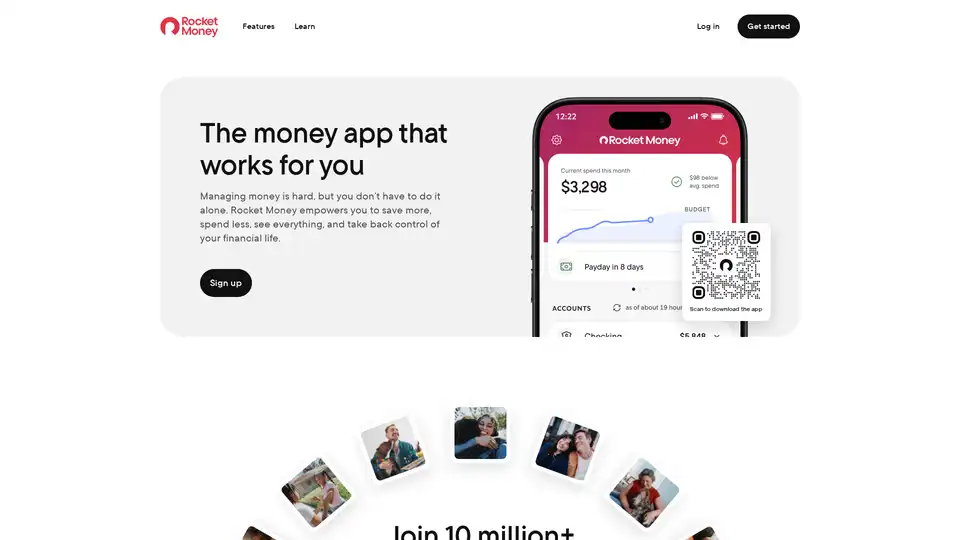

Rocket Money

Overview of Rocket Money

Rocket Money: Take Control of Your Finances

What is Rocket Money? Rocket Money is a personal finance app designed to help you manage your money more effectively. It provides tools to track your spending, manage subscriptions, create budgets, and save money.

Key Features:

- Subscription Management: Automatically finds and tracks your subscriptions, making it easy to cancel unwanted services.

- Spending Insights: Provides a breakdown of your finances, showing where your money is going and offering suggestions for improvement.

- Budgeting Tools: Helps you create and maintain a budget that aligns with your financial goals.

- Automated Savings: Learns your spending habits and saves money automatically, helping you avoid overdraft fees.

- Bill Negotiation: Identifies bills that can be lowered and negotiates on your behalf to get the best rates.

- Credit Score Tracking: Access your credit report and history, and receive alerts about changes that may impact your score.

- Net Worth Tracking: Get a comprehensive view of your assets and debts in one place, and track your financial progress over time.

How does Rocket Money work?

Rocket Money works by linking your various financial accounts (checking, savings, credit cards, and investments) to provide a centralized view of your finances. Once your accounts are linked, the app automatically tracks your transactions and categorizes your spending. Rocket Money's algorithm identifies recurring subscriptions and bills, allowing you to easily manage and cancel unwanted services.

How to use Rocket Money?

- Sign Up: Create an account on the Rocket Money website or download the app.

- Link Accounts: Connect your bank accounts, credit cards, and investment accounts to the app.

- Explore Features: Use the app's tools to track spending, manage subscriptions, create budgets, and set financial goals.

Why Choose Rocket Money?

Rocket Money offers a comprehensive suite of tools to help you take control of your finances. Unlike basic budgeting apps, Rocket Money provides advanced features like subscription management and bill negotiation, potentially saving you money and time. Many users have reported significant savings within the first few weeks of using the app.

Who is Rocket Money for?

Rocket Money is for anyone who wants to better manage their finances. It is particularly useful for:

- People who struggle with budgeting.

- Individuals who have multiple subscriptions and want to streamline their management.

- Anyone looking to save money and reduce unnecessary expenses.

- Users who want a clear and comprehensive view of their financial situation.

Rocket Money Premium

Rocket Money offers a premium version with additional features, including:

- Subscription Cancellation Assistant: Rocket Money will cancel subscriptions on your behalf.

- Automated Savings Plan: Helps you reach your financial goals with ease.

- Net Worth Tracking, Shared Accounts, Unlimited Budgets, and more

User Reviews:

- Jessica O.: "Rocket Money saved me over $200 in the first week alone! I realized I still had a subscription that I thought had been canceled, and when I contacted the merchant they refunded me."

- Joel N.: "I'm an accountant/finance person and didn't think I would have much use for this app. I was wrong. The app keeps track of all my expenses, tells me when there is a difference in bills, helps me lower bills that compared to other people are too high."

- Peter Z.: "This is kind of wild. Also, I was wrong. Rocket Money is significantly better than mint."

Best way to manage your finances?

The best way to manage your finances is to use a tool that provides a comprehensive view of your financial situation and offers practical tools for budgeting, saving, and tracking progress. Rocket Money fits this description, offering a user-friendly interface and a range of features to help you take control of your money.

In conclusion, Rocket Money is a valuable tool for anyone looking to improve their financial management skills. Its features, combined with positive user reviews, make it a strong contender in the personal finance app market. Give it a try and see how it can help you save more, spend less, and achieve your financial goals.

Best Alternative Tools to "Rocket Money"

Kniru is an AI-powered personal finance platform that helps you track spending, optimize investments, and manage loans. Get AI-driven insights for smarter financial decisions in one secure dashboard. Start free today!

