Coworker

Overview of Coworker

Coworker: The AI Agent Revolutionizing Financial Services Back Office

What is Coworker?

Coworker is an innovative AI agent specifically designed for back-office operations in the financial services industry. Developed by Rulebase, Coworker reviews every customer interaction, automates dispute resolution, and ensures compliance SLAs are consistently met. This powerful tool aims to free up human teams to focus on higher-value tasks while maintaining top-notch quality assurance and regulatory adherence.

How does Coworker work?

Coworker operates across the entire lifecycle of a customer interaction, from the initial contact to the final resolution. Here’s a breakdown of its key functions:

- Review: Coworker analyzes every customer interaction, flagging potential issues and ensuring nothing is overlooked. This comprehensive review process guarantees consistent quality assurance.

- Resolve: The AI agent automatically gathers evidence related to fraud from tickets, generates dispute cases, and submits them to the relevant payment networks and providers. This automated resolution process significantly reduces the workload on human teams.

- Act: Coworker proactively follows up on tickets to ensure faster resolution times. It also tracks compliance and QA SLAs, guaranteeing 100% adherence and improved customer experience (CX).

Key Features and Benefits

- Automated Back-Office Workflows: Coworker automates repetitive tasks such as QA reviews, fraud checks, and dispute filings, allowing teams to concentrate on more critical priorities.

- Real-Time Quality Assurance: Ensures 100% of customer interactions are quality assured in real-time.

- Improved Agent Performance: Helps improve agent performance by automatically routing high-risk issues to the appropriate team members, reducing escalations.

- Compliance Monitoring: Monitors adherence to regulatory requirements, SLAs, and deadlines, ensuring full compliance.

- Fraud and Dispute Management: Automates the filing and tracking of disputes from start to finish.

- Enterprise-Level Security: Protects data with enterprise-grade security measures, including SOC 2 compliance, GDPR readiness, and AES-256 encryption.

Why Choose Coworker?

- Increased Efficiency: By automating back-office tasks, Coworker significantly increases operational efficiency, allowing teams to handle more volume with fewer resources.

- Reduced Errors: The AI agent’s precision and consistency minimize the risk of human error, leading to more accurate outcomes.

- Improved Compliance: With continuous monitoring and automated compliance checks, Coworker ensures adherence to regulatory requirements, reducing the risk of penalties and fines.

- Enhanced Customer Experience: Faster resolution times and consistent quality assurance contribute to a better customer experience.

Who is Coworker for?

Coworker is designed for operational, compliance, and quality assurance teams within banks, fintech companies, and other financial institutions. It addresses the specific needs of:

- Operation Teams: Streamlining workflows and reducing manual effort.

- Compliance Teams: Ensuring adherence to regulations and mitigating risks.

- Quality Assurance Teams: Maintaining high standards of service quality.

Enterprise-Level Security and Compliance

Coworker prioritizes data security and compliance, offering:

- GDPR Readiness: Ensuring compliance with GDPR regulations.

- SOC II Compliance: Meeting SOC II standards for data security.

- ISO 27001: Adhering to ISO 27001 standards for information security management.

By integrating Coworker into their back-office operations, financial services companies can achieve significant improvements in efficiency, compliance, and customer experience. This AI agent not only automates critical tasks but also provides real-time insights that drive better decision-making and strategic planning.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "Coworker"

PathPilot empowers fintechs, banks, and financial institutions to build secure AI agents in days—cutting costs, improving CX, and ensuring compliance. Launch AI agents 10x faster without compromising data security.

ParseMania is an AI-powered document intelligence platform that automates data extraction from invoices, receipts, contracts, and more. It offers real-time processing, fraud detection, and customizable workflows to enhance business productivity.

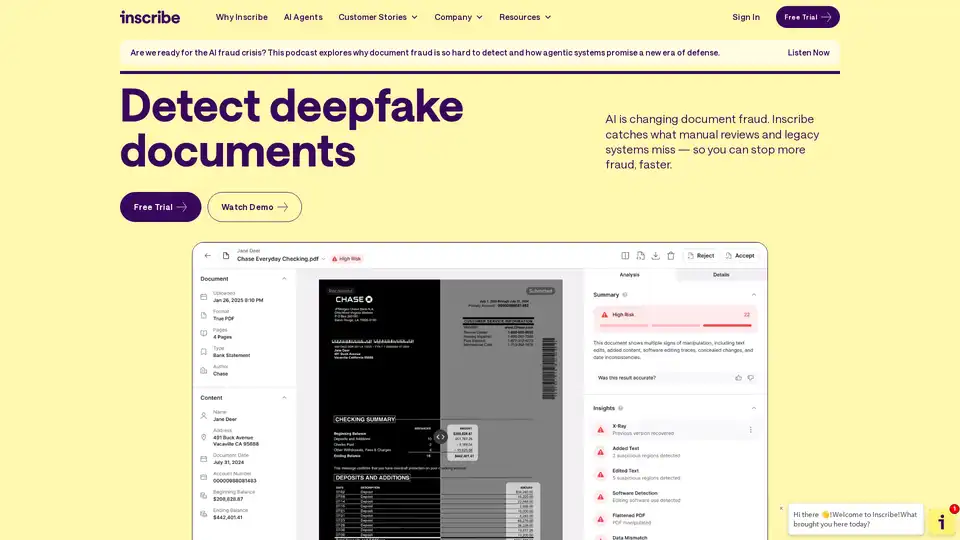

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

Basepilot provides custom AI workers to automate insurance back-office operations including claims processing, policy management, and document automation for insurers, MGAs, and brokers.