Crbit

Overview of Crbit

Crbit: The AI-Powered Personal Finance App

What is Crbit? Crbit is a cutting-edge personal finance application designed to help users supercharge their finances through collaboration, budgeting, and confident saving. It provides advanced tools for managing personal, family, or business finances.

Key Features:

- Collaborative Finance Management: Effortlessly manage shared finances by tracking accounts, spending, and budgets with family and loved ones.

- Financial Oversight: Monitor the financial activities of elderly family members or children with a simple, one-time link.

- AI-Powered Insights with Wally: Get personalized financial insights from Wally, Crbit's AI agent, which will soon handle financial tasks autonomously.

- Budgeting Tools: Create budgets that fit your lifestyle and track expenses effectively.

- Subscription Management: Stay on top of recurring charges and manage payments proactively.

- Spending Visualization: Visualize spending patterns to make smarter, data-driven financial decisions.

- Goal Setting: Set personal or shared financial goals with your partner and track progress together.

- Receipt Organization: Organize receipts quickly and easily for clear records of every expense.

- Expense Tracking: Track shared expenses with notes and cost splitting features.

How does Crbit work?

Crbit connects to your financial institutions to provide a centralized view of your accounts, transactions, and financial activity. The AI agent, Wally, analyzes your data to provide personalized insights and recommendations. The app allows you to collaborate with family members on budgeting and financial planning. Key to its user experience is the ability to track and categorize spending to drive saving opportunities.

Benefits of Using Crbit:

- Effortless Collaboration: Connect with others to share finances, review expenses, and plan goals together.

- Customizable Views: Personalize Crbit for personal, family, or business finance management.

- Expense Comparison: Compare spending across categories with partners for a detailed financial breakdown.

- Automated Receipt Organization: Maintain clear expense records with easy receipt management.

- Efficient Expense Tracking: Keep track of shared expenses with detailed notes and splitting features.

Pricing:

Crbit offers two pricing tiers:

- Free: $0/month - Includes basic features.

- Premium: $4.99/month - Offers advanced analytics, multiple profiles, receipt management, transaction splitting, and more.

Use promo code CRBIT2025 to get 3 months free for early adopters.

FAQ:

- How does Crbit ensure the security of my financial data? Crbit utilizes advanced security measures to protect your financial information.

- How can I collaborate with my partner or family members using Crbit? Crbit allows you to connect with family members and share financial information through a secure, one-time link.

- What features does Crbit offer for tracking monthly expenses and managing recurring transactions? Crbit provides tools for categorizing expenses, tracking spending patterns, and managing recurring transactions.

- Can I view personal, couple/family, and business accounts separately in Crbit? Yes, Crbit allows you to create multiple profiles for different financial needs.

- How does Crbit help me manage and store receipts? Crbit offers a receipt scanning and organization feature to keep track of all your expenses.

Why is Crbit Important?

Crbit addresses the common challenges of personal finance management by offering a centralized, collaborative, and AI-driven solution. Its customizable features and insights help users make informed financial decisions, manage expenses effectively, and achieve their financial goals.

Conclusion:

Crbit is an innovative personal finance app that leverages AI and collaboration to simplify financial management. Whether you're managing personal, family, or business finances, Crbit provides the tools and insights you need to achieve financial success. Download the Crbit app today and take control of your financial future!

Best Alternative Tools to "Crbit"

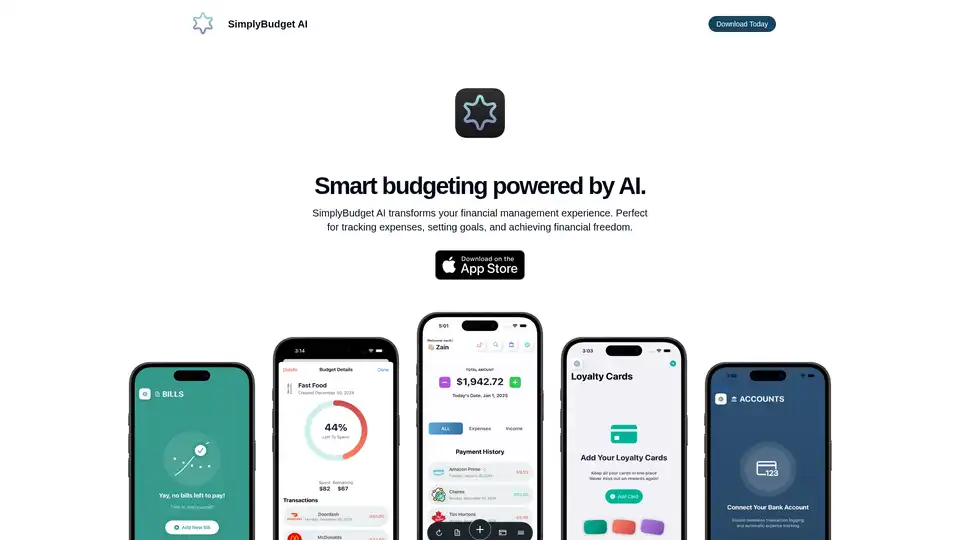

SimplyBudget AI is a smart budgeting app that uses AI to simplify financial management. Track expenses, set goals, and manage loyalty cards effortlessly. Download today to achieve financial freedom!

