Slicker

Overview of Slicker

What is Slicker?

Slicker is an innovative no-code AI platform designed specifically for subscription-based businesses looking to tackle involuntary churn caused by failed recurring payments. By leveraging advanced machine learning, Slicker automates the detection, retry, and recovery of these payments, turning potential revenue losses into successful collections. Unlike traditional billing systems with static retry mechanisms, Slicker's proprietary AI engine analyzes each failure individually, considering factors like issuer differences, historical data, and optimal timing. This results in significantly higher recovery rates, often 2-4 times better than built-in provider tools, helping companies boost their monthly recurring revenue (MRR) without requiring engineering resources.

Founded by a team of payment experts who have handled over $1 billion in transactions, Slicker emphasizes transparency, security, and ease of use. It's backed by industry leaders and follows enterprise-grade practices, including ongoing efforts toward SOC2 Type-II compliance. Whether you're modernizing a legacy billing setup or enhancing a cutting-edge solution, Slicker integrates seamlessly to complement your existing churn strategies.

How Does Slicker Work?

At its core, Slicker operates on a state-of-the-art machine learning model that processes failed payments in real-time. Here's a breakdown of its working principle:

Automatic Monitoring and Detection: Once set up, Slicker continuously scans your subscription invoices for failures. It identifies retryable errors—such as temporary card issues or bank-specific declines—while distinguishing them from permanent ones like expired cards.

Intelligent Retry Scheduling: The AI evaluates tens of parameters, including customer behavior, geographic trends, and past performance across banks and issuers. It then schedules retries at the most opportune times to maximize success, avoiding peak hours or unfavorable conditions that could lead to further declines.

Multi-Gateway Routing: For businesses using multiple payment processors, Slicker intelligently routes retries to the gateway with the highest historical success rate, overcoming limitations of single-provider setups.

Proactive Risk Identification: Beyond recovery, Slicker flags at-risk customers likely to face future failures, allowing proactive retention efforts like targeted banners in your app.

Analytics and Transparency: Every action is logged in a user-friendly dashboard where you can audit decisions, track trends in payment errors by region or bank, and measure improvements in recovery rates over time.

The setup is lightning-fast—typically just 5 minutes in the dashboard—and requires no coding. You connect your billing system, and Slicker handles the rest on autopilot.

Key Features of Slicker

Slicker stands out with a suite of features tailored to streamline payment recovery and enhance revenue predictability:

Payment Recovery on Autopilot: Automates the entire process, from detection to collection, freeing your team to focus on growth rather than chasing invoices.

Advanced Machine Learning Model: Incorporates industry expertise to optimize retries, adapting to nuances in global payment ecosystems.

Error Analysis for Retry Decisions: Dynamically assesses generic error codes, accounting for variations between issuers to determine retry viability.

Multi-Payment Gateway Support: Leverages your full stack to route payments effectively, ideal for scaling businesses.

In-Depth Analytics: Provides insights into failure patterns across customers, geographies, banks, and error types, helping you refine overall strategies.

Full Transparency: No black-box AI here—review every retry action, past or planned, directly in the dashboard.

Complementary Integration: Works alongside your current tools, whether you're using built-in retries or a comprehensive churn playbook.

Enterprise Security: Adheres to top cloud practices, ensuring data protection for sensitive financial information.

These features not only recover lost revenue but also offer actionable intelligence to prevent future issues, making Slicker a holistic solution for subscription health.

Integrations and Compatibility

One of Slicker's biggest advantages is its plug-and-play integrations with leading billing and payment platforms, eliminating the need for custom development. It supports:

Popular Providers: Stripe, Chargebee, Recurly, Zuora, and Recharge for seamless data syncing.

Custom Systems: Even in-house billing setups can be connected via APIs, ensuring broad applicability.

This compatibility means you can reduce churn without diverting engineering time—simply authorize access, configure basic settings, and start seeing results.

Why Choose Slicker for Payment Recovery?

In the competitive world of subscription services, even a small percentage of failed payments can erode MRR significantly. Slicker addresses this by delivering measurable outcomes: customers typically see a 10-20 percentage point uplift in recovered payments. Its performance-based pricing model—charging only for successful recoveries—aligns incentives perfectly, with a one-month free trial to prove value upfront.

Compared to billing providers' limited static retries, Slicker's AI-driven approach yields superior results, as validated by user experiences. It's particularly valuable for businesses dealing with high-volume subscriptions, where manual intervention is impractical. By increasing retention rates, Slicker directly contributes to sustainable growth, turning what was once 'money left on the table' into reliable revenue streams.

Who is Slicker For?

Slicker is ideal for a range of subscription-focused companies:

SaaS Providers: Managing recurring billing at scale, needing to minimize involuntary churn.

E-commerce Subscription Services: From box deliveries to digital content, where payment failures disrupt customer journeys.

