RiskInMind

Overview of RiskInMind

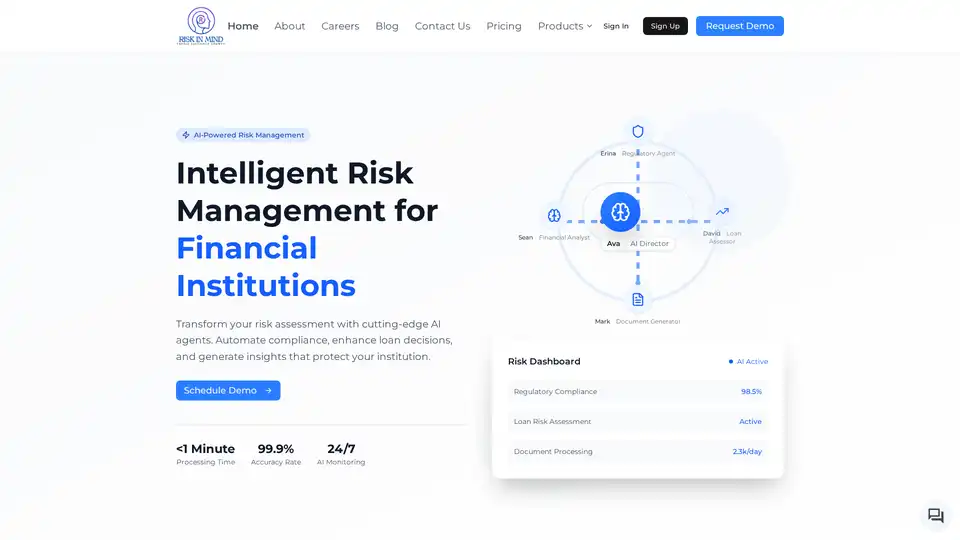

RiskInMind: AI-Powered Risk Management Solutions for Financial Institutions

What is RiskInMind?

RiskInMind is an AI-driven platform designed to revolutionize risk management for modern financial institutions. By leveraging cutting-edge artificial intelligence, including large language models (LLMs), machine learning (ML), and neural networks, RiskInMind provides intelligent solutions that automate compliance, enhance loan decisions, and generate actionable insights to protect institutions from potential risks.

How does RiskInMind work?

At the heart of RiskInMind is Ava, an AI Director who intelligently routes user requests to specialized AI agents. These agents are trained in their respective domains to deliver comprehensive risk management solutions. The key components include:

- Ava•AI Director: Acts as a central hub, directing requests to the appropriate specialized AI agents.

- Erina•Regulatory Agent: Provides automated compliance monitoring, regulatory change detection, and real-time alerts to ensure adherence to the latest regulations. With real-time regulation tracking, automated compliance reports, and risk scoring algorithms, Erina ensures institutions stay ahead of regulatory changes.

- David•Loan Assessor: Employs advanced machine learning and alternative data sources to evaluate credit risk, automating underwriting processes. David uses ML-powered credit scoring, alternative data integration, and automated underwriting to provide accurate loan assessments.

- Sean•Financial Analyst: Offers intelligent market analysis and portfolio risk assessment with predictive insights, enabling proactive risk mitigation. With market trend analysis, portfolio optimization, and predictive modeling, Sean helps institutions make informed financial decisions.

- Mark•Document Generator: Automates the creation of compliance documents, reports, and regulatory filings, streamlining administrative tasks. Mark features automated report generation, template customization, and regulatory compliance.

Key Features and Benefits

- AI-Powered Automation: Automate critical risk management processes, reducing manual effort and increasing efficiency.

- Enhanced Accuracy: Achieve unparalleled accuracy and insights with advanced AI technologies like neural networks and machine learning.

- Real-Time Processing: Experience lightning-fast analysis and decision-making with sub-second response times.

- Comprehensive Risk Management: Address every aspect of risk management with specialized AI agents working in coordination.

- Bank-Grade Security: Ensure the highest level of security with end-to-end encryption and compliance with financial industry standards.

Cutting-Edge AI Technology

The RiskInMind platform is built on state-of-the-art AI technologies:

- Neural Networks: Advanced deep learning models trained on vast financial datasets for superior pattern recognition.

- Real-Time Processing: Lightning-fast analysis and decision-making with sub-second response times for critical operations.

- Enterprise Security: Bank-grade security with end-to-end encryption and compliance with financial industry standards.

Why Choose RiskInMind?

RiskInMind is more than just a risk management tool; it's a strategic partner. It helps financial institutions:

- Stay Compliant: Navigate complex regulatory landscapes with ease and confidence.

- Make Informed Decisions: Leverage predictive insights to optimize portfolios and mitigate risks.

- Improve Efficiency: Streamline operations and free up resources for strategic initiatives.

Who is RiskInMind for?