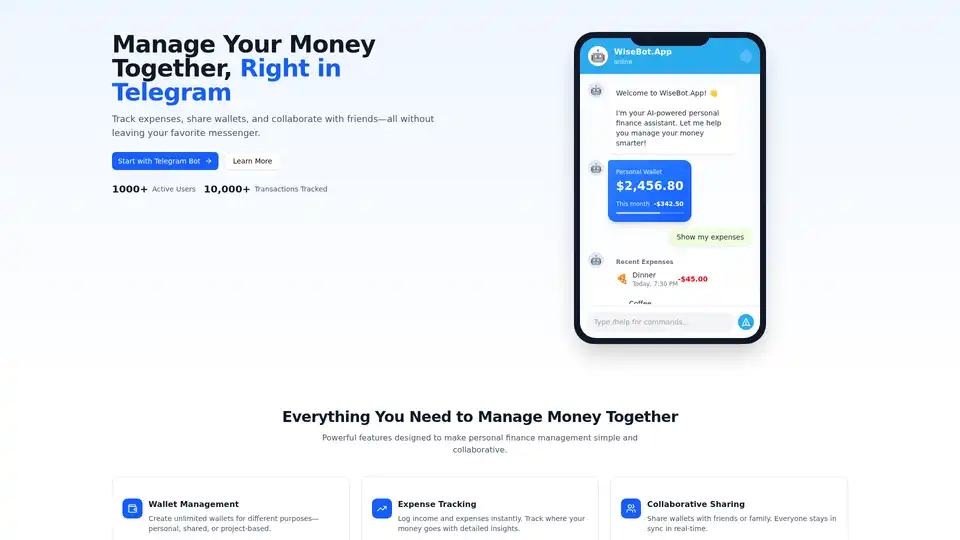

WiseBot.App is an AI-powered personal finance assistant in Telegram. Track expenses, manage wallets, share budgets collaboratively, and get smart AI insights—all securely without extra apps.

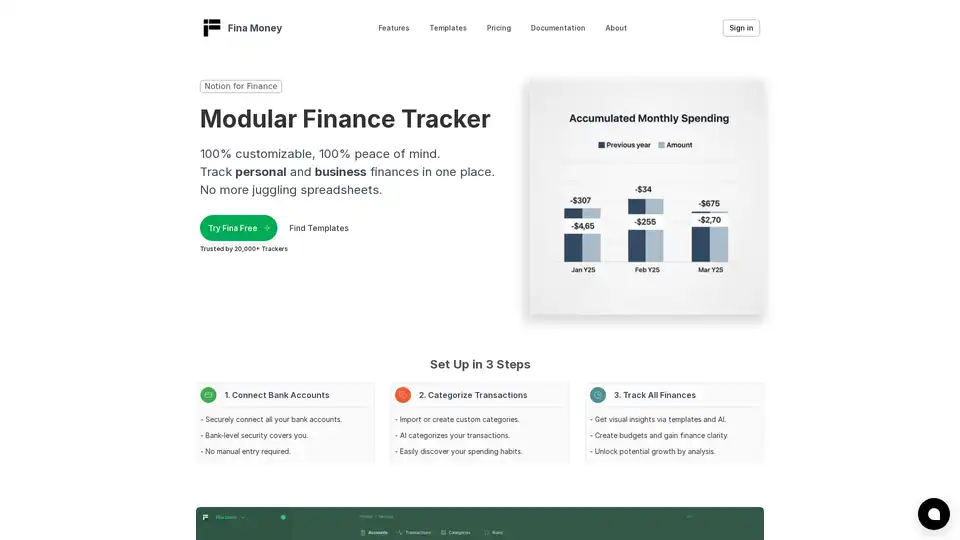

Fina Money is an AI-powered financial tracker for personal & business use. Manage your money easily, create custom budgets, and get financial insights.

