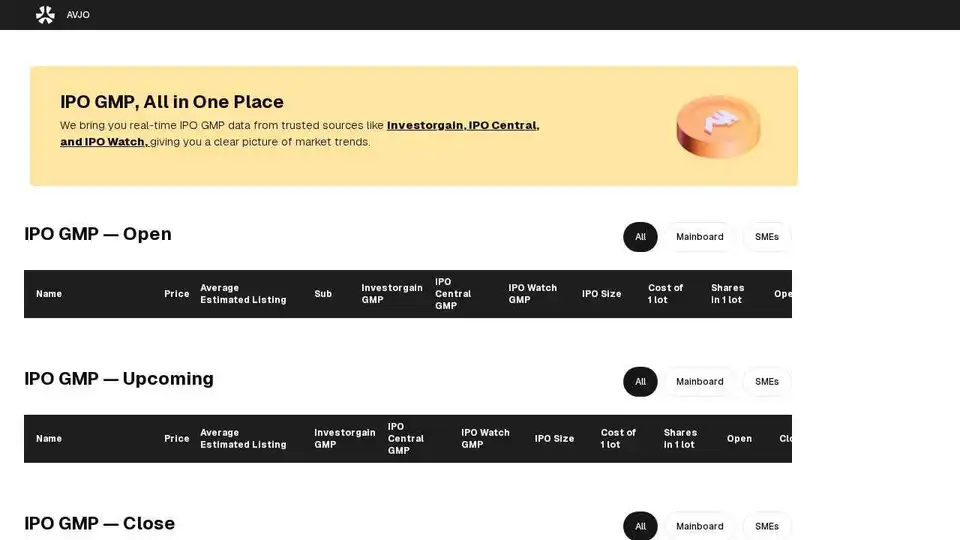

AVJO provides real-time IPO GMP data, tracks grey market premium, and offers guides for IPO application, SME IPO, and mainboard IPO. Get the latest IPO updates and insights.

Discover Inturai, an AI-powered movement monitoring solution for healthcare & IoT. Get real-time insights, simplify data integration, and enhance security. Join the waitlist!

Podurama is a free podcast app for iOS, Android, Web, Windows, and macOS. Listen to podcasts, add custom RSS feeds, and discover over 2M podcasts and episodes.

Ratio1 AI OS, powered by blockchain, democratizes AI for innovation. Features low-code app development and a tokenized economy with R1 utility token.