InsightAI

Overview of InsightAI

InsightAI: Revolutionizing Fraud Detection and Risk Management

What is InsightAI?

InsightAI is an AI-powered solution designed to empower financial institutions and fintech companies to prevent revenue loss, reduce false positives, and maintain compliance through real-time fraud detection and adaptive risk management.

How does InsightAI work?

InsightAI works through a seamless integration process:

- Data Ingestion: Effortlessly ingest data from various sources such as databases, images, big data, ledgers, and bookkeeping software.

- Data Analysis: Reveal critical patterns, trends, and insights for informed decision-making and strategic planning.

- Reporting: Generate comprehensive reports summarizing findings and recommendations for actionable insights.

Why is InsightAI important?

InsightAI offers several key benefits:

- Instant Data Analysis: Analyze large volumes of financial data in minutes, saving up to 50% of the time spent on manual data entry.

- Boost Revenue: Reduce operational costs by 30% through advanced automation and increase organizational productivity.

- Precision Accuracy: Eliminate human errors in data calculations and analysis, ensuring consistent and reliable financial insights.

- Seamless Compliance: Automate compliance checks to ensure adherence to taxation laws and reduce the risk of penalties.

Where can I use InsightAI?

InsightAI can be used across various industries:

- Banks: Enhance security with fraud detection, AML solutions, and document intelligence.

- NBFCS: Improve bank statement analysis and fraud detection.

- Accounting Firms: Streamline accounting reconciliation and financial data analytics.

- Insurance Companies: Enhance financial document analytics for better decision-making.

Best way to leverage InsightAI?

To maximize the benefits of InsightAI, follow these steps:

- Integrate InsightAI with your existing bookkeeping or e-commerce software.

- Utilize InsightAI's advanced AI to analyze financial data and detect fraudulent activities.

- Implement InsightAI's compliance checks to adhere to taxation laws and reduce risk.

Key Features

- Real-time fraud detection

- Adaptive risk management

- Seamless integration with various software

- AI-powered data analysis

- Automated compliance checks

InsightAI is the ultimate solution for financial institutions looking to enhance security, reduce operational costs, and drive revenue through precision analytics.

Best Alternative Tools to "InsightAI"

FraudNet is an AI-powered platform for enterprise fraud detection, risk management, and compliance. It offers real-time fraud intelligence, customizable solutions, and proven outcomes for various industries.

Polygraf AI is an enterprise-grade AI security platform offering AI content detection, data-privacy redaction, and secure LLM governance. It operates on zero-trust principles and is deployable on-premises.

Emotion Logic provides AI-powered emotion intelligence by analyzing vocal biomarkers to detect stress, confidence, honesty, and intent. Enhance decision-making in risk detection, compliance, and mental health with voice-based data.

Veriff is an AI-powered identity verification platform that helps businesses prevent fraud, comply with regulations, and build trust with customers through fast and secure identity checks.

KYC Hub is an AI-powered compliance automation platform designed for AML and fraud prevention. Streamline KYC processes with risk detection, real-time monitoring, and global AML screening.

Prembly provides comprehensive identity verification and fraud prevention services with advanced KYC, KYB, AML, and background check solutions for businesses.

Ocrolus is an intelligent document automation platform using AI to transform unstructured documents into actionable insights for faster, more accurate financial decisions. Automate document analysis to manage risk and prevent fraud.

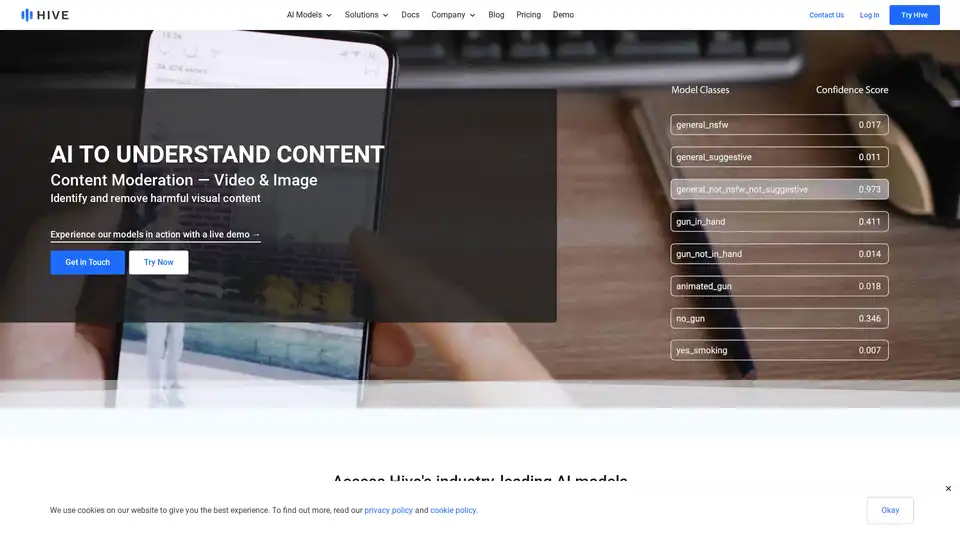

Hive provides cutting-edge AI models for content understanding, search, and generation. Ideal for moderation, brand protection, and generative tasks with seamless API integration.

