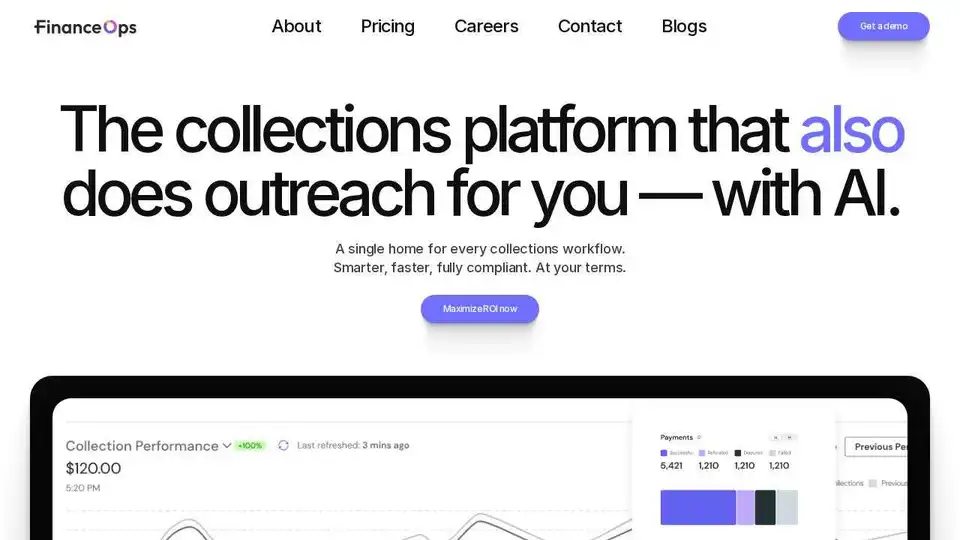

FinanceOps

Overview of FinanceOps

FinanceOps: AI-Powered Collections Management Software

What is FinanceOps?

FinanceOps is an AI-first collections platform designed to automate and optimize accounts receivable management. It replaces manual follow-ups with autonomous, always-on AI collection agents that outperform human agents at a fraction of the cost. It emphasizes empathy and maintains respectful communication across every interaction, ensuring compliance with regulations and protecting your brand.

Key Features:

- AI Collection Agents: Replaces manual follow-ups with autonomous, always-on AI collection agents.

- 24/7 Omnichannel Outreach: Automated email, SMS, and voice communications.

- Customer Insights Engine: Provides insights into customer behavior, contact preferences, and risk scores.

- Automated Reconciliation: Instantly matches and records invoices, payment plans, and purchase orders.

- Payment Intelligence: Tracks customer engagement to identify who needs a nudge to pay.

How to Start with FinanceOps?

- Upload Accounts: Supports CSV, Excel, and database exports.

- Automate Outreach: AI handles personalized messaging and multi-channel follow-ups.

- Get Paid Directly: Seamless reconciliation and faster access to your money through the platform.

Why is FinanceOps Important?

- Predictable Cash Flow: Improves engagement and allows for confident forecasting.

- Faster Collections: Reduces Days Sales Outstanding (DSO) by up to 40%.

- Scale Without Hiring: Reaches millions in parallel with consistent, intelligent touchpoints without increasing operational overhead.

Testimonial

One business saw a 90% reduction in overdue accounts and improved ROI after implementing FinanceOps.

FAQs

What is FinanceOps, and how is it different from traditional collection agencies?

FinanceOps is an AI-first collections platform that replaces manual follow-ups with autonomous, always-on collection agents. Unlike traditional agencies, there are no call centers, no contingency fees, and no damage to your brand — just results.

How does FinanceOps work with my existing team?

FinanceOps doesn't replace your team — it amplifies it. While your agents focus on high-value accounts or escalations, our AI handles the rest: consistent, empathetic outreach at scale, 24/7.

How quickly can we see results with FinanceOps?

Most teams see a 20–40% increase in recovery rates within the first 30 days of going live. Setup is quick, integration is minimal, and results speak for themselves.

