DataVisor

Overview of DataVisor

DataVisor: AI-Powered Fraud and Risk Management Platform

What is DataVisor?

DataVisor is a comprehensive fraud and risk management SaaS platform that uses AI and advanced machine learning to help financial institutions and large organizations combat various types of fraud and financial crimes in real-time.

Key Features and Benefits:

- Real-Time Data Orchestration and Decisioning: Integrates seamlessly with existing data infrastructure, transforming it into a centralized intelligence hub for predictive analytics.

- Generative AI-Powered Detection & Automation: Uses patented machine learning algorithms and AI Co-Pilot for faster and more accurate fraud detection.

- Comprehensive Fraud Solution Suite: Offers a wide range of tools addressing all aspects of fraud management, simplifying complexity and optimizing processes.

- Quick Onboarding & Integration: Provides a quick and painless onboarding experience with no need for frequent re-tuning.

How to use DataVisor?

DataVisor is used as a SaaS platform. Organizations can integrate it with their existing systems to detect and prevent fraud. It offers various modules and solutions for different use cases, including:

- Account Onboarding

- Application Fraud

- AML Compliance

- ACH and Wire Fraud

- Card Fraud

- Check Fraud

Why is DataVisor important?

DataVisor is important because it helps organizations:

- Reduce fraud losses

- Improve efficiency

- Increase approval rates

- Stay ahead of emerging fraud attacks

Where can I use DataVisor?

DataVisor can be used by:

- Banks

- Credit Unions

- Digital Payments companies

- Fintech companies

Testimonials:

- Marjolein Grothauzen (Senior Product Manager - Marketing Fraud): Stated the positive ROI delivered by DataVisor.

- Maxim Spivakovsky (Sr. Director, Global Payments Risk Management): Noted the proactive tools and rapid deployment of strategies enabled by DataVisor.

- Peter Senchenkov (Head of Platform Strategy): Highlighted the role of DataVisor's platform in accelerating their business.

- Robert Rix (Risk Manager - Trust and Payments): Emphasized the ability of DataVisor to safeguard users and ensure platform integrity.

Best Alternative Tools to "DataVisor"

InsightAI: AI-powered fraud detection and risk management for financial institutions. Reduce loss, improve compliance. Best AI tool for Finance professionals.

KYC Hub is an AI-powered compliance automation platform designed for AML and fraud prevention. Streamline KYC processes with risk detection, real-time monitoring, and global AML screening.

Flutch develops custom AI agents for business automation, offering quick implementation, integration with existing systems, and detailed analytics. Automate sales, support, and analytics tasks with AI agents tailored to your specific needs.

FraudNet is an AI-powered platform for enterprise fraud detection, risk management, and compliance. It offers real-time fraud intelligence, customizable solutions, and proven outcomes for various industries.

Oscilar is an AI-powered risk decisioning platform that helps businesses manage fraud, credit, onboarding, and AML compliance risks. It offers agentic AI, comprehensive analytics, and proactive detection capabilities.

ChainAware.ai is an AI-driven Web3 security platform offering tools for crypto wallet auditing, fraud detection, and rug pull prevention across multiple blockchains.

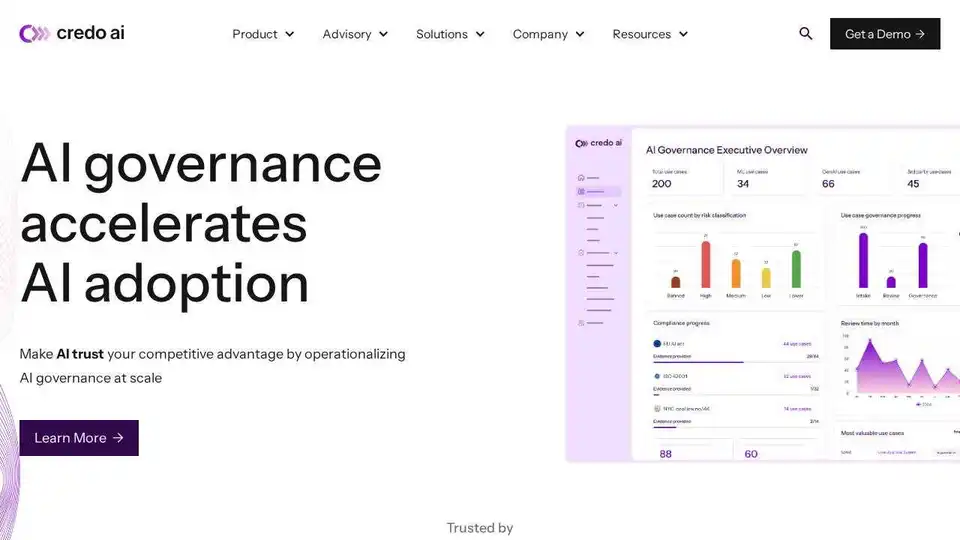

Credo AI is an AI governance platform that helps enterprises streamline AI adoption by implementing and automating AI oversight, AI risk management, and AI compliance. Make AI trust your competitive advantage.

Webb Fontaine revolutionizes global trade with AI-driven solutions for customs, risk management, and single window systems, streamlining trade and logistics operations. Enhance security and compliance with AI.

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

Overwatch Data is an AI-powered threat intelligence platform that helps cyber and fraud teams detect, investigate, and act on digital threats in real-time. Leverage AI agents to monitor dark web and social media for emerging threats.

AnChain.AI provides AI-powered AML compliance and crypto investigation solutions for governments, banks, and fintechs, detecting fraud faster and ensuring regulatory compliance.

SHIELD is a device-first fraud intelligence platform that helps businesses stop fraud and reduce friction using real-time device intelligence. It offers tamper-proof device IDs and configurable risk controls.

Güeno is an all-in-one platform for fraud prevention and compliance, offering AI-powered risk engine, transaction monitoring, and KYC validation to automate and predict transactional behavior.

PathPilot empowers fintechs, banks, and financial institutions to build secure AI agents in days—cutting costs, improving CX, and ensuring compliance. Launch AI agents 10x faster without compromising data security.