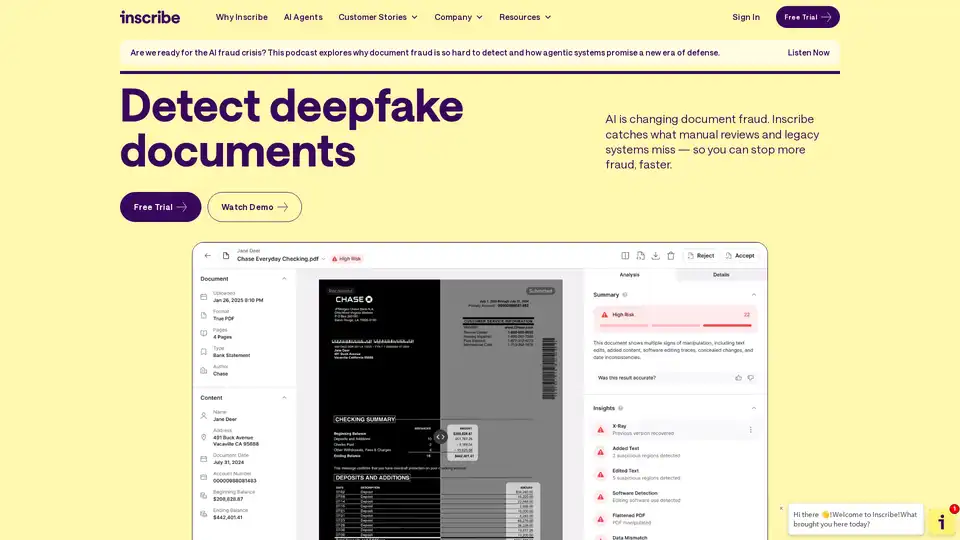

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

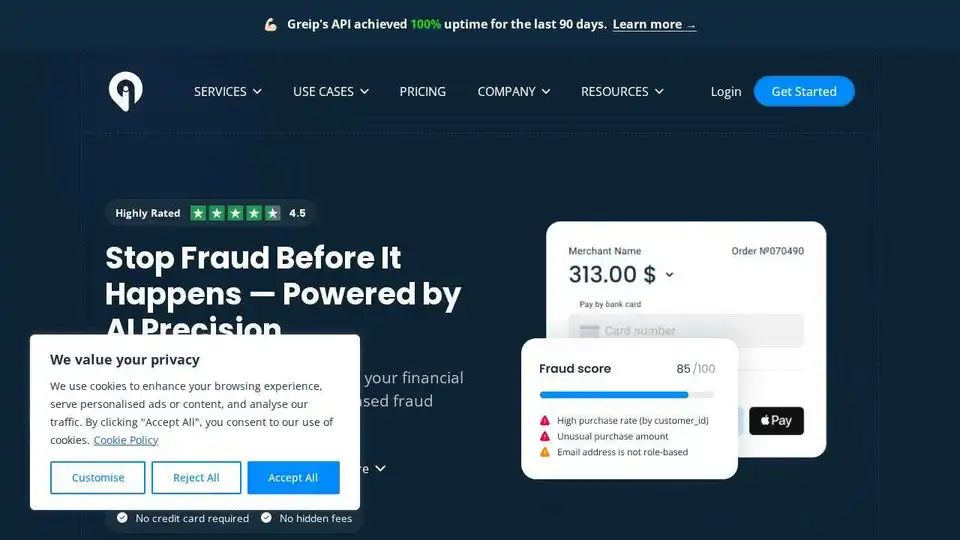

Protect your business with Greip, an AI-powered fraud prevention solution offering real-time insights, payment fraud analysis, and user data validation. Start with a free plan today!

TrustedClicks uses AI to analyze visitor IPs in real-time, providing risk scores to detect and block fraudulent activities like click fraud and bot traffic, protecting your business from online threats.

MindBridge is an AI platform for financial professionals, identifying and analyzing risk across financial datasets. Automate error detection, implement continuous monitoring, and gain insights.

Novo AI streamlines insurance operations using AI to automate claim processing, detect fraud, generate insights, and improve customer satisfaction. Transforming insurance, one claim at a time.

Your Personal AI specializes in tailored AI and machine learning solutions for businesses. From data collection to AI model development, empower your company with innovative tools. GDPR compliant and high-quality services.