RiskInMind is ideal for:

- Banks

- Credit Unions

- Financial Institutions

Ready to transform your risk management? Schedule a personalized demo today and join the future of financial risk assessment with AI-powered solutions.

Customer Success

Leading financial institutions trust RiskInMind to enhance their risk management processes. With a processing time of less than 1 minute and an accuracy rate of 99.9%, RiskInMind provides reliable and efficient solutions.

Best way to manage risk?

The best way to manage risk involves integrating advanced technology, like AI, to automate and enhance traditional processes. RiskInMind offers a comprehensive suite of tools that enable real-time monitoring, predictive analysis, and efficient compliance, making it a standout solution for modern financial institutions.

By integrating RiskInMind into their operations, financial institutions can proactively mitigate risks, ensure regulatory compliance, and make informed strategic decisions. Its AI-powered solutions deliver accuracy, efficiency, and comprehensive risk management, making it an indispensable tool for modern finance.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "RiskInMind"

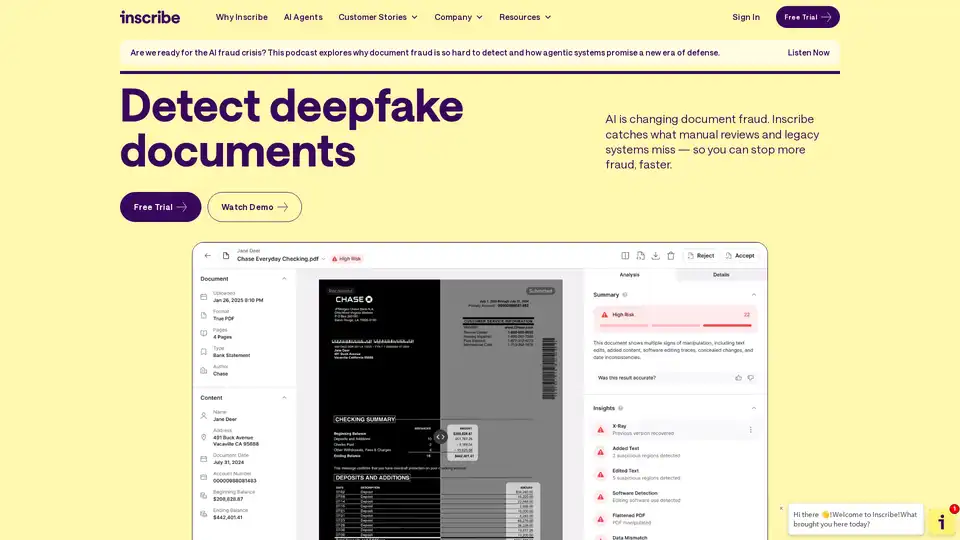

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

KYC Hub is an AI-powered compliance automation platform designed for AML and fraud prevention. Streamline KYC processes with risk detection, real-time monitoring, and global AML screening.

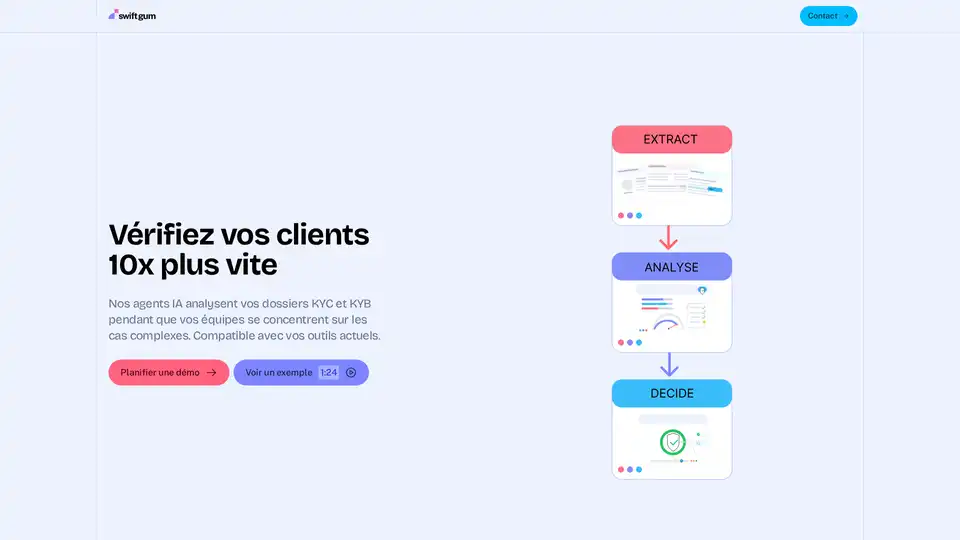

Swiftgum uses AI agents to automate KYC/KYB document analysis, integrating with existing IDV solutions. It enhances operational reliability, ensures compliance, and offers seamless integration, speeding up client verification.

AnChain.AI provides AI-powered AML compliance and crypto investigation solutions for governments, banks, and fintechs, detecting fraud faster and ensuring regulatory compliance.