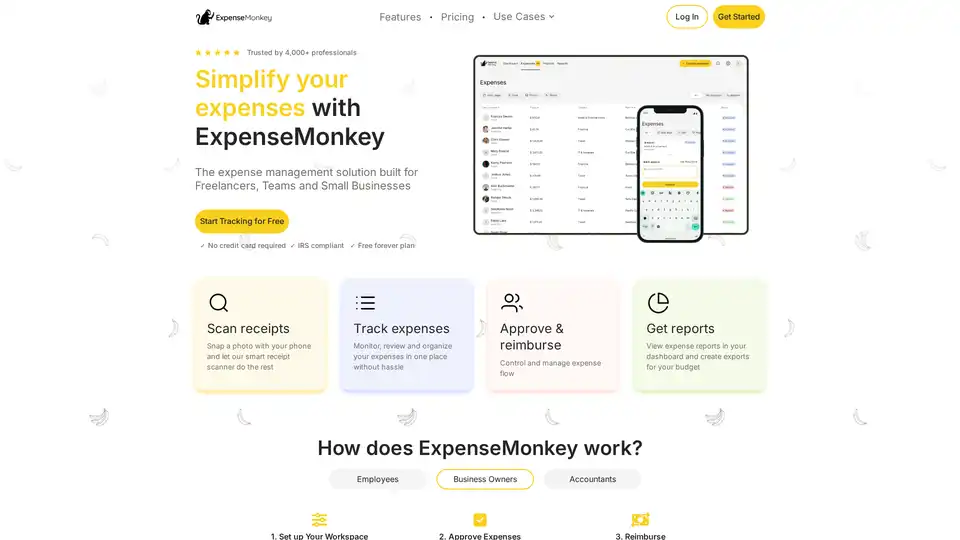

ExpenseMonkey: Free AI-powered expense tracker for businesses & freelancers. Automate receipt scanning, track expenses by client/project, and generate tax-ready reports. Save 7+ hours/month!

Kniru: AI-powered personal finance app for tracking spending, optimizing investments, and managing loans. Start for free.

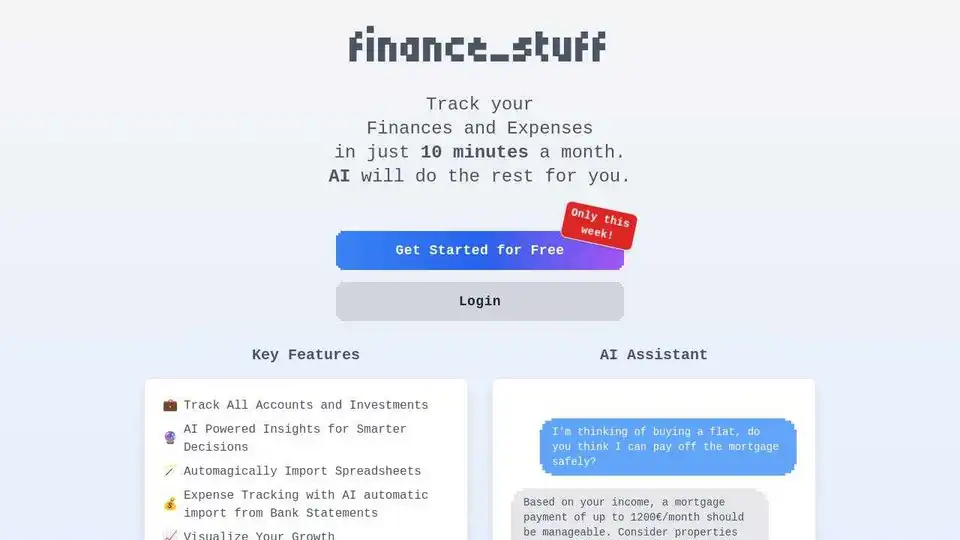

Track finances & expenses in 10 minutes/month with finance_stuff. AI insights, statistics & visualizations for smarter financial management.

TalkieMoney is an AI-powered voice expense tracker app that makes financial management fun and easy. Log expenses with voice or text commands and get smart categorisation.

BringTable uses GPT-4 AI to scan, organize, and analyze bills by extracting data into structured tables for effortless financial management.

An advanced AI-powered bank statement converter that helps you convert your PDF bank statements to a readable CSV or Excel format on your phone. Features include fast and accurate conversion, and a user-friendly interface.

Origin Financial is an AI-powered platform that consolidates finances for budgeting, investment tracking, and financial planning, offering personalized advice.

Cleo is an AI financial assistant that helps you budget, save, manage debt, and build healthy financial habits. Get expert insights and personalized coaching to improve your financial life. Try Cleo for free!

Simplify Money is an AI-powered personal finance app that helps you plan your goals, invest, and learn finance with ease. Track your net worth and more!

intelliAssets simplifies asset management with AI-powered tools for tracking investments, cryptocurrency, and personal finances. Make smarter decisions and achieve better outcomes.

Kniru is an AI-powered personal finance platform that helps you track spending, optimize investments, and manage loans. Get AI-driven insights for smarter financial decisions in one secure dashboard. Start free today!