Enterprise Teams: Those modernizing legacy systems or integrating AI into financial operations without heavy IT involvement.

Growth-Stage Startups: Looking to optimize MRR early on with no-code tools.

If your business relies on predictable recurring revenue and you've noticed gaps in payment success rates, Slicker is a smart, low-risk addition to your toolkit. It's especially suited for teams prioritizing data-driven decisions in finance and customer retention.

Real Results and User Insights

Users rave about Slicker's impact. For instance, the platform's focus on individual payment analysis leads to higher recovery rates than generic systems. FAQs highlight common wins: one user noted a 15% MRR boost after implementation, while another appreciated the proactive alerts for at-risk accounts. With configurable guardrails—like setting maximum retry limits—you maintain control while benefiting from AI expertise.

In summary, Slicker isn't just a tool; it's a revenue optimizer that uses cutting-edge AI to safeguard your subscription model's health. By automating retries, providing deep analytics, and ensuring secure, transparent operations, it empowers businesses to thrive in a payment landscape full of variables.

Best Alternative Tools to "Slicker"

Corgi Labs offers an AI-powered payment acceptance model to optimize payments and prevent fraud, increasing approvals and revenue with customized logic on your existing payment platform.

FlyCode is an AI-powered platform that helps SaaS and eCommerce businesses recover failed payments and reduce involuntary churn, increasing subscription revenue through intelligent payment retries and optimization.

Flagman Casino is an online casino platform designed for Uzbekistan players, offering quality games, fast payments, and bonuses. Licensed in Curacao, it features slots, table games, and live dealers.

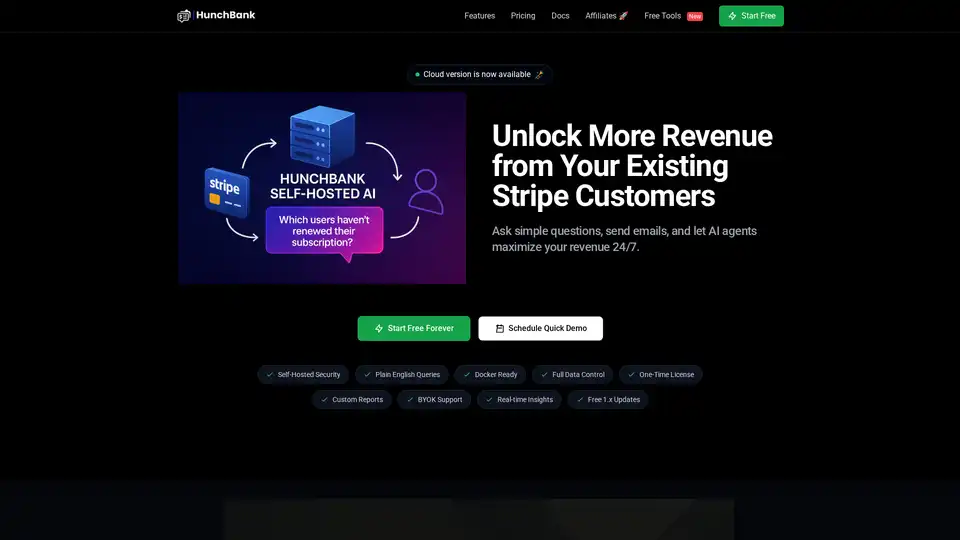

Hunchbank: AI-powered Stripe analytics to unlock more revenue from existing customers. Automate email marketing, prevent churn, detect fraud with AI agents.

Xobot is an AI-powered debt collection platform automating voice calls, SMS, WhatsApp, and email for higher liquidation rates and lower costs. Maximize recovery with AI.

Clara Health transcribes every call, reads your EMR, spots missed dollars, and sends AI agents to claim them.

Discover Spingenie Casino: A comprehensive review covering game selection, payment methods, security measures, and licensing. Find out if Spingenie Casino is a safe and reliable online gambling platform.

IllumiFi provides secure cloud hosting and management for your Unifi Controller, offering remote access, simple setup, and complete control of your Unifi network. Start your 7-day free trial today!

Gymconnect is advanced gym management software that streamlines operations with attendance tracking, membership management, payment processing, and AI workout plan.

AI Seed Phrase Finder uses AI to recover lost Bitcoin wallets by generating and validating seed phrases and private keys. Regain access to your forgotten crypto assets swiftly and efficiently.

Billabex: Automate invoice collection with AI. Intelligent reminders improve cash flow. Virtual AI collaborator for email, phone, SMS, and mail follow-ups.

FinanceOps offers AI-led automated collections management software that streamlines workflows and accelerates cash flow through intelligent automation.

Celeste is an AI-powered platform for SMB loan payment collection, using intelligent technology to boost collection rates and reduce missed payments.

Clerkie is an AI-powered platform simplifying debt and money management. Optimize loan portfolios, automate payments, and ensure real-time compliance. Empower borrowers with flexible payment solutions.