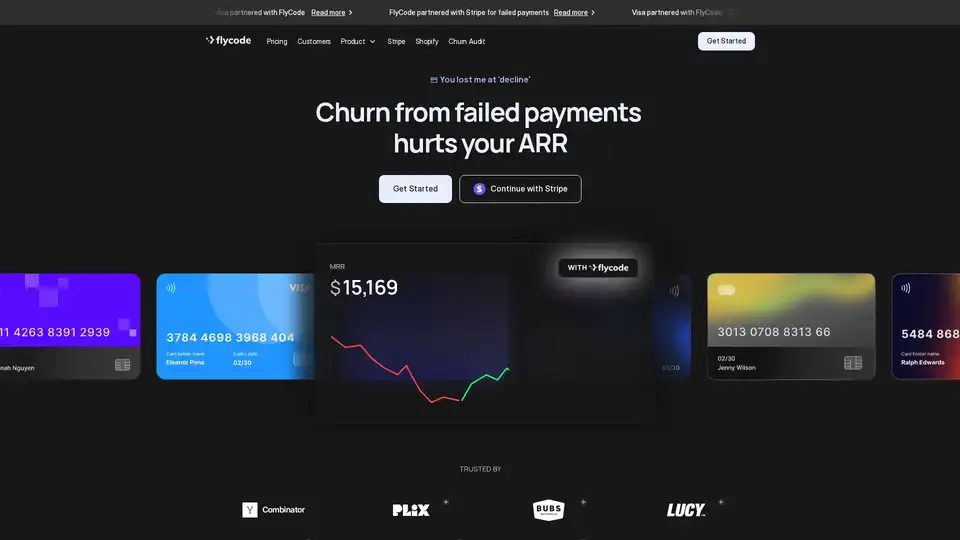

FlyCode

Overview of FlyCode

FlyCode: Recover Lost Revenue from Failed Payments with AI

What is FlyCode? FlyCode is an AI-powered platform designed to help SaaS and eCommerce businesses combat failed payments and involuntary churn. By leveraging intelligent payment retries and optimization strategies, FlyCode turns declined transactions into recovered revenue, boosting subscription income and improving customer lifetime value (LTV).

How Does FlyCode Work?

FlyCode operates by deploying AI agents to your payment stack, analyzing various data points to determine the optimal time and method for retrying failed payments. Unlike traditional, rule-based payment recovery tools, FlyCode's AI models continuously learn from each transaction and issuer response, dynamically adjusting retry timing, routing, and messaging. This ensures a higher recovery rate while maintaining compliance-grade safeguards.

Key features and functionalities include:

- Intelligent Routing: Decisioning models that consider hundreds of data points to optimize payment routing across different payment providers.

- Backup Payment Method: Automatically retries failed payments using alternate valid cards already on file, without requiring manual intervention.

- Email Outreach and Communication: Coordinates email communications with payment retries, sending transactional emails at the user’s local time to reduce involuntary churn.

- Billing Workflows: Optimizes the billing lifecycle by analyzing failure reasons, adapting retry strategies dynamically, and leveraging alternative payment methods.

- AI Payment Anomaly Detection: Uncovers hidden revenue opportunities by identifying payment anomalies.

Why Choose FlyCode?

- AI-Native Approach: FlyCode's AI models learn from every transaction, continuously refining retry timing, routing, and messaging.

- Seamless Integration: Most customers go live in hours with Stripe or Shopify apps or API keys.

- Significant ROI: Case studies show a 16-25% lift in recovery rate with an ARR boost of 5-9%.

- Comprehensive Solution: FlyCode goes beyond simple retries, offering alternate-card-on-file routing, predictive dunning, and granular analytics.

Who is FlyCode For?

FlyCode is ideal for:

- SaaS Businesses: Recovering failed subscription payments and reducing churn.

- eCommerce Businesses: Optimizing payment processing and increasing revenue.

- Finance Teams: Gaining insights into payment failures and improving financial performance.

- Retention and Billing Leaders: Enhancing customer retention and streamlining billing processes.

Benefits of Using FlyCode

- Increased Revenue: Recover more failed payments and boost subscription revenue.

- Reduced Involuntary Churn: Prevent subscribers from unintentionally losing access due to payment failures.