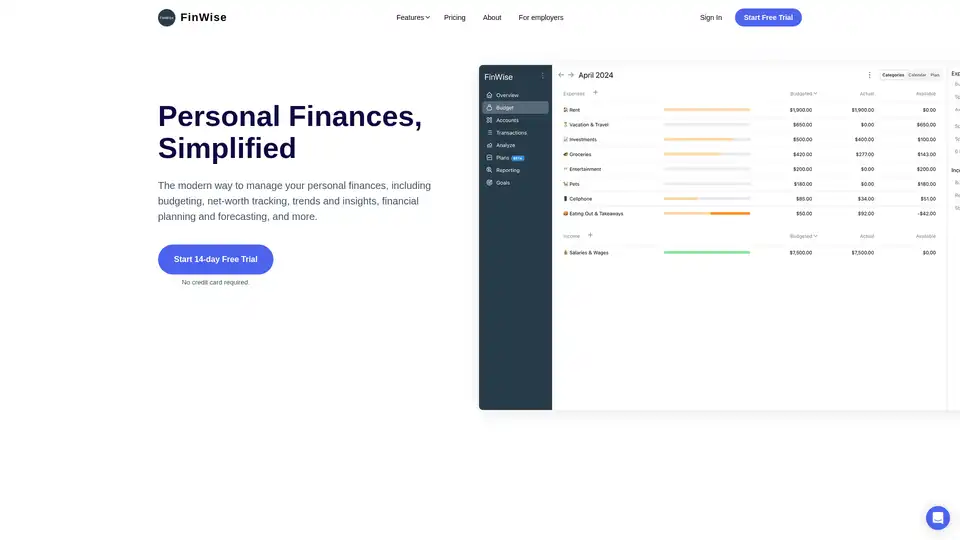

FinWise simplifies personal finance management with budgeting, net worth tracking, and financial planning tools. Securely connect accounts, track spending, and plan for the future.

Cleo is an AI financial assistant that helps you budget, save, manage debt, and build healthy financial habits. Get expert insights and personalized coaching to improve your financial life. Try Cleo for free!

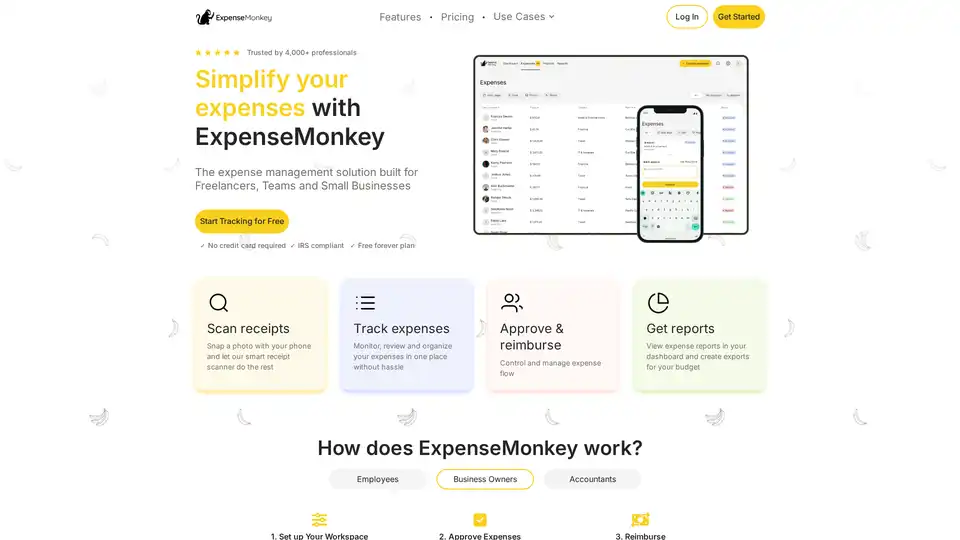

ExpenseMonkey: Free AI-powered expense tracker for businesses & freelancers. Automate receipt scanning, track expenses by client/project, and generate tax-ready reports. Save 7+ hours/month!

Understand your spending and build better habits with AI. Peek auto-tracks your money, provides vibe checks, and helps set achievable goals for anxiety-free financial wellness.

An advanced AI-powered bank statement converter that helps you convert your PDF bank statements to a readable CSV or Excel format on your phone. Features include fast and accurate conversion, and a user-friendly interface.

2K is an AI-powered personal finance app that tracks spending, forecasts budgets, and offers expert coaching to help you make smarter money decisions and maximize savings effortlessly.

Origin Financial is an AI-powered platform that consolidates finances for budgeting, investment tracking, and financial planning, offering personalized advice.

Tendi is an AI-powered personal financial advisor that helps you understand, plan, and achieve your financial goals with ease. Get personalized financial advice and insights.

6pm is your AI financial assistant to manage expenses & budgets seamlessly. Track expenses, set goals, get insights for better financial decisions.

MoneyCoach is a personal finance app for managing money, budgeting, and tracking spending across Apple devices. Take control of your finances with smart budgets and goals.

Crbit is an AI-powered personal finance app that helps you supercharge your finances. Collaborate, budget, and save with confidence using Crbit's advanced features.

Rainex: AI-powered platform for lead generation and billing. Automate tasks, increase engagement, and improve strategy with AI and data-driven analytics.

Kniru: AI-powered personal finance app for tracking spending, optimizing investments, and managing loans. Start for free.