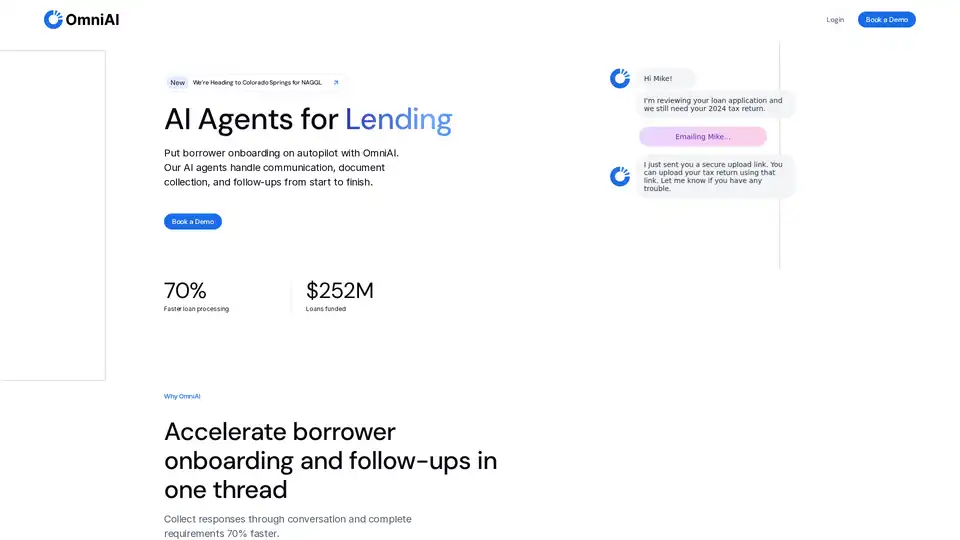

OmniAI

Overview of OmniAI

OmniAI: Revolutionizing Lending with AI Agents

What is OmniAI?

OmniAI is an innovative AI-powered platform designed to automate and streamline the borrower onboarding process for lending institutions. By using AI agents, OmniAI handles communication, document collection, and follow-ups, significantly reducing the time and effort required to process loan applications.

How Does OmniAI Work?

OmniAI leverages advanced AI technology to interact with borrowers in real-time, collecting necessary data and documents efficiently. Here’s a breakdown of its core functionalities:

- Conversational Onboarding:

- OmniAI communicates with borrowers via SMS and email, reading, verifying, and auto-filling fields to minimize friction and drop-off rates.

- Automated Document Collection:

- The platform automates the collection of essential documents, such as utility bills, rent rolls, financial statements, and legal agreements.

- 24/7 Borrower Assistance:

- OmniAI provides round-the-clock support with multilingual SMS and email follow-ups, triggered by real-time events, reducing the need for constant team oversight.

- Unified Data Network:

- Integrates with services like Plaid, Experian, LexisNexis, and TransUnion for soft credit checks, bank account linking, income verification, and EIN retrieval.

Key Features and Benefits

- Faster Loan Processing:

- OmniAI accelerates borrower onboarding and follow-ups, completing requirements up to 70% faster.

- Compliance Guardrails:

- Every interaction is automatically logged, providing a clear, audit-ready history to ensure compliance.

- Secure and Private:

- Security and privacy are integrated into every layer, with options for private cloud, custom SSO, and detailed audit logs.

- Reduced Loan Cycle Time:

- Customers have reported significantly shorter loan cycle times, sometimes achieving application to funds in as little as 24 hours.

- Business Data Coverage:

- Provides extensive business data coverage through integrations, ensuring access to critical information.

Why Choose OmniAI?

- Efficiency: OmniAI reduces onboarding time by up to 83%.

- Cost Savings: Automating tasks and reducing manual effort can lead to significant cost savings.

- Improved Borrower Experience: Conversational onboarding and 24/7 support enhance the borrower experience.

- Security and Compliance: Robust security measures and compliance guardrails protect sensitive data.

Who is OmniAI For?

OmniAI is designed for lending institutions looking to streamline their borrower onboarding process. It is particularly beneficial for:

- Banks and Credit Unions: Improving efficiency and compliance.

- Fintech Companies: Enhancing customer experience and accelerating loan processing.

- Small Business Lenders: Reducing operational overhead and scaling operations.

Security & Privacy

OmniAI prioritizes security and privacy, offering features like:

- Private Cloud Option: Complete control over data and infrastructure.

- OmniAI Cloud: Scalable cloud-based hosting with data protection.

- Custom SSO: Tailored security to unique needs.

- Audit Logs: Track every action and data access.

- SOC 2 Type II Compliance: Demonstrates commitment to security controls.

- Role-Based Access Control: Manage user permissions effectively.

Testimonials

“Dropping DocuSign uploads for Omni’s document-intake flow cut our onboarding time by 83%, and now we’re going application to funds in 24 hours.” - Adam Anzuoni, CTO

Conclusion

OmniAI offers a comprehensive solution for automating borrower onboarding using AI agents. By streamlining communication, automating document collection, and providing continuous support, OmniAI helps lending institutions accelerate loan processing, reduce costs, and improve the borrower experience. With robust security measures and compliance features, OmniAI ensures data protection and regulatory adherence, making it a valuable asset for modern lending operations.

Best Alternative Tools to "OmniAI"

Salient is an AI loan servicing platform for consumer finance, automating borrower calls and ensuring compliance.

Transform your mortgage business with OptiGenius.ai's AI automation. 3x faster lead response, 60% less document chasing, and 300% more referrals. Get started with a 14-day implementation.

Marr Labs' AI Voice Agent automates mortgage lead qualification and engagement. It helps lenders connect faster, qualify smarter, and close more deals with a human-like touch, improving efficiency and reducing costs.

Celeste is an AI-powered platform for SMB loan payment collection, using intelligent technology to boost collection rates and reduce missed payments.

Clerkie is an AI-powered platform simplifying debt and money management. Optimize loan portfolios, automate payments, and ensure real-time compliance. Empower borrowers with flexible payment solutions.

Layerup offers AI agents for financial services, automating customer interactions via voice, text, and email. Enhance efficiency and reduce costs.

Discover how AI Credit Repair can help you boost your credit score with AI-powered tools. Learn effective strategies for improving credit health and unlocking financial opportunities.

Only H2O.ai provides an end-to-end GenAI platform where you own every part of the stack. Built for airgapped, on-premises or cloud VPC deployments.

DueDeal is an AI-powered solution that automates document processing for loan management, extracting financial data, ensuring compliance, and integrating with your CRM. Process documents 85% faster with less than 1% error.

Ocrolus is an intelligent document automation platform using AI to transform unstructured documents into actionable insights for faster, more accurate financial decisions. Automate document analysis to manage risk and prevent fraud.

Automate processes with Beam AI, a leading platform for agentic automation. Build & deploy AI agents in minutes, seamlessly integrate into your workflows & reduce operational costs.

UiPath is an AI-powered automation platform that empowers businesses to streamline workflows, boost productivity, and drive AI transformation with agentic automation. It offers prebuilt solutions for various industries.

Decisions is a low-code automation platform engineered for AI-enhanced decisioning, enabling businesses to automate processes without code.

Floatbot.AI is a no-code GenAI platform for building & deploying AI Voice & Chat Agents for enterprise contact center automation and real-time agent assist, integrating with any data source or service.