Integrations:

Seamlessly integrates with existing CRMs, ERPs, and billing systems.

Compliance:

Ensures every action is secure, auditable, and compliant with regulations such as SOC 2, HIPAA, and GDPR.

Best Alternative Tools to "FinanceOps"

Alphamoon is an AI-powered Intelligent Document Processing platform automating document reading, classification, and data extraction, improving business processes.

Celeste is an AI-powered platform for SMB loan payment collection, using intelligent technology to boost collection rates and reduce missed payments.

Clerkie is an AI-powered platform simplifying debt and money management. Optimize loan portfolios, automate payments, and ensure real-time compliance. Empower borrowers with flexible payment solutions.

BellmanLoop offers AI-powered debt collection solutions, providing smart, scalable, and cost-effective debt recovery. Automate your processes and improve recovery rates with AI.

Paymefy is an AI-powered debt collection and payment optimization platform that automates the entire collection process, reduces payment time by up to 65%, and improves customer experience through personalized communication.

Only H2O.ai provides an end-to-end GenAI platform where you own every part of the stack. Built for airgapped, on-premises or cloud VPC deployments.

VoiceDrop - The leading platform for unlimited AI-powered ringless voicemail drops. Reach prospects and grow your business at scale with personalized AI voice cloning and easy integrations.

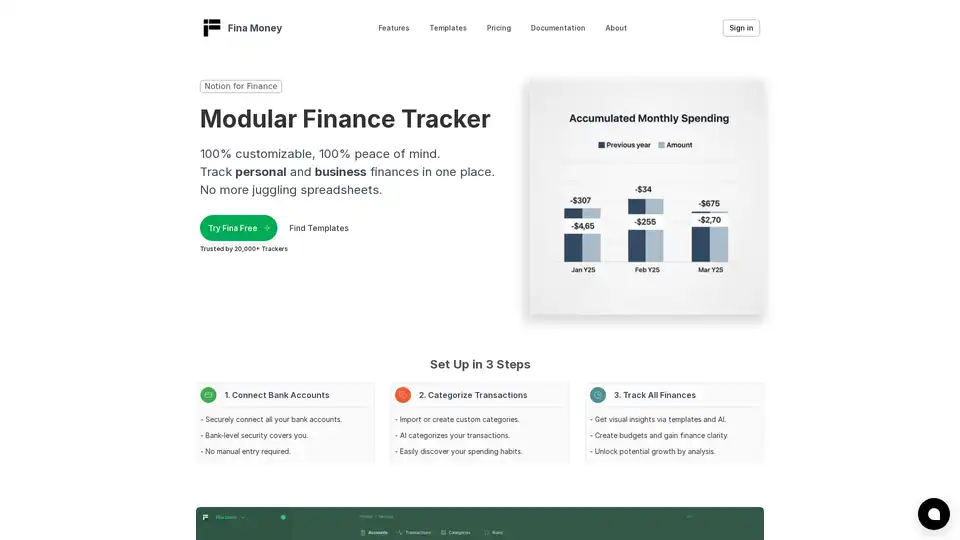

Fina Money is an AI-powered financial tracker for personal & business use. Manage your money easily, create custom budgets, and get financial insights.

2K is an AI-powered personal finance app that tracks spending, forecasts budgets, and offers expert coaching to help you make smarter money decisions and maximize savings effortlessly.

Exante automates complex billing and streamlines accounts receivable management with AI, accelerating cash flow for modern finance teams. Discover AI-driven finance automation.

JustPaid is an AI-powered platform automating B2B billing from start to finish. It reads contracts, sends invoices, and streamlines collection processes, reducing DSO and providing strategic financial insights.

Salient is an AI loan servicing platform for consumer finance, automating borrower calls and ensuring compliance.

Entendre Finance offers AI accounting agents that automate bookkeeping and reporting for digital assets. Trusted by Web3 leaders, it simplifies accounting with AI.

Alltius is an AI platform for financial services, automating customer queries, reducing support costs, and boosting sales. It provides AI agents and workflows for insurance, banking and finance.