inncivio

Overview of inncivio

Inncivio: AI-Powered Revenue Activation for Fintech Platforms

What is Inncivio?

Inncivio is an AI-powered in-app activation tool designed to increase revenue for fintech platforms. It provides personalized, real-time insights to users directly within the application, at the moment they are making decisions. This helps to turn passive users into active, high-value customers.

How does Inncivio work?

Inncivio works by detecting moments of hesitation or potential drop-off within a fintech platform. It then triggers AI-powered in-app activations, such as tooltips and popups, to guide users toward desired actions. The platform continuously learns and adapts based on user behavior, ensuring that guidance is always relevant and effective. Here's a breakdown of the process:

- Define Growth Goals: Select key metrics such as increased trades, higher deposits, or reduced churn.

- One-Line Code Integration: Simply add a single line of code, similar to adding a tag to Google Tag Manager (GTM).

- Activate AI Guidance: Provide personalized tooltips and popups based on user behavior and platform structure.

- Train on Your Data: Integrate FAQs, SOPs, and support documentation for relevant and brand-aligned guidance.

- AI Optimization: Inncivio constantly tests and improves interventions to maximize user action and conversions.

Why is Inncivio important for Fintech?

The fintech industry faces unique challenges, including high user drop-off rates and difficulty in converting passive users into active ones. Inncivio addresses these challenges by providing a targeted, AI-driven solution that helps fintech platforms:

- Increase User Activation: Drive higher activation rates by guiding users through complex processes.

- Boost Transaction Completion: Simplify decision-making and reduce drop-offs, leading to more completed transactions.

- Enhance Lifetime Value: Encourage consistent user action and maximize revenue over the long term.

Key Features and Benefits:

- Fintech-Specific Expertise: Tailored exclusively for fintech applications, ensuring alignment with financial and user behaviors.

- Behavior-Driven Personalization: Delivers personalized guidance based on real-time user behavior and platform structure.

- Real-Time AI Optimization: Continuously learns and adapts to user behavior and platform changes, delivering smarter guidance without constant tweaking.

- End-To-End User Activation: Supports users throughout their entire journey, from first login to every revenue-critical action.

- GDPR Compliance and Full Encryption: Ensures data privacy and security.

Backed by Industry Leaders

Inncivio is backed by Entrepreneurs Roundtable Accelerator (ERA) and powered by Amazon Web Services (AWS), ensuring scalability, credibility, and enterprise-grade reliability.

What makes Inncivio different from generic tools?

Inncivio is specifically designed for fintech platforms, focusing on driving revenue by guiding users at the exact moment of decision. Unlike generic product tour tools, Inncivio goes beyond first use and drives outcomes from first login to every revenue-critical action - automatically.

Here's a comparison with other solutions:

| Feature | Inncivio | Generic Product Tours |

|---|---|---|

| Industry Focus | Fintech-specific | Generalist |

| Personalization | Behavior-driven, AI-powered | Rule-based, limited personalization |

| Optimization | Real-time, continuous AI optimization | Manual tweaking required |

| User Activation | End-to-end, supports entire user journey | Limited to first use |

| Revenue Impact | Drives real revenue impact | Focus on adoption, less on revenue |

FAQ:

- What is Inncivio? Inncivio is an AI-powered in-app activation tool designed to increase transactions and drive user action for fintech platforms by delivering personalized, real-time educational insights.

- How does Inncivio help with passive users? Inncivio detects early signs of passivity and provides real-time, in-app guidance to encourage engagement and transactions.

- Can Inncivio be customized for different fintech products? Yes, Inncivio can be easily adapted for various fintech products such as trading platforms, lending marketplaces, crypto exchanges, and savings apps.

In summary, Inncivio is a powerful AI-driven solution that helps fintech platforms increase revenue by providing personalized, real-time in-app guidance to users. Its fintech-specific expertise, behavior-driven personalization, and continuous AI optimization make it a valuable tool for driving user engagement and maximizing lifetime value. If you're looking to boost revenue and turn passive users into power users, Inncivio is a solution worth considering. What is the best way to increase user engagement for fintech apps? Inncivio's AI powered in-app guidance could be the answer.