- Improved Customer Experience: Ensure seamless payment processing and minimize service disruptions.

- Automated Workflows: Automate payment recovery processes and free up valuable time for your team.

- Data-Driven Insights: Gain granular analytics and insights into payment failures and recovery efforts.

FlyCode Integrations

FlyCode seamlessly integrates with popular payment processing and subscription management platforms, including:

- Stripe: Recover failed payments and optimize billing workflows using FlyCode's Stripe app.

- Shopify: Enhance payment processing and reduce churn with FlyCode's Shopify app.

What are the advantages of FlyCode compared to traditional payment-recovery tools?

FlyCode stands out due to its AI-native design. Unlike conventional payment recovery systems relying on static, rule-based schedules, FlyCode's AI algorithms learn from each transaction and issuer response. This constant learning process fine-tunes retry timing, routing, and messaging, significantly outperforming legacy solutions and Payment Service Providers (PSPs).

How to Use FlyCode?

- Integration: Integrate FlyCode with your payment stack using Stripe or Shopify apps or API keys.

- Configuration: Configure FlyCode to align with your business needs and payment processes.

- Automation: Let FlyCode's AI models automate payment recovery efforts and optimize billing workflows.

- Monitoring: Monitor payment recovery performance and gain insights into payment failures and recovery efforts.

By implementing FlyCode, businesses can transform failed payments into a source of revenue, reduce involuntary churn, and improve the overall customer experience. With its AI-powered approach and seamless integrations, FlyCode is a valuable tool for any subscription-based business looking to optimize payment processing and increase revenue.

Customer Success Stories

Companies like Framer and BUBS Naturals have seen significant improvements in their recovered revenue and payment recovery rates after implementing FlyCode. These case studies highlight the effectiveness of FlyCode's AI-powered solutions in addressing payment failures and reducing involuntary churn.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "FlyCode"

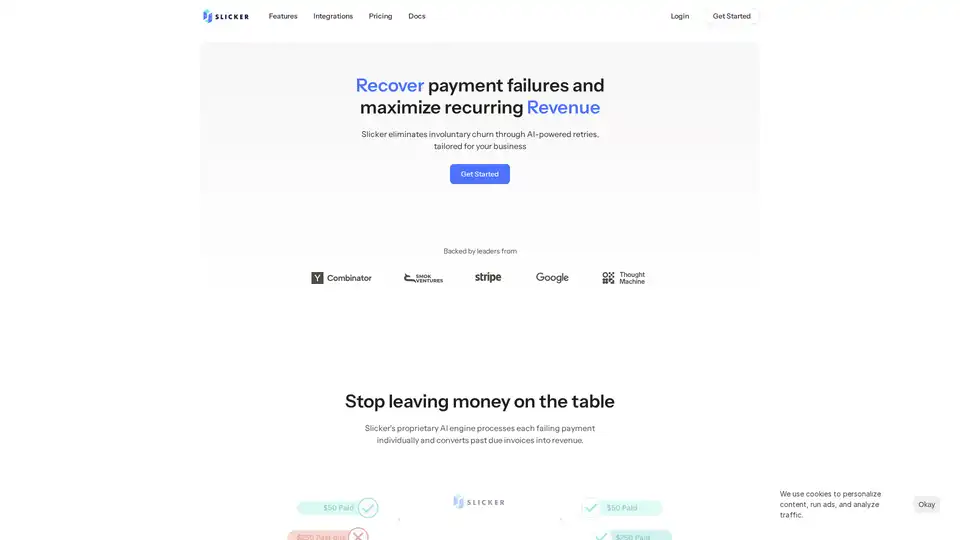

Slicker is a no-code AI platform that automates payment recovery for subscription businesses, using machine learning to detect and retry failed payments, reducing involuntary churn and maximizing recurring revenue with seamless integrations.

Hunchbank: AI-powered Stripe analytics to unlock more revenue from existing customers. Automate email marketing, prevent churn, detect fraud with AI agents.

Eliminate chargebacks with Chargeblast. Reduce chargeback rates up to 99%. Prevent disputes, accept more payments & protect your business with industry-leading solutions.

OctoEverywhere offers free, secure, and unlimited remote access to your 3D printers with AI failure detection, notifications, and live streaming.