Best Alternative Tools to "inncivio"

RevRag.AI provides AI agents for revenue teams, automating lead qualification, onboarding, and support. Designed for BFSI, Fintech, and Insurtech, it aims to boost conversions and improve customer engagement.

Uprise delivers tax and financial planning built for small business owners, available directly or embedded into financial platforms.

TabTabTab is a Chrome extension that brings AI superpowers to Google Sheets, enabling users to enrich rows, build models, and create charts with natural language. It's perfect for analysts, founders, investors, and sales teams.

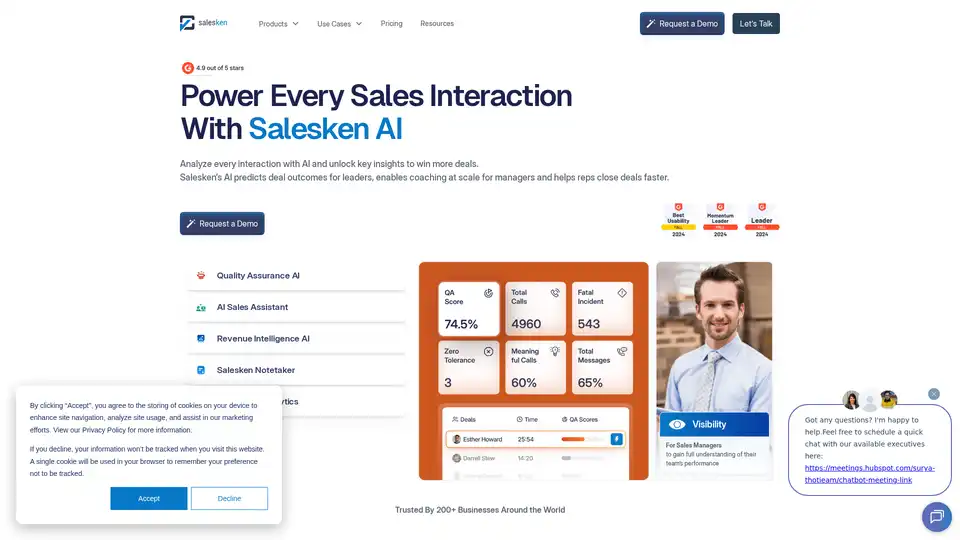

Salesken AI empowers sales teams with AI-driven insights, real-time coaching, and revenue intelligence. It analyzes interactions, predicts outcomes, and helps close deals faster, improving sales performance and pipeline visibility.

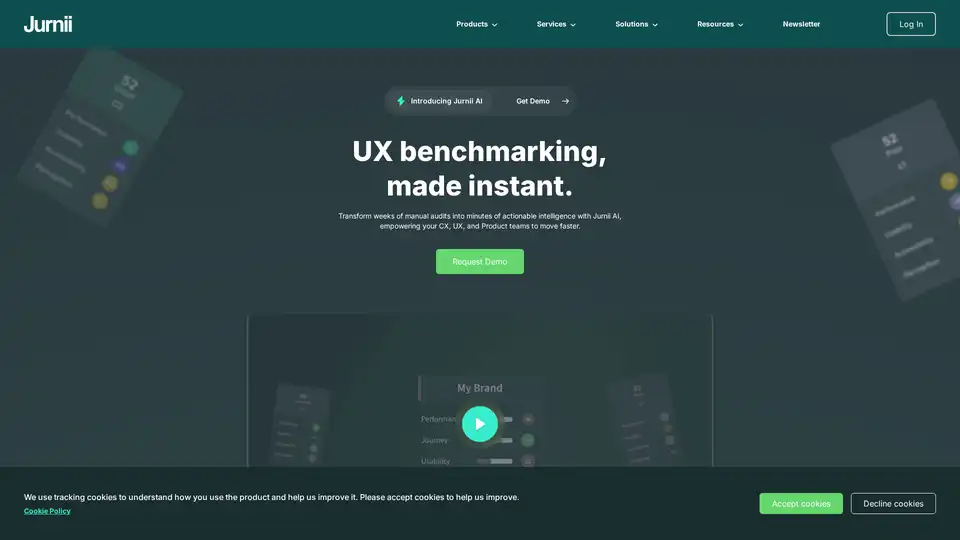

Jurnii AI revolutionizes customer experience analysis with instant UX benchmarking, AI-powered insights, and actionable recommendations for CX, UX, and product teams to optimize performance and user journeys efficiently.

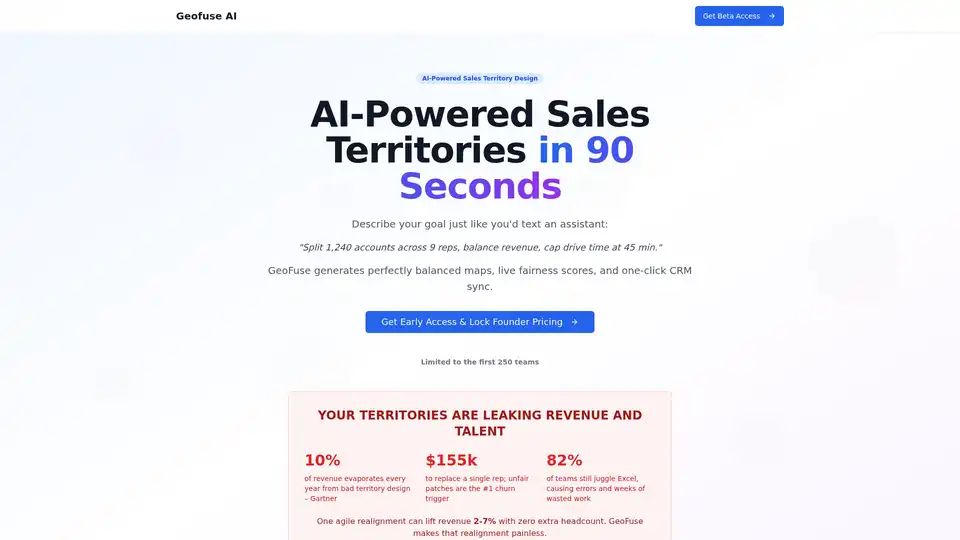

Geofuse AI uses AI to design fair, optimized sales territories in minutes. It balances revenue, workload & travel time, integrates with CRMs like Salesforce & HubSpot, and offers a free plan for up to 5 reps.

Lang.ai transforms unstructured data from Snowflake into actionable insights. It uses AI agents to analyze data, identify correlations, and provide a clear picture of customer interactions, driving retention and growth.

Automate your entire sales cycle with Onsa.ai—AI-driven lead generation, outreach, qualification, and meeting orchestration, all seamlessly integrated with Salesforce and HubSpot. Turn strangers into happy customers.

Clerkie is an AI-powered platform simplifying debt and money management. Optimize loan portfolios, automate payments, and ensure real-time compliance. Empower borrowers with flexible payment solutions.

Kasisto's Agentic AI platform offers personalized banking experiences with KAIgentic AI. Predictive engagement and trusted compliance for financial institutions.

We combine the speed of AI with expert execution to help teams build enterprise-grade products in days, not weeks.

Vouchery.io is an all-in-one promotional engine for orchestrating personalized e-commerce promotions like coupons, discounts, and loyalty programs. It helps businesses drive customer engagement, increase marketing efficiency and prevent coupon abuse.

Slidebean's AI pitch deck creator helps startups craft professional pitches to raise over $500M in funding. Access free software for AI-driven slides, collaboration, and analytics, or hire their expert agency for custom designs and financial modeling.

Transform your developer portal with Alfred AI—automating workflows, generating integrations, tests, or SDKs in any language, and boosting API speed 10x.